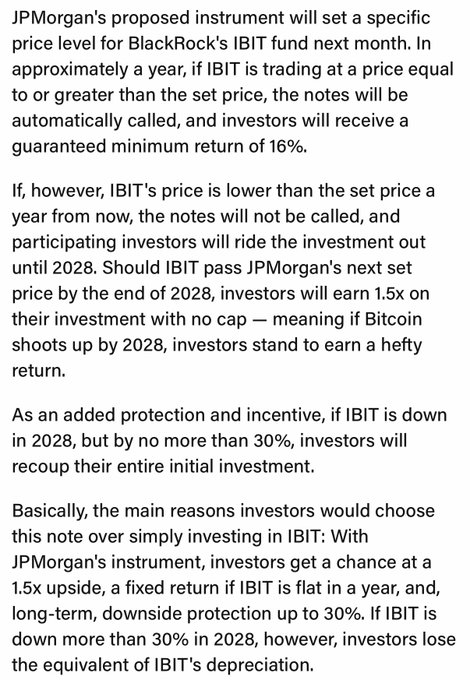

JPMORGAN PREPARES TO LAUNCH PRODUCT LINKED TO BLACKROCK BITCOIN ETF (IBIT) 🔸 This product is a structured note, providing the following benefits: — Minimum 16% profit in 1 year if IBIT reaches target price and product will automatically end early — If IBIT does not reach its target after 1 year, investors will continue to hold the product until 2028 — If IBIT exceeds JPMorgan's target by 2028, investors will earn 1.5x returns and have no cap on returns — Risk protection down to 30%: if IBIT decreases but not more than 30% by 2028, the investor will get back the entire initial Capital — If IBIT decreases by more than 30%, the investor suffers a loss corresponding to the decrease in IBIT 🔸 Why is JPMorgan doing this? Not because they believe in Bitcoin, but because: — They earn fees for releasing and managing products — Keep customers in the banking system, instead of letting them buy BTC themselves — Customers want to invest in Bitcoin with a “safety net”, so banks provide products to meet that need — JPMorgan doesn't need to hold Bitcoin but still benefits from hedging and risk management

This article is machine translated

Show original

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content