Key Highlights

- QwQiao argues that major L1 networks and tokens lack lasting competitive advantages, also known as a moat, which makes it vulnerable

- He believes that the main problem is that it is now too easy for users and developers to switch between different blockchains, which pulls down the long-term value of their tokens

- He proposed a solution, saying that blockchains should build apps and services directly on their networks

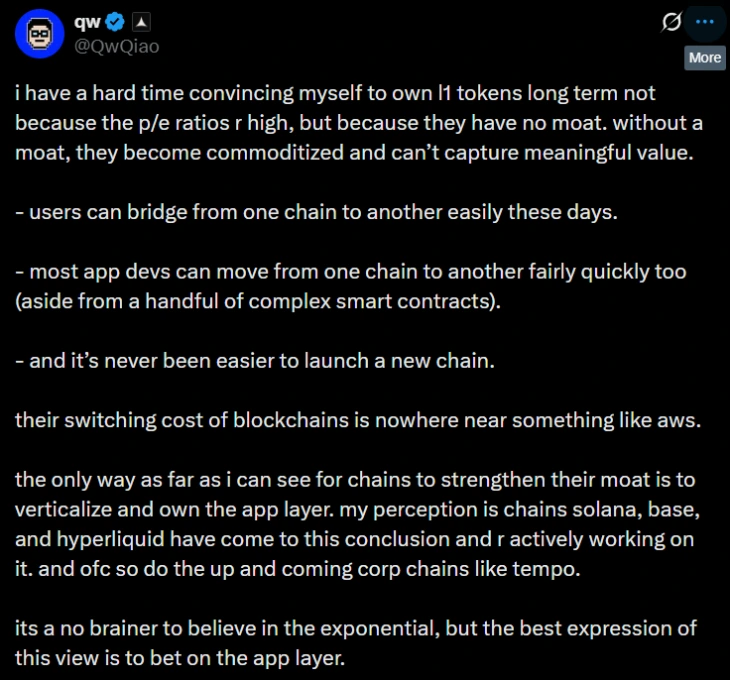

On November 27, QwQiao, a partner at the Alliance DAO, shared a tweet in which he raised questions about the long-term value of L1 tokens.

(Source: QwQiao on X)

In the latest post on X, he stated that he has a “hard time convincing” to hold Layer 1 (L1) blockchain tokens for the long term. His concern was not about their current high prices. Instead, he questioned their very core structure by stating that L1 networks do not have a “moat.”

Without this much-needed protection, he believes that these infrastructure chains will become simple commodities, like electricity or water. Due to this, it will be unable to capture major value over time.

L1 Tokens Have No Moat: QwQiao

The main point of QwQiao’s argument is very simple. He mentioned that in today’s crypto sector, there is almost no friction in preventing users, developers, or capital locked on the blockchain from leaving one blockchain for another.

According to QwQiao, it only takes a few minutes to move digital assets between different blockchains, thanks to advanced bridge technologies like Wormhole and LayerZero. The total volume of these cross-chain transfers has already surpassed billions of dollars in 2025.

For developers, the process of moving an application is also easy. Most can transfer their code across compatible chains in a few days. The rise of user-friendly development tools has even simplified the process of moving to non-compatible networks.

Apart from this, it just takes weeks to launch an entirely new blockchain or application-based rollup, not years, with the help of readily available kits.

This infrastructure makes the cost of switching blockchains low in comparison to the difficulty of moving a company’s data off a cloud service provider like Amazon Web Services (AWS).

Qw stated that “its a no brainer to believe in the exponential, but the best expression of this view is to bet on the app layer.”

QW is partner of Alliance DAO, which is an organization known as one of the most successful DAOs in the cryptocurrency space. It is also known as the DeFi Alliance. This group has helped launch major projects like Pump.fun and Fantasy Top.

It has raised $50 million in the fundraising round by top-tier investment firms like Sequoia and Paradigm.

Before this, Qw has also raised earlier warnings in 2025 about risks in retail ETFs, and AI tokens have proven correct. Now, his views on L1 tokens have become a topic of debate among the crypto community.

QwQiao Thinks Vertical Integration is a Solution

QwQiao has also shared his solution for the survival of L1 networks. He argues that they must stop acting as pure infrastructure and instead fully move to own the application layer built on top of them.

“the only way as far as i can see for chains to strengthen their moat is to verticalize and own the app layer. my perception is chains solana, base, and hyperliquid have come to this conclusion and r actively working on it. and ofc so do the up and coming corp chains like tempo,” he said.

He mentioned Base, an L2 network from Coinbase, as an example. It is quickly attracting a large user base of new DeFi activity. He also mentioned Hyperliquid, which is a decentralised exchange (DEX) built on its own high-performance Layer 1 blockchain.