Pi Coin is one of the few assets that is holding green while the majority of the crypto market is red this month. Bitcoin price is down about 20% and Ethereum is down nearly 27% compared to last month. Pi Coin, once considered a weak project, is still up nearly 18% in the same period.

Even after today's 5% drop, its monthly trend remains positive. This unusual strength now puts Pi Coin (PI) just 6.5% away from attempting a new breakout. Here's how!

Cash flow reinforces the uptrend

The first strong sign comes from the Money Flow Index (MFI). MFI uses both price and volume to indicate XEM buyers or sellers are in control. Pi Coin broke the MFI trend on November 16, 2023, right as the price started to rise.

Since November 14, 2023, Pi Coin has increased by nearly 26%, and the MFI breakout confirms that buyers were active early. The indicator has dipped slightly, but remains above its trendline. As long as it remains above, the dips are likely to be minor corrections rather than outright declines.

Continue buying on dips: TradingView

Continue buying on dips: TradingViewWant to know more about such Token ? Subscribe to editor Harsh Notariya's daily crypto newsletter here .

Volume flows also support this idea. The On-Balance Volume (OBV) line broke its trend on November 18, 2023, two days after the MFI breakout. OBV tracks XEM more volume is flowing into or out of an asset.

A late OBV breakout typically means that retail investors have entered after large holders have already stepped in. OBV remains in negative territory near -1.84 billion, a common feature of downtrends. Note that the long-term price trend for PI remains bearish , having fallen more than 30% over the past three months.

Volume supporting the PI story: TradingView

Volume supporting the PI story: TradingViewThe rising OBV slope shows improving demand. A break above -1.84 billion would strengthen the short-term trend.

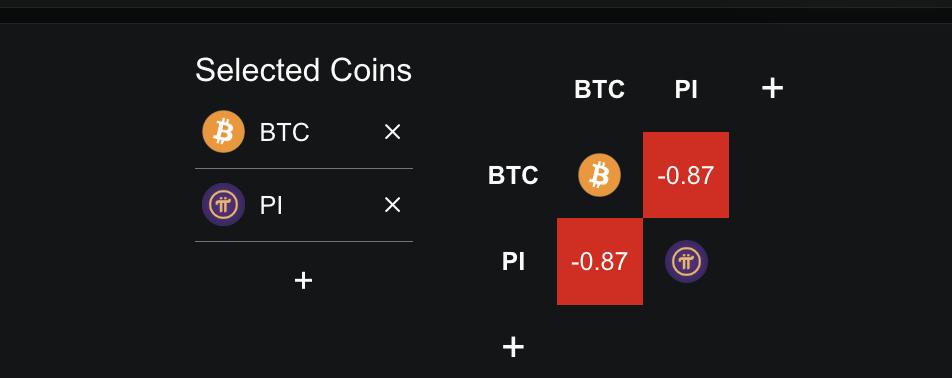

A rare detail that adds more weight: PI's seven-day correlation with Bitcoin is near -0.87. This is the Pearson coefficient, which measures XEM two assets move together. A result near -1 means they move in opposite directions.

PI- BTC Correlation : Defillama

PI- BTC Correlation : DefillamaThis explains why Pi Coin remains green while Bitcoin and other major coins are falling. If BTC continues to correct, according to this theory, the price of Pi Coin could continue to rise higher.

Upcoming Crossover Creates Bullish Case

The 4-hour chart supports the bullish thesis. Pi Coin is trading above all major exponential moving Medium . The 50-period moving Medium is moving closer to the 200-period moving Medium .

Pi Coin Could Extend Its Uptrend in the Short Term: TradingView

Pi Coin Could Extend Its Uptrend in the Short Term: TradingViewIf the 50 line crosses above the 200 line, this structure creates what traders call a Golden Cross. It typically means that short-term strength is catching up with the long-term trend direction. This setup supports the idea that Pi Coin's uptrend still has room to run.

The exponential moving Medium (EMA) gives more weight to recent price data, so it reacts faster than simple moving Medium .

Pi Coin Prices to Watch

Trend-based Fibonacci extensions show the next resistance near $0.25. Pi Coin needs a clear daily close above this level to open up a wave higher. That would require a move of about 6.5% from the current price. Breaking above $0.25 could allow Pi Coin's upside momentum to extend , with both $0.31 and $0.34 levels on the table.

On the downside, important support lies near $0.23. Losing this level on a daily close would increase the risk of a drop to $0.20, which could erase most of Pi Coin's recent gains.

Pi Coin Price Analysis: TradingView

Pi Coin Price Analysis: TradingViewCurrently, Pi Coin is still one of the rare assets that remains green in a red market, when looking at the monthly timeframe. If buyers can push it up another 6.5%, there may be another breakout attempt coming soon.