Investors may be looking for coins to buy if Bitcoin falls below $80,000 as the market continues to decline. BTC has fallen about 24% since November 11 and continues to drag other major assets due to its strong dominance.

However, a few altcoins show strong structure or negative correlation with Bitcoin. These names could hold up better if BTC heads to $80,000 or even breaks below it. Here are our top picks, starting with the strongest setup.

Zcash (ZEC)

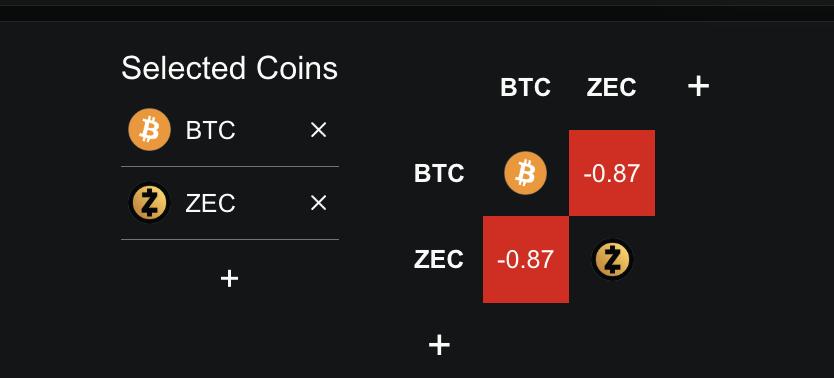

Zcash remains one of the cleanest charts in a market rife with crashes. It also has a one-month correlation with Bitcoin of -0.87, meaning ZEC typically moves inversely to BTC.

Zcash Correlation : Defillama

Zcash Correlation : DefillamaThis is important now because Bitcoin's trend is weakening as the 100-day EMA is getting close to crossing below the 200-day EMA. If that happens, a drop below $80,000 becomes much more likely.

Want to hear more about Token ? Subscribe to Editor Harsh Notariya's daily Crypto Newsletter here .

BTC Price Analysis: TradingView

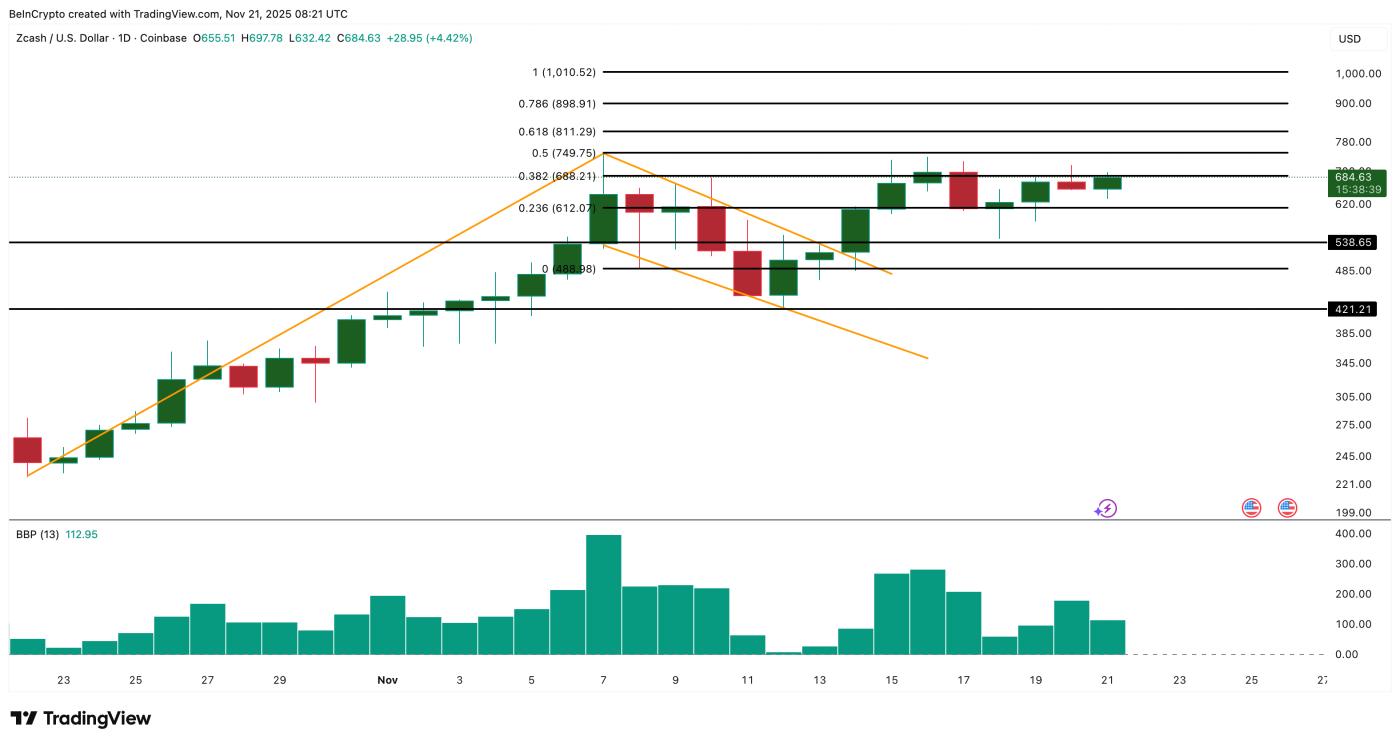

BTC Price Analysis: TradingViewZEC price continues to hold the breakout from November 14. Buyers have protected every dip, keeping the trend intact even as BTC loses support levels. The main resistance is at $749. A clear breakout above this level opens the way to $898, followed by the round number area around $1,010.

Zcash Price Analysis : TradingView

Zcash Price Analysis : TradingViewIf Bitcoin continues to fall, this negative correlation gives Zcash a chance to rise higher while the broader market slides.

Another sign supporting the move. The Bull Bear Power indicator, which compares price to a basic trendline, shows whether buyers or sellers are in control of the upward momentum. Despite some small dips, the indicator has remained positive for more than a month. That means buyers have not lost control during any of the declines.

With Bitcoin continuing to weaken, steady buyer power and negative correlation give Zcash a real chance to move higher if BTC continues to slide.

The invalidation level is near $488. A daily close below this level would mean the breakout has failed, and ZEC could slide back to $421. That scenario is only likely if Bitcoin price regains stability.

Pi Coin (PI)

Pi Coin has emerged as one of the coins to buy if Bitcoin falls below $80,000, mainly because it has shown clear strength while the market has weakened. Over the past month, Bitcoin has fallen about 19%, but Pi Coin is still up nearly 18%.

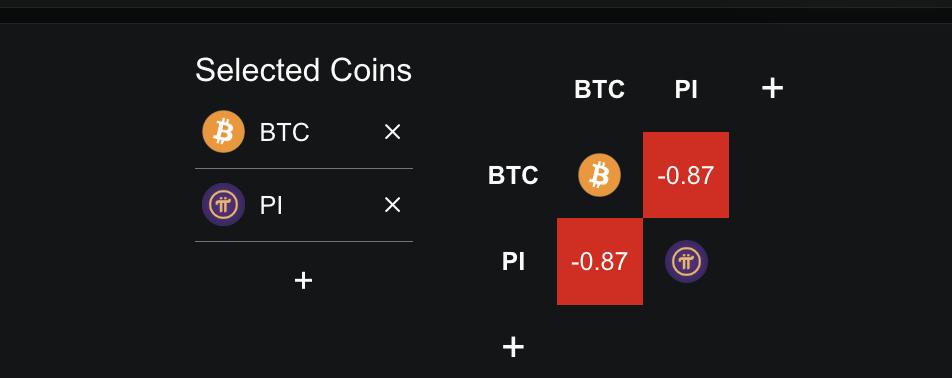

One important factor is the seven-day correlation with Bitcoin. Pi Coin maintains a negative correlation of –0.87, meaning it often moves in the opposite direction. When Bitcoin falls, Pi often has room to rise. This negative correlation alone makes PI an attractive hedge in the current environment.

PI Correlation: Defillama

PI Correlation: DefillamaThe price structure also supports this view. Pi is trading near a key resistance at $0.25. A clean push above this level could open the way to $0.29, especially if Bitcoin remains weak. But if Pi falls below $0.22, the next support lies near $0.20.

Money flow data confirms short-term strength. Chaikin Money Flow (CMF), an indicator of XEM large money is flowing into or out of an asset, remains above zero. A reading above zero indicates stronger buying pressure. Between November 14 and November 21, both price and CMF made higher lows.

This shows that large buyers have supported the recent recovery.

PI Price Analysis: TradingView

PI Price Analysis: TradingViewCMF is currently near 0.11. If it breaks above this level, it will create a higher high. This shows that big money is coming back, which could fuel a new rally if Bitcoin continues to fall.

Pi Coin remains a rare bright spot in a red market. With strong cash flows, a negative correlation of -0.87, and a clear breakout of $0.25, it stands out as one of the clearest structures in a bearish Bitcoin scenario.

Tensor (TNSR)

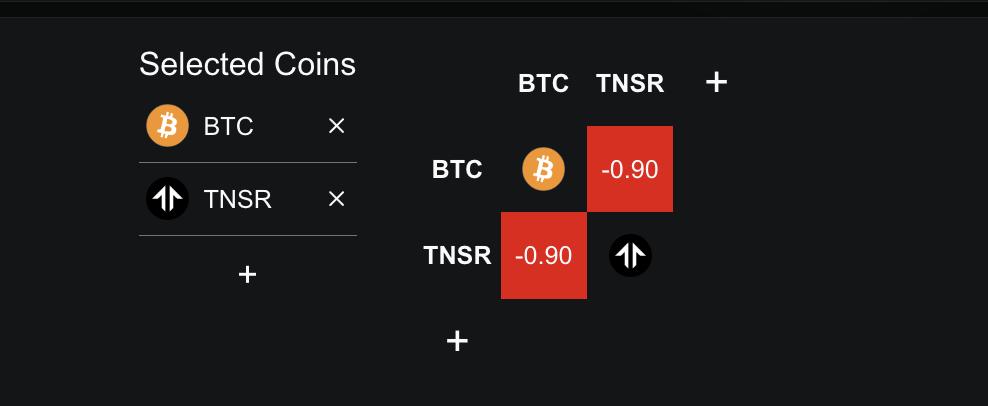

Tensor is also on the list of coins to buy if Bitcoin falls below $80,000, mainly because it shows one of the strongest negative correlations with Bitcoin in the short term. Its seven-day Pearson coefficient is near -0.90, meaning it usually moves in the opposite direction when Bitcoin falls.

TNSR Correlation: Defillama

TNSR Correlation: DefillamaRecent developments support this view. Tensor is up more than 340% over the past week, despite the broader market decline. A newly created wallet has been steadily buying up more than 16 million TNSR during the rally . This steady buying has helped push the price up despite weak activity in Tensor’s Non-Fungible Token marketplace, where transactions and fees have been falling for months.

The chart shows why momentum remains strong. The 20-day exponential moving Medium (EMA) has crossed above the 50-day Medium and is moving toward the 100-day Medium . If the 20 line crosses above the 100 line, traders see it as a stronger bullish signal because it shows recent strength overcoming long-term weakness.

The exponential moving Medium (EMA) is a type of price Medium that gives more weight to recent data, so it reacts more quickly than a simple moving Medium .

Tensor is trading near $0.24 after hitting $0.36 earlier. To continue the uptrend, it needs to clearly break $0.36 and then $0.38. If Bitcoin continues to fall and the negative correlation holds, Tensor could reach $0.44 and even $0.72 based on the expansion levels.

TNSR Price Analysis : TradingView

TNSR Price Analysis : TradingViewIf the market reverses and Bitcoin recovers strongly, TNSR could revisit $0.17, which was the previous support zone.

Currently, strong accumulation, improving Medium , and strong negative correlation make Tensor a reasonable choice in this list.