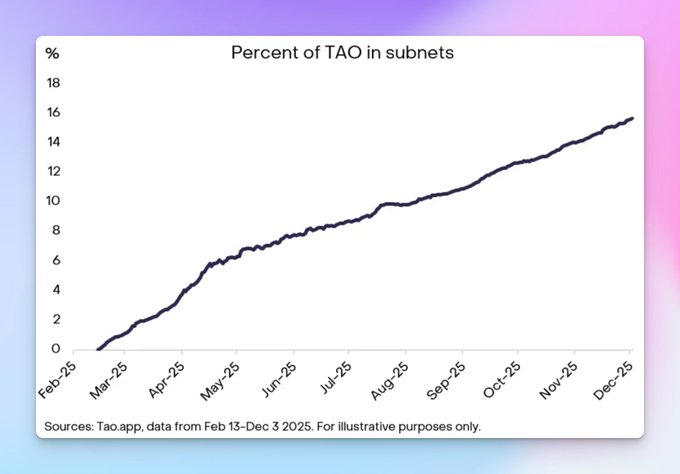

Bittensor’s (TAO) halving is coming up in a few days. Emissions getting cut in half is a pretty big deal, but the bigger story is Taoflow. Before Taoflow, emissions were guaranteed. Every subnet received some share of the daily 7,200 TAO (soon to be 3,600 after the halving) regardless of its performance. Now, subnets are now paid based on how much $TAO is flowing in versus flowing out. Subnets that attract sustained staking inflows receive more emissions. Subnets that see withdrawals get less. Some may eventually get nothing. So what does that mean? Strong subnets consolidate both TAO and alpha liquidity, while weak subnets lose emissions entirely and may die off. You can already see the trend. Most staking is flowing into the top performers. The top 10 subnets are pulling in almost half of all emissions. Funds are noticing too. DSV, Stillcore, and Yuma (with DCG backing) are all getting involved. Emissions getting cut in half + TaoFlow = big changes. The network is already ruthless. Out of 200 subnets created, 71 have been removed. With Deregistration, Taoflow, and now the halving, Bittensor is sending a message: if you cannot compete, you are out. If you want exposure to TAO, consider holding TAO itself and maybe one or two leading subnets. This is not the time to chase betas.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content