Author: Stacy Muur, Crypto KOL; Translator: Jinse Finance

In my view, 2025 will be a turning point for the cryptocurrency industry: the focus will shift from speculative cycles to the construction of fundamental, institutional-grade architectures. Below, we'll analyze eleven key themes for that year.

1. Institutions become the dominant force in crypto fund flows.

I believe 2025 will witness institutions taking over liquidity in the crypto market. After years of waiting, institutional capital will finally completely overwhelm retail funds.

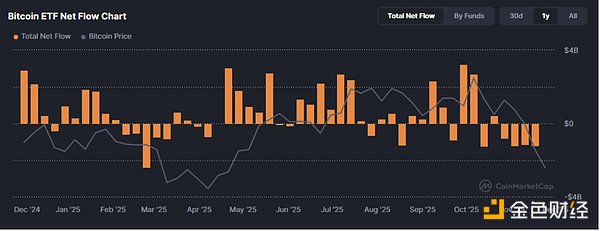

Institutional capital didn't just arrive in 2025; it has already crossed a key threshold. For the first time, the marginal buyers of crypto assets are no longer retail investors, but asset allocators. Taking the US spot Bitcoin ETF as an example, inflows exceeded $3.5 billion in a single week during the fourth quarter, led by products such as BlackRock's IBIT.

This is a structured investment arrangement that reallocates risk capital. Bitcoin is no longer seen as a novelty, but rather as a macroeconomic tool with portfolio utility: digital gold, a convex inflation hedge, or a purely uncorrelated asset.

However, this shift has also brought about a two-way impact.

Institutional fund flows are less responsive and more sensitive to interest rates. They compress market volatility while also anchoring cryptocurrencies more closely to macroeconomic cycles. As one chief investment officer put it, "Bitcoin has become a liquidity sponge in compliance cloak." As a globally recognized store of value asset, its narrative risk has decreased; however, interest rate risk remains.

This shift in capital flows affects everything: from exchange fee reductions to the demand curve for interest-bearing stablecoins and tokenized physical assets.

The core issue is no longer whether institutions will enter the market, but how protocols, tokens, and products will adapt to capital demands that use the Sharpe ratio (rather than market hype) as the decision-making criterion.

2. Real-world assets (RWA) become a real asset class, rather than a conceptual narrative.

By 2025, tokenized real-world assets (RWAs) had evolved from a concept into a real capital market infrastructure.

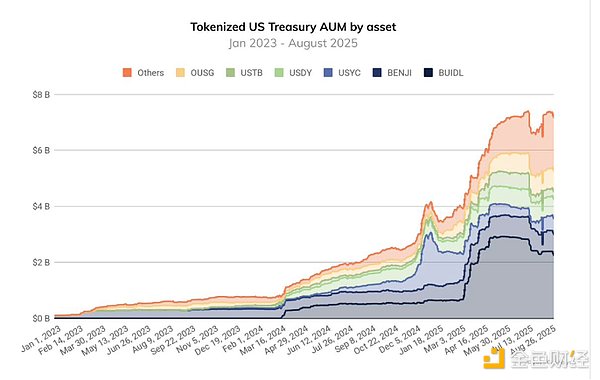

As of October 2025, the total value of Real-World Asset (RWA) tokens had exceeded $23 billion, representing a nearly fourfold year-on-year increase, signifying the formation of substantial supply. Approximately half of this capital is allocated to tokenized government bonds and money market strategies. With institutions like BlackRock issuing BUIDL products pegged to $500 million in government bonds, this is no longer marketing rhetoric, but rather a pool of on-chain assets secured by guaranteed liabilities, rather than unbacked code.

Stablecoin issuers are beginning to back reserve assets with short-term notes, while protocols such as Sky (formerly Maker DAO) have incorporated on-chain commercial paper into their collateral portfolios.

Treasury-backed stablecoins are no longer on the fringes; they have become cornerstones. The assets under management of these tokenized funds nearly quadrupled in 12 months, from approximately $2 billion in August 2024 to over $7 billion in August 2025. Real-world asset (RWA) infrastructure from institutions like JPMorgan Chase and Goldman Sachs has also moved from testnets to production environments.

In other words, the boundary between on-chain liquidity and off-chain asset classes is blurring. Traditional financial asset allocators no longer need to purchase tokens representing real-world assets; they now hold the assets themselves, issued directly on-chain. This shift from synthetic representation to the tokenization of real assets is one of the most profound structural advancements of the year.

3. Stablecoins have become both a killer application and a systemic vulnerability.

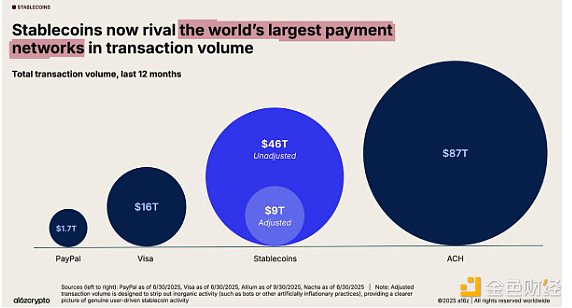

Stablecoins have delivered on their core promise: a programmable, scalable dollar system. Over the past 12 months, on-chain stablecoin transaction volume reached $46 trillion, a year-on-year increase of 106%, with an average monthly transaction volume of nearly $4 trillion.

From cross-border settlements to ETF access and DeFi liquidity, these tokens form the financial lifeline of the crypto world, making blockchain a functional dollar network.

However, its success was accompanied by systemic vulnerabilities. 2025 also exposed the gap between interest-bearing stablecoins and algorithmic stablecoins, especially those models that relied on endogenous leverage. Stream Finance's XUSD plummeted to $0.18, wiping out $93 million in user capital and creating $2.85 billion in debt across the entire protocol.

Elixir's deUSD collapsed due to a single large loan default.

The collapse of USDx on the AVAX chain, suspected of being manipulated, is just one example among many. What they all share are: opaque collateralization, cyclical re-collateralization, and concentrated risk ultimately leading to the failure of the peg.

The yield-seeking nature of 2025 exacerbates this vulnerability. Capital is flowing into interest-bearing stablecoins, with some offering annualized yields of 20-60% through complex vault strategies. Ethena, Spark, and Pendle have attracted billions of dollars, with traders chasing structured yields through synthetic dollars.

However, with the collapse of projects like deUSD and XUSD, DeFi did not mature but instead became centralized. Nearly half of Ethereum's total locked value is concentrated in Aave and Lido, with the remaining funds clustered in a few strategies linked to interest-bearing stablecoins. Ultimately, this has resulted in a fragile ecosystem built on excessive leverage, cyclical liquidity, and shallow diversification.

Therefore, while stablecoins drive the system, they also put it under pressure. We are not suggesting that stablecoins are ineffective—they are indispensable to the industry. However, 2025 proved that their design is just as important as their utility. Moving into 2026, the integrity of dollar-denominated assets has become a primary concern, not only for DeFi protocols but also for all participants in capital allocation or building on-chain financial infrastructure.

4. L2 Integration and the Disillusionment of the "Chain Stack" Ideal

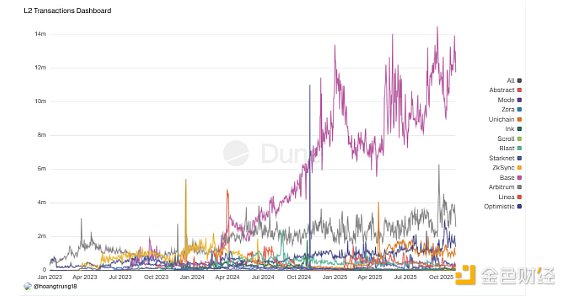

In 2025, Ethereum's "Rollup-centric" roadmap clashed with market reality. Dozens of L2 networks tracked on L2Beat exhibited a winner-takes-all structure—Arbitrum, Base, and Optimism accounted for the vast majority of new TVL and funding flows, while smaller Rollups generally saw their revenue and activity shrink by 70%–90% after incentives ended. Liquidity, MEV bots, and arbitrageurs all chased depth and tight spreads, further amplifying the Matthew effect and drying up order flow on edge chains.

Meanwhile, cross-chain bridge transaction volume surged: reaching $56.1 billion in July 2025 alone, clearly demonstrating that "everything is a rollup" still means "everything is fragmented." Users are still struggling to cope with dispersed balances, L2 native assets, and duplicated liquidity.

We are simply pointing out that this is consolidation, not failure. Fusaka's 5-8x Blob throughput, ZK application chains like Lighter achieving speeds of 24,000 TPS, and new specializations (such as Aztec/Ten's privacy solutions and MegaETH's ultra-high performance) all point to the same shift: a few execution environments are emerging from the competition.

The remaining projects will enter "dormant mode" until they can prove that they have a strong enough moat that makes it difficult for the leader to fork.

5. Predicting market evolution into financial infrastructure

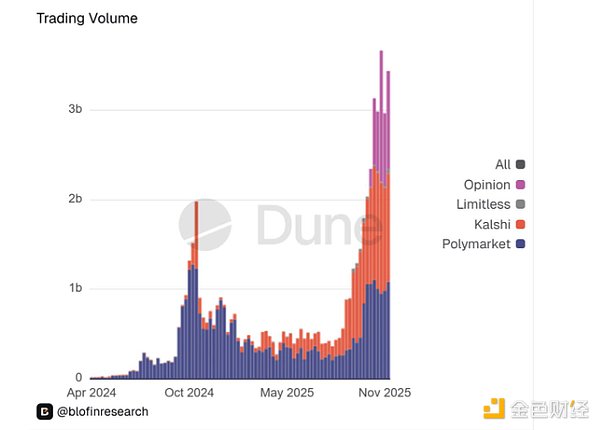

Another big surprise in 2025 was that prediction markets gained official legal status.

This once marginalized sector is now quietly integrating into the core architecture of the financial system. Long-time leader Polymarket has returned to the mainstream in a regulated manner: its US division has been approved by the Commodity Futures Trading Commission (CFTC) as a designated contract market, and the Intercontinental Exchange (ICE) has reportedly invested billions of dollars at a valuation of nearly $10 billion. Trading volume has subsequently surged.

The prediction market has transformed from a "niche interest sector" into an industry with weekly transaction volumes in the billions of dollars, and the Kalshi platform handles event contracts worth tens of billions of dollars annually.

I believe this marks a key turning point where on-chain markets are beginning to be seen as infrastructure.

Major gaming companies, hedge funds, and DeFi native managers have begun using Polymarket and Kalshi as prediction channels rather than entertainment tools. Crypto projects and DAOs are also starting to use this order book data as a source of real-time governance and risk signals.

However, this "weaponization" of DeFi has two sides. Regulatory scrutiny will become more stringent, liquidity will remain highly concentrated in event-driven trading, and the correlation between "prediction markets as signals" and actual outcomes remains to be verified under stress. Looking ahead to 2026, we can assert that event markets have now entered the institutional sphere of influence alongside options and perpetual contracts, and portfolio managers must form their opinions—whether and how to allocate such risk exposure.

6. The integration of AI and encryption has evolved from a hot topic to a practical infrastructure.

By 2025, the integration of AI and encryption will have evolved from conceptual hype into a practical architecture.

I believe the following three themes can summarize this year.

First, the intelligent agent economy has moved from conceptual idea to operational reality. With protocols such as x402 enabling AI agents to trade autonomously with stablecoins, the integration of Circle with USDC, the rise of the coordinator framework, and the development of reputation layers and verifiable systems (EigenAI, Virtuals) all indicate that practical intelligent agents need collaborative mechanisms, not just reasoning capabilities.

Second, decentralized AI infrastructure has become the cornerstone of this field. Bittensor, through its Dynamic TAO upgrade and the December halving event, repositioned itself as "the Bitcoin of AI"; NEAR's chain abstraction brought in actual intentional transaction volume; Render, ICP, and Sentient validated the feasibility of decentralized computing, model profiling, and hybrid AI networks. We observed that infrastructure received a market premium, while "AI wrapper" projects are gradually declining.

Third, the vertical integration process is accelerating. Almanak's AI cluster has deployed quantitative-level DeFi strategies, Virtuals has generated $2.6 million in fees on the Base chain, and bots, prediction markets, and geospatial networks are evolving into trusted operating environments for intelligent agents.

The shift from "AI wrappers" to the integration of verifiable intelligent agents and robots indicates that product-market fit is maturing. However, trust infrastructure remains a critical missing link—the risk of "AI illusion" continues to pose a threat, like a dark cloud hanging over autonomous transactions.

Overall, market sentiment leans towards bullishness on infrastructure towards the end of the year, while remaining cautious about the utility of intelligent agents, and 2026 is generally seen as a potential breakout year for verifiable, economically valuable on-chain AI.

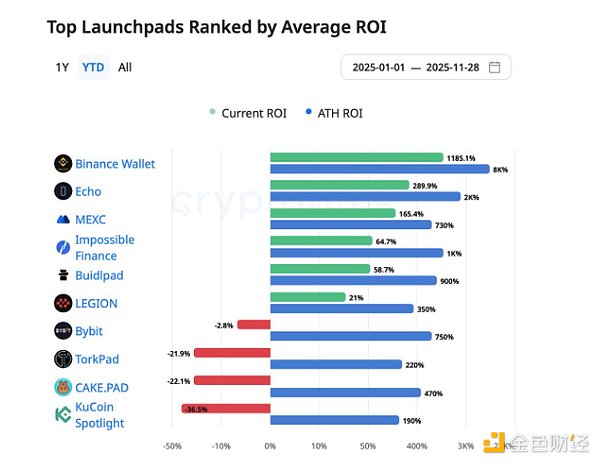

7. Launchpad Returns: Reshaping the Retail Investor Paradigm (Taking Legion, BuildPad, and MetaDAO as Examples)

We believe that the new paradigm for launching platforms in 2025 is not a "comeback of ICOs," but rather an industrial transformation of ICOs. The so-called ICO 2.0 in the market is essentially a mature evolution of the crypto capital formation system towards the Internet Capital Market (ICM): a programmable, regulated, 24/7 uninterrupted issuance channel that replaces lottery-style token sales.

Regulatory clarity—accelerated by the revocation of the SAB 121 order—is transforming tokens into financial instruments with vesting periods, disclosure, and recourse, rather than simple emissions. Platforms like Alignerz are coding fairness at the mechanism level: hash auctions, refund windows, and tokenized vesting schemes (allocation linked to lock-up periods rather than behind-the-scenes channels). "Rejecting VC dumping and eliminating insider manipulation" is no longer just a slogan, but an architectural choice.

At the same time, we observed a trend of structural consolidation led by trading platforms: Coinbase, Binance, OKX, and Kraken platforms provide accessible entry points for institutions through KYC/AML, liquidity guarantees, and vetted project channels. Independent startup platforms are being squeezed into vertical niches (gaming, memecoins, early-stage infrastructure).

On the narrative level, AI, RWA, and DePIN dominate the issuance race, with launch platforms acting as narrative routing machines rather than hype machines. The real transformation lies in the fact that the crypto industry is quietly building an ICM layer that can support institutional-grade issuances and the economics of long-term token holders—rather than a nostalgic replay of 2017.

8. Projects with highly diluted valuations lack investment value structurally.

For much of 2025, we are witnessing a simple rule come to life: a combination of high fully diluted valuation (FDV) and low circulating supply is structurally unprofitable. Numerous projects—particularly new L1 public chains, sidechains, and "real yield" tokens—are entering the market with fully diluted valuations in the billions of dollars and single-digit circulating supply.

As one research institution put it, "High fully diluted valuations and low liquidity are a liquidity time bomb." Any substantial sell-off by early investors could destroy the order book.

The outcome was predictable. Tokens initially surged upon launch, only to suffer continuous losses as unlocking phases and insider exits occurred. Cobie's maxim—"Refuse to buy overvalued tokens"—has evolved from an online meme into a risk management framework. Market makers widened spreads, retail investors exited, and many such tokens remained stagnant for the remainder of the year.

In contrast, tokens with real utility, deflationary mechanisms, or cash flow linkages are structurally significantly better than projects that rely solely on fully diluted valuation figures.

I believe 2025 permanently reset buyers' tolerance for token economic design. Fully diluted valuations and circulating supply are now seen as rigid constraints, not secondary considerations. Entering 2026, if a project's supply cannot be absorbed by exchange order books without disrupting the price chart, it will be practically worthless as an investment.

9. Information Finance: Rise, Frenzy, and Collapse

I believe that the rise and fall cycle of information finance in 2025 will be one of the purest stress tests of "tokenized attention".

Information finance platforms such as Kaito, Cookie, and Loudio once promised to reward analysts, creators, and community moderators for their "knowledge labor" with points and tokens. This briefly became a hot track for venture capital, with institutions such as Sequoia Capital, Pantera, and Spartan investing heavily.

The information overload in the cryptocurrency field and the narrative of "AI×DeFi" make on-chain information curation seem like a clearly missing underlying module.

However, this design choice is a double-edged sword: when attention becomes the unit of measurement, content quality collapses dramatically. Platforms like Loud were quickly overwhelmed by AI-generated spam, bot farms, and engagement manipulation; a small number of accounts reaped the vast majority of rewards, while long-tail participants gradually realized that the game had been manipulated.

The prices of multiple tokens plummeted by 80%-90%, while the collapse of projects such as WAGMI Hub (which raised hundreds of millions of dollars but suffered a major vulnerability attack) further destroyed the credibility of the field.

The final conclusion is that the initial implementation of information finance proved structurally unstable. Its core concept—monetizing valuable encrypted information signals—remains attractive, but the incentive system needs to be redesigned to measure verified contributions rather than simply clicks.

The next generation of projects expected in 2026 will learn from these lessons.

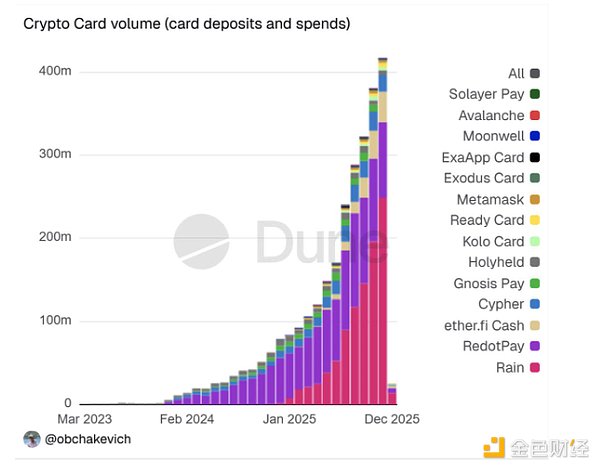

10. Consumers' Return to Encryption – Led by Digital Banks

The return of consumer crypto in 2025 is increasingly being interpreted as a structural shift driven by digital banking (rather than native Web2 applications).

I believe this shift reflects a deeper understanding: adoption accelerates as users access the system through familiar financial infrastructure, while the underlying settlement, yield, and liquidity channels have quietly migrated on-chain.

This has given rise to a hybrid banking architecture—digital banks that abstract away the complexities of gas fees, custody, and cross-chain transactions while giving users direct access to stablecoin yields, tokenized government bonds, and global payment channels. The result is a consumer funnel that drives millions "deeper on-chain" without forcing them to think like seasoned users.

There is a general consensus in the industry that digital banking is becoming the de facto interface layer for mainstream encryption needs.

Cases such as Ether.fi Cash, Plasma, UR Global, Rain, Solid, and Metamask Card mark this shift: instant fiat currency access, 3-4% cashback cards, 5-16% annualized returns through tokenized government bonds, and self-custodied smart accounts—all integrated into a compliant, KYC-native environment.

These applications benefit from the regulatory restructuring in 2025: the repeal of SAB 121, the stablecoin framework, and clearer guidance on tokenized funds, which reduces operational friction and expands the potential market space in emerging economies where pain points such as yield, foreign exchange savings, and cross-border remittances are prominent.

11. The process of normalizing global regulation

I believe 2025 will be the year when cryptocurrency regulation finally becomes normalized.

The conflicting regulatory directives can be categorized into three identifiable paradigms: the European framework (MiCA+DORA system, which has issued more than 50 MiCA licenses and treats stablecoin issuers as electronic money institutions), the American framework (GENIUS Act-style stablecoin legislation and SEC/CFTC guidelines running in parallel, with the launch of spot Bitcoin ETFs), and the Asia-Pacific puzzle (Hong Kong's full-reserve stablecoin regulations, Singapore's refined licensing system, and the widespread adoption of FATF travel rules).

This transformation is far from superficial; it restructures the risk model.

Stablecoins have transformed from "shadow banking" tools into regulated cash equivalents; institutions like Citigroup and Bank of America can now pilot tokenized cash under clear rules; platforms like Polymarket can resume operations under CFTC regulation; and the US spot Bitcoin ETF can operate with over $35 billion in continuous inflows without fear of survival. Compliance has shifted from a burden to a moat: entities with sound compliance technology architectures, clear equity structures, and auditable reserves suddenly gain lower capital costs and faster institutional access.

By 2025, crypto assets will have transitioned from a gray area of curiosity to a regulated asset class. Entering 2026, the debate has shifted from "whether the industry should be allowed to exist" to "how specific structures, disclosure requirements, and risk control measures should be implemented."