Hedera (HBAR) has been trading sideways for the past few days, as the altcoin struggles to generate significant recovery momentum. After a sharp decline this month, HBAR is waiting for a decisive momentum to break the stagnation.

However, the support needed to fuel that recovery appears limited, and broader market uncertainty isn't helping HBAR.

Hedera traders are placing Short orders

Deposit rates on major exchanges indicate that traders are still hesitant. The current negative deposit rates indicate that market participants expect prices to fall further and are taking short positions to profit from the potential price decline. This type of sentiment is often seen in long consolidation periods where traders lose confidence in the asset’s ability to recover.

However, deposit rates are sensitive and can change rapidly. Their frequent fluctuations represent volatility and uncertainty rather than a sharp downward trend. If sentiment changes and traders start to reverse their short positions, HBAR could benefit from a sudden wave of buying, helping it to recover its previous decline.

Want more information on Token like this? Sign up for Editor Harsh Notariya's Daily Crypto Newsletter here .

HBAR Deposit Interest Rate. Source: Coinglass

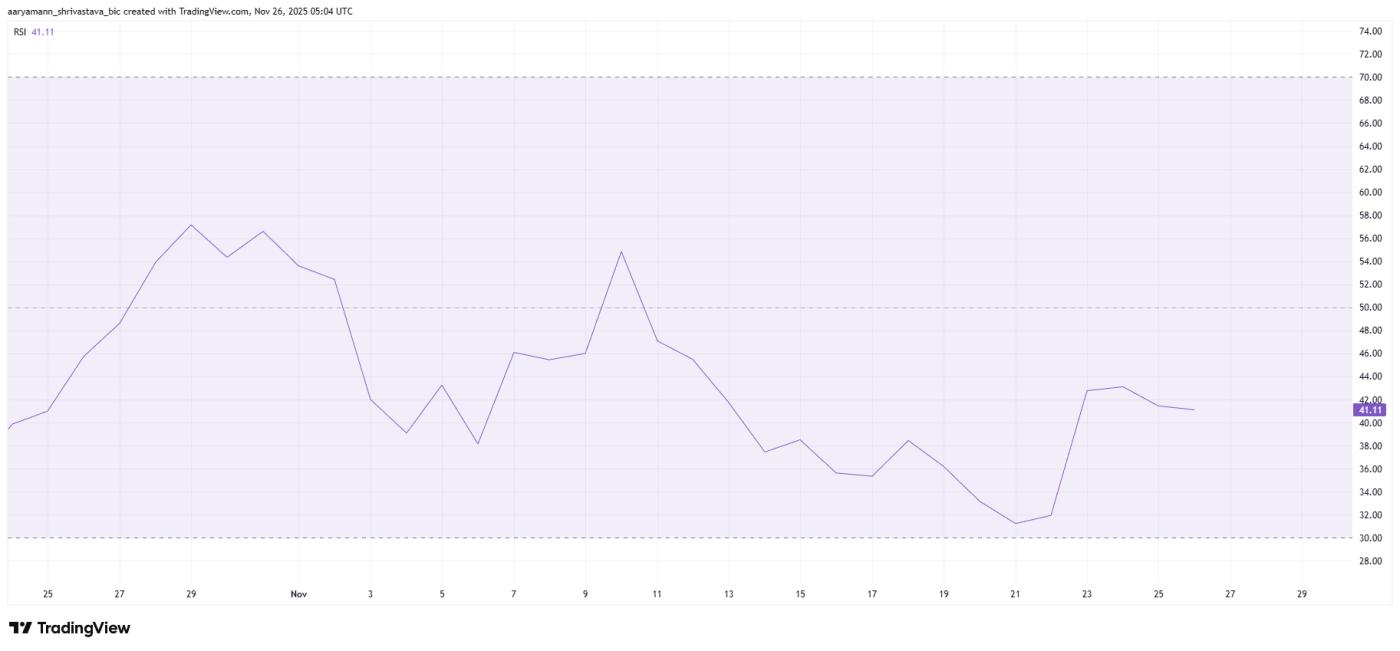

HBAR Deposit Interest Rate. Source: CoinglassThe overall bullish backdrop remains weak. Hedera ’s Relative Strength Index is below the neutral level of 50.0, in bearish territory. This position reflects persistent market pressure and a lack of strong bullish conviction. When RSI holds in negative territory, price action often struggles to make higher highs or create sustained rallies.

The market-wide caution also affects HBAR's recovery potential . Unless momentum indicators turn bullish, the altcoin may continue to be stuck in its current range.

RSI of HBAR. Source: TradingView

RSI of HBAR. Source: TradingViewHBAR price has a long way to go

HBAR is trading at $0.144, just below the important resistance level at $0.145. For a significant rally to begin, the altcoin must flip this resistance into support. This would allow it to advance towards $0.154 — a level that previously Vai as a ceiling.

Based on current indicators, HBAR could continue to congregate between $0.154 and $0.130. The bearish sentiment and weak macro signals suggest that the altcoin could remain stuck in this range unless a strong momentum emerges.

HBAR Price Analysis. Source: TradingView

HBAR Price Analysis. Source: TradingViewTo recover from November's losses, HBAR needs to rise by about 40%, pushing it to the $0.200 region. This requires overcoming several resistance levels, starting with $0.154. If HBAR can clear that level, a move to $0.162 and higher becomes possible, giving the altcoin a chance to reassert its bullish case.