A leaked internal document shows that Brevan Howard’s Nova Digital fund has been granted by Berachain the right to recoup $25 million of its investment within a year after the TGE.

Berachain Exposed for Secret "Money Back" Clause with VC

Berachain Exposed for Secret "Money Back" Clause with VC

$25 million refund clause

- An internal document recently published by Unchained Crypto on November 25 revealed a special clause between Brevan Howard, a fund management group worth more than $34 billion, and the Berachain project, allowing Brevan's Nova Digital subsidiary fund to get a full refund of its $25 million investment if it is not satisfied with the results after one year since the BERA Token was launched.

SCOOP 🚨: Berachain gave its co-lead investor a refund right that is valid for up to a year after BERA's TGE, according to documents obtained by @Unchained_pod .

— Jack Kubinec (@whosknave) November 24, 2025

Unchained has published those documents, along with the full story (by me), at the link below.

The refund right was… pic.twitter.com/d3bGOf4Ru8

- According to leaked documents, Nova Digital Master Opportunities Fund, a subsidiary of Brevan Howard Digital, co-led Berachain's $100 million Series B round in March 2024 with Framework Ventures, valuing the project at $1.5 billion.

- Nova's investment of $25 million, made through a SAFT agreement but with a full or partial refund clause within 12 months after TGE, starting February 6, 2025.

- Specifically, Nova has the right to request Berachain to refund the entire $25 million in cash on or before February 6, 2026 if the BERA Token price does not meet expectations. In return, if the refund right is exercised, Nova will give up all the allocated BERA Token , which are locked under a one-year cliff period.

- This can be XEM as a golden term for Nova Digital and is unprecedented in blockchain deals, helping Brevan Howard almost completely eliminate risks, if BERA increases in price, they enjoy all the profits; but if the Token drops sharply, they only need to request a refund of all the cash contributed.

- In traditional Token deals, the right to refund is only applied if the project does not issue Token or violates the issuance commitment, and never because the Token price drops. Therefore, this clause is considered asymmetric and lacks transparency if other investors are not similarly informed.

BERA Price Drops, $25 Million Repayment Likely High

- Insider sources say that Nova only needs to deposit an additional $5 million into the Berachain fund within 30 days after the TGE to trigger this refund clause. However, there is currently no evidence to confirm whether Nova has made this deposit or not.

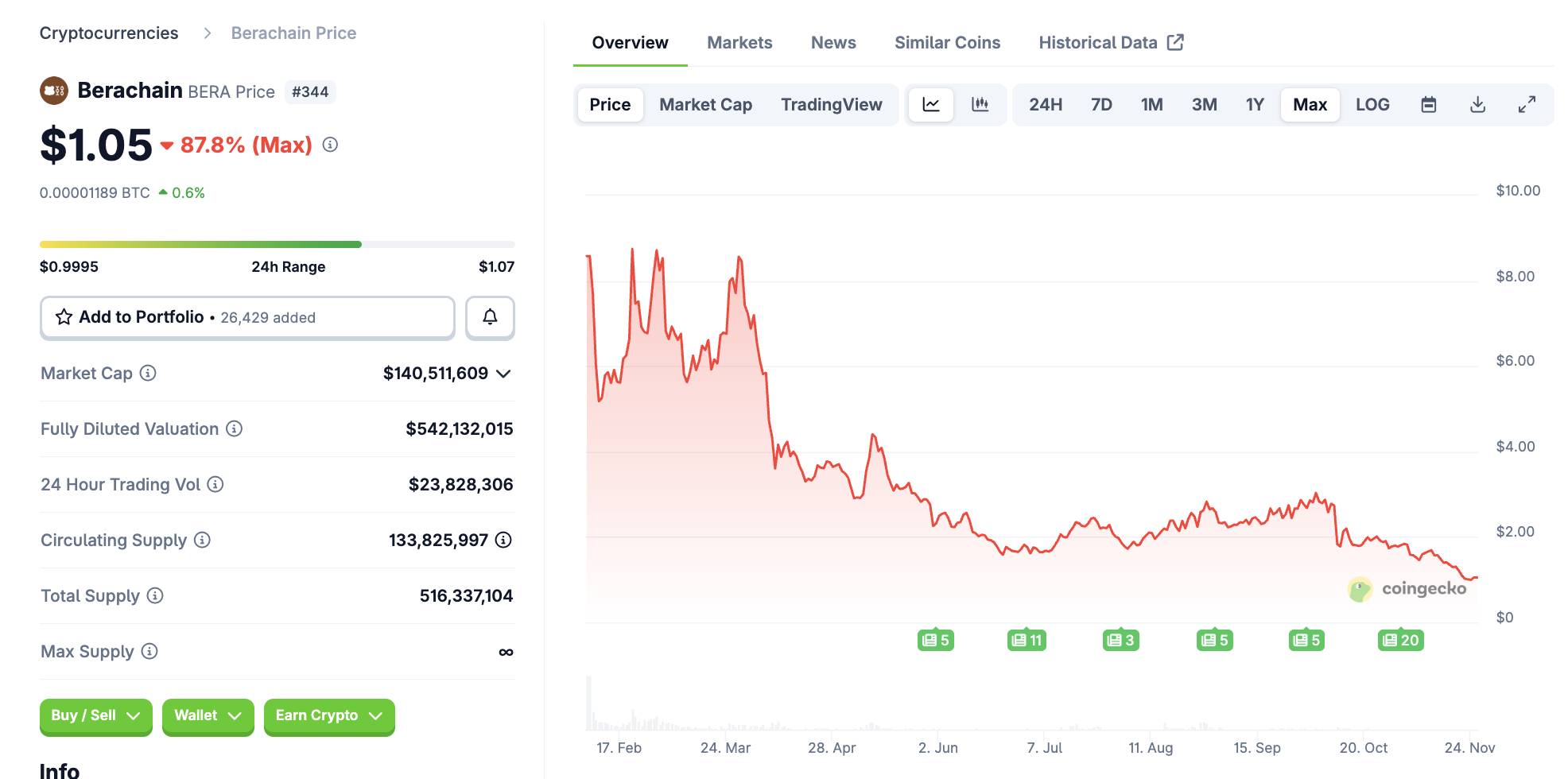

- According to on-chain data from Artemis, since the TGE, the Berachain ecosystem has seen a net outflow of over $367 million, while the BERA Token price hit a record low of $1.02. This decline has left other investors such as Framework Ventures, Polychain, Arrington Capital, Hack VC, and Tribe Capital , who do not have similar protection clauses, suffering heavy losses.

BERA price movement since TGE, screenshot at 12:15 PM on 11/25/2025

BERA price movement since TGE, screenshot at 12:15 PM on 11/25/2025

- In particular, Framework Ventures currently holds 21.1 million BERA Token, purchased at an Medium price of $3.42, equivalent to a loss of more than $50.8 million by the end of Q2/2025.

- Meanwhile, Nova Digital, with its $25 million refund right in hand, can wait until the February 2026 deadline to decide whether to cut losses or withdraw all Capital . If this clause is activated, Berachain will have to repay a huge amount of $25 million in cash, a terrible financial burden for a project that is already liquidation and community trust.

- To complicate matters, Nova Digital is being spun off from Brevan Howard due to differences in risk strategies. Once the Chia -off is complete, Brevan Howard will no longer have direct involvement in Berachain, making it even more likely that the project will have to shoulder this potential liability on its own.

Anomalies and legal questions surrounding the provision

- Besides being shocking because of its one-sided nature, the $25 million refund clause of Brevan Howard – Nova Digital in the investment deal with Berachain also raises a series of serious legal and ethical questions, related to transparency, fairness between investors, and the possibility of violating international financial regulations.

- According to Unchained's investigation documents, this special refund clause is clearly stated in an addendum dated March 5, 2024 between Nova Digital and Berachain Foundation, signed by Jonathan Ip (Berachain Legal Advisor) and Carol Reynolds (Nova Director). However, other investors in the same Series B round, including Framework Ventures, Polychain, Hack VC, Arrington Capital and Tribe Capital , were not informed about this clause.

- Two of the investors participating in the Capital round, speaking anonymously to Unchained, said:

“If we had known that Brevan Howard would have the right to withdraw all of its funds after TGE, we would not have invested. The project’s failure to disclose this provision is a lack of transparency and misleading to investors.”

- According to attorney Gabriel Shapiro, co-founder of MetaLeX Labs and an expert who has participated in more than 50 Token Capital deals, granting an investor unconditional refund rights after TGE without public notice could be XEM material misrepresentation under the SEC's anti-fraud regulations.

- Another key point is that many investors in Berachain's Series B round had MFN clauses, meaning they were guaranteed to receive the same benefits as every other investor if more favorable terms were granted later.

- After the incident was exposed by Unchained, the anonymous representative of Berachain, Smokey the Bera, co-founder of the project – responded that:

“Unchained’s article is inaccurate and lacks context. Brevan Howard is one of Berachain’s largest investors, and they participated in the Capital with the same set of documents as other investors. The term sheets simply reflect the commercial agreements between the two parties.”

- A former Berachain employee source revealed to Unchained:

“Papa Bear has been blunt about Brevan Howard being the project’s ‘credibility talisman’. Their co-lead of the Series B round has made it easier for other funds to open their wallets.

- Compare that to the most recent precedent, Flying Tulip, a project led by Andre Cronje, which granted refund rights to all investors, not just one party. This ensures fairness and transparency, in stark contrast to how Berachain handled its Series B round.

Response from the founder: "Unchained's article is inaccurate and misleading"

- Shortly after Unchained's investigation was published, Smokey the Bera, the anonymous co-founder of Berachain, published a lengthy article on X to "set the record straight" and refute allegations that Brevan Howard was entitled to a $25 million refund clause.

Bm Folks,

— Smokey The Bera 🐻⛓ (@SmokeyTheBera) November 25, 2025

I wanted to put something out here to set the story straight in light of the recent hit piece. I also didn't want to write a knee-jerk response without receiving feedback from our legal team (given allegations made) and some of our largest stakeholders who have been…

- In a post that began with an apology to the community for the delayed response, Smokey said he had consulted with the project's legal team and largest shareholders before speaking out. He argued that Unchained's article was inaccurate, incomplete, and influenced by several disgruntled former employees, and implied that reporter Jack Kubinec approached sources with malicious intent.

- According to Smokey, Nova Digital co-led the Series B round in 2024 from Brevan Howard's office in Abu Dhabi, through a dedicated liquidation fund. He said that the refund clause in the side letter was only intended to protect Nova in the event that Berachain fails to issue a Token or successfully list, not to hedge against the risk of a falling Token price as the article suggests.

- Smokey also revealed that Nova is not only an investor, but also committed to playing the Vai of liquidation provider (LP) for the ecosystem after the network launches. According to him, this is the “commercial agreement” that Unchained quoted out of context.

- Smokey denies that any other investors in the Series B round were granted MFN terms, and argues that the article's details of hidden incentives or lack of transparency are baseless speculation.

- Not long after Smokey's post went viral, Jack Kubinec, an investigative reporter for Unchained, reposted a short response, refuting all accusations that he acted in bad faith.

Bm Smokey. Couple clarifications:

— Jack Kubinec (@whosknave) November 25, 2025

- I sent your PR a list of questions on Oct. 21 outlining what I planned to report. You refused to answer those questions and sent the statement that appeared in the article. When I asked for clarification or actual answers to any of my questions…

- Jack said he sent the official list of questions on October 21, clearly outlining the content to be published. Berachain refused to respond, only sending back a general statement, which was the excerpt published in the original article. After that, although Jack sent four more emails to clarify, Berachain's media team was completely silent.

- He also said that after Blockworks dissolved its editorial department, he proactively informed Smokey that the article would be republished on Unchained, but still received no response. Kubinec emphasized:

“If that clause was only to protect Nova in case Berachain couldn't issue Token, why would it be effective a year after the TGE took place?”

- He also disputed the MFN allegation, saying Unchained never said that all Series B investors had MFN. We just made it clear that at least one investor had an MFN clause that applied to this round.”

- Finally, the journalist asked Smokey directly whether he informed other investors that Nova Digital was entitled to a refund?”

- The public exchange between Smokey and Jack has deeply Chia the Berachain community. Some believe that Unchained is “one-sided”, while others believe that the project’s acknowledgement of the side letter’s existence indirectly confirms the privilege reserved for Brevan Howard.

Berchain's long slide

- Berachain originated from the “Bong Bears” Non-Fungible Token collection that was created in 2021, at the height of the JPEG craze on Ethereum. The collection quickly became an icon in the crypto community with its image of smoking bears.

- The BERA (TGE) Token launch event on February 6, 2025 is XEM one of the biggest TGEs of the year, attracting attention thanks to its loyal community and dense dApp ecosystem.

- However, since the TGE, Berachain has been experiencing continuous fluctuations. After the BERA Token lost more than 66% of its value, a series of applications built on Berachain such as IVX, Memeswap and many other DeFi projects have moved to more popular blockchains such as Hyperliquid. Net withdrawals of more than 367 million USD since the beginning of the year, validators had to pause the network on November 3 due to a Balancer error that nearly stole 12.8 million USD.

- However, Berachain is still trying to revive its image with new deals. Greenlane Holdings, a vape device manufacturer, invested $110 million to establish a Digital Asset Treasury (DAT), to buy and hold BERA. The deal involved Polychain, Kraken, Blockchain.com, North Rock Digital, CitizenX and dao5.

Coin68 synthesis