Bitcoin has reclaimed $86,000 as the US dollar strengthens, but one analyst warns the rally may be structurally weak.

BTC prices held above $86,000 on Monday (updated to BingX exchange rates) after a steady recovery over the weekend from Friday's sharp rise to $80,600, its lowest price since April. The recovery came as traditional markets opened the week on a cautious note, with the US Dollar Index (DXY) steady above 100, hovering near a six-month high.

Key points to Mnemonics:

- The US dollar index held at 100 after Non-Farm Payrolls (NFP) jumped to 119,000 vs 53,000.

- Bitcoin has recovered from $80,600 to above $86,000, but one analyst says this could be a false price rally.

- BTC/gold ratio shows structural underperformance despite BTC/USD rallying back by 2025.

Fed uncertainty remains as NFP lifts US dollar

Bitcoin’s move comes as global markets digest fresh macroeconomic surprises, starting with the strong US non-farm payrolls (NFP) report on November 20, which showed 119,000 jobs added compared to just 53,000 expected.

The stronger-than-expected NFP report added a new layer of tension to the market outlook. Typically, stronger jobs data would dampen interest-rate cut expectations by signaling economic recovery, but this time the effect was mixed: the US Dollar Index (DXY) held steady above 100, a six-month high, while traders recalibrated the Fed's next steps.

On Friday, New York Federal Reserve President John Williams signaled that a rate cut in the near term is still possible, arguing that labor market weakness, not inflation, is the bigger risk going forward.

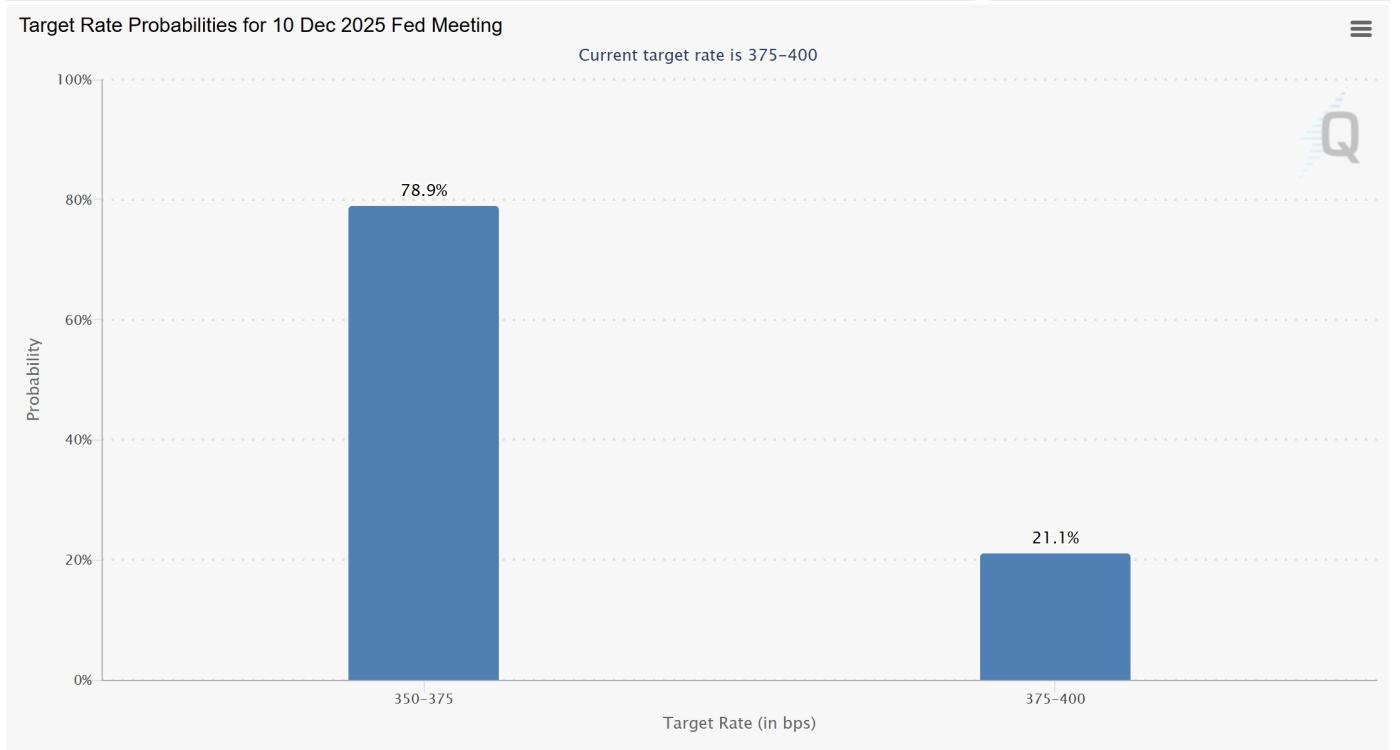

However, markets appeared optimistic on Monday, with data from the CME group now predicting a 78.9% chance of a 25 basis point rate cut in December, up from 44% last week. However, Boston Fed President Susan Collins said she was still undecided, highlighting the deep Chia over Fed policy.

The dollar rose against the euro and sterling as European financial tensions intensified, while the yen gave up some of Friday's gains despite fresh verbal intervention from Tokyo.

Is Bitcoin's Recovery Really Happening or Just a Dollar Distortion?

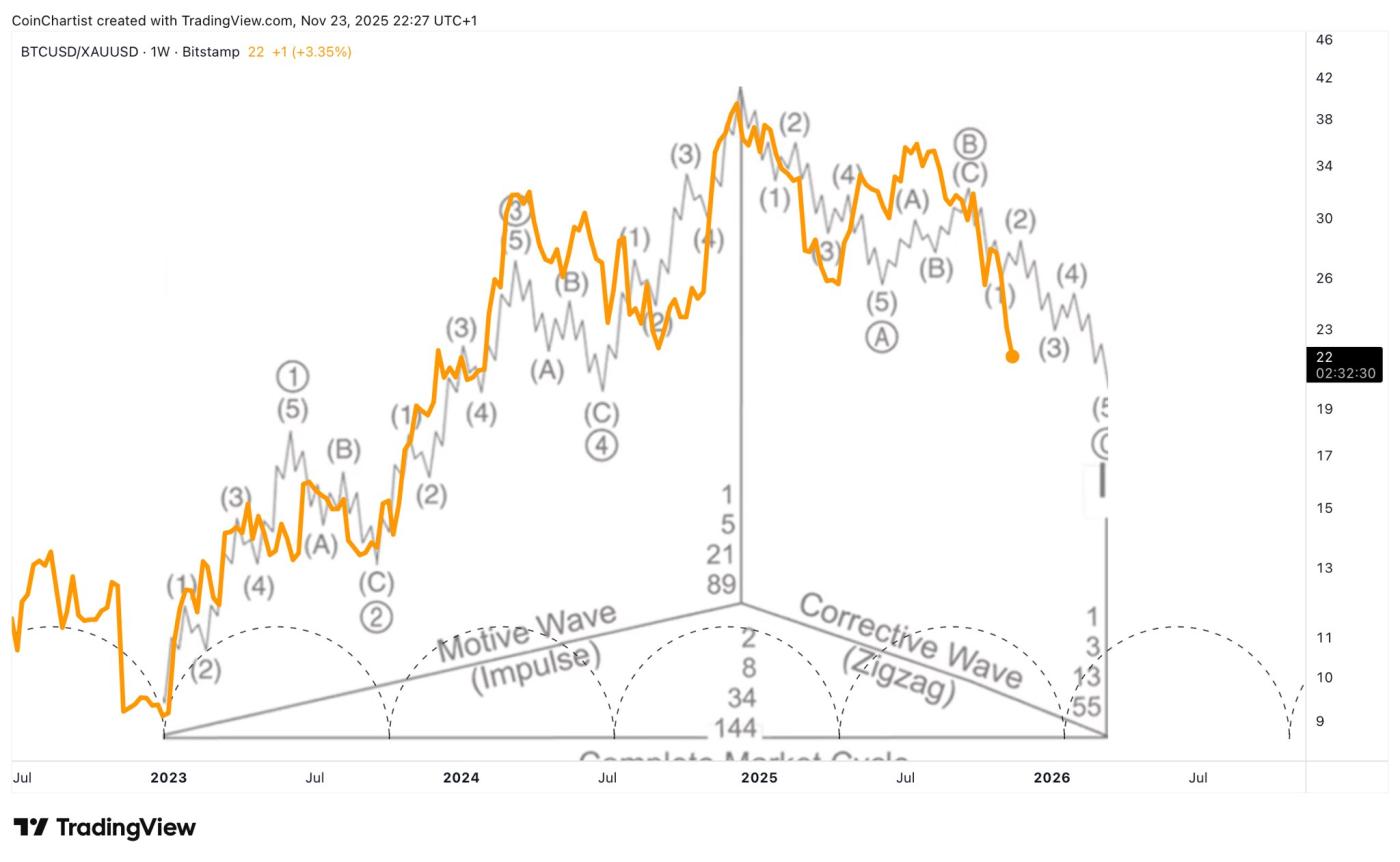

While Bitcoin’s strong weekend rally has improved short-term sentiment, some analysts warn against misinterpreting the rally. Market analyst Tony Severino notes that BTC ’s latest October high against the US dollar could be a “B-wave” rally, amplified by a weakening dollar rather than actual strength in the cryptocurrency.

Severino's BTC/gold ratio chart shows a cycle top in March 2025 near 46, followed by a correction period that Dip around December 2025 and January 2026, coinciding with Bitcoin's halving cycle. Severino said this falling ratio implies Bitcoin is underperforming gold, meaning BTC/USD's rally may be masking structural weakness.

However, Bitcoin's ability to reclaim the mid-$80,000s amid a stronger dollar has given traders a technical opportunity until volatility and Fed uncertainty subside until the next big move.

Source: Cointelegraph