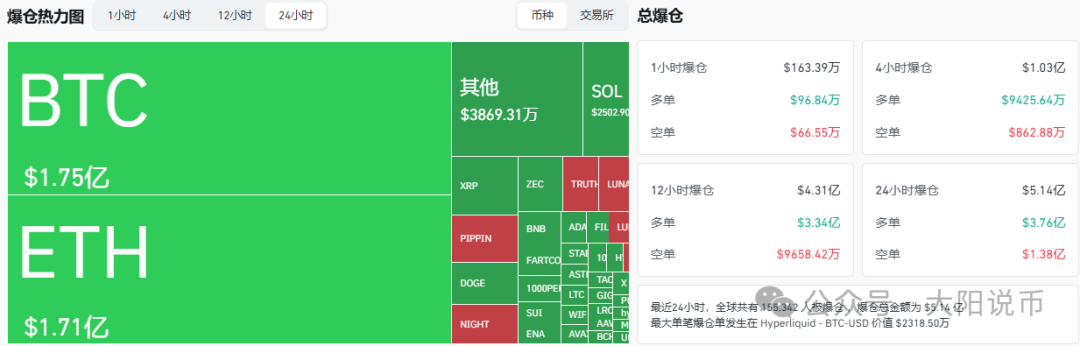

🌍In the past 24 hours, a total of 155,332 people worldwide have been liquidated, with a total liquidation amount of $514 million. The largest single liquidation occurred in Hyperliquid - BTC-USD, worth $23.185 million.

🔥Market sentiment is stable, and the next move will be driven by data and expectations of interest rate cuts.

The current turnover rate is at a high level, mainly reflecting investors engaging in trading and speculation at a crucial stage. It is expected that the turnover rate will gradually decrease after today. Data also indicates that recent turnover mainly comes from short-term investors who bought at low prices, especially new investors with costs below 90,000 who are showing relatively significant selling pressure.

The current market's overall shareholding structure is normal, and stability has not shown any abnormalities. There has been no panic selling by those holding high positions. Future market trends will depend on December's economic data; if expectations for an interest rate cut in January continue to strengthen, market enthusiasm is likely to persist.

If you don't understand or aren't sure what's going on, remember to follow me 👇

✅ Today's market analysis:

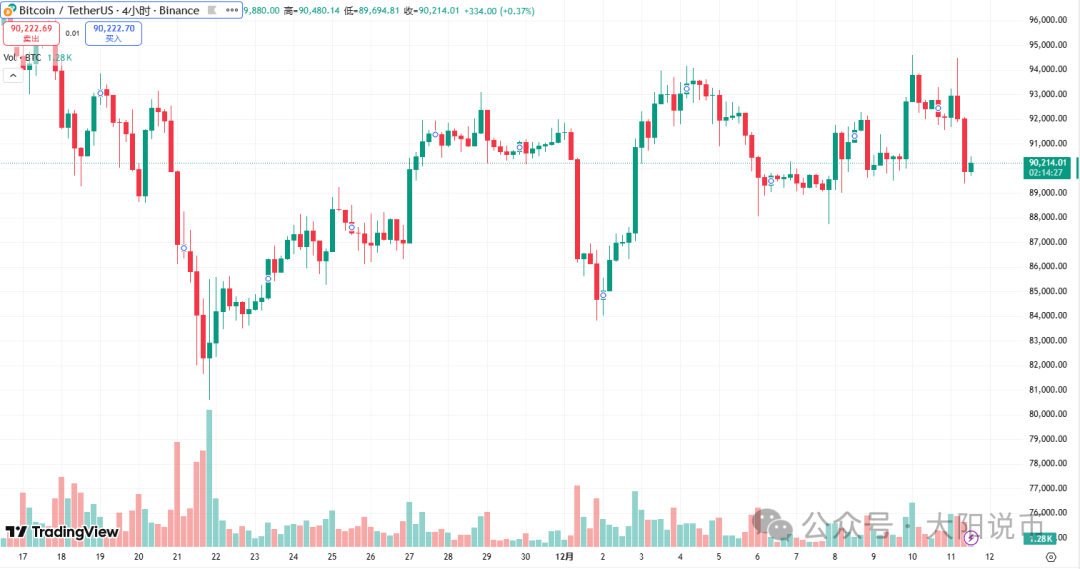

BTC

Bitcoin's key support level remains around 88,700 today. A potential Fibonacci retracement level is expected in the 86,200-86,700 range, but this is less likely. It's more probable that it will consolidate in the 89,000-88,000 range, building momentum for a rebound next week. Trading strategy should simply be prepared for potential Fibonacci retracements. Short-term resistance is at 92,500, a key level that will likely determine whether the price action strengthens; a break above this level is needed for a sustained upward trend.

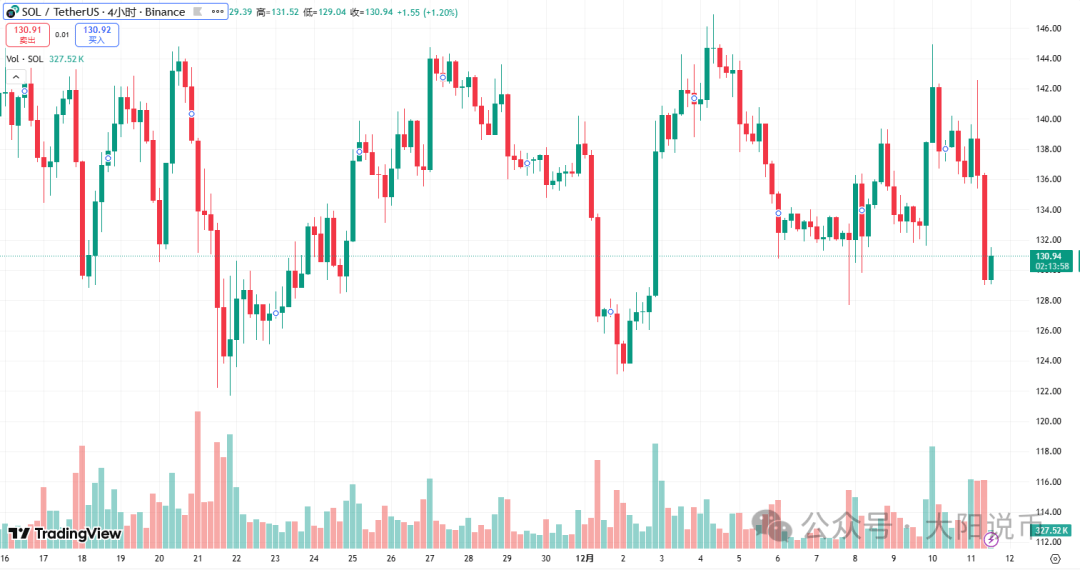

SOL

The 129 support level mentioned yesterday will be tested today. If it breaks down, the next target is 125.3. Before the short-term resistance at 137.7 is broken, the market is unlikely to be strong.

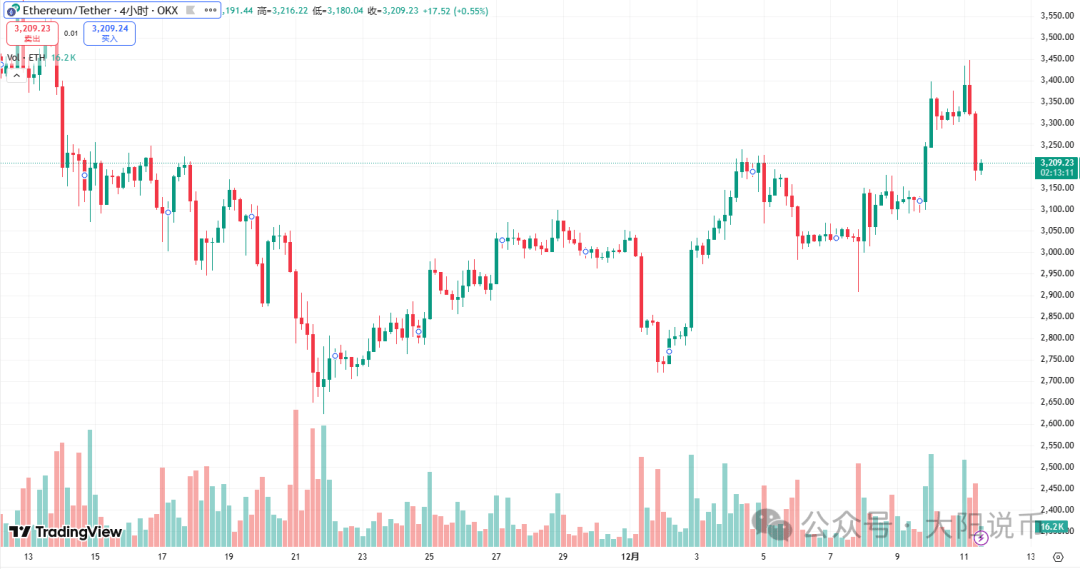

ETH

Ethereum's resistance level of 3444 was confirmed yesterday, reaching a high of 3446. Today, the resistance level has shifted down to 3338, and a strong performance is unlikely until this level is broken. Support is initially seen in the 3130-3110 range, with a key level to watch at 2940.

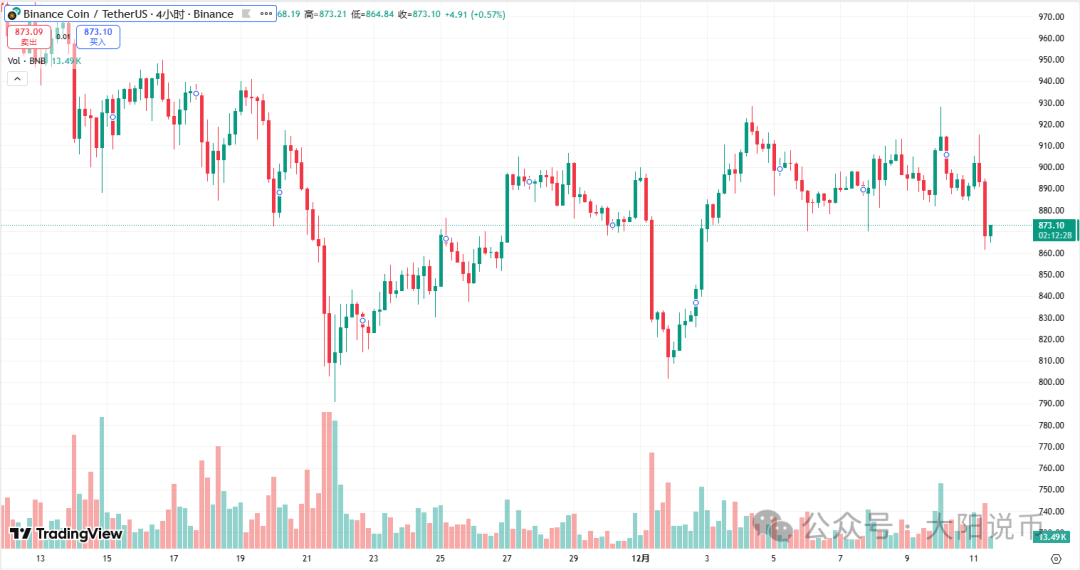

BNB

BNB is currently the weakest performer in the market. This afternoon, pay attention to the 873 level. If the hourly candle closes above this level, the resistance levels are 882, 898, and 915 respectively. If it fails to hold above 873, the support levels are 861, 846, and 830.

👀Is it time to buy the dips in the counterfeit market?

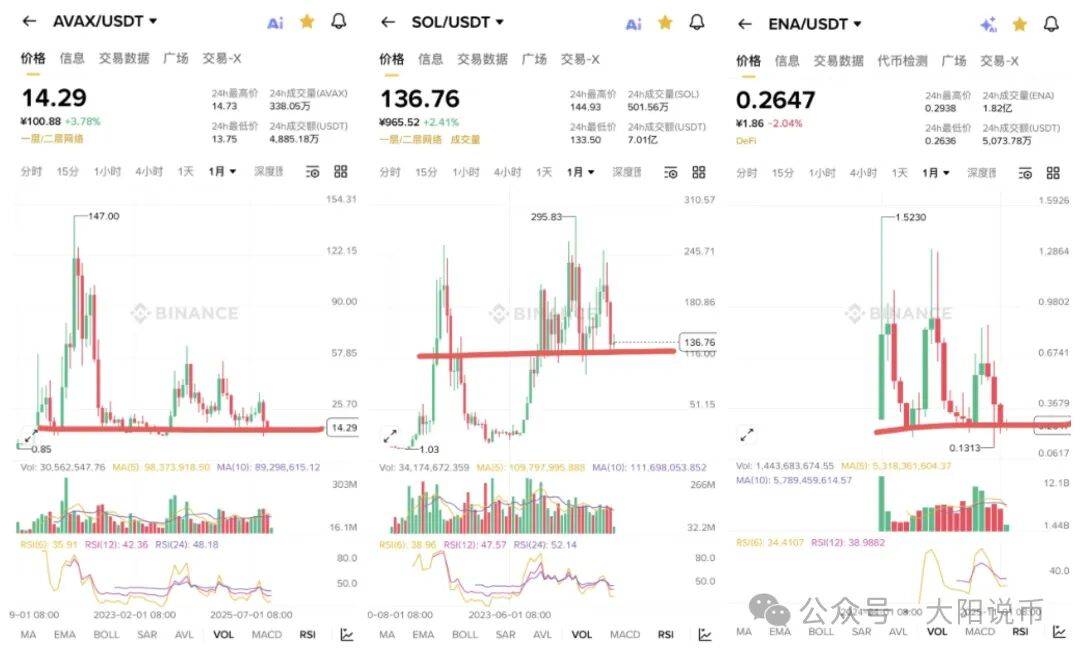

Observing the monthly charts of SOL, AVAX, and ENA reveals that they have reached key monthly support levels. These represent the trends of mainstream coins, established public chain coins, and new coins in this bull market, respectively, and also roughly reflect the overall situation of the current Altcoin market.

From a technical perspective, the current level presents some conditions for buy the dips, but market sentiment remains cautious, with many investors still on the sidelines. If even monthly support fails to trigger a significant rebound, the prospects for some Altcoin may face even more severe challenges.

🤡The leverage structure of the Altcoin market has recently shown significant divergence.

Short positions in cryptocurrencies such as HYPE, XMR, and ASTER have been largely liquidated, and the current market is mainly filled with leveraged long positions. This could easily trigger a chain reaction of liquidations of long positions, so these cryptocurrencies are relatively weak in the short term.

In contrast, VIRTUAL, FIL, BON, and PEPE exhibit the opposite pattern, with leverage concentrated on the short side, making the market more prone to short squeezes. Therefore, their potential for a subsequent rebound should be greater.

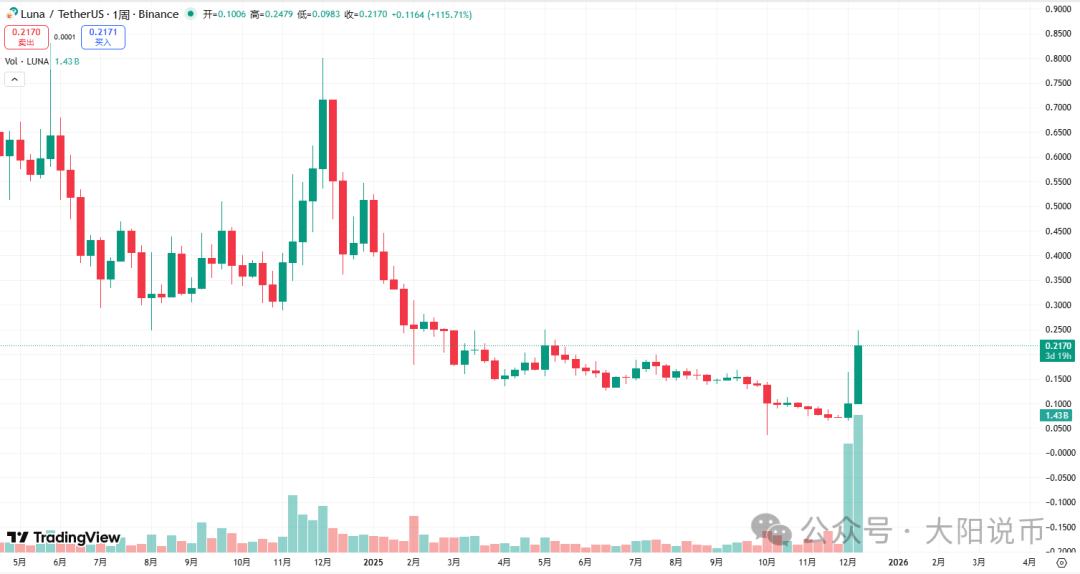

$LUNA

LUNA has started to rebound, it seems this market is getting increasingly active. Once we find a good entry point, we can short LUNA. I believe this coin will most likely return to where it started.

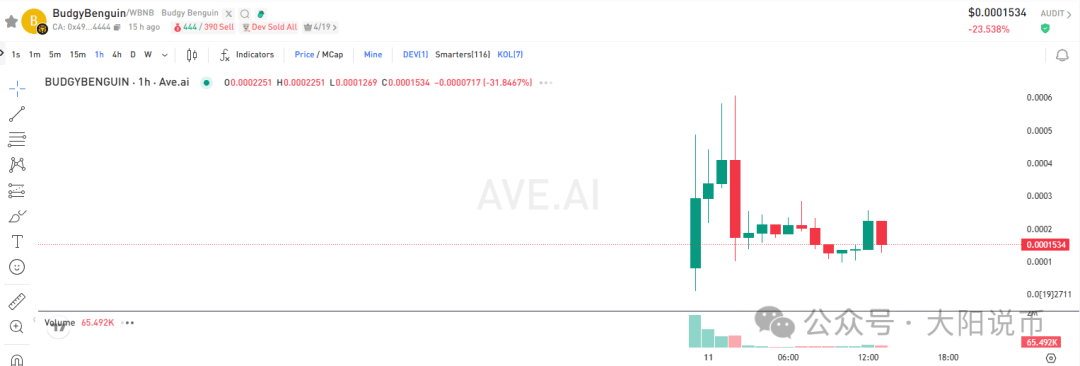

$BudgyBenguin

BudgyBenguin, the tiger-striped penguin, topped the trending charts last night and received official interaction from BNBCHAIN. The initial ATH (Average Term) only reached 500,000, bottoming out at around 100,000. The main reason for the first wave was the shill, and historical experience shows that BSC (Browser Investors' Stock) hot topics often undergo a deep shakeout first (this round has already seen an 80% drop in the hourly chart, from 500,000 to 100,000), preventing retail investors from easily acquiring shares. The shakeout may have now ended, and the trend is basically clear.

$ASTER

The trading strategy for this coin is very precise; the 0.9 level has been tested several times without truly breaking through, and even when it briefly dips, it immediately rebounds. Crucially, CZ holds positions at this level, making it a psychological barrier and a defensive line for retail investors. Currently, it seems highly likely to break down; closely monitor the 0.9 level. If it breaks decisively, short it immediately.

Three Alphas today

$CYS (ZK+AI Infrastructure) will be launched at 4 PM this afternoon, having secured 21.85 million RMB in funding. It is developed by a domestic team and will be available on KuCoin simultaneously.

$BTX (music copyright RWA) launched at 6 PM, securing 6-9 million in funding, simultaneously released on Gate.io.

$US (SUI ecosystem stablecoin) is now available for collection (5-10 $US per person), synced with Bitget.

All projects hope to take advantage of the market recovery to launch quickly.

QQ number 1037184923

Every sharp drop is followed by a period of great potential. Those who are unsure about future market strategies can follow Potato (or similar product/service): TDTB07