Key Highlights

- Bitcoin has witnessed a rally, surging over $92,000 with 8% hike in 24 hours

- The rally was seen after Vanguard announced that it would now allow its brokerage clients to access investment funds like ETFs focused on Bitcoin, Ethereum, XRP, and Solana

- Ahead of the December 10 Fed rate meeting, this spike in the cryptocurrency is seen as a spark in its further upward momentum

On December 2, the biggest cryptocurrency, Bitcoin (BTC), jumped over 8% on the daily chart, helping it to soar from $84,800 to above $92,000.

At the time of writing this, the cryptocurrency was trading at around $91,740 with an impressive market capitalization of $1.83 trillion, according to CoinMarketCap.

Why is Bitcoin Rising?

One of the major reasons behind the upward trend is the Bitcoin accumulation by whales. Crypto whales have taken charge and started a number of large transfers over the past month. They are moving millions of dollars’ worth of Bitcoin from secure private wallets into trading exchanges to new, unknown addresses.

BlackRock just deposited 1,634 $BTC($142.6M) to #CoinbasePrime.https://t.co/qmuDIrPHc6 pic.twitter.com/sP3Mm1JOPW

— Lookonchain (@lookonchain) December 2, 2025

For example, BlackRock has deposited 1,634 Bitcoins, worth $142.6 million, to Coinbase Prime. Some experts believe that this could be a tactic to unsettle smaller investors and create an opportunity to buy more Bitcoin at lower prices.

Data from the analytics platform Arkham shows that November saw an unusual level of whale movements. In the multiple transfers, over $100 million worth of Bitcoins were sent from cold storage wallets to exchanges.

Generally, this kind of transaction shows that major holders are preparing to sell their holdings.

Vanguard Opens Door to Bitcoin ETFs

Vanguard, the leading asset management company, made a major announcement on December 2. With the change in its previous stance, the company revealed that it will now allow its brokerage clients to access investment funds like ETFs focused on Bitcoin, Ethereum, XRP, and Solana.

THE VANGUARD EFFECT: Bitcoin jumps 6% right around US open on first day after bitcoin ETF ban lifted. Coincidence? I think not. Also $1b in IBIT volume in first 30min of trading. I knew those Vanguardians had a little degen in them, even some of the most conservative investors… pic.twitter.com/OKyihvEqqD

— Eric Balchunas (@EricBalchunas) December 2, 2025

Andrew Kadjeski, head of brokerage and investments at Vanguard, said,“Cryptocurrency ETFs and mutual funds have been tested through periods of market volatility, performing as designed while maintaining liquidity. The administrative processes to service these types of funds have matured, and investor preferences continue to evolve.”

This is considered to be one of the most important news stories today that triggered a rally in the cryptocurrency market.

According to the market expert, the cryptocurrency market is showing signs of recovery. It is already starting to build a bullish outlook leading into the key date of December 10, a day when the next Fed meeting is going to be conducted.

According to Crypto Fortress, the next important point is expected to be on December 4. The price action on that date will signal the likely short-term direction. If the price moves upward on Dec 4, a short-term reversal back down can be expected. On the flip side, if the price drops, the downward trend is likely to continue upward afterward.

The price of Bitcoin is now trading just 19% above the estimated average cost of electricity for miners to produce it. Historically, the market price has fallen below this critical production cost threshold only two times in the last 5 years. First was during the global financial crisis of March 2020, and again in April of 2024.

This level is now a major focus point for experts, as a potential drop below this level would likely trigger a wave of mine capitulation.

However, there are some contradictory predictions for Bitcoin. For example, one analyst states that Bitcoin’s 4-hour candle failed to close its body above a certain level

“Now, no one can confidently say that Bitcoin will go up until that level is broken—meaning, until we get that decisive 4-hour candle closing above it,” the analyst said.

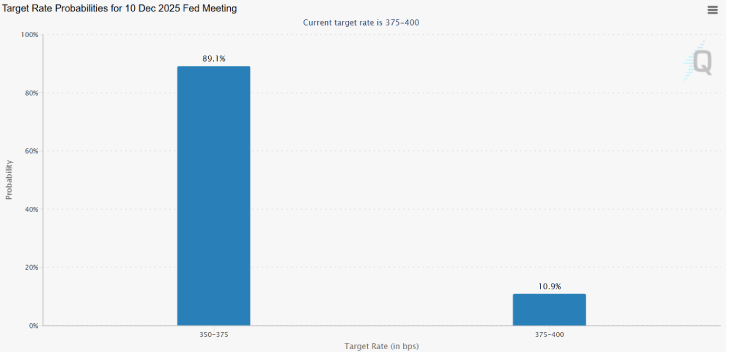

(Source: CME Group)

Apart from this, hopes for Federal Interest rate cuts have also increased. CME Group indicator shows that there is approximately a 89% chance of a Fed rate cut by 25 points.