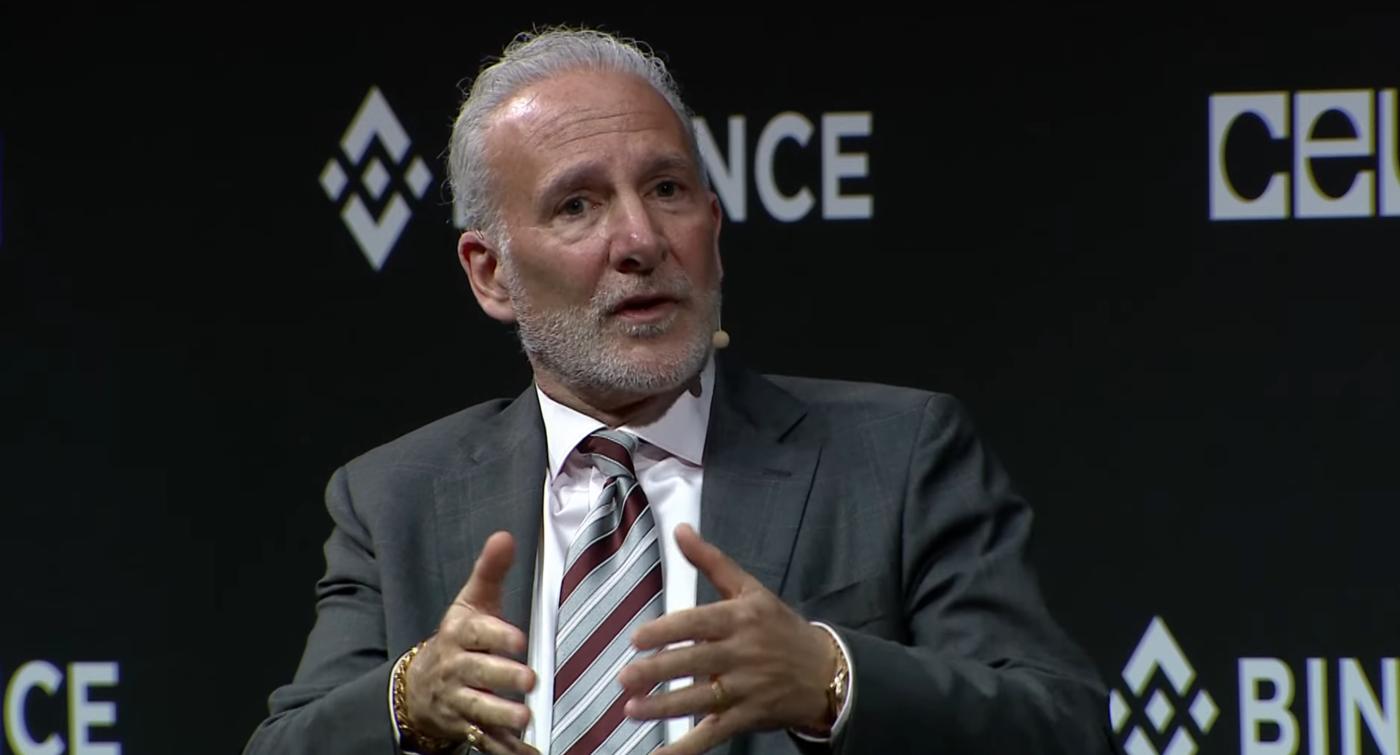

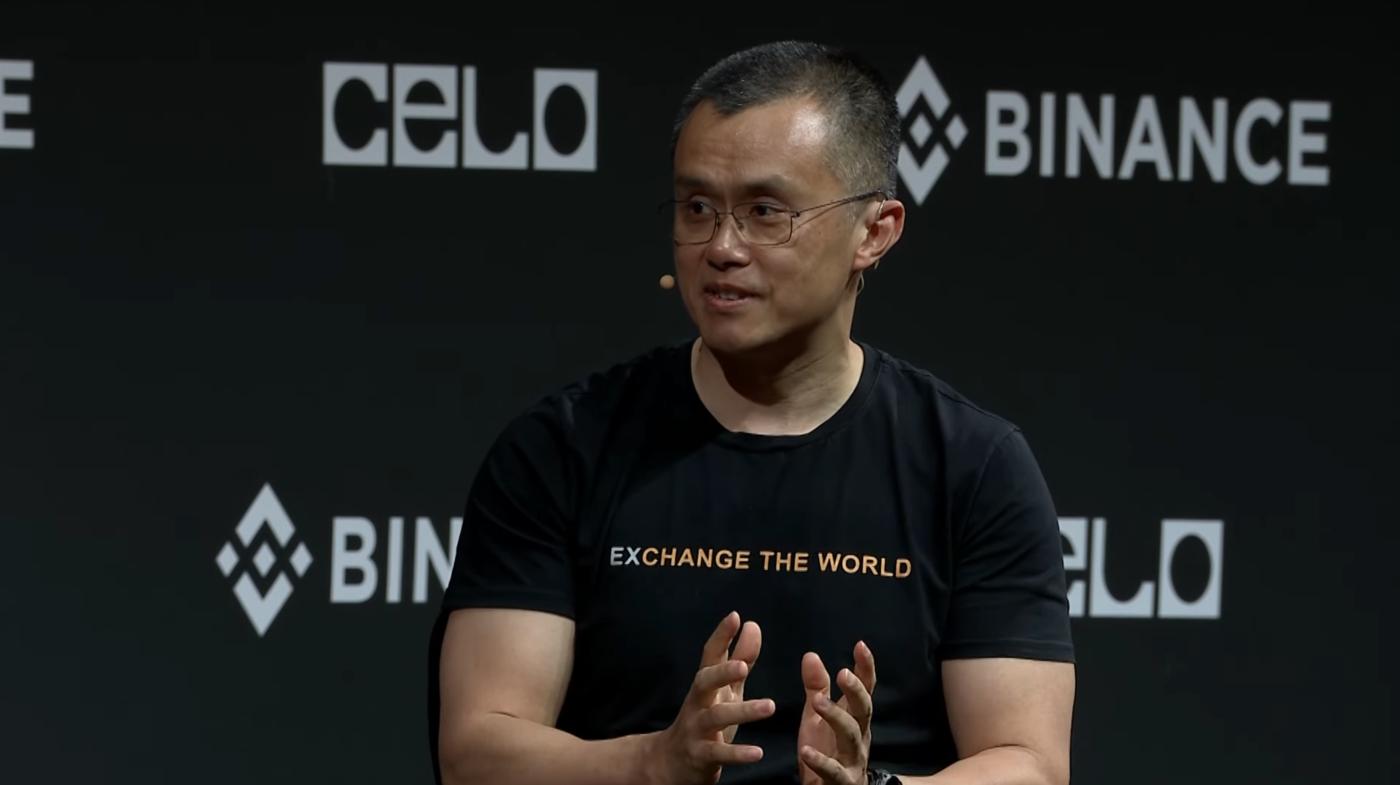

At Binance Blockchain Week in Dubai (December 3-4, 2025), a public debate surrounding "Gold vs. Bitcoin" brought the philosophical divergence between traditional finance and crypto assets into the spotlight. The opposition on either side of the stage was highly symbolic: Binance founder CZ represented a digital financial system based on algorithms and consensus; Peter Schiff, chief economist at EuroPacific Capital, defended the physical credit order anchored in gold. On the surface, this was "digital assets versus physical assets"; in essence, it reflected the generational shift in monetary trust mechanisms—from physical backing to mathematical consensus.

The paradox of technology: those who deny Bitcoin embrace its underlying logic.

The contrast at the start of the debate became the focus. Peter Schiff, a long-time critic of Bitcoin for having "no intrinsic value," presented a blockchain-based "tokenized gold" project. In his speech, Schiff acknowledged that blockchain technology has historically improved gold's divisibility, transferability, and circulation efficiency—in a sense, "becoming better than gold itself." However, this digitization did not change its foundation of trust. While on-chain records are transparent, the existence of gold still requires the endorsement of vaults and custodian institutions; trust shifts from "mathematical certainty" back to "institutional certainty." CZ pointed out that Schiff's solution merely revived old-fashioned centralized trust—repackaging it with a "chain" but not changing the trust structure. This reflects a typical path of traditional finance in digitization: absorbing the transparency of blockchain technology while avoiding the philosophical core of decentralization.

The Trust Dilemma: A BRICS Summit and the "Oracle Problem"

To further illustrate this contradiction, CZ displayed a physical gold bar weighing approximately one kilogram and worth $130,000 on stage, inviting Peter Schiff to authenticate it. As a seasoned gold investor, Peter Schiff hesitated—he admitted that without seeing the mint's seal, he couldn't confirm its authenticity. This scene vividly illustrates the "oracle problem": during the on-chain process of physical assets, they must rely on off-chain verification institutions to input "reality" into the "block," yet the verification power returns to a centralized entity. CZ used this to point out that with Bitcoin, verification can be completed in milliseconds and without relying on a third party. The "weight" of gold thus contrasts sharply with the "certainty" of crypto assets.

Disagreements over the definition of value: physical credit versus network consensus

The core of the debate lies in the question of "where does value originate?" Peter Schiff, continuing the Austrian School's position, argues that money must possess physical scarcity and use value. Gold's conductivity and malleability establish its value on a verifiable physical entity; Bitcoin, based solely on a scarcity algorithm, lacks physical support and is therefore "not consumable." CZ's rebuttal reflects a monetary perspective in the information age: value no longer depends on atoms, but on the utility and trust radius of the network. He points out that for users in developing countries lacking banking infrastructure, Bitcoin reduces cross-border payments from days to minutes, "this efficiency is value itself." The divergence between the two logics lies in:

- Peter Schiff argues that the function of money should be traced back to commodity credit;

- CZ, on the other hand, believes that currency is an information protocol, and its value is determined by the scale of network consensus. This is not only a technical disagreement, but also a difference in systemic beliefs.

The Dialectics of the Time Dimension: Short-Term Fluctuations and Long-Term Evolution

When the discussion turned to investment performance, Peter Schiff cited Bitcoin's 40% drop in price when measured in gold as an example, criticizing its volatility and speculative nature. CZ responded that, over a longer time horizon, Bitcoin's cumulative returns since its inception have redefined the relationship between risk and reward in financial history. He pointed out that short-term price fluctuations cannot mask long-term structural shifts—currency is moving from centralized credit to a global consensus network. Furthermore, reality demonstrates that the two are not a zero-sum game: institutions like BlackRock hold both gold and Bitcoin, viewing the latter as "high-beta digital gold," not a substitute.

From opposition to integration: the rebalancing of monetary trust

The debate ended unexpectedly—CZ invited Peter Schiff to integrate his tokenized gold project into the Binance ecosystem. This may foreshadow a new phase in the financial system: not "Bitcoin replacing gold," but rather all assets undergoing "Bitcoinization"—being digitized, on-chained, and liquidated. Peter Schiff's insistence and CZ's optimism represent different reactions from the same era: one attempts to perpetuate historical credit, while the other is committed to reconstructing the trust system . From a broader perspective, both lead to the same goal: in an environment of diminishing dollar credibility, humanity is searching for new value anchors, whether in gold or code. The difference lies in this— Peter Schiff believes the anchor should be rooted in the material world, while CZ believes the anchor can be embedded in algorithms and consensus .