Privacy coins have been in the spotlight in the crypto space throughout late 2025. Top assets like Zcash (ZEC) have outperformed the market, resisting major price drops while most other cryptocurrencies are still in decline.

BeInCrypto spoke to a number of experts to understand why these coins are surging and whether it is possible to identify the next big opportunity in the crypto market before it goes mainstream.

Anonymous coins maintain strong growth momentum in 2025

BeInCrypto reported a month ago that privacy-focused cryptocurrencies had emerged as the best-performing sector in the market. Notably, this remains true today, even as the broader market continues to extend its two-month decline.

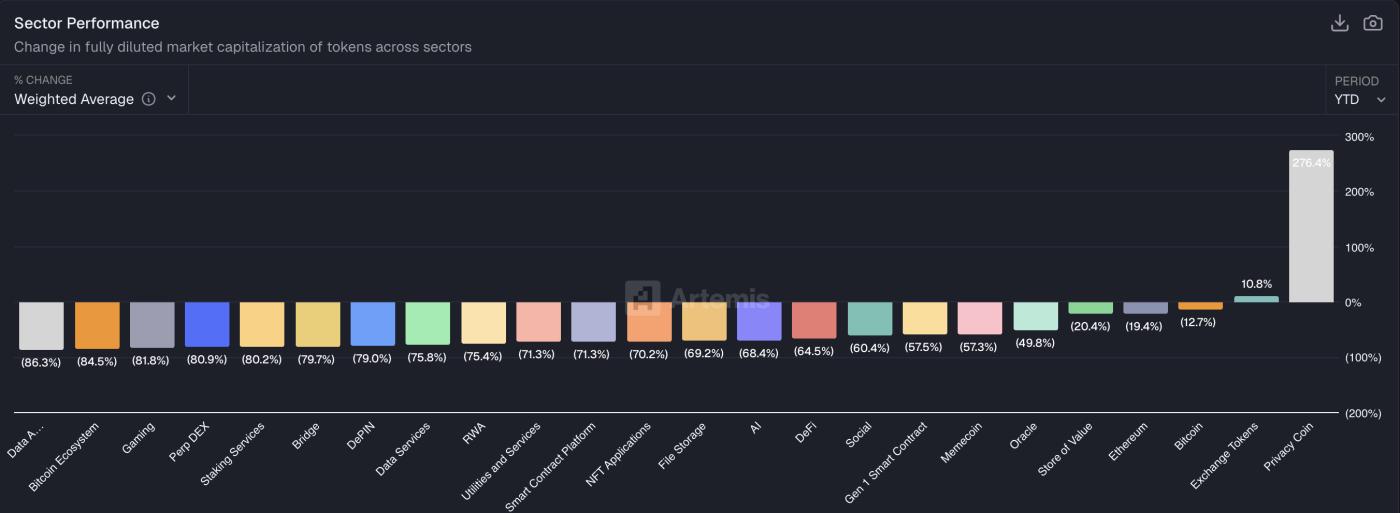

Privacy coins are up 276.4% YTD, making them the strongest sector and one of only two sectors with positive returns this year.

Cryptocurrency industry performance. Source: Artemis

Cryptocurrency industry performance. Source: ArtemisIn contrast, Bitcoin (BTC) and Ethereum (ETH) have both turned negative due to recent declines. Notably, ZEC has increased in value by more than 700% since the beginning of October. DASH ( DASH ) has also increased by nearly 200%, showing strong momentum.

The impact of increased global Capital controls and surveillance

According to Nic Puckrin, cryptocurrency analyst and co-founder of The Coin Bureau, the price surge is closely related to the sudden increase in global surveillance and Capital controls.

He pointed to examples like Türkiye giving its financial watchdog broader powers to freeze cryptocurrency accounts. In addition, regulators around the world are tightening oversight of digital assets.

Puckrin explains that Bitcoin and Ethereum no longer embody the original “cypherpunk” ideals of privacy and censorship resistance. Instead, they have become highly traceable.

They are even more susceptible to surveillance than cash, rekindling interest in cryptocurrencies that offer stronger privacy protections.

“There is an ideological element coming from the early adopters who are losing faith in the Bitcoin narrative due to the overwhelming involvement of institutions. Privacy advocates no longer see Bitcoin as the solution. And then there are investors who want to ride the wave of momentum – for example, Zcash has increased over 1,500% in the past year. It’s natural for people to want a piece of that,” he said.

Jamie Elkaleh, CMO of Bitget Wallet, shares a similar view. He argues that as regulatory clarity improves and institutional adoption accelerates, users are increasingly concerned about AI-driven surveillance and rampant transparency of on- chain activity.

Elkaleh emphasizes that this tension is reshaping industry expectations. Clearer rules are attracting more mainstream players to the market, but these users are coming with a different set of requirements.

“What we're seeing is the industry maturing: clearer rules are bringing more mainstream users in, and those users increasingly expect financial privacy, sovereignty, and security tools to be core features, not fringe options,” he conveys.

Meanwhile, Ray Youssef, founder and CEO of NoOnes, attributes the boom in privacy coins to a combination of narrative spin and macroeconomic favorableness.

He observed that, after years of witnessing the institutionalization of Bitcoin and Ethereum, as well as meme based altcoin cycles, Capital is now flowing into assets considered “crypto by design,” with decentralization and user-controlled privacy at their core.

Youssef added that institutional participation in crypto continues to increase. As a result, many retail traders and native crypto users are looking for projects that restore a sense of autonomy and privacy.

However, he stressed that this shift is not a complete rejection of institutional Capital . Instead, both forces can coexist and reinforce each other when a compelling story emerges.

“The ideological thread of privacy and sovereignty provides a strong narrative and keeps users engaged. The economic thread of short, medium, and long-term returns attracts both traders and Capital allocators. For a cycle to last, the market needs to stack up, ensuring a narrative attracts believers and metrics/flows attract Capital. What is happening now is that ideology ignites the fire and economics fuels the fire,” the CEO commented.

Rob Viglione, Founder of zkVerify and CEO of Horizen Labs, emphasized that the renewed interest represents a broader market shift. He noted that users are increasingly recognizing privacy as a core requirement for real-world use, not a side benefit.

He explained that the current momentum goes beyond individual Token price rallies. It signals a deeper reassessment of how privacy should operate across the entire crypto ecosystem.

“The first privacy coins were groundbreaking, but they were also isolated. They demonstrated that strong encryption was possible, but they lived outside the environments where most of the real economic activity took place,” Viglione said.

What's different today is that privacy is now built directly into Ethereum-based environments. Developers are no longer chasing standalone privacy chain .

Instead, they are looking for privacy solutions that can plug into existing ecosystems where liquidation, users, and applications already operate.

“That’s why this moment matters. The price volatility is just a surface sign of a much deeper shift: privacy is becoming an expectation, not an exception,” the CEO commented.

Is utility becoming the next crypto meme trend?

The rise of privacy-focused assets raises the question: is this just a short-term bull run, similar to previous meme coin rallies, or does it reflect a real shift toward stories with real value? Analysts say the answer lies somewhere in between.

Meme coin rallies are typically quick, highly speculative, and short-lived, and don’t last long, Youssef said. When that momentum dies down, the market typically moves on to more sustainable value stories.

This includes areas such as payments, privacy, real-world transaction layers, DeFi infrastructure, and more. In this context, privacy Token are attracting new interest because they offer clear autonomy, censorship protection, and the ability to transact without exposure or the risk of unilateral freezing. He Chia that,

“If users and investors realize that these characteristics represent long-term value and not just a short-term craze, the Capital flow into this space could last beyond a temporary narrative spin,”

Meme coins tend to thrive during periods of market euphoria, Puckrin said. Meanwhile, Token with real value tend to perform better when investors are more cautious or looking to recoup profits.

“But what is important to note here is that we are not seeing a significant rotation into utility Token . There are pockets of better returns, but most altcoins are still underperforming Bitcoin. We have yet to see anything like a traditional altcoin season, and until then, utility Token gains are the exception rather than the rule,” he told BeInCrypto.

How to Spot the Next Big Trend in the Cryptocurrency Market

As new stories emerge faster than ever, identifying an explosive trend early has become one of the biggest challenges and opportunities for crypto investors. Puckrin explains that,

“It’s as much about luck as it is about caution. You can look at market imbalances, or developer migrations to new chain or projects. You can XEM where the demand is. But ultimately, the narrative in crypto is often as speculative as it is fundamental, and that can be hard to judge. It’s often just about being in the right place at the right time.”

Still, analysts have identified institutional investment trends as a good starting point for evaluating any sector.

“If I had to pick one story for this cycle, it would be RWAs. Institutional Capital is pouring into Tokenize RWAs – don’t forget that this also includes stablecoins – and we’re seeing partnerships between RWA projects and institutions. Institutional Capital is an important indicator to watch this cycle because it’s based on long-term demand rather than a fever,” Puckrin suggests.

Youssef takes a more structured view, framing the process as “pattern recognition with signal guidance.” He outlines key signals, including real user demand, on- chain activity, the use of protocol features, and expanding market access.

“For privacy, look at shielded tx adoption, exchange accessibility, wallet integration, and legal title. For DePIN, look at device deployment rates, infrastructure partnerships, real-world data sources, and revenue per device. For AI and on chain models, developer integrations, API demand, and Token value capture are Vai . For DeFi /RWA, TVL, yield sustainability, partner quality, and custody structure are likely to drive the next cycle. In short, across the board, investors should look at tokenomics sustainability, security history, and real-world usage,” he analyzed.

The CEO also revealed that regulatory sentiment Vai a crucial role. New stories are more likely to gain traction when the environment is favorable. Finally, Capital flows, whether from retail traders, whales, or institutional investors, can also be a signal.

“If these characteristics move together, we may be seeing a new trend forming,” he stressed.

Ultimately, Elkaleh believes that identifying new trends starts with tracking early indicators, such as developer activity, new exchanges, and social momentum on platforms like X. Small- Capital Token with strong fundamentals often provide the first signs of a narrative forming.

He asserts that investors who combine behavioral signals with fundamental analysis will have the clearest view of where momentum is before it becomes apparent to the broader market. Elkaleh points out that,

“The strongest signals today are institutional investment Capital , industry-level market Capital expansion, and the early convergence of categories like RWA, DePIN, AI, and DeFi. These sectors are providing real utility—from real-world infrastructure to AI-powered financial automation—which puts them in a position to lead the next cycle. For privacy coins, the breakthrough will come from integrating zero-knowledge and privacy tools directly into everyday wallets and DeFi products, making privacy a convenience, not a choice.”

While these metrics don’t guarantee success, they provide a useful framework for recognizing early momentum. As user demand, developer activity, regulation, and Capital flows begin to align, a new narrative may be forming long before it becomes mainstream.