The world of digital assets is never short of volatility, but every deep drop implies a rethinking of the industry's fundamentals. Bitcoin has broken through $91,000, rising 4.18% in the past 24 hours. This market movement at the end of November has brought a ray of hope to the crypto market. After falling from a high of approximately $126,000 in early October to below $81,000, a pullback of nearly 30%, Bitcoin is finally showing signs of stabilization.

In a recent sharing session, Molly, the official spokesperson for Huobi HTX, stated that this round of market adjustment is not a simple "emotional collapse," but rather a "repricing" that occurs across three dimensions: macroeconomics, capital, and market structure.

Initial stabilization after a sharp drop

After weeks of decline, Bitcoin has finally shown signs of a rebound. According to market data, Bitcoin has broken through the $90,000 mark again, rising 4.18% in the past 24 hours. Not only Bitcoin, but other major crypto assets also showed signs of recovery: Ethereum rose 3.15%, XRP rose 6.98%, BNB rose 2.03%, and Solana rose 3.72%.

https://www.htx.com/zh-cn/trade

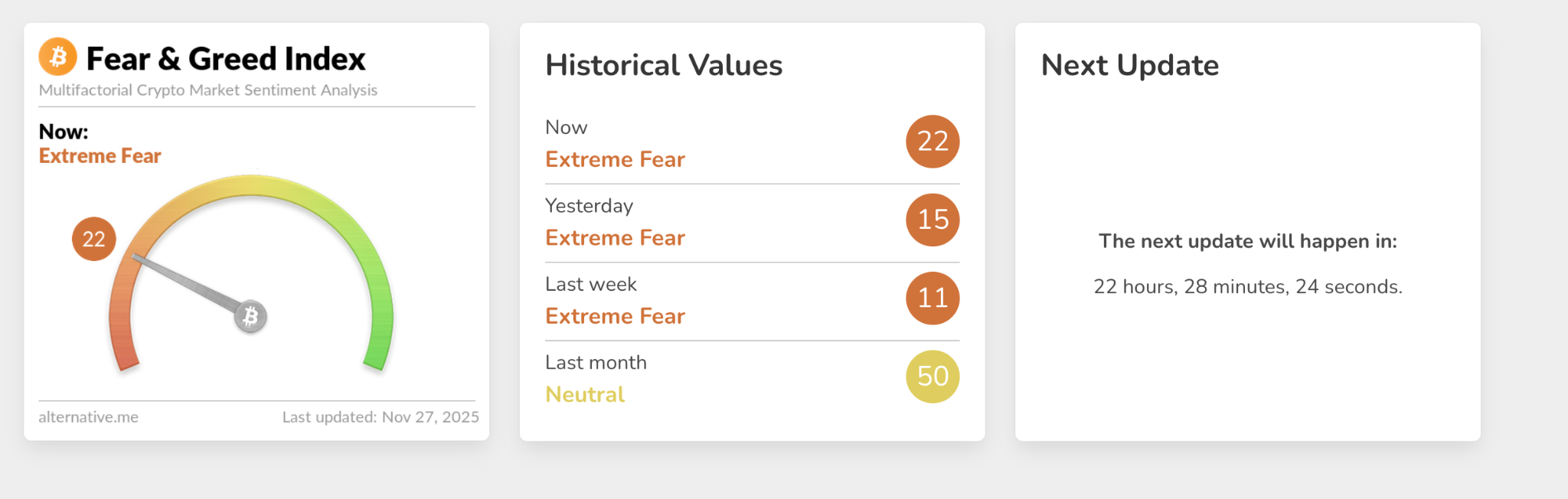

While market sentiment has improved somewhat, it remains in a state of "extreme fear." According to Alternative data , the cryptocurrency fear and greed index rose to 22 today from 20 yesterday, but it has not yet escaped the "extreme fear" zone. The recovery of market confidence will take time.

Macroeconomic Background: Data Vacuum and Policy Game

Based on market analysis, this week presents a typical "high volume before, low volume after" structure for the US and cryptocurrency markets: Thanksgiving and Black Friday will compress effective trading days, concentrating all core data releases from Monday to Wednesday. Meanwhile, delayed data due to the government shutdown and the absence of the October non-farm payrolls report have made the market highly reliant on high-frequency employment data. Today's decline in weekly initial jobless claims in the US indicates that the employment situation has not deteriorated. While most institutions expect a very high probability of a Fed rate cut in December, some believe the Fed still has the opportunity to pause rate cuts.

The flurry of speeches by Federal Reserve officials ahead of the November 29 blackout period will further amplify short-term macroeconomic volatility. According to the latest probability data, the market now sees a 69.3% chance of a 25 basis point rate cut by the Fed in December, a significant reversal from last week's 22%.

Market Structure: Defensive Posture and Panic Pricing

Against this backdrop, the crypto market continues to digest the deep correction since October, with Bitcoin falling by about 30% from its high, ETFs experiencing continued net outflows, the Coinbase premium weakening, and overall risk appetite remaining low.

The structure of the derivatives market clearly reflects this defensive stance: tensions in the options market have cooled significantly: the premium of one-week put options relative to call options has plummeted from 11% last Friday (the 2025 high) to about 4.5%.

Technical indicators show oversold conditions: Bitcoin's 14-day Relative Strength Index (RSI) has fallen to 32, below early October levels and approaching oversold territory. Implied volatility has returned to April levels: indicating that traders are preparing for a breakout move.

Overall, we are currently in the final stages of a downtrend, but risk appetite has not yet recovered. If this week's data continues to show marginal weakening in consumption and employment without triggering concerns about a "hard landing," it may lead to a technical recovery. Conversely, given the extremely thin liquidity environment during the holiday season, it could still trigger a short-term sell-off.

Short-term outlook: tipping point and opportunities

From a technical perspective, Bitcoin's short-term support level is at $80,000, while the resistance zone is between $90,000 and $95,000. Whether it can break through this resistance zone will determine the sustainability of the rebound.

Option skew indicates that bets on a rebound from current levels are increasing, relative to further declines. Meanwhile, short positions in the BlackRock Bitcoin Fund (IBIT) have also fallen sharply, suggesting weakening bearish sentiment. Despite overall market caution, funds are shifting from a single price-driven game to a structured allocation based on three core logics: liquidity efficiency, yield generation, and information pricing. Signs of fund rotation have already appeared in sectors such as stablecoins and PERP derivatives.

Industry Perspective: Finding Opportunities Amidst Panic

In an environment of heightened market volatility, Molly stated, "Between compliance and innovation, we believe it's not a matter of choosing one over the other, but rather a matter of multiple systems operating in parallel and improving each other. In the long run, our value lies in screening trustworthy, high-quality assets for our users."

She further pointed out that the current market phase is characterized by a transition from "panic" to "hope." In today's industry environment of "marketing and innovation," Huobi HTX's differentiated approach is to focus on sincerity rather than gimmicks. Huobi HTX hopes to earn users' long-term trust through every act of sincerity.

Analysts believe that in 2025, crypto investment should focus on platform ecosystems, pay attention to the integration of AI and Web3, maintain a high degree of policy sensitivity, and adhere to long-termism. The crypto market is never short of trends, but what truly changes a company's fate is the ability to seize the benefits of consensus.

Remaining calm amidst volatility and seeing opportunity in panic—this may be the best strategy in the current market environment. As the global crypto market continues to evolve, trading platforms are crucial hubs connecting users, innovation, and the future digital asset ecosystem.

Note: The content of this article is not investment advice, nor does it constitute an offer, solicitation of an offer or recommendation for any investment product.