The market has been surprisingly active this week as Monad (MON) has been caught in a wave of fierce debate – and the focus is none other than Arthur Hayes. In just 48 hours, the BitMEX founder has turned MON into the most tense battlefield in the altcoin market.

Hayes changed his tone, the whale quietly gathered goods

MON just launched its mainnet and immediately became a hot topic when Hayes posted a shocking status: predicting the Token could reach 10 USD. But what shocked the community more was that... he "turned around" after only two days.

On November 25, Hayes quipped that a bull market needs a “useless Layer-1 with a huge max Capital ” and then admitted that he was long MON.

By November 27, he had completely changed his mind: declaring “it’s done,” abandoning MON and advising traders to “let it go to zero.”

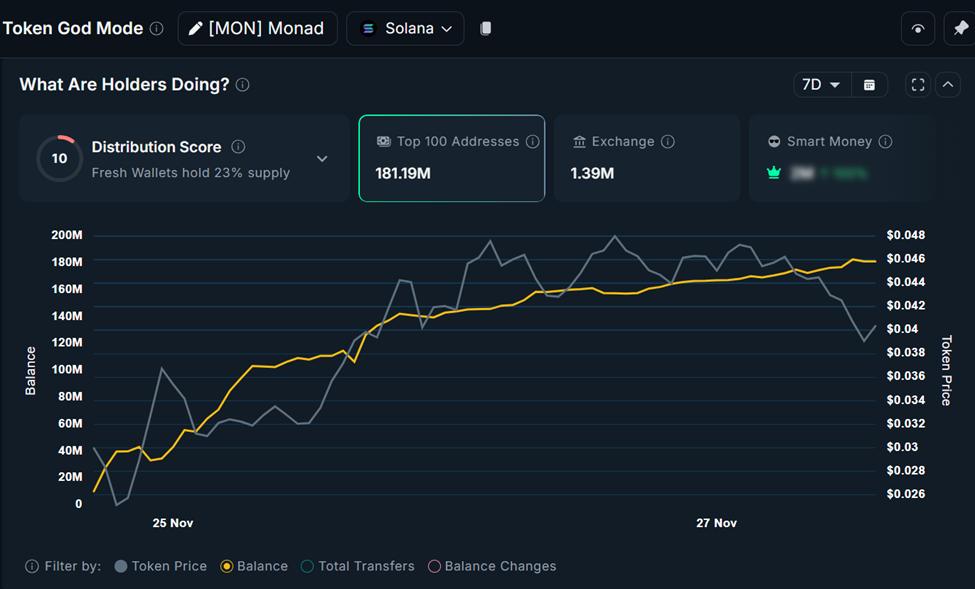

However, the on- chain action tells a different story.

Whale address 0x9294 withdrew 73.36 million MON from Gate.io in just 24 hours – equivalent to more than $3 million .

The largest whale groups increased their holdings to 10.67% , bringing their total MON holdings to 176.44 million Token .

The “regular whales” also stepped up their purchases, bringing the total amount of MON they hold to 55.42 million Token .

In total, more than 300 million MON are now in the hands of major investors – a figure that is in stark contrast to the negative attitude expressed by Hayes.

Hayes quietly rotates Capital to ENA, Pendle and ETHFI

While MON was in the spotlight, Hayes shifted money to projects with “real yield” models and yield infrastructure:

4.89 million ENA (~1.37 million USD)

436,000 Pendle (~1.13 million USD)

696,000 ETHFI (~543,000 USD)

On November 26 alone, he spent an additional $536,000 to buy 218,000 Pendle. Notably, Hayes also continued to buy back ENA, even though two weeks earlier he had sold 5.02 million ENA at a lower price.

Lookonchain even commented: “Hayes continues to sell low – buy high.”

However, this move shows a clear Capital rotation strategy: move away from meme -based L1 Token , prioritizing cash flow into projects with real cash flow.

MON faces turmoil: fake Token transfers and strong fluctuations

In parallel with the drama between Hayes and the community, Monad also faced an attack with fake transactions. Some fraudulent contracts created virtual swaps, simulated transactions to trick new users into opening wallets and checking liquidation.

The chaos happened right in the mainnet launch phase, causing MON to fall into a zone of strong volatility.

MON is down more than 13% , currently trading around $0.03828 (according to CoinGecko).

Uncertainty is growing as fake Token transfers appear frequently – exploiting the ERC-20 standard to fool less experienced users.

The big question: Is Hayes reacting emotionally or strategically?

Arthur Hayes' extremely quick "turnaround" move raised many questions in the community:

Is this purely an emotional reaction?

Or is it a way to create volatility that benefits professional traders?

And most importantly: why are other whales buying heavily in the midst of the market's loudest noise?

While Hayes made a big exit from MON, big investors chose to quietly add more. The two opposing sides are creating an unbalanced picture, forcing the market to find its own solution.

In a world of chaotic information, investors are advised to closely monitor on-chain data rather than follow emotions or shocking statements. The crypto market may be noisy, but what happens quietly is the scariest thing.