II. Scoring according to the rules

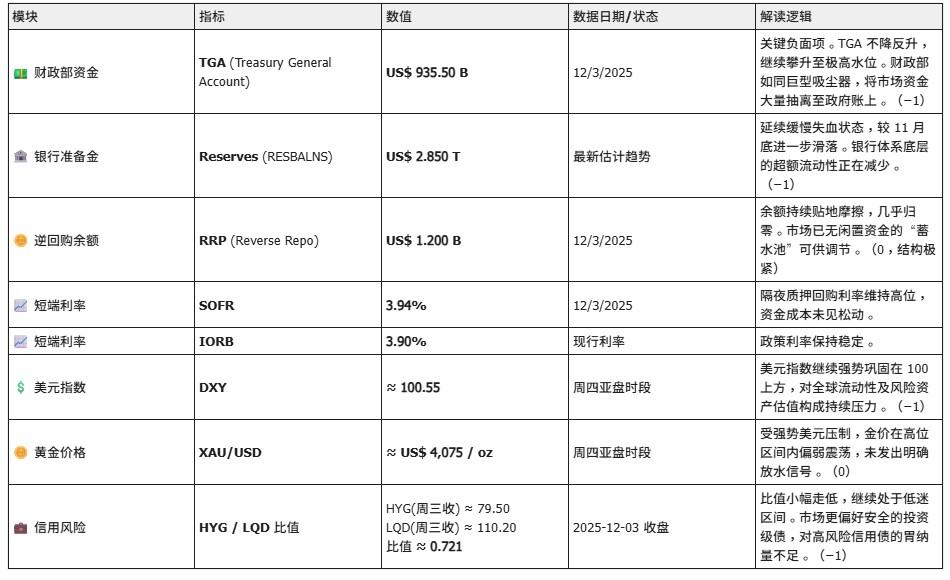

- TGA remains extremely high and continues to rise → pumping → -1

- TGA is not only at a high level, but it is also continuing to increase (absorbing water), making it the biggest source of contraction at present.

- 👉Score: −1

- Reserve requirements trending downward → tightening → -1

- The trend remains downward, and the water level continues to drop.

- 👉Score: −1

- RRP drops by more than $100 in one week → liquidity injection → +1

- The balance has been almost completely cleared, with no room for further release.

- 👉Score: 0

- SOFR − IORB > 0.05% → Tight Funding → −1

- 3.94% - 3.90% = 0.04%. The interest rate spread is still within the normal range.

- 👉Score: 0

- DXY strongly defends the 100 mark → Tightening environment → -1

- The DXY has stabilized above 100.55, establishing a strong dollar environment.

- 👉Score: −1

- Gold rose +1% and TGA declined → monetary easing → +1

- The condition is not met.

- 👉Score: 0

- A declining/sluggish HYG/LQD ratio indicates credit tightening, which could lead to a decrease of 1.

- The ratio is approximately 0.721, indicating that credit risk appetite remains weak.

- 👉Score: −1

👉Today 's total score calculation : -1 (TGA) + -1 (Reserves) + 0 (RRP) + 0 (Interest Rate Spread) + -1 (DXY) + 0 (Golden Combination) + -1 (Credit Ratio)

✅Total score = -4

III. Liquidity Indicators

👉Today 's overall assessment: 🔴 Tight

IV. Comprehensive Interpretation

Today's liquidity report shows the situation is becoming increasingly tense , with red lights continuing to flash.

The current market landscape is very clear:

- The core liquidity pump is operating at full capacity : the Treasury (TGA) holds a massive amount of cash (>935 billion), which has been genuinely withdrawn from the market. Unless the TGA begins large-scale spending (releasing liquidity), the market will hardly feel any significant easing of liquidity.

- The buffer has disappeared : RRP has gone to zero, which means that the market has lost its "backup reservoir" to deal with sudden liquidity shocks.

- Water levels are dropping : the banking system's reserves are slowly being depleted.

Conclusion: Under the dual pressure of a strong dollar and massive liquidity drain from TGA (Treasury General Exchange), the current macroeconomic environment is extremely unfavorable for the valuation expansion of risk assets. The market is currently operating in a state of "liquidity shortage," making it less resistant to any negative news. Caution is advised regarding assets that require high liquidity support.