BTC dropped 25 basis points in the early morning, but the price failed to break through the key level and instead fell further. The next interest rate cut is probably not until the middle of next year, so this rate cut did not have much of a positive impact on the price of cryptocurrencies, and the news has not caused any significant ripples for the time being.

BTC is currently in an ascending triangle pattern and is testing the lower support level again in the short term. The key level to watch is the 88,000-89,000 range; as long as it doesn't break below this level, you can consider entering long positions. My original plan was to enter below 90,000 yesterday, but the current trend looks quite weak. Those who have already entered should take profits and wait for the price to retrace to the 88,000-89,000 support level before considering re-entering. There will likely be at least one more rebound later; when it retraces to that level , long.

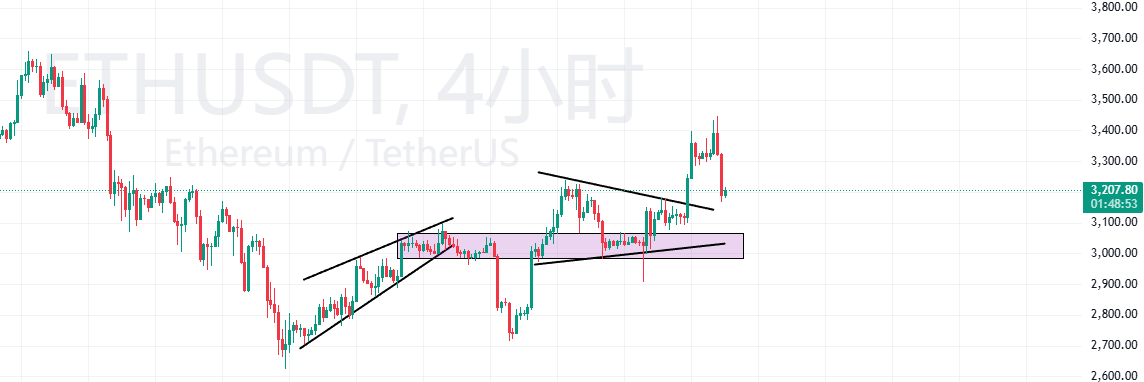

This short-term pullback in ETH is still testing the lower support level. Yesterday, I analyzed that a long position could be entered at 3130-3150, but the price only dropped to around 3165, so the entry point wasn't reached and the long position wasn't executed.

However, opportunities still exist within this range, so just stick to the original plan. Wait for the smaller timeframe to retrace to the 3130-3150 range before considering a long; this also coincides with the upper trendline before the triangle pattern breakout. If you haven't received an order yet, just keep waiting; absolutely do not chase the price upwards! Otherwise, if you chased the price yesterday, you'd be trapped now. This pullback is also as I predicted; just continue waiting for entry opportunities.

BTC and ETH are likely to experience another downward spike on a minor timeframe. Once this drop bottoms out, we can enter long positions as planned. After entering long positions, we expect to capture a rebound, after which we should switch to a short strategy. This is because the daily indicators are almost fully digested, and there's a high probability of a bull trap before the real decline. My plan is to first capture this bull trap, and then immediately reverse and open a short position. Specific operational details will be continuously updated; remember to follow me if you have any questions!

Many people are confused as to why Luna, LUNC, and USTC have seen their prices surge several times over in the past few days. The core reason is founder Do Kwon, who is scheduled to have his sentencing hearing in New York today. The market has been speculating in advance about the possibility of a reduced sentence, which has driven up the prices. However, it's important to clarify that even if Do Kwon completes his sentence in the US, he will most likely be extradited back to South Korea. In that case, South Korea will likely have him serve several more decades in prison – a point that shouldn't be overlooked.

Retrospective analysis:

BCH is almost at its entry price of 520, just wait! This coin is truly "erratic"—it can grind you down in sideways trading, then suddenly surge and scare you! Of the five lottery coins I bought (Gps, Ntrn, Newt, Pnut, and Nil), three are already losing money. Pnut, once a popular MEME coin, even plunged sharply today, with a spot trading volume of only 800,000, showing very little support. This price action is truly dismal!

There's a very real pattern to this market trend: every time Bitcoin reaches a temporary high, it ultimately ends with speculation in MEME coins. Conversely, if Bitcoin doesn't rebound, there won't be any MEME coin rally.

The logic is very simple: Bitcoin keeps rising → everyone starts speculating on MEME → Bitcoin stops rising → the MEME rally also stops. The AI-related rallies in January, the BONK rally in June, and the BSC chain rally in October all followed the same pattern. These three waves were large-scale financial frenzies, occurring roughly every 3-4 months.

I think the current sluggish performance of Bitcoin is actually a good thing, indicating that the Lunar New Year rally in February is becoming increasingly worth waiting for. We're already used to this kind of months-long market consolidation. As long as you don't rigidly adhere to a fixed "bull market" or "bear market" trading strategy, it's quite easy to trade. Catch a wave of market movement, make a profit, then rest for a few months and wait for the next wave—it's much better than blindly staring at hourly candlestick charts every day!

The market is constantly changing, and specific entry and exit points should be determined based on real-time conditions. Follow the trend after a breakout! No matter how confident you are, please strictly adhere to your stop-loss and take-profit strategies! That's all for today! Follow me so you don't get lost! QQ: 2178747366, QQ: 2499660658 ( Add me with a note, and I'll add you to our learning and discussion group).