According to a recent report, 87% of wealthy individuals in Asia hold digital assets, and 60% plan to increase their investment in this area.

This indicates that the digital asset sector in this region is becoming increasingly mature. Wealthy investors in major markets have begun to XEM crypto as an important part of their investment portfolios.

The adoption rate of digital assets is rapidly increasing among wealthy investors in Asia.

The survey results come from Sygnum's APAC HNWI 2025 Report . The report, which surveyed over 270 wealthy and professional investors across 10 markets in the Asia-Pacific region, reveals a major shift: digital assets are increasingly becoming an integral part of long-term wealth protection and growth strategies in the region.

The report shows that 87% of investors own digital assets in their portfolios. Additionally, 49% of survey participants stated they allocate more than 10% of their portfolio to crypto, with the Medium for wealthy investors falling between 10-20%. 60% of them indicated they would continue to increase their investment allocation in this sector.

“Wealthy investors in Singapore and the Asia-Pacific region are viewing digital assets as a genuine opportunity to create and protect wealth. Their disciplined, generation-oriented investment approach, combined with a higher risk appetite, encourages them to invest boldly in digital assets — especially given Singapore’s well-regulated MAS regulatory framework, which provides reassurance to these investors,” said Lucas Schweiger, author of the report and Head of Digital Asset Ecosystem Research at Sygnum.

Preserving assets is more important than speculation.

A recurring theme throughout the report is the increasingly sophisticated investment behavior of individual investors in Asia. 90% of survey participants now XEM digital assets as crucial for long-term wealth preservation and future generation planning . Portfolio diversification has become the leading reason for investment decisions, far surpassing short-term trading or chasing major trends.

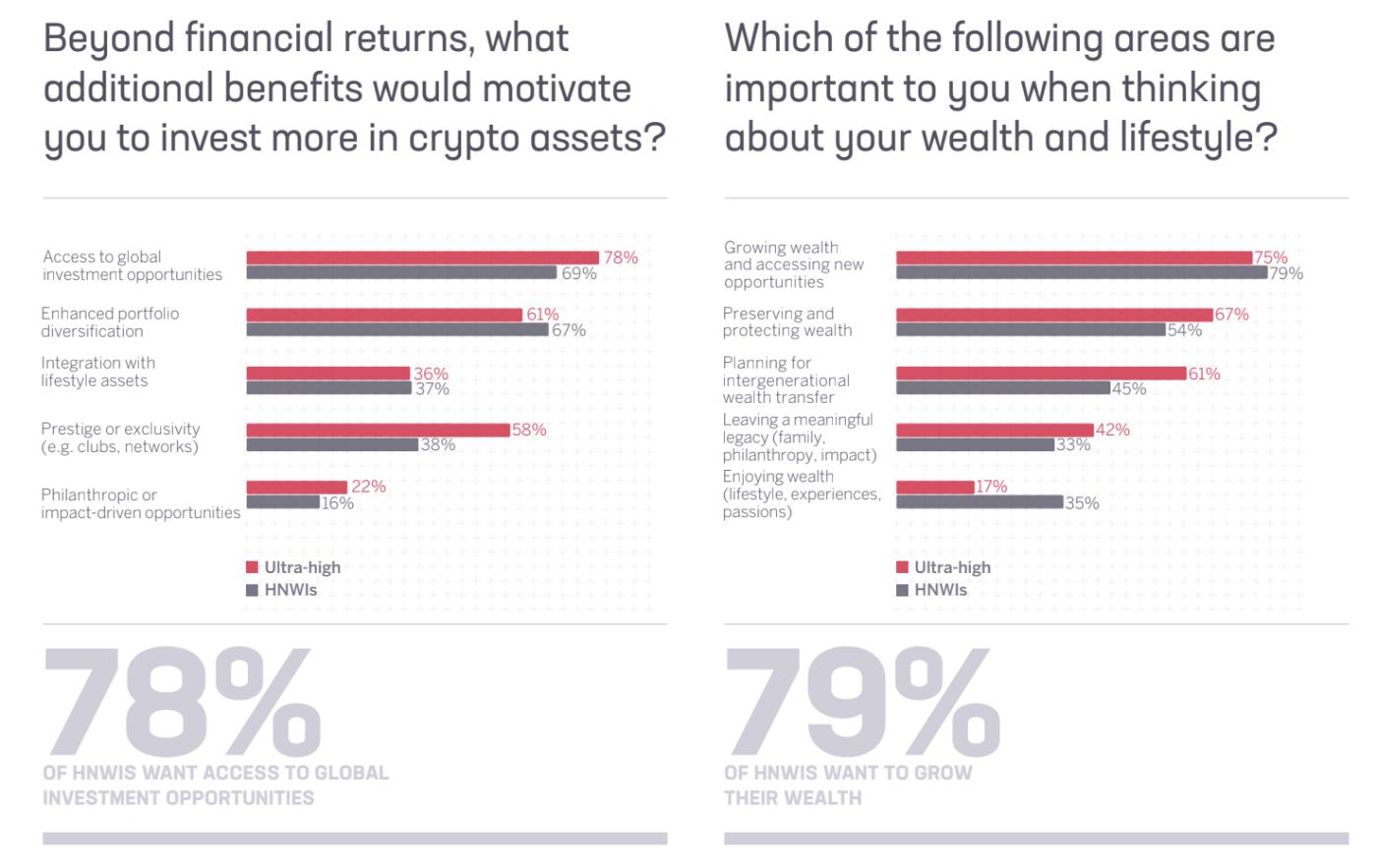

The views of wealthy Asian investors on crypto. Source: Sygnum

The views of wealthy Asian investors on crypto. Source: SygnumThe demand for more professional and diversified investment products is also increasing. These investors are particularly interested in proactive investment strategies, third-party investment management, or products that generate higher returns, tailored to their existing asset structure.

Notably, an increasing number of investors expect traditional asset management firms to adapt quickly. Recently, BeInCrypto reported that many investors in the US have moved their funds away from investment advisors if they don't offer opportunities in crypto.

“The MAS’s regulatory framework in Singapore, coupled with Hong Kong’s increasingly refined regulations on digital assets, has created a foundation for traditional asset management firms to offer crypto-related services—the question now is no longer whether private banks will cater to this demand, but when they will begin,” Chia Gerald Goh, co-founder and CEO of Sygnum Asia Pacific.

The need for diversification in ETFs extends beyond Bitcoin and Ethereum.

The demand for diversified ETFs is also very clear. The report indicates that 80% of respondents want ETFs that include multiple digital assets beyond Bitcoin and Ethereum. Solana received significant interest , with 52% expressing a desire to invest in this Token .

Following closely behind are multi-asset crypto indices at 48%, and XRP at 41% . Notably, 70% of those surveyed indicated they would allocate more Capital or increase their holdings if these ETFs incorporated Staking yields.

However, Sygnum also noted that many investors are becoming more cautious following the recent period of significant market volatility.

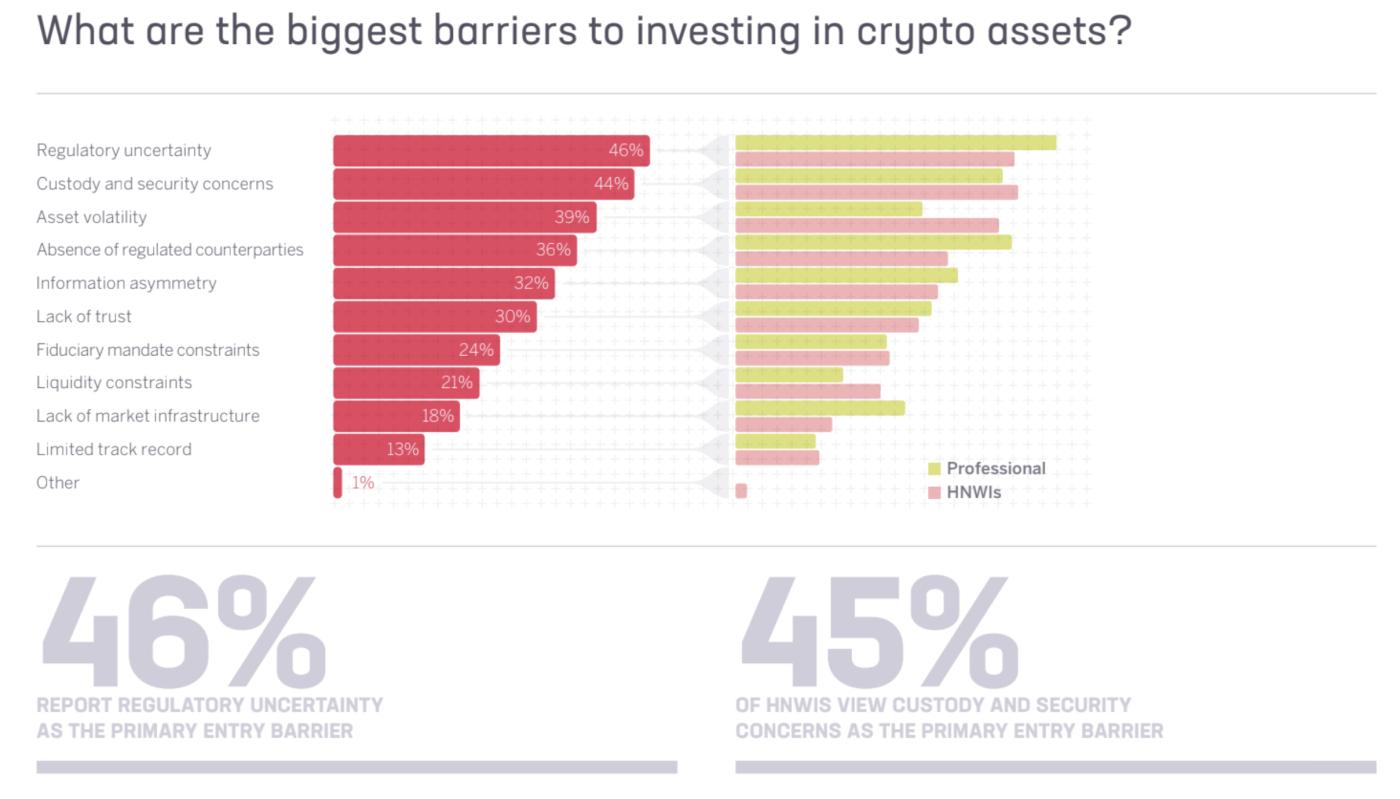

Difficulties are hindering investors. Source: Sygnum

Difficulties are hindering investors. Source: SygnumFactors such as unclear regulations, concerns about storage and security , and varying licensing requirements across countries remain major barriers to wider participation.

Nevertheless, long-term confidence in the crypto market remains very strong. 57% of wealthy investors and 61% of ultra-wealthy investors said they were optimistic or very optimistic about the market's long-term prospects. Their confidence is reinforced as digital assets become increasingly integrated into traditional finance.

Mr. Goh emphasized that the Asia-Pacific region is emerging as the world's fastest-growing and most influential digital asset hub, and this trend is expected to explode even further by 2026.