Some Bitcoin players are speculating that the significant increase in the likelihood of a Fed rate cut in December could cause Bitcoin prices to “bottom Dip for now.”

Bitcoin players were noticeably more optimistic on social media today as the likelihood of a US Federal Reserve interest rate cut in December nearly doubled from just a day earlier.

Some crypto market participants are speculating that this could be the catalyst Bitcoin needs to halt the asset's downtrend.

“Let’s XEM if that’s enough to find a Dip here,” crypto analyst Moritz said in a post on X on Friday, as Bitcoin price traded at $85,071, down 10.11% over the past seven days, according to BingX .

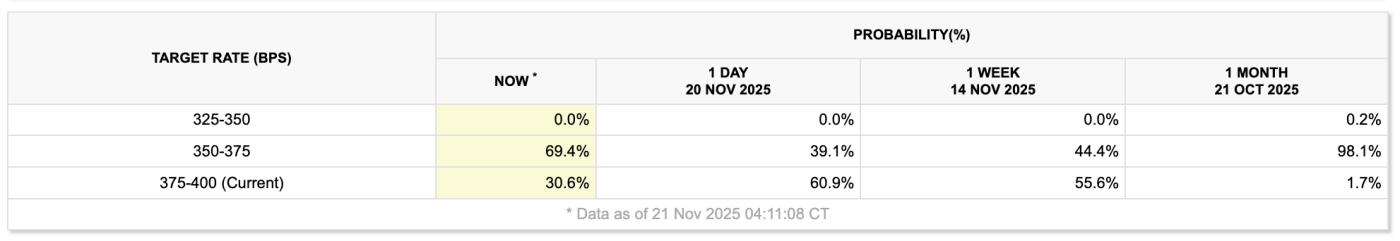

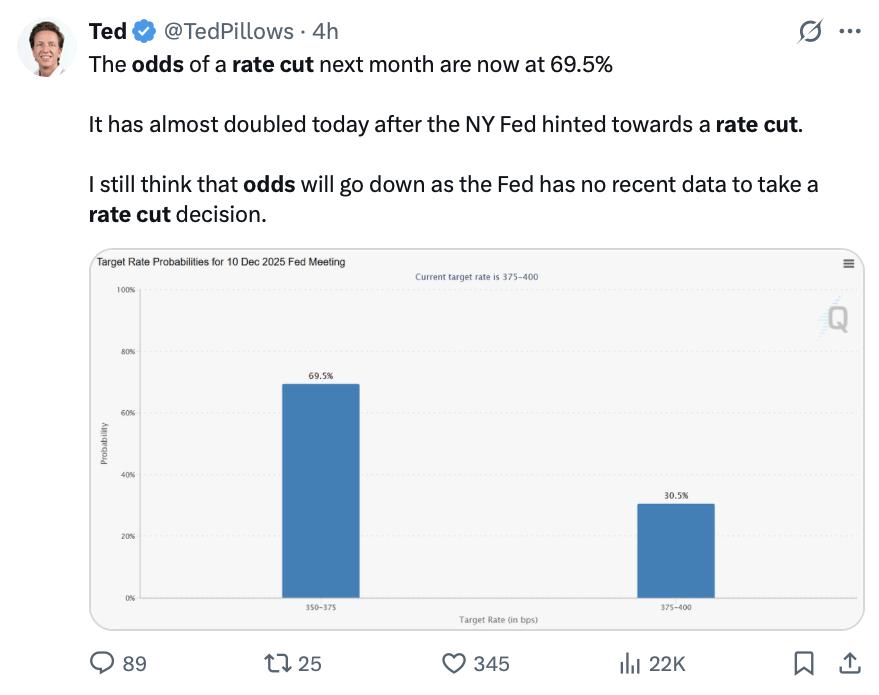

The probability of a rate cut at the Federal Open Market Committee's (FOMC) December meeting nearly doubled to 69.40% on Friday, according to the CME FedWatch Tool. Just a day earlier, on Thursday, the probability had fallen from 30.30% to 39.10%.

Many in the broader market attributed the surge at least in part to dovish comments from New York Federal Reserve President John Williams, who said the Fed could cut interest rates “in the near term” without jeopardizing its inflation target. That’s why the odds “rose sharply,” Bloomberg analyst JOE Weisenthal said.

This setup looks “very bullish,” the analyst said.

Economist Mohamed El-Erian, however, warned market participants not to “get carried away” with these comments. Meanwhile, the broader crypto community reacted with even more optimism. “Normally, this would be optimistic,” Mister Crypto said in a post on X on Friday.

Fed rate cuts typically benefit riskier assets like Bitcoin and the cryptocurrency market in general, as traditional assets like bonds and term deposits become less profitable for investors.

Cryptocurrency analyst Jesse Eckel pointed to the rising likelihood of a rate cut, saying, “Broadly speaking, the picture is extremely bullish.”

“I don’t see why we keep cutting,” Eckel said. “We’re moving from a tightening cycle to an easing cycle,” he added.

Cryptocurrency analyst Curb said, “Cryptocurrency is going to explode with massive price increases.”

The possibility of previous rate cuts was “mispriced”

“While the market is leaning towards a ‘no cut’ scenario, we believe the likelihood of a rate cut is actually mispriced,” Coinbase Institutional said in a post on X on Friday. “Recent tariff research, private market data, and real-time inflation indicators suggest otherwise.”

“Since the October FOMC meeting, the futures market has shifted from expecting a 25 basis point cut to favoring a hold, largely due to rising inflation concerns,” Coinbase Institutional said.

However, studies show that raising tariffs can reduce inflation and increase unemployment in the short run, similar to a negative demand shock,” the report added.

Sentiment across the entire cryptocurrency market has remained weak over the past seven days. The Crypto Fear & Greed Index, a gauge of overall crypto market sentiment, posted an “Extreme Fear” score of 14 in its update on Friday.

Source: Cointelegraph