Prediction market platform Kalshi has raised $1 billion in a new Capital round, pushing the company's valuation to $11 billion.

The move comes as prediction platforms are rapidly moving into the mainstream, with users flocking to the sites to bet on everything from elections to cryptocurrency prices to even the daily temperature.

Kalshi Reaches $11 Billion Valuation After Record Capital Round

Kalshi’s latest Capital round comes less than two months after the company raised $300 million at a $5 billion valuation. TechCrunch reported that the latest Capital was led by a mix of existing and new investors, according to people familiar with the matter.

Returning investors include Sequoia and CapitalG. Andreessen Horowitz, Paradigm, Anthos Capital, and Peg also joined. Meanwhile, rival platform Polymarket is pursuing an ambitious Capital target, aiming for a $12 billion valuation .

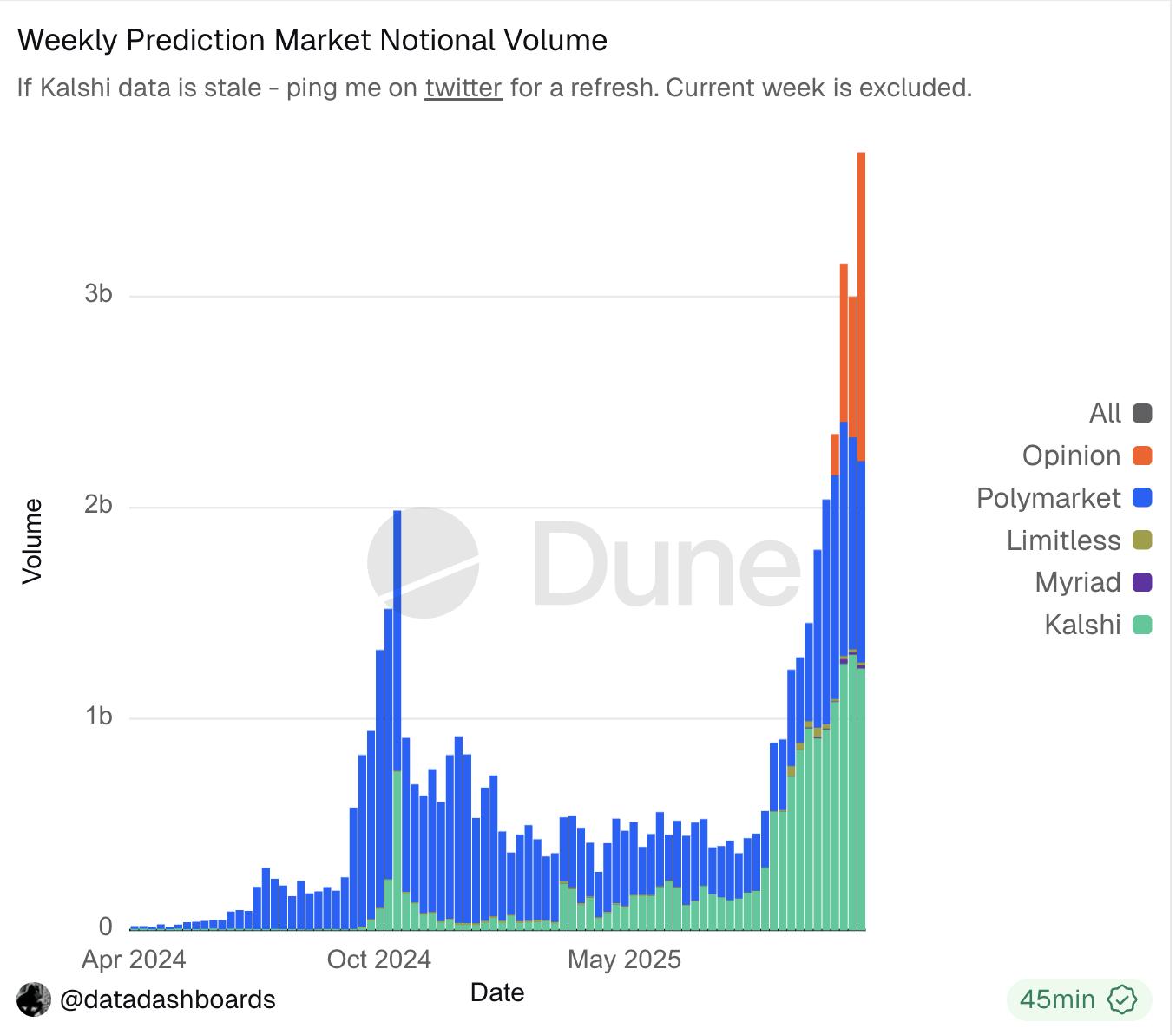

Kalshi emerged as the leading prediction platform, overtaking Polymarket in September. However, this dominance has recently been challenged by Opinion.

Data from Dune Analytics shows the platform recorded a weekly nominal volume of $1.46 billion. This is slightly higher than Kalshi's $1.2 billion, while Polymarket reached just under $1 billion.

Market volume of prediction platforms. Source: Dune

Market volume of prediction platforms. Source: DuneHowever, Kalshi continues to expand its presence. The platform now serves users in over 140 countries. According to official data from the data tracker , Kalshi's total transactions have exceeded 68.4 million, with a cumulative volume of over $17 billion.

Additionally, the prediction market continues to gain traction, further bolstered by Google’s latest move. Google Finance has integrated real-time data from both Kalshi and Polymarket, marking a notable step in bringing event-based trading to the wider public.

Despite this growth, Kalshi is facing increasing regulatory challenges. The platform operates as a federally regulated Designated Contract Market under the supervision of the Commodity Futures Trading Commission.

“Kalshi is regulated by the Commodity Futures Trading Commission (CFTC) – an independent agency of the U.S. government that has regulated U.S. Derivative markets since 1974 and is overseen by Congress,” the company noted.

But problems are emerging at the state level. In Massachusetts, the attorney general filed a lawsuit in September seeking to block the company from offering sports-related prediction products in the state.

In Nevada , U.S. District Court Judge Andrew Gordon has indicated he may XEM his April ruling granting Kalshi a preliminary injunction to stop it from enforcing the state's gambling laws. Maryland regulators have denied the platform's request for a preliminary injunction.

Finally, in New York, the company proactively filed a lawsuit to prevent the state gaming commission from classifying its sports prediction markets as illegal gambling.