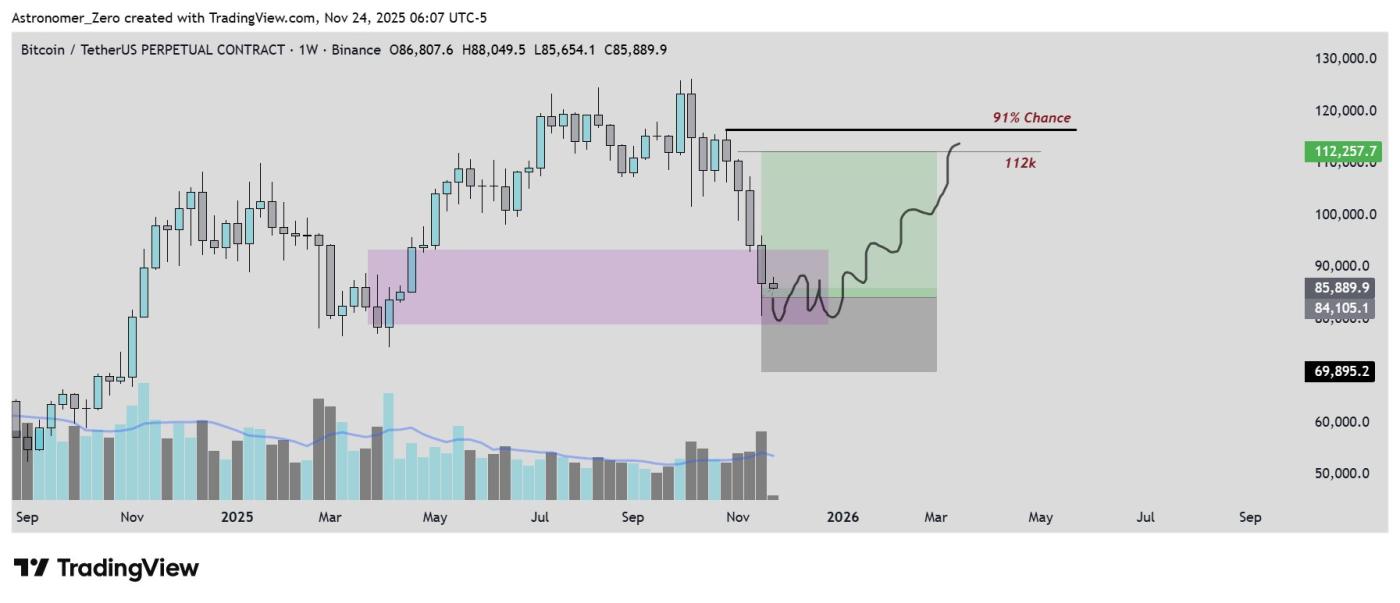

Bitcoin's drop to $80,000 marked a Dip and there is a 91% chance that a reversal of the current trend will take BTC price back to $118,000, an analyst says.

Traders are experiencing one of the fastest capitulation events since late 2022, but one market analyst argues that historical data confirms that $80,000 was the Dip.

Key points to Mnemonics:

- A Bitcoin analyst has given a 91% probability that BTC will not see a weekly close lower than the current low.

- The NVT Golden Cross shows that Bitcoin's market Capital may be undervalued, signaling a long-term investment opportunity.

- Macroeconomic liquidation signals from Arthur Hayes and a rapid on- chain recovery supported the $80,000–$85,000 floor.

Capitulation volume confirms high probability Dip for BTC

Bitcoin analyst Astronomer says the ongoing bearish sentiment, conveyed as “waiting for the trend” or claims of the bull cycle ending, is coming at exactly the wrong time.

According to the capitulation volume model, based on the three-layer rule for weekly candles, it identifies the Dip of the previous cycle when three consecutive high volume red candles appear before a major reversal.

In 11 historical cases, this capitulation pattern has produced consistent results. In two of the 11 cases, Bitcoin rallied around 35% before resuming a broader downtrend.

In eight out of 11 cases, this pattern marked the start of a new bull run, eventually leading to a new record high. Only one case resulted in a sustained downtrend, making it a clear statistical outlier.

This forecast gives a 91% chance of the price hitting $118,000 from current levels, a 99% chance of hitting $112,000, and a 75% chance of the broader bull market continuing.

The astronomer stressed that sentiment is the real trap; sell now or wait for trend confirmation in line with the cautious behavior of the crowd and risk chasing the next local high.

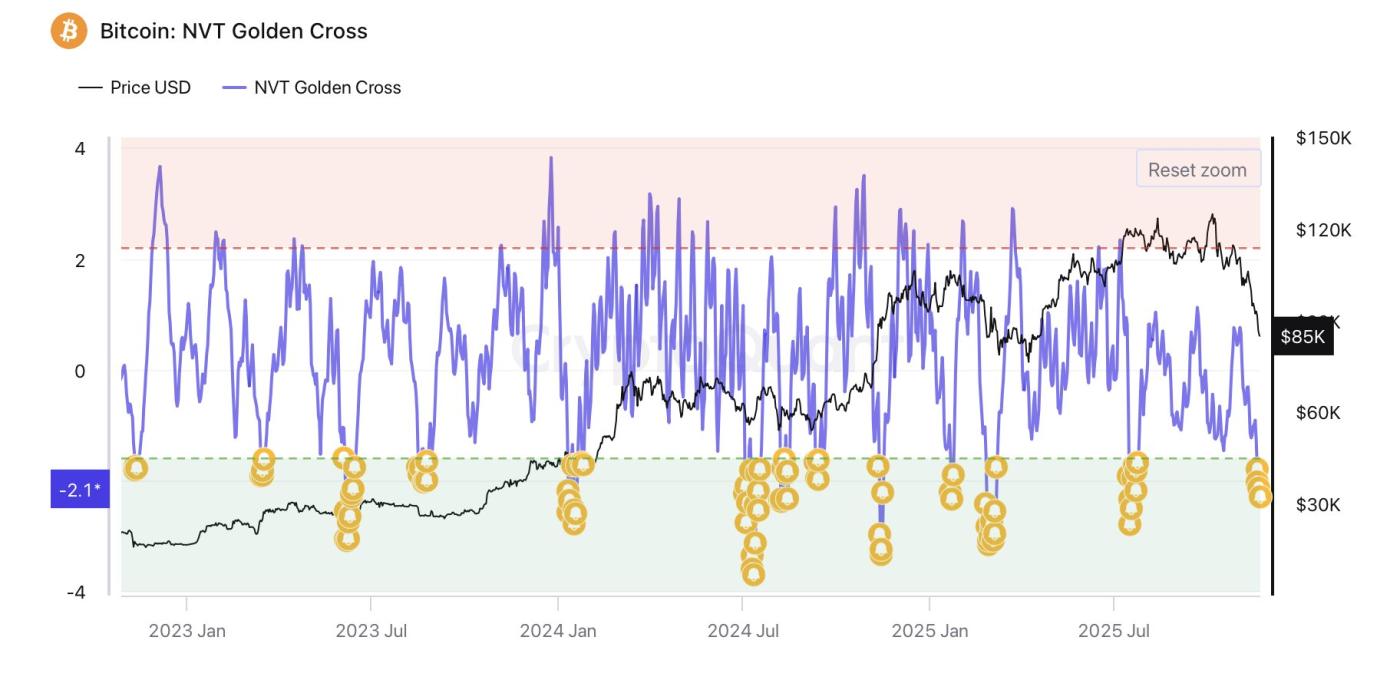

Meanwhile, BTC network value on trade (NVT) has dropped to -1.6, which typically signals market undervaluation and a chance of a short-term Medium reversion. However, crypto trader Darkfost warns against using leverage in the current climate.

Arthur Hayes: “I think $80,000 will hold” as liquidation increases

Cointelegraph reported that Arthur Hayes asserted that BTC ’s recent 35% drop to $80,500 marked the Dip of the cycle, citing the imminent end of the Federal Reserve’s quantitative tightening cycle and rising lending by U.S. banks.

As liquidation improves, Hayes predicts a “rising tidal effect” for cryptocurrencies. “Prices could drop below $90,000, they could drop as low as $80,000 – updated prices according to the BingX exchange, but $80,000 still holds,” Hayes said, arguing that increased liquidation, not market sentiment, will drive the next rally.

Onchain data supports this view. Data from CryptoQuant shows that BTC just recorded its largest net real loss since the FTX collapse, but the market quickly reversed to the positive almost immediately.

Such rapid absorption by forced sellers implies that the floating supply has been Dump, allowing BTC to defend the $80,000–$85,000 region if traditional market conditions remain stable.

Source: Cointelegraph