Ethereum price once again tried to break above the long-standing $3,000 resistance, but the attempt stalled. After the sudden surge, ETH slid back down to this support level, suggesting the market remains Chia .

Although bullish momentum is gradually returning, investor impatience could hamper the recovery if there is no clear trend soon.

Ethereum investors can sell their ETH

The MVRV differential between long and short term is approaching the neutral line, signaling a potential shift in the dominance of profits between long and short term holders. This metric tracks XEM long or short term investors are holding more profits. For Ethereum, if the metric falls below the neutral line, it means that short term investors are holding a larger portion of unrealized profits.

This change is important because short-term investors tend to sell quickly at the first sign of weakness. If they start taking profits near $3,000, ETH could face renewed selling pressure. This behavior often stalls previous recovery efforts, leaving sentiment vulnerable despite broader positive signals.

Want more information on Token like this? Sign up for editor Harsh Notariya's daily crypto newsletter here .

Ethereum Long/Short Term MVRV Divergence Chart. Source: Santiment

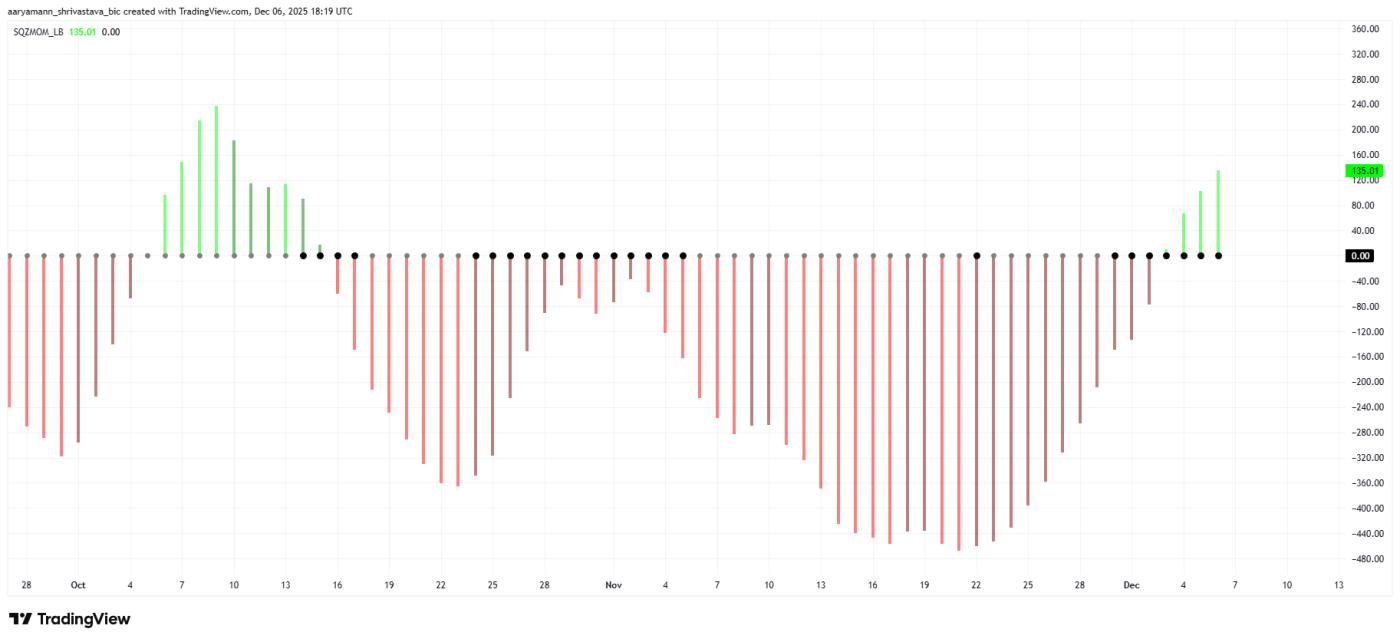

Ethereum Long/Short Term MVRV Divergence Chart. Source: SantimentThe squeeze momentum indicator adds another layer of complexity. ETH is currently in a squeeze phase, which occurs when volatility shrinks and momentum is compressed.

This is often a sign before a strong move. The chart shows that the bullish momentum is strengthening, suggesting that when the pull is released, the price could rise sharply.

If bullish momentum continues to build during this period, ETH could capitalize on the volatility expansion to the upside. This setup has led to rallies in previous cycles, although confirmation depends on market participation and whether buyers step in at $3,000.

ETH Momentum Squeezing Index. Source: TradingView

ETH Momentum Squeezing Index. Source: TradingViewETH price may fall again

Ethereum is trading at $3,045 and remains above the important $3,000 support level. ETH has been trading tightly around this area over the past few days, showing traders' confusion as market signals change.

Mixed signals suggest that ETH could continue to move sideways near $3,000 in the short term. A pullback due to short-term investor profit-taking or broader market skepticism could push Ethereum down to $2,762 before stabilizing.

ETH Price Analysis. Source: TradingView

ETH Price Analysis. Source: TradingViewHowever, if the bullish momentum strengthens and the macro conditions are favorable, ETH could surpass $3,131 and target $3,287. A clear breakout above these levels would invalidate the bearish view and pave the way for a broader recovery.