Approximately $360.7 million worth of leveraged positions were liquidated in the cryptocurrency market over the past 24 hours.

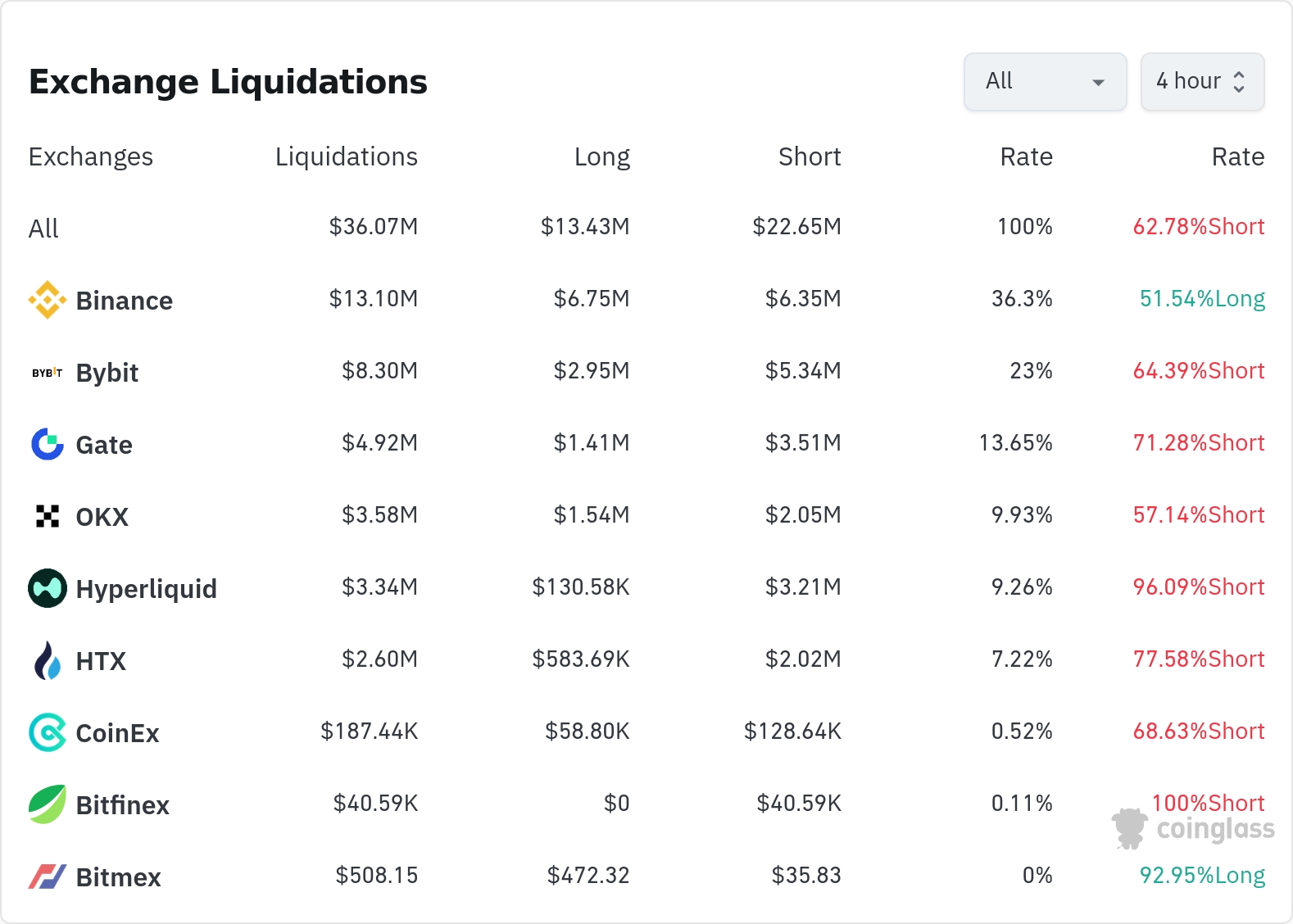

According to currently aggregated data, short positions account for approximately 62.78% of liquidated positions, recording a higher proportion than long positions.

Binance saw the most position liquidations over the past four hours, with a total of $131 million. Long positions accounted for 51.54% of this liquidation, demonstrating a balanced liquidation pattern.

The second-highest number of liquidations occurred on Bybit, where $83 million worth of positions were liquidated. Short positions accounted for 64.39% of these liquidations, with traders betting on a downtrend reversal incurring significant losses.

A particularly high short position liquidation rate (96.09%) was observed on hyperliquid exchanges, with an unusual phenomenon observed on Bitfinex, where only 100% of short positions were liquidated.

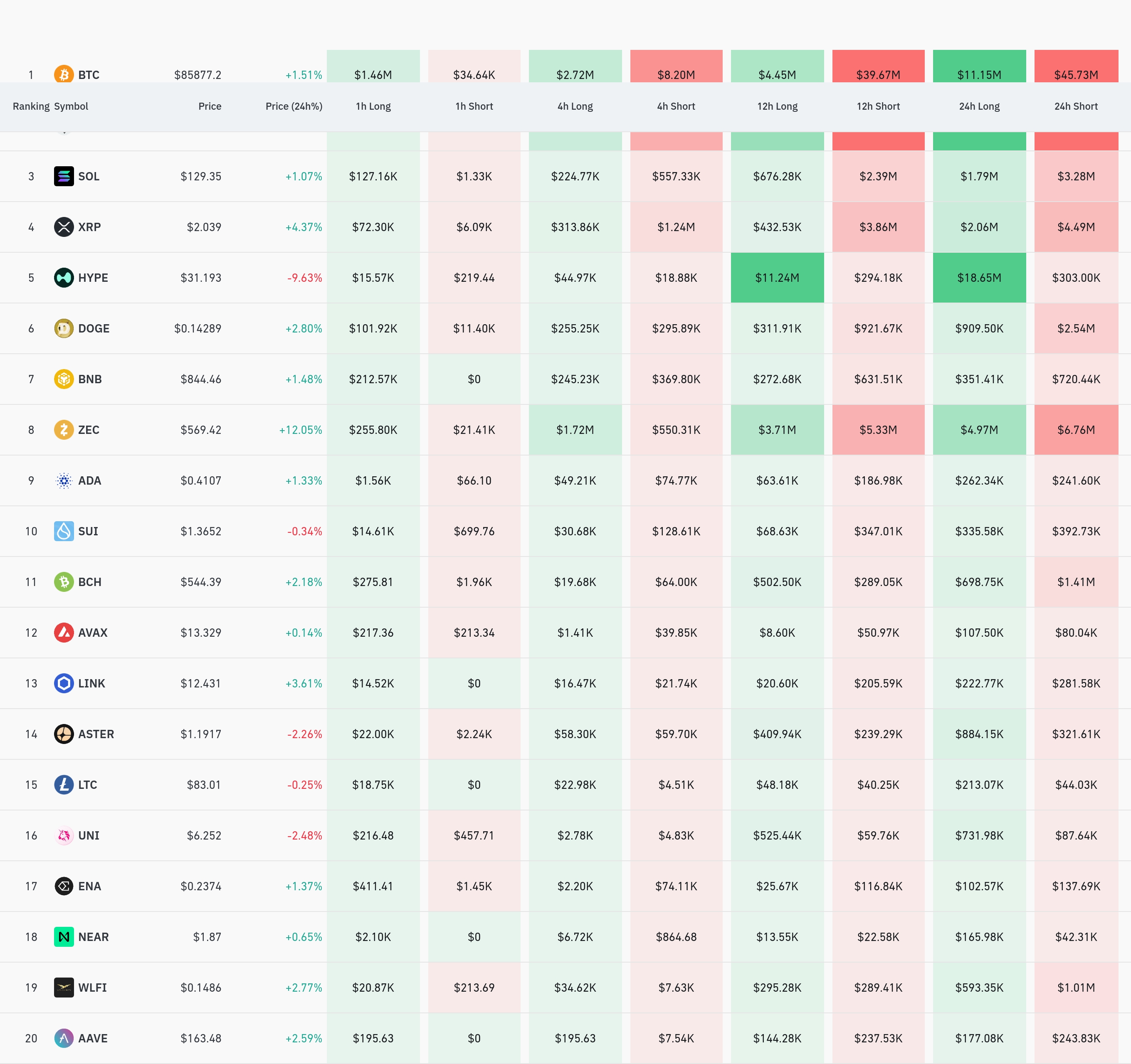

By coin, Bitcoin (BTC) recorded the most liquidations. Bitcoin is currently trading at $58,577.2, and over the past four hours, $2.72 million in long positions and $8.2 million in short positions were liquidated. A total of $50 million in liquidations occurred over the past 24 hours.

Ethereum (ETH) recorded the second-highest liquidation volume after Bitcoin, with approximately $34 million in positions liquidated over the past 24 hours.

In particular, unexpectedly large-scale liquidations were observed in ZEC, which is currently trading at $569.42. Over the past four hours, $1.72 million in long positions and $550,000 in short positions were liquidated. A total of $11 million in liquidations occurred over 24 hours, demonstrating a high liquidation rate relative to market size.

Solana (SOL) is trading at $129.35, with $220,000 worth of long positions and $550,000 worth of short positions liquidated in the last 4 hours.

Dogecoin (DOGE) is trading at $0.14289, showing a relatively balanced liquidation pattern with $250,000 liquidated from long positions and $290,000 liquidated from short positions.

XRP is trading at $2.09, with $310,000 in long positions and $1.24 million in short positions liquidated over the past 4 hours, indicating a high short position liquidation ratio.

In the cryptocurrency market, "liquidation" refers to the forced closure of leveraged positions when traders fail to meet margin requirements. This liquidation data shows a higher than expected liquidation rate for short positions, indicating that traders who bet on a decline suffered significant losses amidst the recent upward market momentum.

Article Summary by TokenPost.ai

🔎 Market Interpretation

- Approximately $360.7 million worth of leveraged positions were liquidated over the past 24 hours.

- Unusually, the short position liquidation rate (62.78%) is higher than that of long positions.

- By exchange, the largest liquidation amounts were Binance ($131 million) and Bybit ($83 million).

- By coin, liquidation amounts were highest in the following order: BTC ($50 million), ETH ($34 million), and ZEC ($11 million).

💡 Strategy Points

- A high short position liquidation rate suggests that the market is showing stronger upward momentum than expected.

- It is noteworthy that altcoins such as ZEC have seen large liquidations relative to their market size.

- The extremely high short position liquidation rate (96.09%) on certain exchanges, such as Hyperliquid, indicates that traders on those exchanges mispredicted market direction.

📘 Glossary

Liquidation: The process of forcibly closing a position when the margin for the position in leveraged trading falls below the maintenance margin level.

- Long Position: A position purchased in anticipation of an asset price rise.

- Short Position: A position sold in anticipation of a decline in asset price.

- Leverage: A lending system that allows you to trade with a larger amount than your own capital.

TokenPost AI Notes

This article was summarized using a TokenPost.ai-based language model. Key points in the text may be omitted or inaccurate.

Get real-time news... Go to TokenPost Telegram

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.