Bitcoin has been below $90,000 this week due to liquidation pressure, weak ETF demand, and converging macroeconomic uncertainty.

The decline erased gains from previous attempts to retake the $94,000–$95,000 zone, marking the second major drop this month.

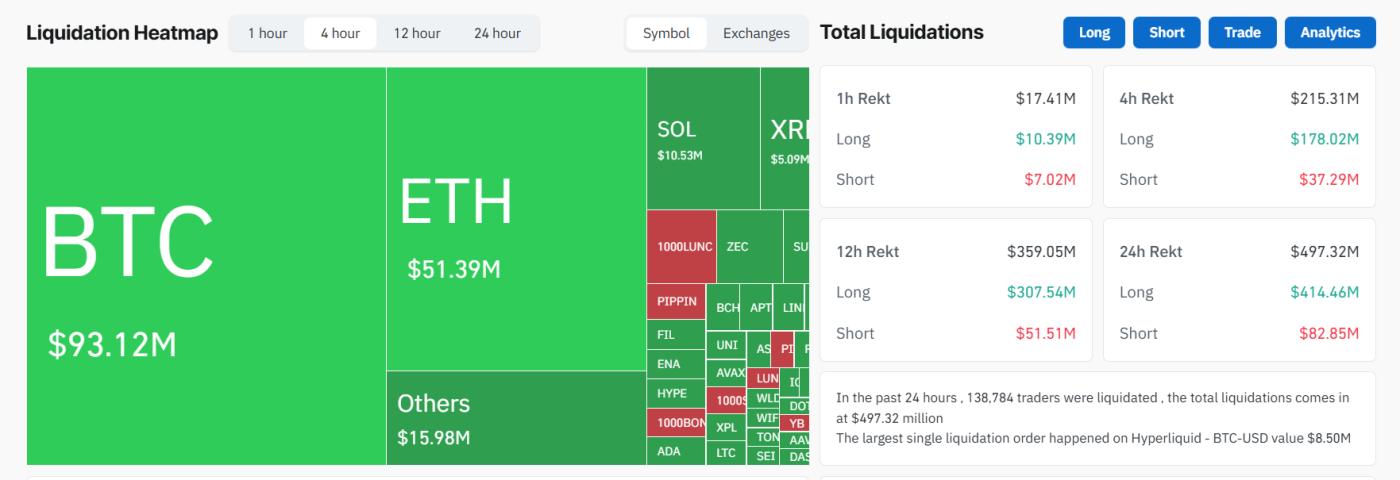

Forced liquidation across the market

The cause was a wave of forced liquidations . Nearly $500 million was wiped off exchanges, including about $420 million in long positions, and more than 140,000 traders were liquidated within 24 hours.

Crypto Liquidations Today. Source: CoinGlass

Crypto Liquidations Today. Source: CoinGlassETF inflows fail to absorb selling. BlackRock's iShares Bitcoin Trust has seen six consecutive weeks of net outflows, totaling more than $2.8 billion.

Inflows into US ETFs were just $59 million as of December 3, 2025, indicating weakening institutional appetite.

US Bitcoin ETF sees nearly $195 million in net outflows as of December 4, 2025. Source: SoSoValue

US Bitcoin ETF sees nearly $195 million in net outflows as of December 4, 2025. Source: SoSoValueMacro pressures add fuel to the slump

The macroeconomic backdrop has become unfavorable. The Bank of Japan has hinted at the possibility of raising interest rates, threatening the liquidation provided by carry trades, which has helped sustain global risk assets.

Traders also reduced risk-on ahead of the release of US PCE inflation data, forcing Bitcoin to remain within a cautious range of $91,000–$95,000.

The latest US PCE data came in as expected, showing core inflation is cooling but still above the Federal Reserve's target.

Markets reacted cautiously, taking this as evidence that inflation is falling but not fast enough to warrant a quick rate cut.

Signals from companies have added to concerns. MicroStrategy warned it could sell Bitcoin if its treasury valuation ratio weakens, causing its stock to fall 10%.

Pressure on Miners increases as energy costs rise, hashrate drops, and high-cost operators start selling BTC to maintain liquidation.

On chain flows reflect the emotional Chia . Matrixport has moved more than 3,800 BTC out of Binance into cold storage, indicating accumulation from long-term holders.

However, analysts estimate that a quarter of the total circulating supply is still at a loss at current prices.

Public sentiment shows fear — but there are some silver linings

Traders on social platforms debate whether the move was organic or manipulated, with market analysts largely blaming excessive leverage, thin liquidation and macro hedging rather than coordinated price intervention.

Others point to long-term optimism, citing JPMorgan's new $170,000 price model for 2026.

Bitcoin is currently trading near a key pivot point. Liquidation clusters between $90,000 and $86,000 leave the market vulnerable without fresh ETF inflows or easing macroeconomic pressures.

A move back above $96,000–$106,000 is needed to confirm the recovery momentum.

Volatility is in the air right now. Bitcoin has fallen, recovered, and fallen again — and traders are waiting for the next decisive move.