🌍In the past 24 hours, a total of 98,736 people worldwide have been liquidated, with a total liquidation amount of $257 million. The largest single liquidation occurred in Hyperliquid - BTC-USD, valued at $4.6389 million.

🔥Have all the short-term positive factors been exhausted? Who is buy the dips below 90,000?

Data shows that although the turnover rate has decreased compared to before, it is still very high. The trading in the last 24 hours has mainly been driven by short-term investors betting on whether the Federal Reserve will release a dovish signal tonight.

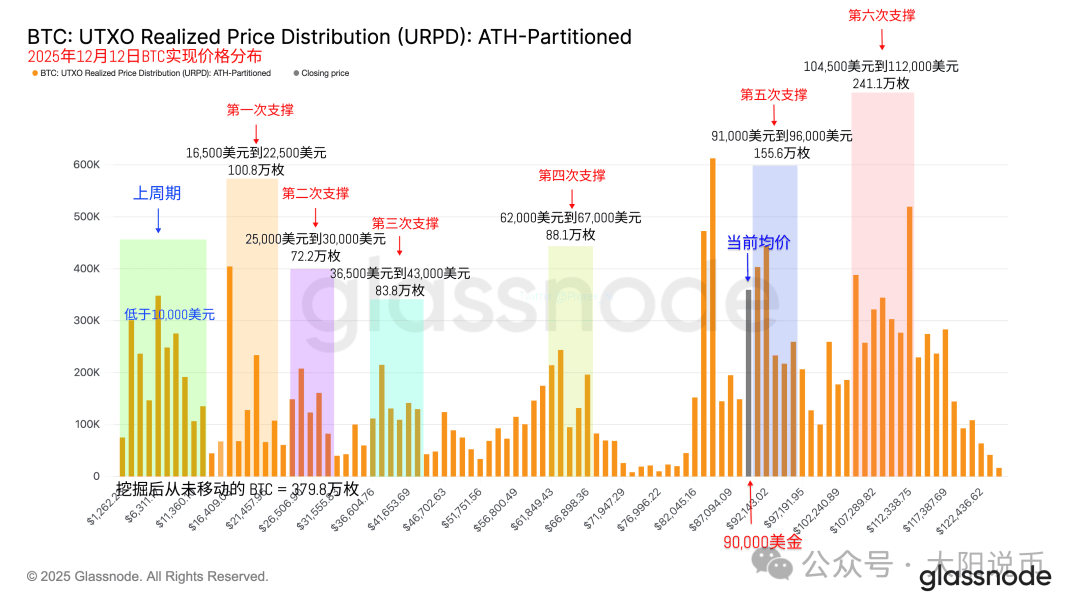

As it turned out, Powell's speech was not more dovish, and the market felt that the short-term positive factors had ended and that the negative factor of interest rate hikes might be coming. Therefore, those who buy the dips below 90,000 in the past few days became the main force of turnover.

However, judging from the holding structure, it remains very stable. Even though prices have fallen several times, those who were trapped at high prices and those who held early positions have basically not moved and are still patiently watching.

Most people with USDT tend to buy and invest haphazardly, resulting in repeated losses throughout the bear market. In the end, they might have been better off holding BTC and ETH, even if they were stuck with losses, at least they could have recovered to new asset highs. After a bear market, most people's principal dwindles, making it very difficult to return to new asset highs.

If you don't understand or aren't sure what's going on, remember to follow me 👇

✅ Today's market analysis:

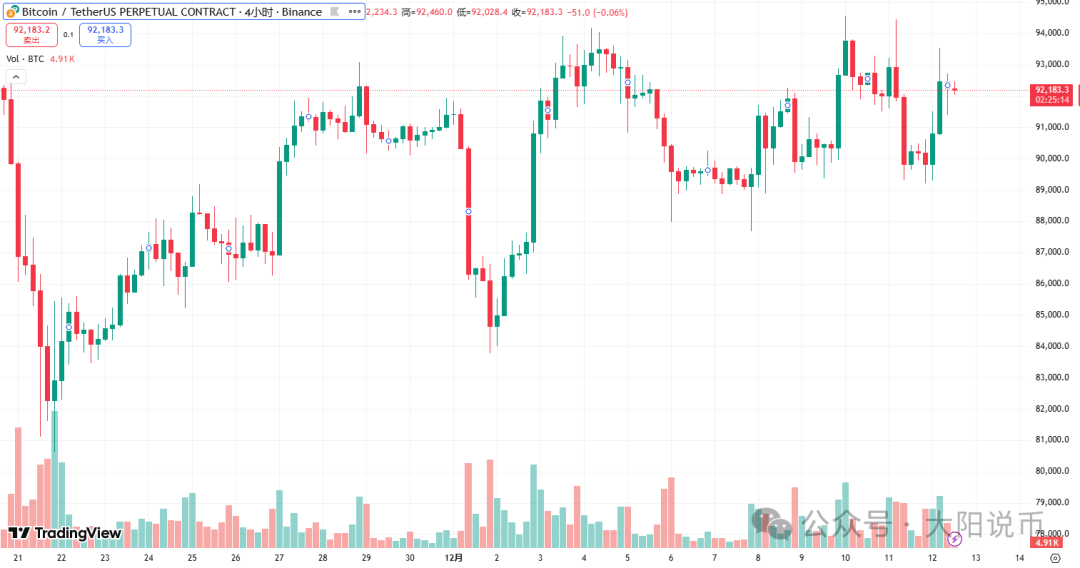

BTC

Bitcoin's focus today is on whether it can return to the 90500-90200 support zone, which presents a potential entry opportunity. If a deeper pullback occurs, pay close attention to the 88600 level. Next week's rebound target is a break above the previous high of 94000, with the 95200 resistance level serving as the first profit target for long positions.

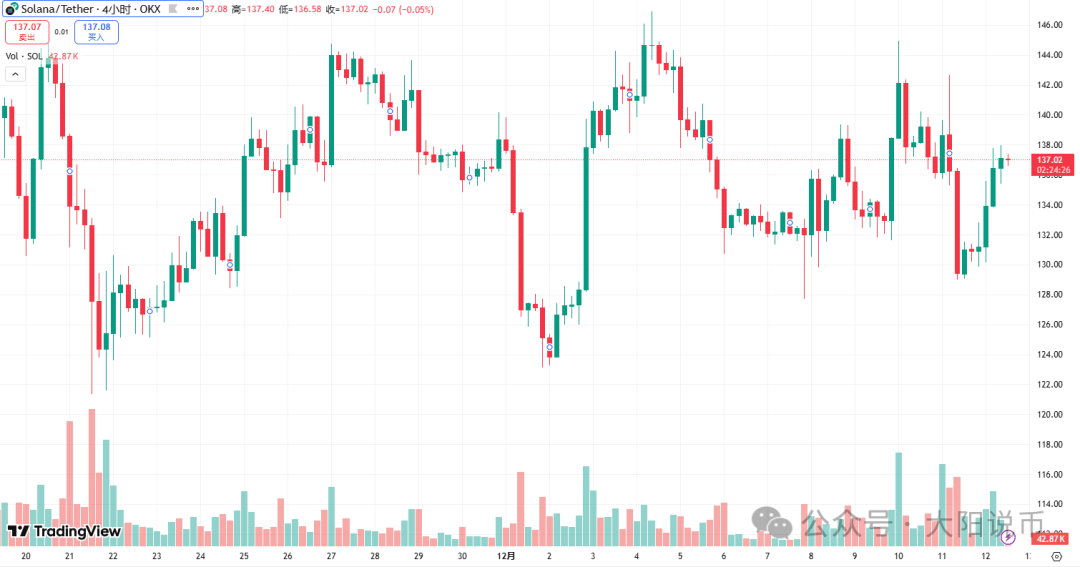

SOL

SOL encountered resistance near the 137.7 level mentioned yesterday. Current support can be monitored around 132; observe whether another entry opportunity arises. If a sharp drop occurs, watch the 127.5 level. Short-term resistance is at 141; a break above this level could lead to 144.3.

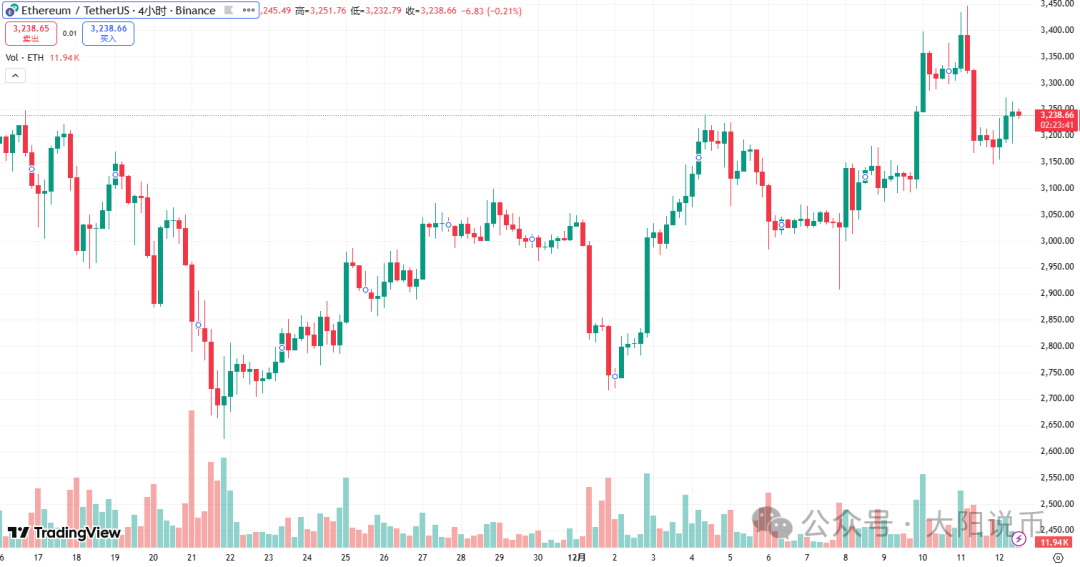

ETH

Ethereum found support near the 3130 level yesterday, narrowly missing the mark by about 10 points. Today's trend is relatively weak, with support levels to watch in the 3125-3110 range, and a potential retracement level at 3060. Resistance is at 3388; a successful break above this level could see a rebound target of 3485 next week.

BNB

Today, pay close attention to the 881 level. As long as the 4-hour chart doesn't break below this level, the bullish trend can be maintained, with upward resistance levels around 894, 905, and 915. If the 4-hour chart breaks below 881, this upward trend may end, or a deeper correction may begin, with support levels around 872, 860, and 845.

👀How to safely consume whole cows? After BTC starts to rise, how to switch to mainstream cryptocurrencies that haven't yet seen a price increase!

Regarding the current market, I am not fixated on the bull-bear divide. The crypto market is no longer what it used to be, especially BTC. Unless a global crisis erupts, it is unlikely that we will see an extreme bear market where institutions collectively withdraw.

The core logic is that real profits often accumulate during bear markets (through continuous dollar-cost averaging or holding) and are realized during bull markets; most losses are caused by blindly chasing highs during bull markets, and are only fully exposed during bear markets.

Therefore, my strategy is to hold BTC long-term as a ballast , waiting for the bull market to begin. Market movements are typically led by BTC, then spread to other major cryptocurrencies. After BTC rises, I can take partial profits and rotate to less-traded major cryptocurrencies to capture rotation opportunities. This approach avoids the significant risks associated with Altcoin during a bear market while still allowing safe participation in altcoin rallies through BTC profits. Even if I make a mistake, my principal will not be harmed.

In short, focus on response rather than prediction. Take a long-term view, ignore short-term fluctuations, accumulate resources during downturns, and prepare for the next cycle.

🤡Don't want to get bogged down in the competition? Buy on dips? These are the cryptocurrencies for a comeback!

My $bee dog has already returned to around 1 million! This meme community is really resilient. After the official airdrop to KOLs, the market was so bad that it dropped to tens of thousands, but the community remained active and confident, and it was pulled back up in half a month!

If you don't want to follow the lead of BSC and want to achieve stable long-term profits, just buy WEB2 emoji coins like $Hakimi$, $Vulgar Penguin$, and $Honeybee Dog$ when prices are low.

These types of stocks, as long as they have been popular before and haven't cooled down, will basically fluctuate with the market. They have obvious bottoms and long periods of consolidation, providing ample time to enter the market. However, you need to be patient (at least look at the daily chart). Short-term returns are not high, so they are suitable for those who want to hold them for the long term!

$ZEC

ZEC's technical pattern is clear, with key resistance in the 450-470 range. I personally believe a breakout is highly probable, and if successful, the target could be above 500. Is anyone trading against me? Is it safe to short in this resistance zone?

$PIEVERSE

Pieverse airdrops will unlock tomorrow, so there will definitely be selling pressure. The price has already priced it in, and I suspect many are hedging. Will it cause a short squeeze like with MMT before? I'm going long now, with a first target of 0.6!

Every sharp drop is followed by a period of great potential. Those who are unsure about future market strategies can follow Potato (or similar product/service): TDTB07