Once listed on Binance, everything can change for a small or Medium Token . It brings more volume , more users, and immediate attention. As December 2025 approaches, some altcoins are starting to show stronger charts, increased interest, and early signs that they are preparing for a new move on the exchange.

If Binance adds any of them next month, the price reaction could be strong. Here are three to watch.

irys (irys)

Irys (IRYS), a layer-1 data chain , is only two days old in the CEX space, but it is already on the shortlist for a new listing on Binance. It is already listed on Coinbase, which gives it early credibility, and Binance has launched IRYS/ USDT Futures Contract with 20x leverage . When Binance adds Futures Contract before a spot listing, it usually increases the likelihood of a full listing around that time. That is why IRYS is on the December watch list.

The market reacted quickly. IRYS price increased by nearly 80% in the past 24 hours, right when the Futures Contract were released.

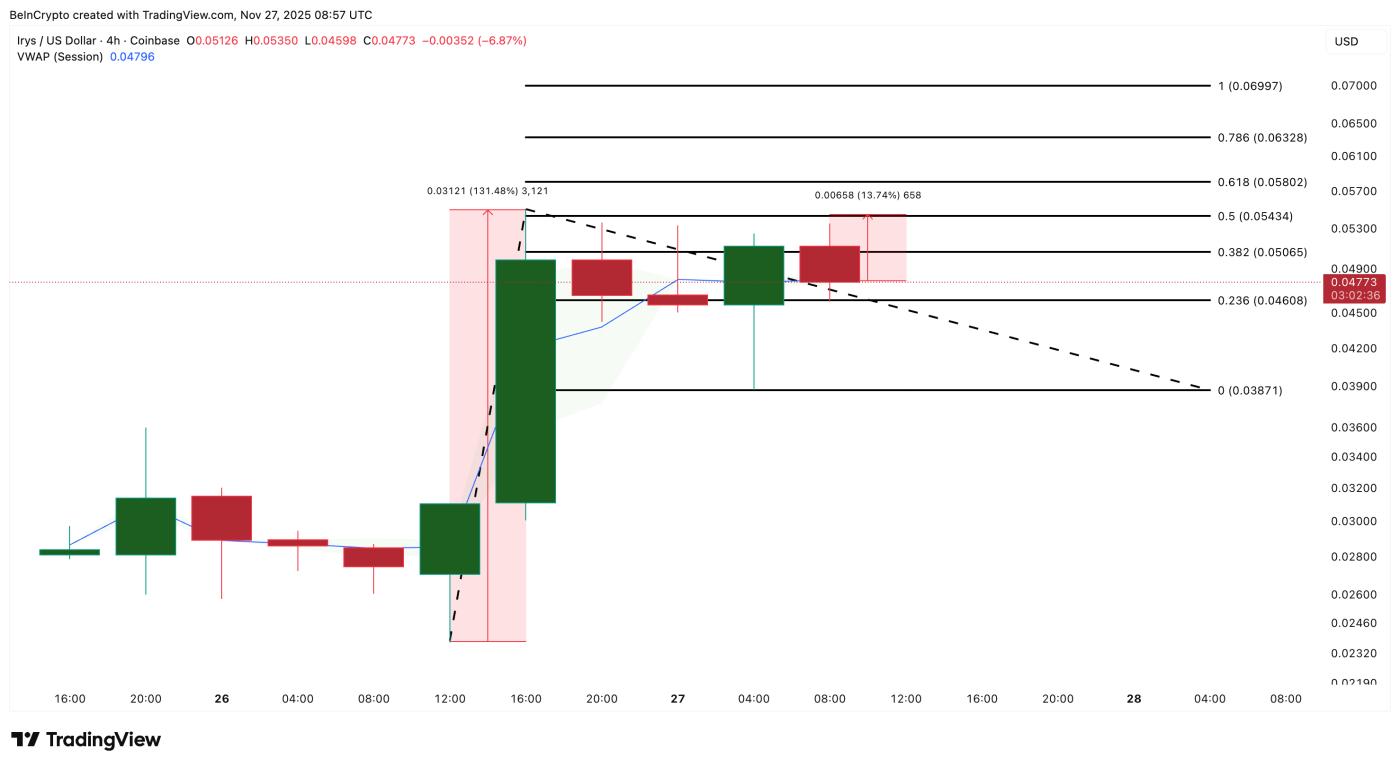

On the 4-hour chart, it has rallied about 131% from its post-listing low and is currently trading above the Volume Weighted Medium Price (VWAP). VWAP is the volume-adjusted Medium price. Holding above this level shows that buyers are still in control and suggests a potential push towards $0.054, then $0.063 and even $0.069.

Want more information about Token like this? Subscribe to Editor Harsh Notariya's Daily Crypto Newsletter here .

IRYS Price Analysis: TradingView

IRYS Price Analysis: TradingViewThis setup would be broken if IRYS slides back below VWAP. A clean break below $0.046 would put support at risk and open the door to $0.038 or lower. This would dampen the current Binance listing excitement and indicate that traders are starting to sell before the hype rather than getting ready for a new rally on Binance listing.

myx finance (myx)

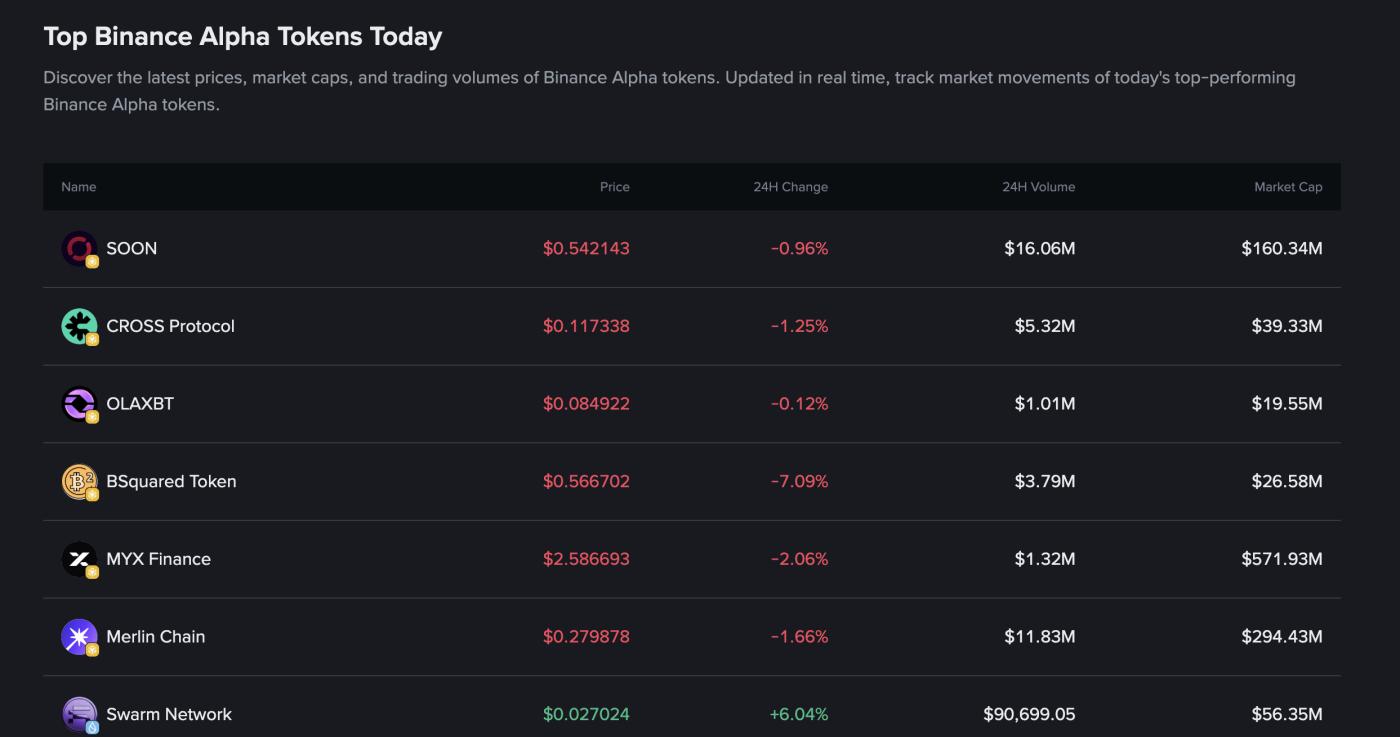

MYX Finance (MYX), a DEX project, is one of thestrong candidates for a new listing on Binance . It is near the top of the Binance Alpha table, has the highest market Capital of the group at around $571 million, and has retained most of its post-listing gains despite a drop of around 5.7% over the past month. It is still up more than 115% in three months. It is currently available for spot trading on platforms like Bitget and Gate.

MYX on Binance Alpha: Binance

MYX on Binance Alpha: BinanceThe daily chart shows MYX is in an ascending channel that has held since early November. The lower trendline has been touched multiple times and remains the stronger band. If the price pushes above $3.05, which coincides with the 0.618 Fibonacci level, MYX could attempt a move to the upper side of the channel.

MYX Price Analysis: TradingView

MYX Price Analysis: TradingViewThe bull-bear strength indicator, which measures who is controlling the short-term pressure, shows that neither side has the upper hand. This keeps the setup open. But if $2.59 fails to hold, the structure will quickly weaken, and $2.31 could become a possibility, reducing the momentum for a Binance listing in December.

monad (mon)

Monad (MON), a high-speed EVM chain , was listed on CEX just a few days ago, on November 24. It is already trading on Coinbase, Kucoin, Bybit, Gate, Bitget , and Upbit, putting it in the same early exposure zone that many Token enter right before a new Binance listing push.

New Binance Listing For Monad When Most CEXs Already Have It?: CoinGecko

New Binance Listing For Monad When Most CEXs Already Have It?: CoinGeckoThis broad spot coverage is important because Binance recently moved MON/ USDT from a pre-market perpetual contract to a standard USD-M perpetual contract. Binance only moved the contract to a standard model when it could reliably source spot index prices from multiple major exchanges. This confirms that MON now has enough external liquidation to have a stable futures index.

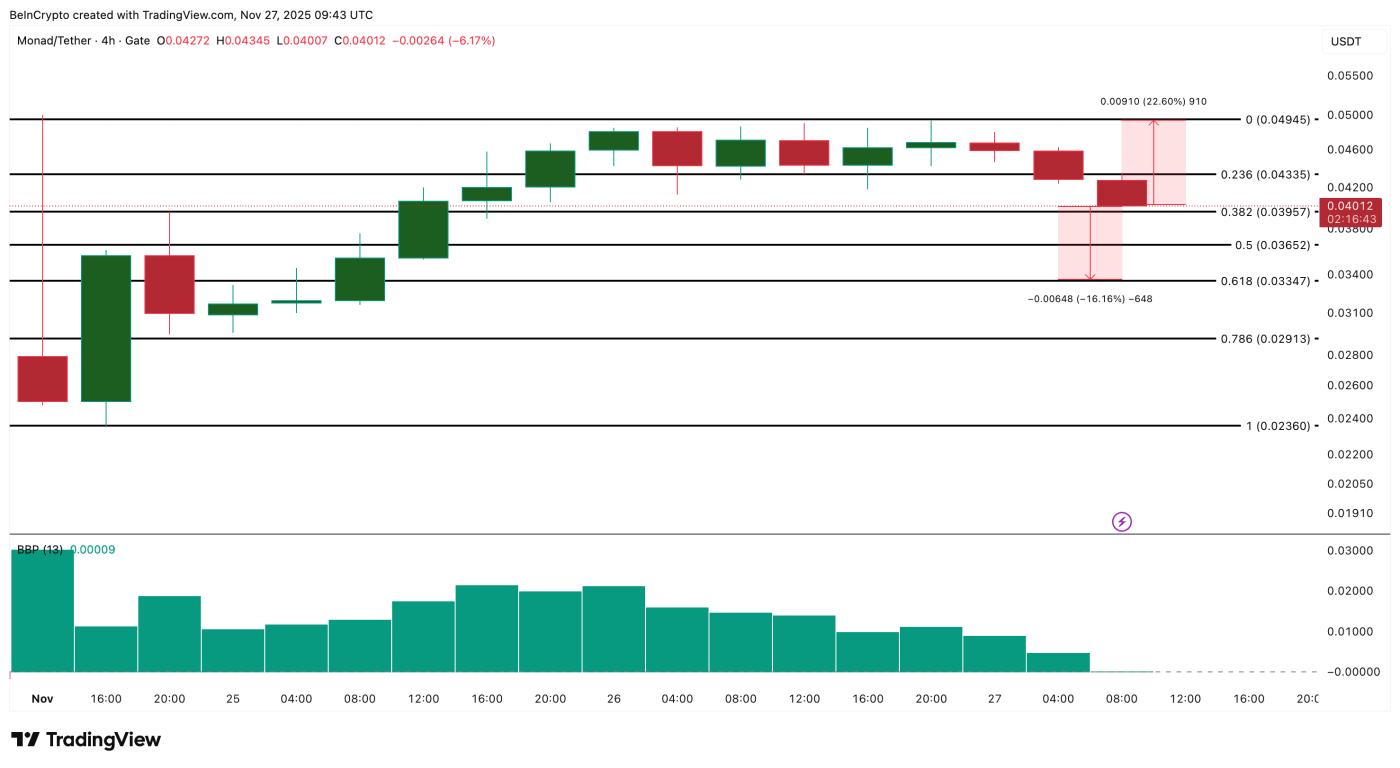

On the 4-hour chart, MON needs to retrace to $0.049 to regain momentum. Buyers have weakened, but a new listing on Binance could push the price back to this level. A clear break above $0.049 would open the door for further upside.

Monad Price Analysis: TradingView

Monad Price Analysis: TradingViewIf MON price loses the $0.040 mark, the strength between buyers and sellers will tilt to the negative side and there is a high possibility of a return to $0.033, which is in line with the 0.618 Fibonacci level, a strong support in other circumstances. This will destroy the short-term expectation from the listing.