The accumulation of Bitcoin by large companies is slowing down in Q4 2025, with 65% of public companies currently holding BTC below their purchase price and facing unrealized losses. As the wave of corporate buying subsides, Bitcoin Miners are becoming the most persistent group of accumulators.

This shift indicates that corporate treasuries are entering a new phase. The quarterly amount of BTC added is approaching its lowest level in a year. However, Miners remain Vai to holding BTC in the public market, despite facing reduced operational pressure and profitability.

Corporate treasury demand decreases as market volatility increases.

November saw the sharpest drop in Bitcoin (BTC) in 2025. The largest cryptocurrency lost 17.67% of its value that month, leaving many 2025 investors in a losing position.

Digital asset management companies are no exception. According to Bitcoin Treasureries' November report on corporate Bitcoin purchases, as many as 65% of publicly traded companies bought Bitcoin at a price higher than the current market price.

This leaves corporate treasuries facing unrealized losses. This figure is estimated based on data from 100 typical companies.

Meanwhile, demand has also eased over the past few months. The report indicates that corporate treasuries collectively purchased over 12,600 BTC in November. Large institutions, including Strategy and Strive, accounted for the majority of the added BTC .

However, the amount of Bitcoin sold during the month also reached approximately 1,800 BTC, bringing the total net BTC purchases down to around 10,800 BTC.

Several companies reduced their Bitcoin holdings in November 2025. At least five companies reported net selling of BTC , primarily for balance sheet management and strategic purposes:

- Sequans Communications has sold nearly a third of its Bitcoin reserves, liquidating approximately 970 BTC worth around $100 million to ease the pressure of its convertible debt.

- Kindly MD used 367 BTC for strategic investments, including investments in companies developing around Bitcoin.

- Genius Group sold 62 BTC to raise cash for operational needs, then repurchased 42 BTC in early December.

“Overall, it’s clear that the ‘summer buying frenzy’ has subsided, but demand hasn’t disappeared. Instead, public companies seem to be adjusting their buying frequency, becoming slower and more selective as they need time to rebalance their portfolios and assess risk,” Pete Rizzo observed .

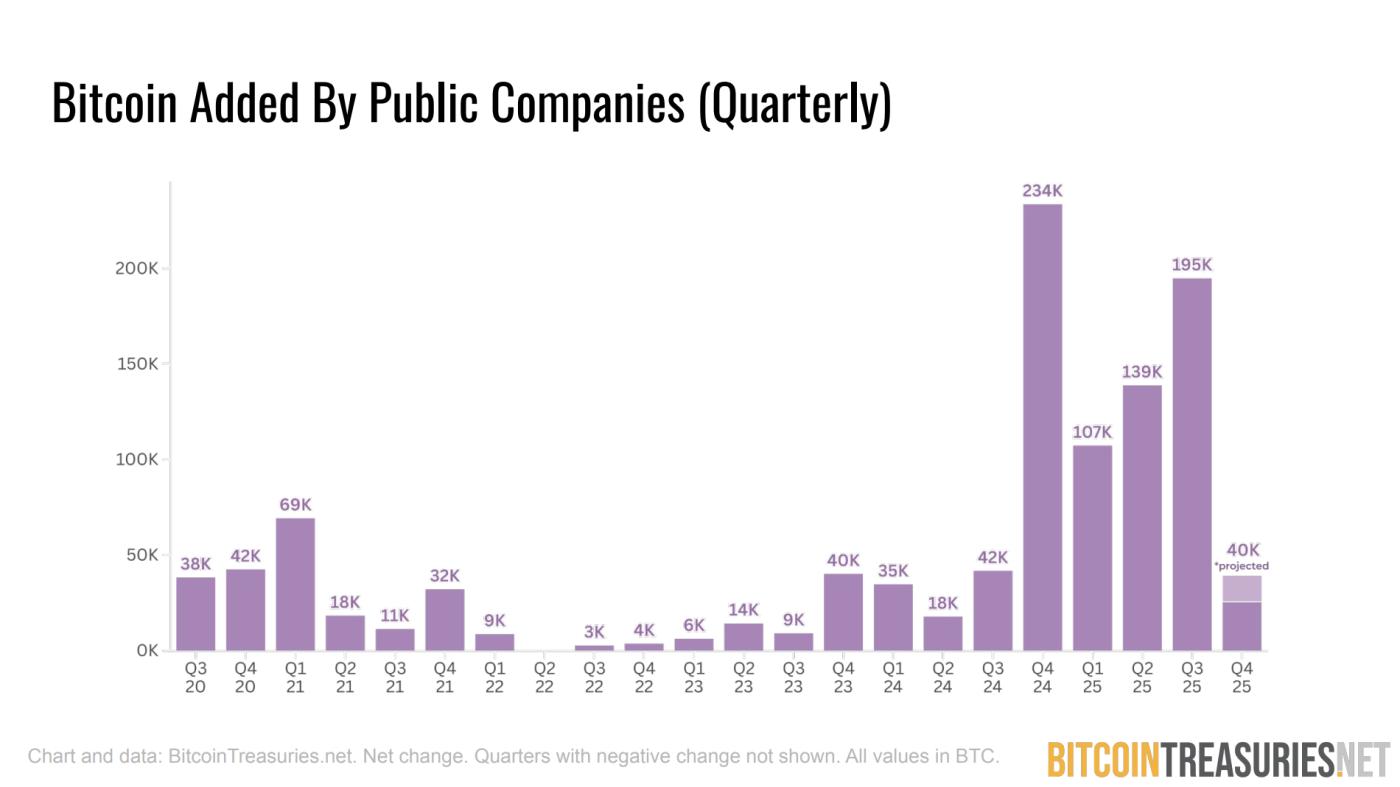

The report predicts that the total amount of Bitcoin purchased by public companies in Q4 2025 will reach or slightly exceed 40,000 BTC by the end of December, making it the weakest quarter of the year and nearly equivalent to the accumulation level of Q3 2024.

“This figure is calculated based on the results of the past two months, along with Strategy having purchased over 10,000 BTC since the beginning of December — bringing the total Q4 purchases closer to the target, just about 5,000 BTC away as of December 9th.”

BTC accumulation forecast. Source: BitcoinTreasuries

BTC accumulation forecast. Source: BitcoinTreasuriesMiners are emerging as strategic investors in the business.

As businesses slow down their buying activity, Bitcoin Miners could lead the new wave of companies. The report indicates that mining companies play a key Vai in the group holding BTC in the public market, accounting for approximately 5% of the total BTC added in November and 12% of the total BTC held by public companies.

During that month, Cango and Riot mined 508 and 37 BTC respectively. American Bitcoin mined 139 BTC. With fewer large businesses adding BTC, Cango and American Bitcoin became two of the top five largest adders to the treasury last month.

“Some Bitcoin mining companies that mine in-house can save significantly on energy and operating costs compared to buying BTC directly on the market, which could be a key reason why the mining industry continues to grow. Because Miners can obtain BTC at a lower price than the market due to the production of new Block , Miners ’ balance sheets are increasingly important in supporting businesses to buy more Bitcoin, especially when other companies are staying out or reducing the scale of their purchases,” Rizzo Chia .

This is happening against the backdrop of continued pressure on Bitcoin mining profitability, despite some technical improvements. The Hashprice index, a measure of profitability in USD per terahash per second per day, has fallen from July to a low of $34.8 at the end of November.

However, the index has recovered to around $39.4. Mining difficulty is also slightly decreasing to 148.2 trillion, down from a record high of 155.97 trillion six weeks ago. This offers some relief for Miners operating with thin profit margins.

Despite slightly improved network conditions, profitability for Miners remains a challenge. The Medium cash cost per BTC is currently $74,600, and the total cost has reached $137,800.