Silver prices surged to $63 per ounce today, setting a new record for the precious metal. Meanwhile, the cryptocurrency market fell 2.74% in the last 24 hours, with all 20 top coins (excluding stablecoins) in the red.

This significant disparity indicates a strong shift in investment Capital . While many consider this a typical sign of a move toward safe-haven assets, others argue that it could mean the opposite.

Why is the price of silver rising?

Silver prices continued their strong upward trend today, setting new records by reaching an all-time high in Asian trading this morning. According to Companies Market Cap data , silver is now the sixth-largest global asset with a market Capital of $3.5 trillion.

Based on recent analysis from The Kobeissi Letter, this metal is on track to record its best 12-month performance since 1979.

“The current surge in silver prices makes the fluctuations of 2020 and 2008 seem insignificant. A new era of monetary policy is about to begin,” the post stated.

When silver prices surged, many people rushed to find safe-haven assets . But what caused this sudden surge in demand for silver? According to trader Michael, this price increase was driven not only by demand but also by "desperation."

He said that within four days, physical silver ETFs had net inflows of more than 15.3 million ounces of silver, the second-largest weekly inflow in 2025.

Michael emphasized that this amount is close to the 15.7 million ounces added throughout November.

“Silver ETFs are heading for their 10th consecutive month of net gains, something that has only ever happened during periods of systemic stress,” he added .

The world's largest silver ETF – SLV – saw nearly $1 billion inflows in just one week, surpassing the inflows into major gold funds. According to Michael, the driving force behind the rise in silver prices stems not only from retail investor interest or inflation concerns. He stated:

“The global monetary system is quietly, rapidly, and internally losing confidence. Silver is the only asset at the crossroads of two crises: 1. The hunt for tangible assets as public debt exceeds tolerable levels; 2. Persistent industrial shortages driven by demand for AI, expanding solar power, electric vehicles, and semiconductors.”

Michael emphasized that when financial instability meets material scarcity, the price of silver not only rises but can also "decouple from the general market," signaling a deeper upheaval than a typical price increase.

Silver and Bitcoin: Performance Gap Widens in 2025

In contrast to the surge in silver, the cryptocurrency market showed less than favorable results. According to data from BeInCrypto Markets, the largest cryptocurrency fell by more than 2% on the day, continuing the broader downward trend .

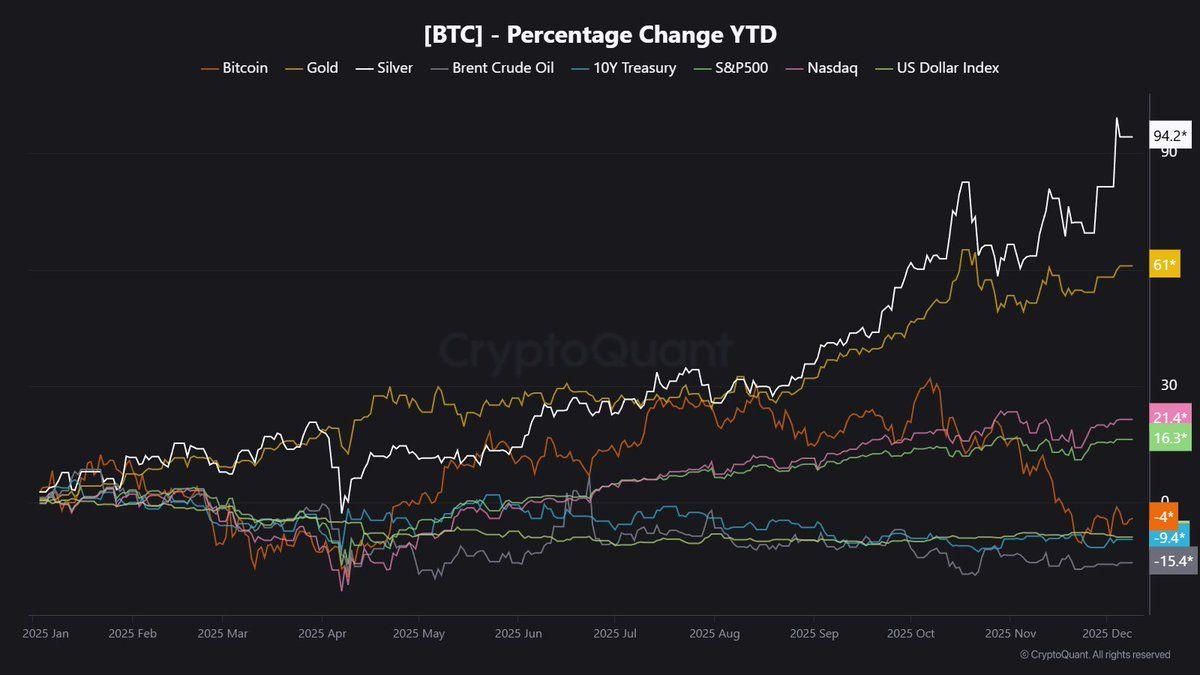

According to expert Maartun, in 2025, silver will emerge as the leading performing asset, potentially even surpassing gold. Conversely, Bitcoin will lag behind these precious metals as well as major stock indices such as the S&P 500 and Nasdaq.

"Over the past four years, the value of Bitcoin relative to silver has plummeted. It has lost more than half its value when converted to silver," economist Peter Schiff commented .

Comparing performance from the beginning of 2025, it shows that silver has surged while Bitcoin has declined in price. Source: X/JA Maartun

Comparing performance from the beginning of 2025, it shows that silver has surged while Bitcoin has declined in price. Source: X/JA MaartunThis indicates a strengthening trend toward safety. In times of market uncertainty , investors often seek safe-haven assets like silver and gold – traditional channels that have been trusted for centuries.

However, some analysts argue that this surge in silver prices is not a sign of investors seeking a safe haven, but rather a sign of risk appetite. Crypto analyst Ran Neuner said the market is currently favoring risk assets, a view that contradicts the traditional expectation of rising gold and silver prices.

“The market is currently completely in risk-on mode, but many people don’t see this just because Bitcoin isn’t going up! Silver has reached an all-time high. It’s breaking records and accelerating strongly. Silver is the ‘gold beta’ and signals a risk-on state!” he asserted .

Neuner also highlighted that the ETH/ BTC ratio has broken above the 50-week simple moving Medium , indicating renewed interest in the cryptocurrency market. He further cited the breakout of the Russell 2000 and the recent shift in direction by the US Federal Reserve as evidence that the market is trending toward higher risk appetite.

“The number of BTC sellers will soon dry up, and a massive catch-up wave will begin. All the data points in one direction!” Neuner asserted.

Many other analysts also predict that demand for Bitcoin will increase again. However, whether this will happen depends on the subsequent market trends and whether retail investors will return strongly in the near future.