Author: @AvgJoesCrypto, Messari

Compiled by: AididiaoJP, Foresight News

Original title: Buy the dips: BTC vs. ETH, which has a more attractive potential return?

Cryptocurrency is the driving force of the industry

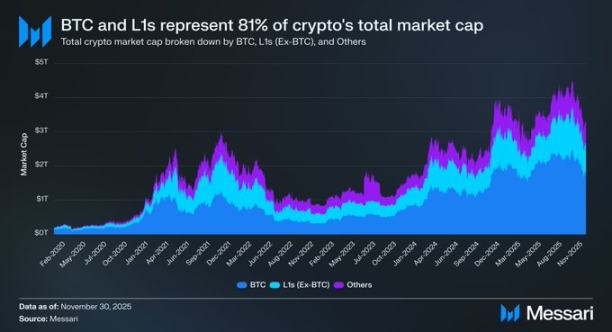

Refocusing on cryptocurrency discussions is crucial because it is essentially the ultimate target for most capital seeking allocation within the industry. The current total market capitalization of cryptocurrencies is approximately $3.26 trillion. Of this, Bitcoin (BTC) accounts for $1.80 trillion (approximately 55%). Of the remaining $1.45 trillion, approximately $0.83 trillion is concentrated in various "alternative Layer 1 blockchains" (L1).

In summary, approximately $2.63 trillion (81% of the total cryptocurrency capital) has been allocated to assets that the market has already regarded as currency or believes can accumulate a "currency premium".

Therefore, whether you are a trader, investor, capital allocator, or ecosystem builder, understanding how the market assigns or removes this "currency premium" is crucial. In the crypto world, nothing drives valuation changes more than whether the market is willing to treat an asset as currency. For this reason, predicting where the future "currency premium" will accumulate is arguably the most important consideration when building a crypto portfolio.

Previously, we mainly focused on Bitcoin , but it's equally worthwhile to discuss the other $0.83 trillion in assets that fall somewhere between "currency" and "non-currency." As mentioned earlier, we expect Bitcoin to continue gaining market share from gold and other non-sovereign wealth stores in the coming years. So, what will become of L1? Will it rise with the tide, or will Bitcoin fill the gap with gold by absorbing the monetary premium of L1?

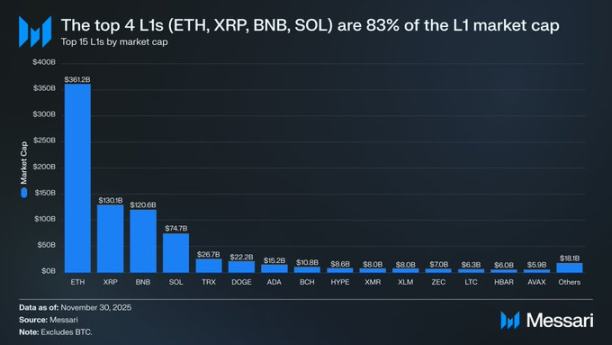

First, it's helpful to examine the current valuation of Level 1 cryptocurrencies. The top four Level 1 cryptocurrencies —Ethereum ($361.15 billion), Ripple ($130.11 billion), BNB ($120.64 billion), and Solana ($74.68 billion)—have a combined market capitalization of $686.58 billion, representing 83% of the entire alternative Level 1 market.

After the four giants, valuations plummeted (TRX was valued at $26.67 billion), but interestingly, the "long tail" remains substantial. The total market capitalization of L1 projects outside the top 15 reached $18.06 billion, accounting for 2% of the entire alternative L1 market capitalization.

It's important to clarify that the market capitalization of L1 loans does not solely reflect their implied "currency premium." There are three main valuation frameworks for L1 loans:

Currency premium

Real economic value

The need for economic security

Therefore, the market value of a project is not entirely equivalent to the market's perception of it as currency.

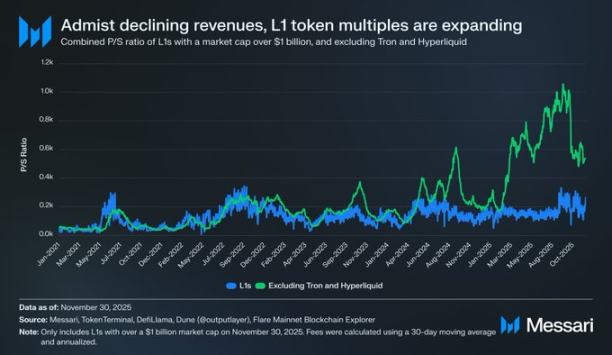

The driver of L1 valuation is the currency premium, not income.

Despite the existence of various valuation frameworks, the market increasingly favors evaluating L1 from a "currency premium" perspective rather than a "revenue-driven" one. Over the past few years, the overall price-to-sales ratio (P/S) of all L1 projects with a market capitalization exceeding $1 billion has remained relatively stable, roughly between 150 and 200 times. However, this overall figure is misleading because it includes TRON and Hyperliquid. In the past 30 days, TRX and HYPE contributed 70% of the group's revenue, but their market capitalization only accounted for 4%.

After removing these two outliers, the true situation becomes clear: while revenue declined, the valuation of L1 contracts rose. The adjusted price-to-sales ratio continued to increase.

November 30, 2021: 40 times

November 30, 2022: 212 times

November 30, 2023: 137 times

November 30, 2024: 205 times

November 30, 2025: 536 times

From a purely economic perspective, one might argue that the market is simply pricing in future income growth. However, this explanation doesn't hold up to scrutiny. Within the same L1 basket (excluding Tron and Hyperliquid), income has declined year after year, except for one specific year:

2021: US$12.33 billion

2022: $4.89 billion (down 60% year-on-year)

2023: $2.72 billion (down 44% year-on-year)

2024: US$3.55 billion (31% year-on-year growth)

2025 (annualized): US$1.7 billion (down 52% year-on-year)

In our view, the simplest and most direct explanation is that these valuations are driven by "currency premiums," rather than current or future revenue.

L1's performance has consistently lagged behind Bitcoin's.

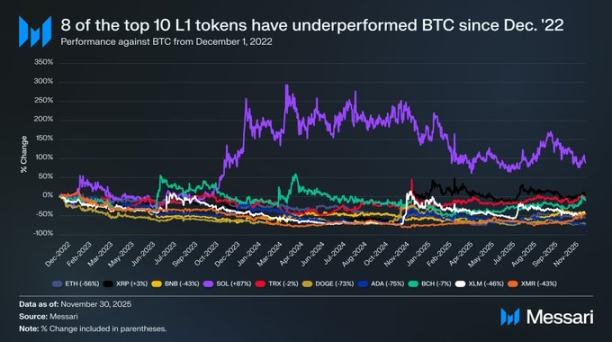

If L1 valuations are driven by expectations of currency premiums, the next step is to explore what factors shape those expectations. A simple test is to compare them to Bitcoin's price performance. If currency premium expectations are merely a mapping of Bitcoin's price movements, then these assets should perform similarly to Bitcoin's beta return (i.e., highly correlated and volatile). Conversely, if expectations are driven by unique factors specific to each L1 asset, their correlation with Bitcoin should be weaker, and their performance more independent.

We examined the performance of the top ten L1 tokens by market capitalization (excluding HYPE) relative to Bitcoin since December 1, 2022, as representative of the L1 sector. These ten assets account for approximately 94% of the total L1 market capitalization, making them representative of the entire sector. During this period:

Eight L1 absolute returns underperformed Bitcoin.

Six of them are lagging behind Bitcoin by more than 40%.

Only two assets outperformed: XRP and SOL.

XRP only outperformed by 3% (this slight lead is negligible given its historically retail-driven nature).

The only one with significant excess returns was SOL, outperforming Bitcoin by 87%.

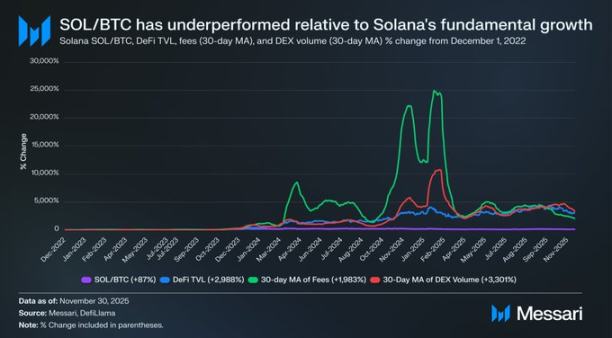

However, a deeper analysis of SOL's outstanding performance reveals that it may actually be "underperforming." During the same period that SOL outperformed Bitcoin by 87%, the fundamentals of the Solana ecosystem experienced exponential growth: total DeFi locked value increased by 2,988%, transaction fee revenue increased by 1,983%, and DEX trading volume increased by 3,301%. By any reasonable standard, the Solana ecosystem has grown 20 to 30 times since the end of 2022. Yet, SOL, the asset designed to capture this growth, only outperformed Bitcoin by 87%.

This means that for an L1 blockchain to achieve meaningful excess returns for Bitcoin, it doesn't need its ecosystem to grow by 200-300%, but rather a staggering 2,000-3,000% growth to generate less than double the excess returns.

Based on the above analysis, we believe that although L1 valuations still rely on future currency premium expectations, market confidence in these expectations is quietly eroding. At the same time, the market's belief in Bitcoin's currency premium remains unshaken; in fact, it could be said that Bitcoin's lead over L1 is widening.

Future Outlook

Looking ahead, we do not believe this trend will reverse in 2026 or in the coming years. With very few possible exceptions, we expect alternative L1 to continue ceding market share to Bitcoin. L1 valuations, primarily driven by expectations of future monetary premiums, will continue to be compressed as the market increasingly recognizes that "Bitcoin is the cryptocurrency with the strongest monetary attributes."

Admittedly, Bitcoin will face challenges in the future, but these challenges are too distant and full of unknown variables to provide strong support for the currency premium of other competing L1 assets at present.

For L1 cryptocurrencies, their narrative is no longer as convincing as Bitcoin's, and they can no longer rely on widespread market euphoria to support their valuations indefinitely. The narrative window that once supported the trillion-dollar dream—"We may one day become money"—is gradually closing.

Investors now have a decade's worth of data to prove that L1's currency premium was only maintained during very short periods of explosive growth for the platform. For the vast majority of the time outside of those periods, L1 consistently underperformed Bitcoin; and as the growth boom subsided, its currency premium began to dissipate.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush