After leaving Movement Labs amidst a scandal, co-founder Rushi Manche established Nyx Group, a diversified investment fund with a size of up to $100 million.

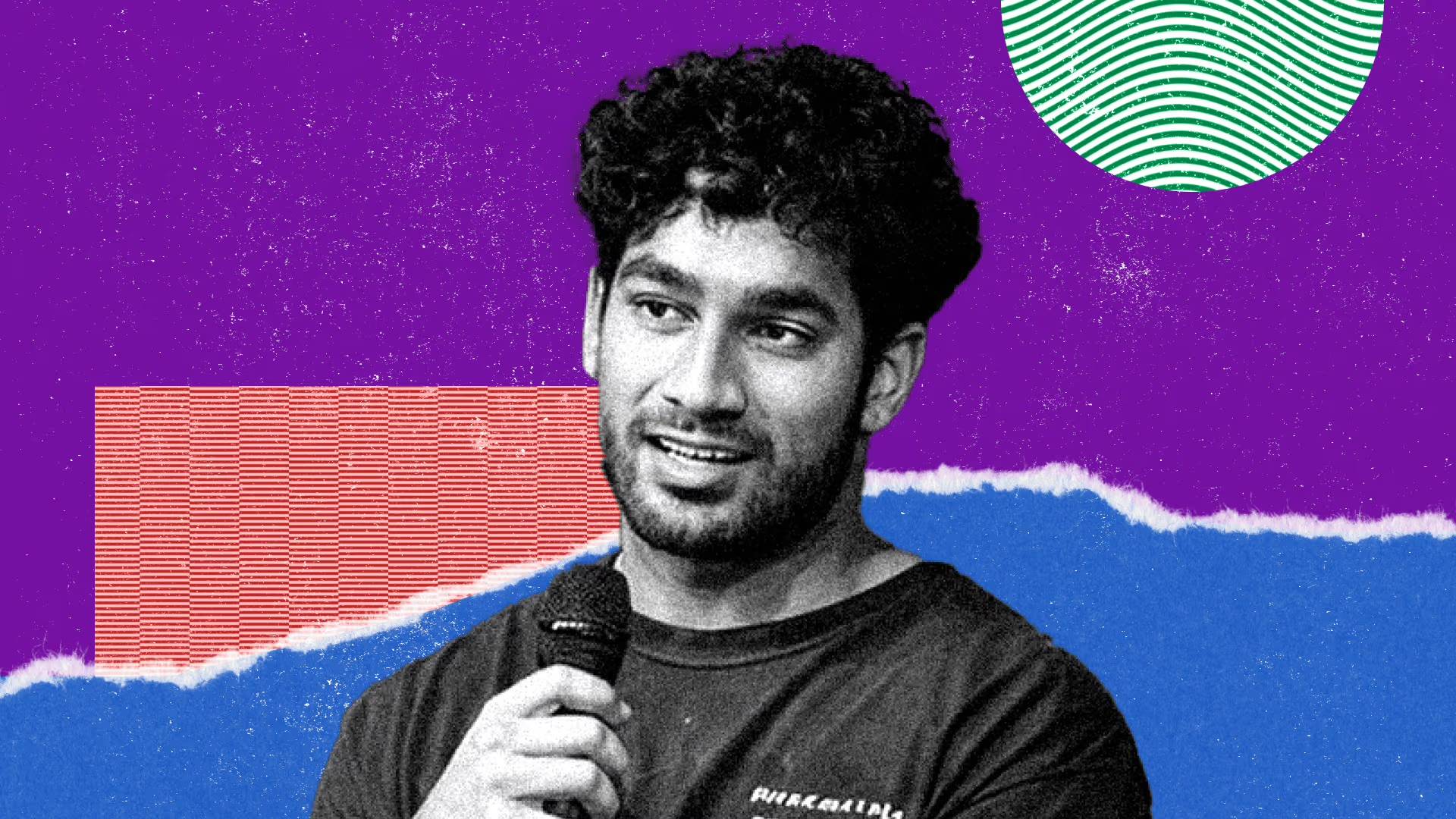

The infamous founder of Movement Labs is back with a $100 million investment fund. Photo: CoinDesk

The infamous founder of Movement Labs is back with a $100 million investment fund. Photo: CoinDesk

Following the controversy at Movement Labs earlier this year, Rushi Manche, co-founder of the blockchain project based on the Move language, announced his return to the crypto market with plans to establish Nyx Group, a multi-strategy investment fund, intending to allocate up to $100 million to the market to support projects preparing to Token Issuance.

EXCLUSIVE: After Movement Labs exit, Rushi Manche unveils Nyx Group venture with $100 million plan to back Token projects https://t.co/fil139PRSY

— The Block (@TheBlock__) December 11, 2025

The Nyx Group fund supports projects launching Token.

Chia to The Block , Nyx Group is not simply a typical cryptocurrency investment fund, but a multi-strategy initiative designed to address the "bottleneck" many blockchain founders face: a lack of liquidation and operational support during the Token launch phase.

- Nyx Group's Capital comes from partners and family offices who share its philosophy of long-term investment. Nyx Group plans to deploy up to $100 million in projects currently in the Token Issuance preparation phase, focusing on projects that have demonstrated product capabilities, possess a real user base, and have a strong development team.

- In addition to investment Capital , Rushi Manche, co-founder of Nyx Group, said the fund operates on a "founder-first" model, not only providing Capital but also directly supporting the project team from the preparation and implementation phases to after the Token is listed on the exchange. Areas of support include:

- Operational and go-to-market strategy: Supporting teams in building effective Token launch plans, from community development and marketing to distribution mechanisms.

- Treasury management: Guidance on managing Capital after fundraising, optimizing cash flow, and mitigating risks.

- Legal compliance and foundation structure: Connect with law firms to ensure the project complies with regulations in key jurisdictions.

- Institutional investment connections: Helping projects access a network of funds and strategic partners within the Web3 ecosystem.

- Manche revealed that Nyx Group has been quietly operating for the past few months and has made some initial investments, although not yet publicly disclosed. He said the plan to disburse funds will extend over the next few years, with a carefully selected investment portfolio.

The painful lessons learned from Movement Labs' fall.

- Before founding Nyx Group, Rushi Manche was a co-founder of Movement Labs , a well-known startup developing blockchain technology based on the Move language, aiming to provide a fast, secure, and flexible platform for decentralized applications (dApps).

However, in early 2025, Manche was unexpectedly suspended and fired after becoming embroiled in a scandal related to a controversial market-making agreement . This sparked a wave of outrage in the community, with many accusing the founding team of market manipulation and Dump shares onto small investors.

Under immense pressure, Movement Labs temporarily ceased operations, invited a third-party independent investigation, and subsequently underwent a complete restructuring, changing its name to Move Industries with new leadership. In subsequent statements, Manche acknowledged mistakes in internal processes and public trust management but denied any fraud or price manipulation.

- The case is currently ongoing, and Manchester declines to comment in detail due to applicable legal constraints.

- In an Chia with The Block, Rushi Manche revealed that the shock from Movement Labs spurred him to found Nyx Group, a better version of what he needed when starting his entrepreneurial journey. He frankly admitted:

“I was once a young founder, made mistakes, and paid a heavy price. Now, I want to pass on that experience to the next generation, providing the support I once lacked and a partner who truly understands the market and the pressures of being a founder.”

Coin68 compilation