Crypto markets may be nearing a pivotal upswing as rising liquidity and expectations for a Federal Reserve rate cut fuel hopes for a broad digital-asset recovery.

Coinbase Flags Liquidity Boost and December Crypto Rebound

Coinbase Institutional, a unit of Coinbase Global (Nasdaq: COIN), stated on social media platform X on Dec. 5 that crypto may be entering a recovery phase. The group pointed to improving liquidity, rising probabilities of a Federal Reserve rate cut, and macro conditions that could support renewed digital-asset strength.

“It’s beginning to look a lot like a recovery,” Coinbase Institutional stated, adding:

We think crypto could be poised for a December recovery as liquidity improves, Fed cut odds jump to 92% (as of Dec 4), and macro tailwinds build.

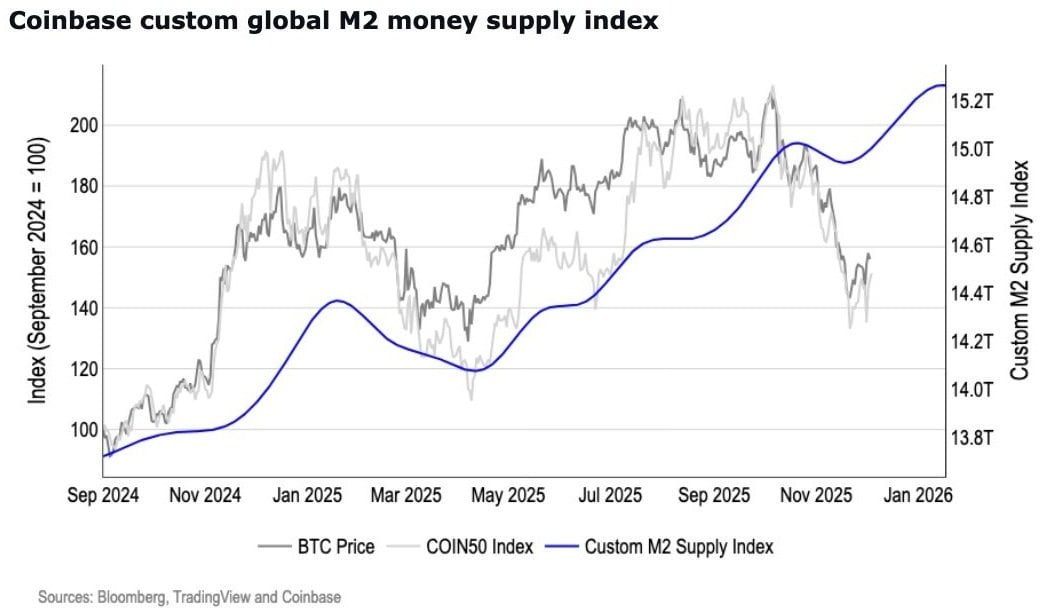

The crypto firm further detailed: “In October, we teased this positioning reset (citing our custom M2 index) anticipating November weakness and a December reversal. This could be the starting line for crypto market momentum to reassert itself.”

The institutional arm of Coinbase also shared an image illustrating its custom global M2 money-supply index, showing bitcoin’s price, the COIN50 Index, and its M2 supply gauge. The visual highlighted a rising liquidity trend through late 2025 even as crypto prices oscillated, reinforcing the institution’s view that systemic liquidity may be turning more supportive.

Analysts frequently track global M2 shifts to understand liquidity cycles, as crypto markets often respond to changes in capital availability. A macro environment leaning toward monetary easing could attract sidelined capital, particularly if volatility moderates. While inflation and growth uncertainty remain, crypto proponents argue that bitcoin’s issuance structure and ethereum’s evolving monetary profile may benefit from renewed liquidity expansion and a softer U.S. dollar.