CEX volume plummeted to $1.6 trillion. Photo: Finance Magnates

CEX volume plummeted to $1.6 trillion. Photo: Finance Magnates

Volume near multi-month Dip

November 2025 painted a very bleak and challenging picture for the global cryptocurrency market. As investor sentiment faltered and Bitcoin prices suffered their deepest correction since the summer, trading activity on both Centralized Exchange and decentralized exchanges (DEX) saw a severe drop in liquidation , signaling a period of local “hibernation” on trading platforms.

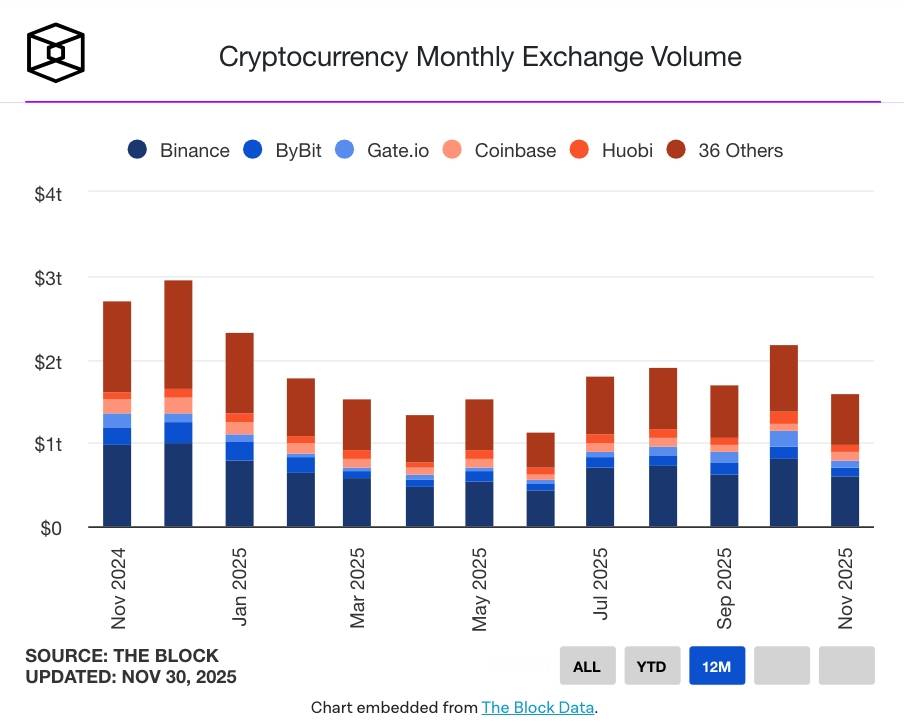

Data from The Block shows that risk aversion has pushed the total spot volume on global CEXs to plummet 26.7% compared to October. This figure fell from $2.17 trillion to just $1.59 trillion, the lowest level recorded since June 2025.

Despite still holding the absolute lead, Binance's Volume has dropped sharply from over $810 billion to $599.34 billion. Bybit ranked second with $105.8 billion, followed by Gate.io ($96.75 billion) and Coinbase ($93.41 billion).

Statistics on volume on top CEXs. Source: The Block (December 1, 2025)

Statistics on volume on top CEXs. Source: The Block (December 1, 2025)

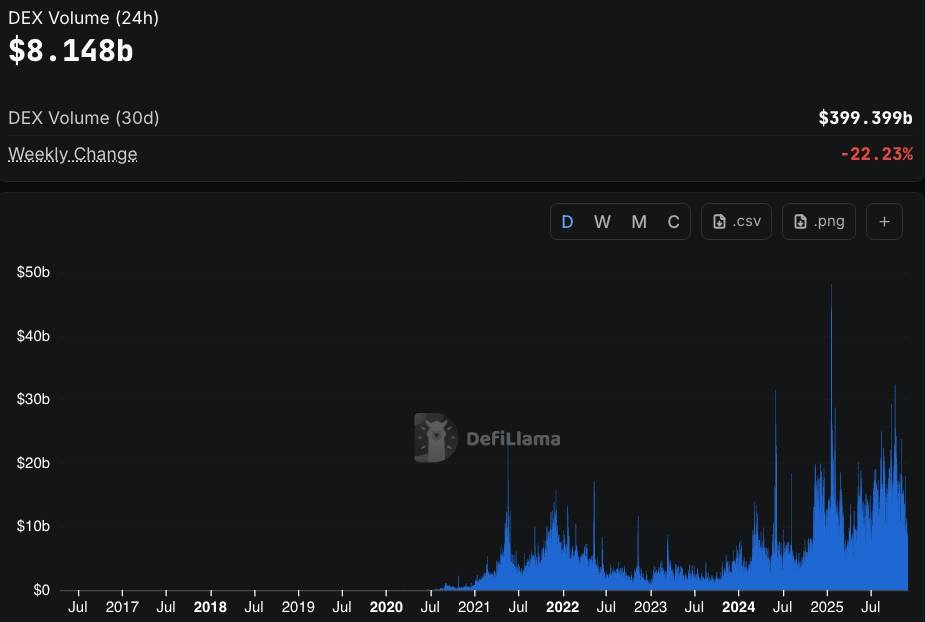

On the same reference frame, DEXs are also not exempt from the law of deceleration. According to defillama , the total DEX volume has "evaporated" by nearly 30%, from 568.43 billion USD (T10) to 399.4 billion USD. Uniswap leads with 79.98 billion USD, PancakeSwap reaches 70.57 billion USD. Notably, the DEX/CEX ratio has decreased from 17.56% to 15.73%, reinforcing the view that the trading flow is returning to centralized exchanges.

Statistics of volume on top DEXs. Source: DefiLIama (December 1, 2025)

Statistics of volume on top DEXs. Source: DefiLIama (December 1, 2025)

“Low volatility in November made CEXs more cost-effective and faster. At the same time, the weakening of speculative flows and incentives in DeFi slowed down the turnover of DEXs, driving this liquidation rotation,” Vincent Liu, chief investment officer at Kronos Research, analyzed.

Bitcoin breaks the threshold, institutional Capital flows out

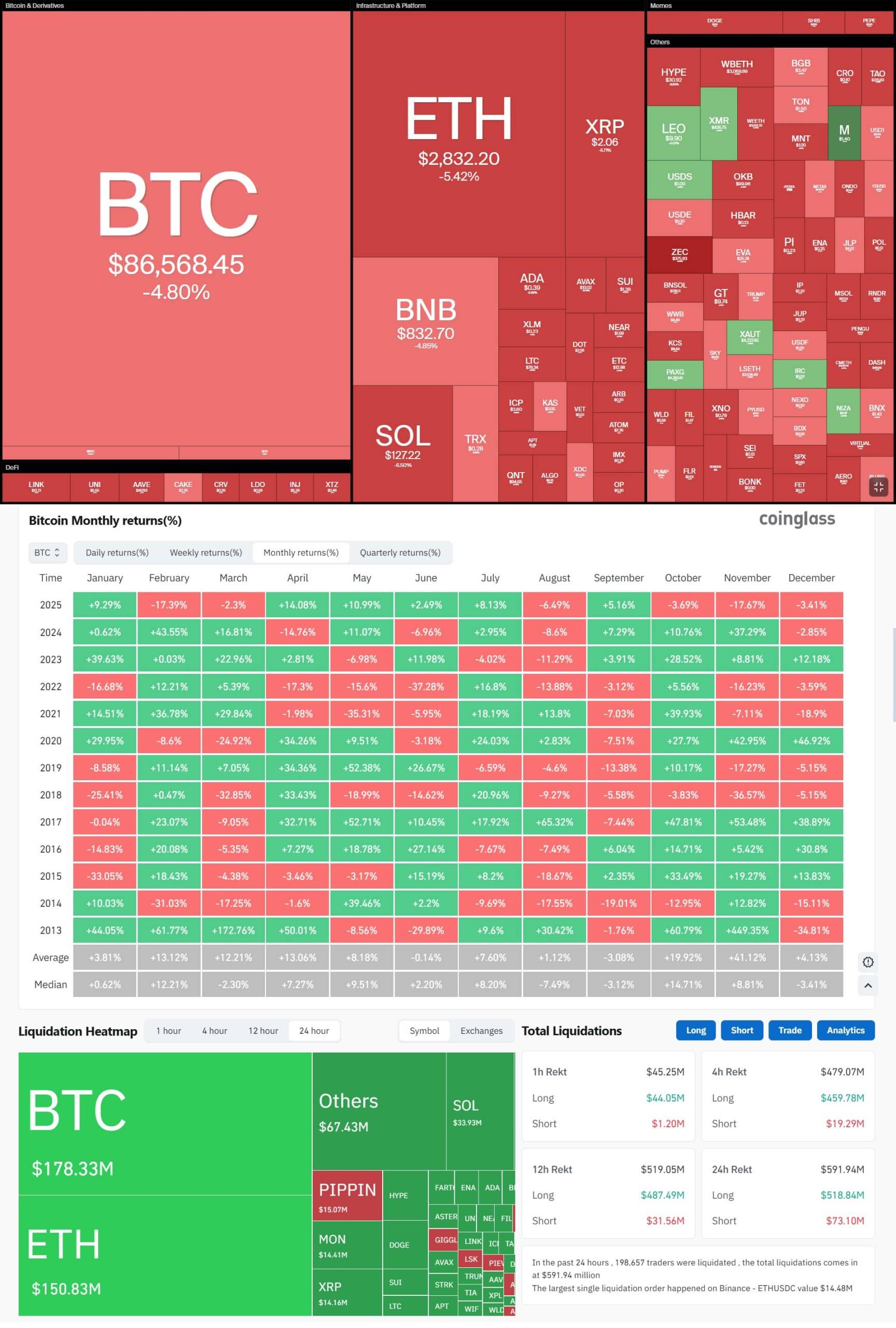

The cryptocurrency market started November at $110,000 but quickly entered a deep correction. By November 21, Bitcoin (BTC) Dip near $81,000 , reflecting large-scale profit-taking after the previous strong rally .

During the month, US spot Bitcoin ETFs saw a net Capital of $3.48 billion, the second-largest outflow on record and a complete reversal from October’s $3.42 billion inflow. In contrast, Ethereum ETFs still saw Capital of $8.34 billion, albeit at a slower pace than last month, suggesting institutional money is still looking to altcoins as a relatively stable haven or risk diversification strategy.

Caution is also reflected in the decline in stablecoin supply, especially those outside of USDT/PYUSD, reflecting lower liquidation and defensive sentiment on both CEXs and DEXs.

December Outlook: Cautious Pessimism Prevails

BTC ended November with a loss of 17.67% . Despite recovering partially from the Dip, the opening trading session of December this morning saw the king coin continue to fall more than 4%, to the $86,000 region, wiping out the recovery effort.

The decline spread widely, causing the total market Capital to evaporate nearly 140 billion USD in just the past few hours. Liquidation pressure skyrocketed, with more than 590 million USD liquidated in 24 hours, of which the Longing side (long buy) accounted for nearly 88%.

Despite the high probability of the US Federal Reserve (Fed) cutting interest rates in December (nearly 90%), the Derivative market shows cautious pessimism. According to Polymarket, the possibility of Bitcoin returning to the $100,000 mark has dropped below 40%, signaling another period of volatility and uncertainty for the cryptocurrency market in the final month of the year.

Coin68 synthesis