In November, NEAR Intents' daily fee revenue reached an all-time high. At the same time, its daily volume also increased tenfold compared to the previous quarter. However, NEAR's price continued to show weakness and was stuck in the 2025 accumulation range.

These positive indicators have fueled hopes that investors can secure good positions before market fear subsides and fundamentals come into play.

How Near Intents Will Be a Catalyst for NEAR Price by End of 2025

NEAR Intents is a multi chain transaction protocol built on NEAR Protocol , a blockchain platform focused on AI and chain abstraction .

The protocol eliminates the need for users to perform complex manual actions. This includes converting Token, managing Gas Price across multiple networks, or handling intermediary steps. NEAR Intents allows users—or AI agents —to express an “intent” for a desired outcome. The protocol then automates the entire process, providing a smooth and efficient experience.

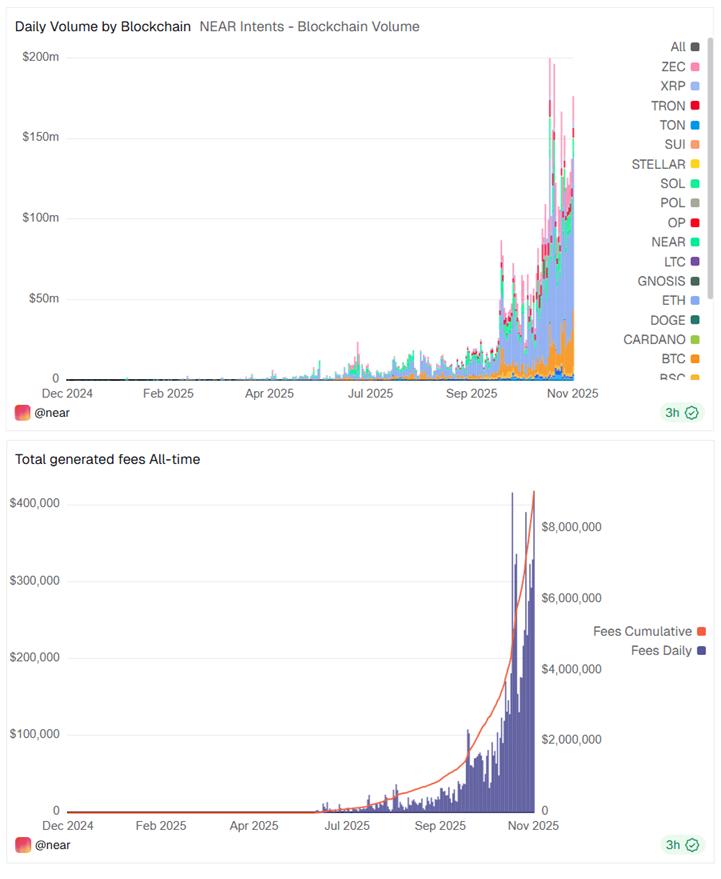

According to Dune Analytics, NEAR Intents’ daily fee revenue has reached a record high of over $400,000, pushing the total accumulated fees above $10 million. Meanwhile, daily volume has consistently remained above $150 million, a tenfold increase from the previous quarter.

Daily volume & fees on NEAR Intents. Source: Dune.

Daily volume & fees on NEAR Intents. Source: Dune.NEAR Protocol also reported that its cumulative volume over the past 30 days has surpassed $3 billion.

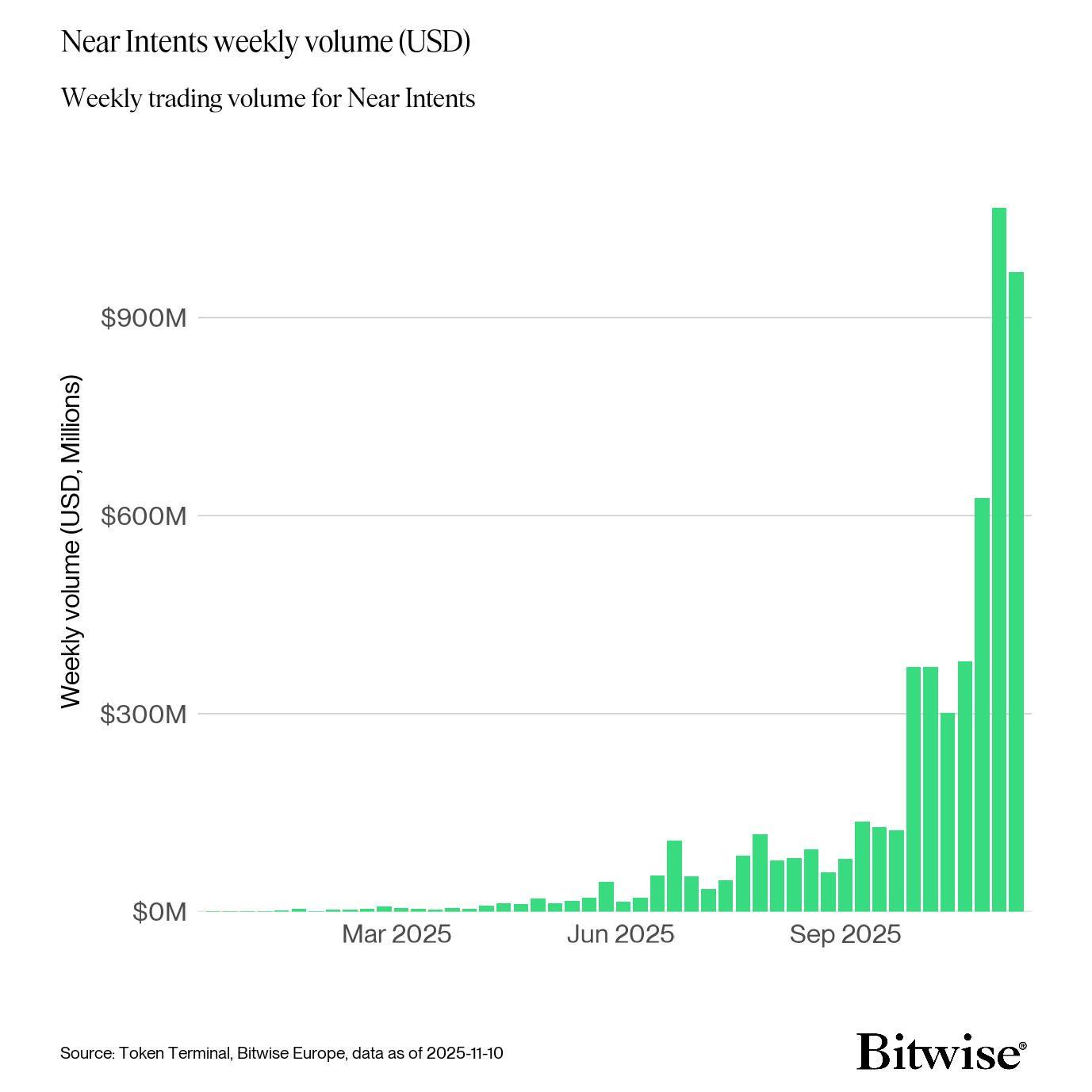

Additionally, a Bitwise report noted that NEAR Intents recorded $969 million in volume for the week beginning November 10, 2025. Bitwise predicts that NEAR Intents will expand its weekly volume by more than tenfold and reach $10 billion by June 2026.

Near Intents Weekly Volume . Source: Bitwise

Near Intents Weekly Volume . Source: BitwiseThis growth will naturally have a positive impact on the NEAR Token .

“NEAR’s Token model is designed to capture value from AI-native activity. This includes intent identification fees, infrastructure services, and model execution, extending beyond traditional Block space monetization,” Bitwise said .

What are the factors driving this increase in mass?

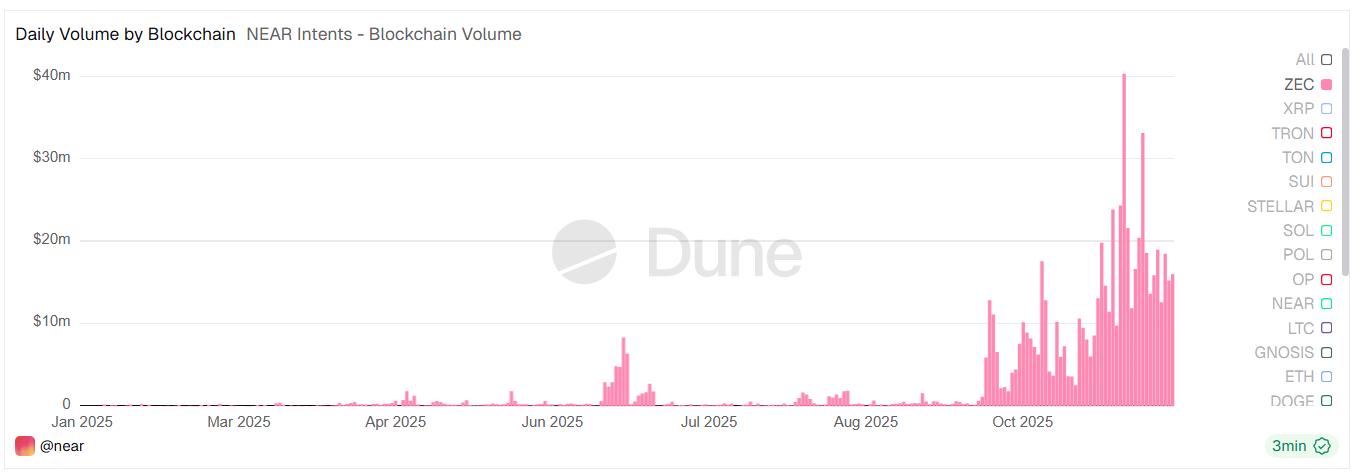

A CoinMetrics report highlights the role of the Zashi wallet. The wallet integrates with NEAR Intents , allowing for easy cross- chain transactions into shielded ZEC . Meanwhile,the amount of ZEC held in shielded pools has reached new highs as demand for privacy increases.

ZEC volume on NEAR Intents. Source: Dune

ZEC volume on NEAR Intents. Source: DuneAs a result, investors are increasingly turning to NEAR Intents. ZEC trading now accounts for about 10% of the protocol's daily volume, Medium around $15 million per day.

NEAR Price Remains Stuck in 2025 Accumulation Range

Despite these developments, NEAR price remains stuck in the 2025 accumulation zone. Data from TradingView shows NEAR moving between $1.90 and $3.10 since the start of the year.

NEAR price performance. Source: TradingView .

NEAR price performance. Source: TradingView .Analyst Vespamatic attributed the stagnation to the falling Bitcoin price, which could see altcoins fall further even as their fundamentals remain strong.

“NEAR is at risk of falling to $0.6, especially if Bitcoin falls to $84,000. In a bear market, almost 99% of altcoins can be destroyed, even though they have strong fundamentals,” Vespamatic predicted .

However, analysts also note that NEAR's current price near $1.9 represents its strongest support level of the year. Combined with recent positive catalysts, this level could create a potential price recovery .