Author: Wang Tai | Editor: Wang Tai

1. Bitcoin Market

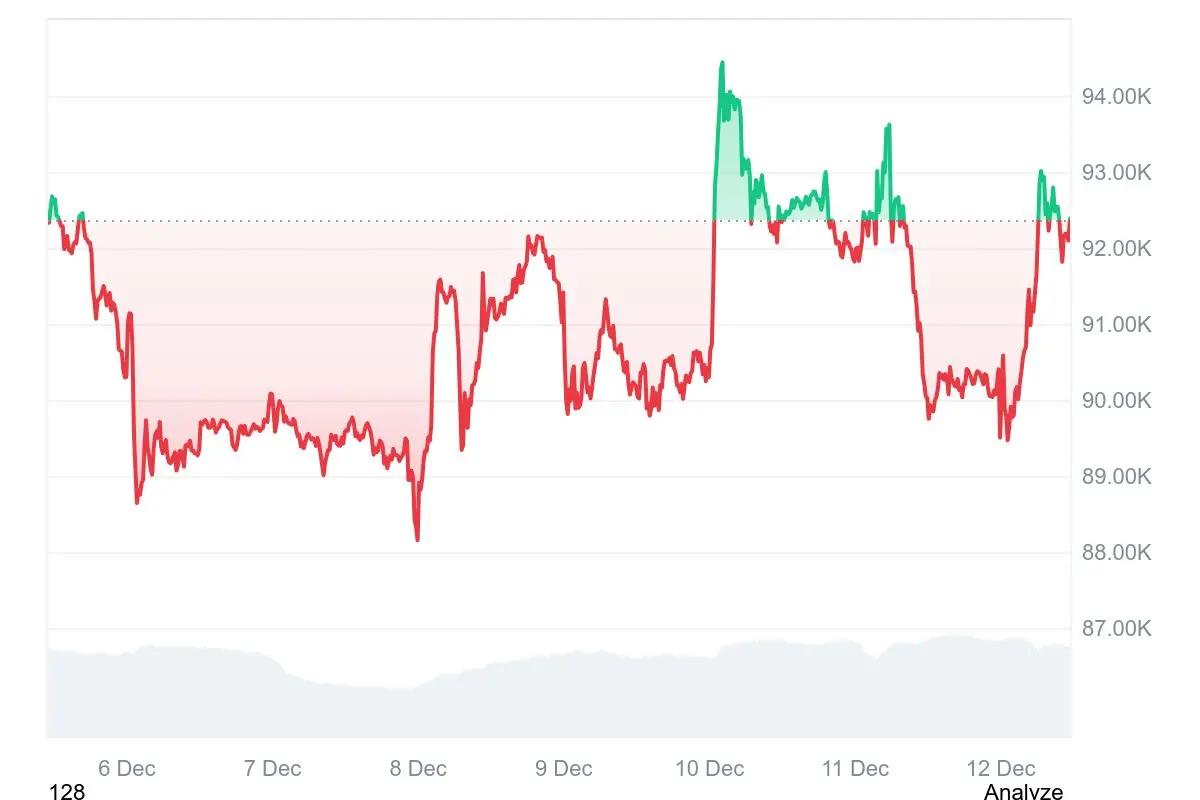

Bitcoin price movement (December 6, 2025 - December 12, 2025)

During this phase, Bitcoin's overall price movement can be summarized as "breaking support → range-bound trading → rebound breakout → high-level consolidation → rapid correction." The price has fluctuated between approximately $88,155 and $94,444, a range exceeding $6,000, with significantly increased intraday volatility. The market is characterized by rapid price action, volatile direction, and shifting sentiment between hesitation and brief periods of optimism. As of this writing, Bitcoin's price is consolidating around $92,000.

The support level was broken on December 6th.

On December 6th, Bitcoin continued its previous period of consolidation, quickly breaking below the previous support level of $90,000 at the start of trading, reaching a low of $88,155, the lowest point of this phase. Throughout the day, the price fluctuated around the lower end of the $88,000–$89,500 range.

Causes of the trend:

- A rebound in US Treasury yields and a stronger dollar index put pressure on risk assets across the board.

- After several days of continuous market gains, a wave of profit-taking occurred.

- The panic selling has exacerbated the downward momentum in the short term.

Range-bound consolidation phase (December 7th – December 8th)

On December 7, prices remained in a low-level consolidation phase without any significant breakouts, trading within the $88,500–$89,800 range throughout the day, with sentiment leaning towards caution.

The price began to fluctuate upwards in the afternoon of December 8th, testing the $90,000 level. After failing to break through several times during the session, it still closed at the upper edge of the range.

Causes of the trend:

- Buying interest is gradually emerging at the bottom, and panic has eased somewhat.

- Technical indicators suggest an oversold correction, prompting some funds to start buy the dips.

- The market is in a wait-and-see mode as it approaches a key psychological level, with no clear direction.

Strong rebound breakout phase (December 9-10)

On December 9th, the price fluctuated around $90,000, but overall showed a trend of upward movement, closing slightly above the key level.

On December 10, market sentiment briefly warmed up, and Bitcoin experienced a rapid upward surge, breaking strongly through the $91,000–$93,000 resistance zone, reaching a high of $94,444 during the session, which was the highest point of this phase, before fluctuating and falling back to around $92,000.

Causes of the trend:

- The Federal Reserve cut interest rates by 25 basis points at its December meeting, stimulating a rapid rebound in liquidity.

- Bullish sentiment briefly prevailed, driving prices up rapidly.

- The technical chart shows a "V-shaped recovery" structure, attracting momentum trading funds to follow suit.

High-level fluctuation phase (December 11)

On December 11, Bitcoin fluctuated at high levels before falling back, breaking below $90,000 multiple times during the day, reaching a low of around $89,600, indicating significant selling pressure at high levels and some short-term funds taking profits and leaving the market.

Causes of the trend:

- The bullish momentum weakened, and the market entered a period of adjustment after failing to break higher.

- High-frequency trading exacerbated volatility, and prices returned to the vicinity of key support areas.

Rapid repair phase (December 12)

On December 12, prices rebounded quickly after the previous day's pullback, rising back to around $93,000 before slightly retreating. At the time of writing, prices were consolidating around $92,000, indicating that the market is still searching for direction.

Causes of the trend:

- The support level below is strong, and the bearish momentum is weakening;

- The rebound was driven by the return of funds, but the trading volume did not increase significantly, and the sustainability of the rebound remains to be confirmed.

- The market remains cautious amid year-end macroeconomic expectations.

2. Market Dynamics and Macroeconomic Background

Fund Flow

1. ETF Fund Dynamics

Bitcoin ETF fund flows this week:

- December 5th: +0.548 billion USD

- December 8: -0.604 billion USD

- December 9: +151.9 million USD

- December 10: +$223.5 million

- December 11: -$154.2 million

ETF inflow/outflow data image

The total net inflow for the week was approximately $216 million, but the trend was highly volatile: initially a small inflow, then a net outflow, followed by two large inflows on the 9th and 10th, which were ultimately offset by large redemptions on the 11th. Overall, the ETF funding situation shifted from "continuous outflow" to "weak fluctuation with several large inflows," indicating that some institutions did indeed re-enter the market around the 9th and 10th to buy on dips. However, the large redemptions on the 11th also show that the recovery in confidence remains fragile.

2. Bitcoin ETFs saw a strong influx of funds, with $224 million flowing in on December 10th, a new high in nearly three weeks.

According to data from Farside Investors, U.S.-listed Bitcoin ETFs saw a total inflow of $223.5 million on December 10, marking their strongest single-day performance in nearly three weeks. This rebound followed several trading days of high outflows and lackluster activity across multiple products. The inflows followed a period of weakening momentum, including a $195 million outflow recorded on December 4. BlackRock's IBIT and Fidelity's FBTC led the pack with $192.9 million and $30.6 million respectively. Other issuers reported flat inflows, although the contributions from the two major funds were enough to push the daily total to its highest level since the end of November. This move coincided with a significant rebound in the asset's price, which climbed above $90,000 during Tuesday's trading session. Bitcoin ETFs had faced selling pressure earlier in the month, but the new inflows have attracted renewed attention from institutional participants focused on market momentum.

3. Spot Bitcoin ETFs continue to attract institutional capital, while BlackRock's outflow data highlights a rotation pattern.

US spot Bitcoin ETFs saw net inflows of approximately $152 million on December 9th, maintaining stable institutional holdings. Fidelity's FBTC stood out, contributing the majority of the day's revenue with $199 million. Other major issuers, including Grayscale, Bitwise, ARK Invest, Franklin Templeton, Invesco, and WisdomTree, also reported positive inflows, indicating stable investor confidence in this category. Analysts noted that this inflow coincided with Bitcoin holdings above $92,000, demonstrating a renewed demand for exposure. Several market observers also noted growing interest from pension funds and family offices. Despite overall market inflows, BlackRock's IBIT saw net outflows of approximately $135 million. Experts attributed this shift to product rotation rather than a decline in overall interest in crypto ETFs. Despite the divergence, total inflows remained robustly positive, suggesting that institutions are still adjusting their holdings amid ongoing macroeconomic developments. Analysts also noted that fund managers are rebalancing their exposure to alternative assets while maintaining cryptocurrency allocations.

4. Futures and Options Market

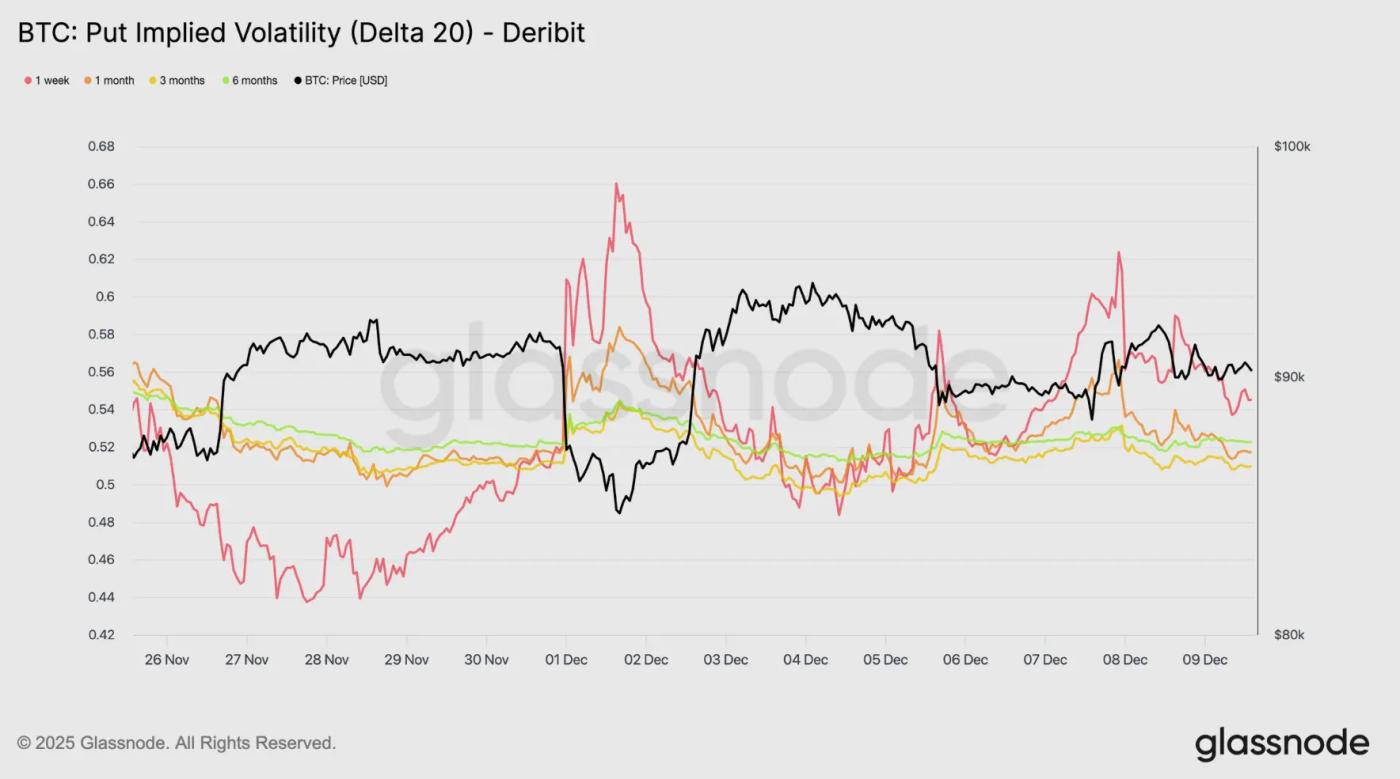

Related images

Interest in leverage was limited in the futures market, open interest failed to rebuild effectively, and funding rates remained near neutral. These dynamics highlight a derivatives environment characterized by caution rather than conviction. In the perpetual market, funds remained in the zero to slightly negative range this week, underscoring the continued decline in speculative long positions. Traders remained balanced or defensive, with less directional pressure exerted through leverage. Due to subdued derivatives activity, price discovery was more driven by cash flows and macroeconomic catalysts than by speculative expansion.

In the options market, the subdued performance of Bitcoin spot trading contrasts sharply with the sudden surge in short-term implied volatility, suggesting traders are bracing for a larger move. Interpolated implied volatility, which estimates IV at a fixed Delta rather than relying on the listed strike price, reveals a clearer structure in cross-term risk pricing. In 20-Delta call options, the one-week term saw an increase of approximately ten volatility points from the previous week, while longer-term contracts remained relatively flat. A similar pattern emerged in 20-Delta puts, with short-term downside implied volatility rising while longer-term expiry dates remained stagnant. Overall, traders are building volatility at anticipated resistance levels, preferring to accept convexity rather than mitigate it ahead of the December 10th FOMC meeting.

5. Miners face increasing pressure, large investors buy on dips.

On-chain analysis points out that in December, Bitcoin faced two challenges: firstly, miners faced increased pressure, with some increasing their selling to cover operating costs; secondly, whale addresses showed significant buying activity around $90,000, creating a tug-of-war between miners selling and large investors buying.

This means that miners will remain marginal sellers in the short term, providing continuous supply to the price. However, as long as whales and institutions continue to accumulate at key support levels, prices are unlikely to experience a "cliff-like" drop like in November, and are more likely to evolve into a period of consolidation and price movement.

Technical indicator analysis

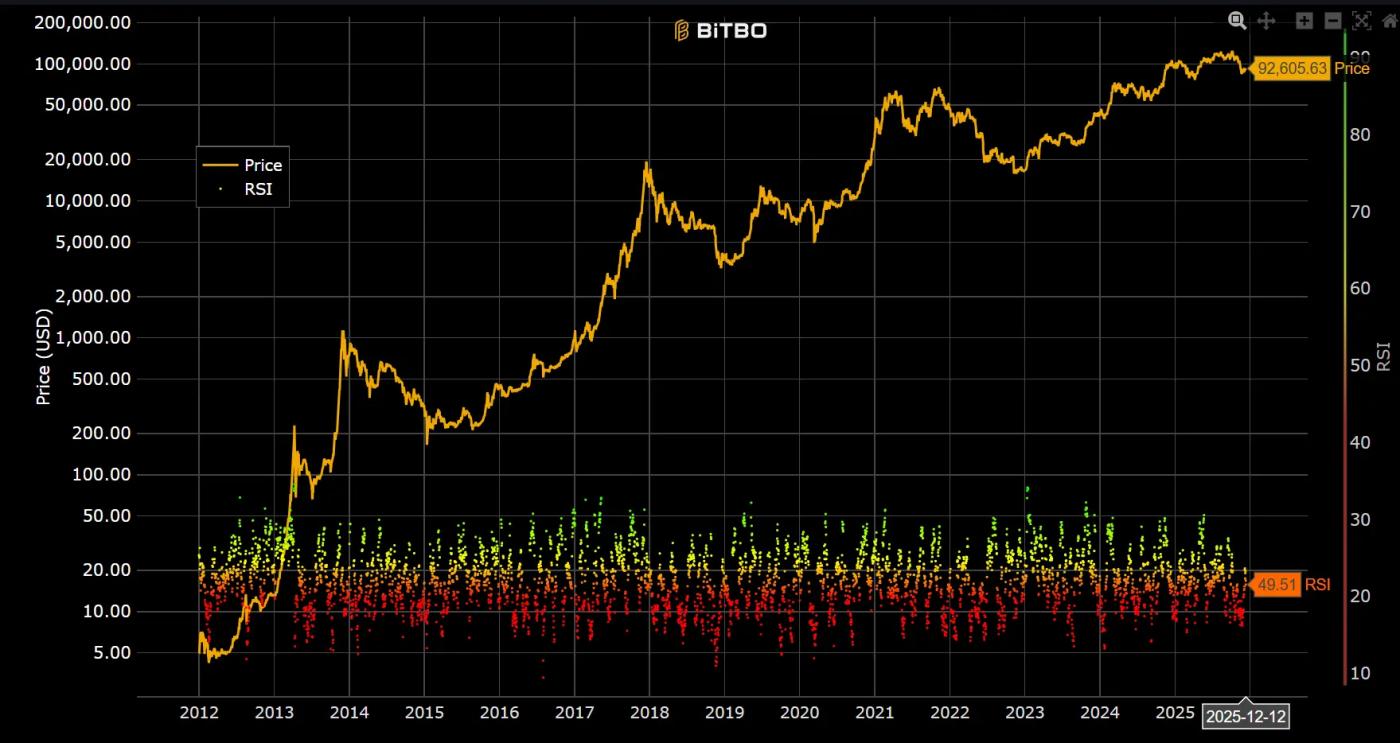

1. Relative Strength Index (RSI 14)

Bitcoin 14-day RSI data image

The RSI at the end of this week was 49.51. Compared with the "near oversold" level of around 30 in the previous weeks, the RSI has clearly rebounded to near neutral. This indicates that the rebound during this period was mainly a technical correction of the previous excessive decline. After the selling pressure was released, the forces of bulls and bears have temporarily returned to a relative balance.

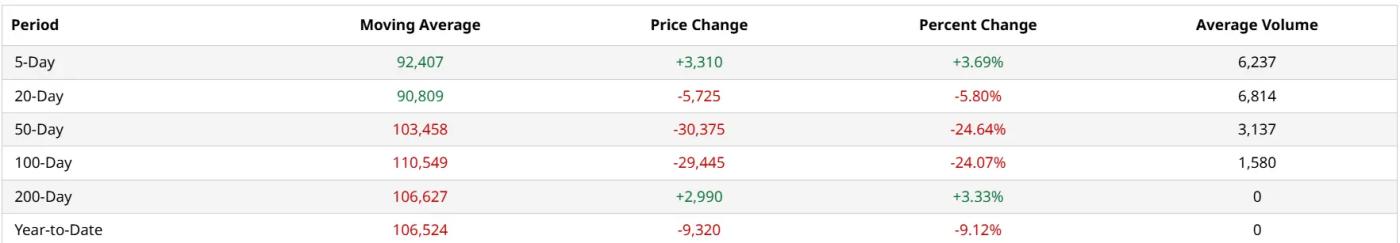

2. Moving Average (MA) Analysis

MA5, MA20, MA50, MA100, M200 data images

The latest moving average data shows:

- MA5: $92,407

- MA20: $90,809

- MA50: $103,458

- MA100: $110,549

- MA200: $106,627

- Current price: $92,605

In the short term, the current price is slightly above the 5-day and 20-day moving averages (MA5 and MA20), indicating that this week's rebound has pulled the price back above the 20-day moving average, easing short-term technical pressure. In the medium term, the price remains significantly below the 50-day and 100-day moving averages (MA50 and MA100), and these two moving averages are diverging downwards, reflecting that the medium-term trend is still in a correction channel. In the long term, the 200-day moving average (MA200) is still above $100,000, meaning that from a longer-term perspective, the current move is merely a deep pullback within a larger bull market and has not broken the long-term structure. However, to restore the bullish trend, the price must at least regain the $100,000 level.

3. Key support and resistance levels

The key support zone recently is roughly between $88,000 and $90,000, corresponding to the previous lows and rebound levels. A Reuters report on the 11th also mentioned that Bitcoin briefly fell below $90,000, once again testing the buying support in that range.

The first resistance level to the upside is around $94,000, a price that has repeatedly become a rebound high and is close to a short-term technical resistance zone. Many institutions also regard this as a watershed between a "breakout or another pullback".

If it successfully breaks through 94,000 and holds, there will be a chance to challenge the psychological barrier of around 100,000. If it fails to break through and falls below 90,000 again, it may re-enter the 80,000 range to consolidate.

Market sentiment analysis

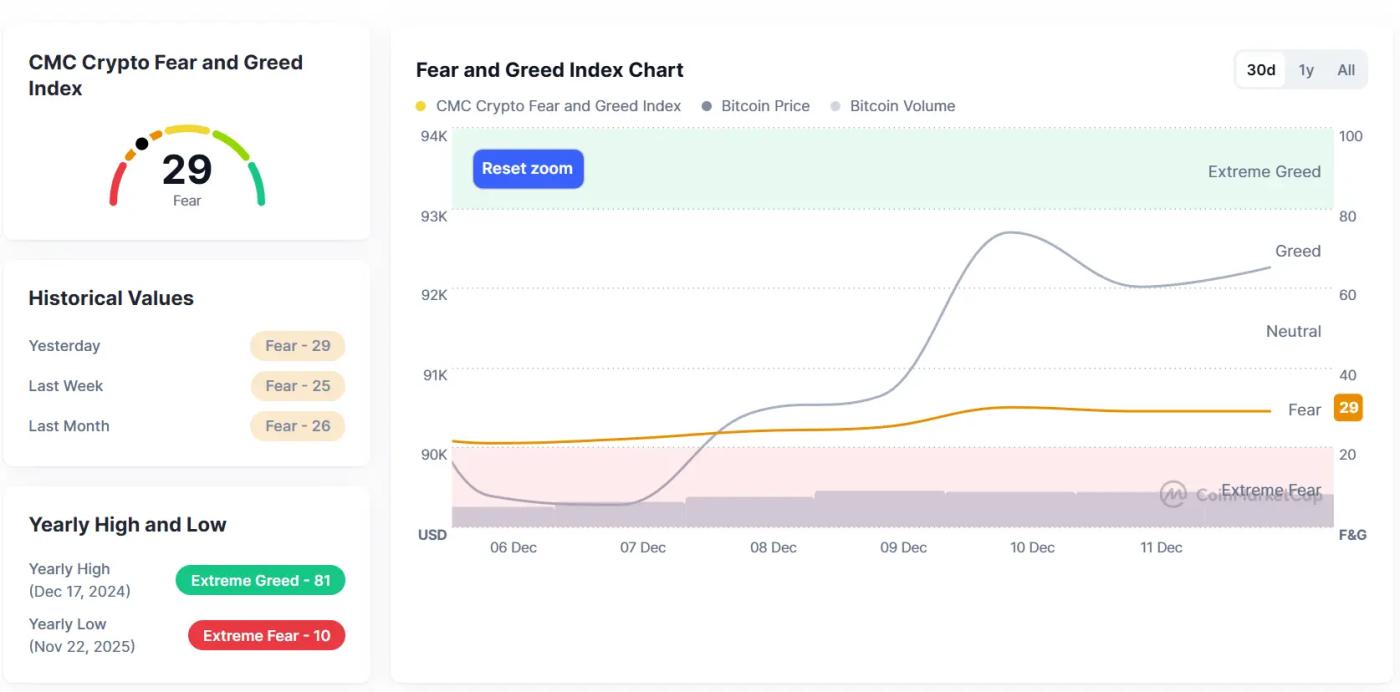

Fear and Greed Index Data Image

As of December 12, the "Fear and Greed Index" was approximately 29 points, placing it in the "Fear" range.

Looking back at this week (December 6th to December 12th), the Fear & Greed Index were 22 (Fear), 22 (Fear), 24 (Fear), 25 (Fear), 30 (Fear), 29 (Fear), and 29 (Fear) respectively. It's clear that the overall sentiment remains in a low range, but it has gradually recovered from the "extreme fear" of the previous weeks. From December 6th to 8th, the index hovered around 25. As prices recovered from below 90,000, sentiment slightly improved from the 9th to the 11th, rising slightly in the 28-30 range.

This indicates that the panic selling phase has passed, and investor sentiment has shifted from panicked flight to hesitant observation. Fear has not yet subsided, but this also means there is still potential for a rebound. If strong positive news or capital inflows emerge later, the market's emotional resilience will be relatively high.

Macroeconomic Background

1. JPMorgan Chase upgrades China stocks to "overweight," stating that the recent correction presents a good entry point.

On December 8, JPMorgan strategists reiterated their positive outlook on Chinese assets in 2026.

In a report released Wednesday, a team led by Rajiv Batra, head of Asia and co-head of global emerging market equity strategy at JPMorgan Chase, upgraded Chinese equities to "overweight" and said that there is a higher probability of a significant upside next year compared to potential downside risks.

Rajiv's team also stated that the recent correction in Chinese assets presents an attractive entry point. Despite a significant rise in the first nine months of this year, reaching a new high since 2021, the MSCI China Index has retreated nearly 6% so far in the fourth quarter.

It's worth noting that during the market turmoil in early April this year, Batra and his colleagues advised investors to buy Chinese stocks, and the MSCI China Index subsequently rose by over 30%. Looking ahead to next year, the JPMorgan team believes that multiple factors will support the strength of Chinese stocks.

Related pictures

2. The US will allow Nvidia H200 chips to be exported to China under certain conditions, which is beneficial to the crypto market.

On December 8th, the US government announced that it will allow Nvidia's high-performance AI chip H200 to be exported to China under the conditions of "compliance review + designated customer approval + 25% surcharge". This policy is seen as a significant loosening of the AI infrastructure supply chain, supplementing the Asian market with high-computing power resources.

From the perspective of the crypto industry, the opening up of high-end computing power signifies a further strengthening of the AI × Crypto narrative, which is expected to drive the long-term growth of smart contracts, AI agents, data center tokens, and related infrastructure projects.

Some analysts suggest this move could boost market risk appetite for technology and crypto assets, providing sentiment support for BTC, ETH, and AI-related tokens.

3. U.S. Treasury yields continued to climb, with the 10-year Treasury yield rising to its highest level since October 7.

On December 9th, the yield on the 10-year U.S. Treasury note climbed to approximately 4.17%, a new high since early October. This was mainly due to inflation data and a strong employment situation weakening market expectations for future interest rate cuts, prompting investors to sell bonds and push yields higher.

In the current context, the bond market correction is putting pressure on traditional risk assets, while it may also strengthen the demand for alternative assets—such as cryptocurrencies and physical assets—as a safe haven or hedge.

4. The Federal Reserve cut interest rates for the third consecutive time by 25 basis points, and only one rate cut is expected in 2026.

On December 11, the Federal Reserve announced a 25 basis point cut to its benchmark interest rate, bringing it to a range of 3.50%–3.75%. This marks the Fed's third consecutive rate cut, in line with market expectations. However, this decision has not only faced significant internal opposition, but the Fed's latest forecasts indicate only one more rate cut is expected in 2026, prompting a reassessment of the future policy path.

Rising expectations of a US interest rate cut are bringing a new round of funding benefits to Bitcoin. As the US enters a new round of interest rate cuts, market liquidity expectations have improved significantly. Lower US dollar interest rates mean lower funding costs and a more relaxed financing environment, benefiting global risk assets as a whole. As a high-beta asset, the crypto market responds even more quickly to changes in liquidity.

Analysts point out that interest rate cuts typically enhance Bitcoin's appeal as an alternative asset. On one hand, funds flow from bonds and money market funds to high-growth assets; on the other hand, the expectation of a weaker dollar due to interest rate cuts makes BTC a viable option against inflation and currency devaluation once again.

Related pictures

4. Policy and Regulatory News

The UK government has officially recognized crypto assets (Crypto/NFT) as private property.

On December 8, the UK government announced that it would include cryptocurrencies and NFT assets in the category of private property, which is seen by many industry insiders as an important sign of promoting the compliant status of crypto assets.

While further detailed regulations are needed—such as custody, consumer protection, and cross-border enforcement—this designation provides a clear legal basis for crypto assets, which is conducive to market confidence and capital inflow.

Integrating crypto assets into the traditional legal framework will help them gain acceptance in the mainstream financial system and increase their integration with traditional assets.

Paraguayan Congress approves bill for full tracking of Bitcoin miners

On December 9th, according to CriptoNoticias, the Paraguayan House of Representatives approved two resolutions on December 4th requesting access to information on cryptocurrency mining activities. The resolutions, proposed by Representative María Constancia Benítez, aim to strengthen control, transparency, and regulation of the rapidly expanding mining industry.

As required by the resolution, relevant agencies must submit reports within 15 days. The first resolution requires the Ministry of Industry and Trade to provide information on individuals and businesses registered for Bitcoin and cryptocurrency mining; the second resolution requires the National Electricity Authority (ANDE) to provide a list of all power connections authorized for cryptocurrency mining, including the names of the responsible persons and the installation locations.

According to Hashrate Index data, Paraguay currently controls approximately 3.9% of the world's computing power, ranking fourth globally, behind only the United States, Russia, and China. Leveraging its abundant hydroelectric power, the country has become a popular destination for international miners.

Related pictures

US Senator Moreno described the crypto bill negotiations as frustrating, noting the tense legislative process at the end of the year.

On December 10, The Block reported that Ohio Republican Senator Moreno said negotiations surrounding the cryptocurrency market structure bill were "quite frustrating," and Democrats and Republicans planned to meet on Tuesday.

On Monday, at the Blockchain Association Policy Summit in Washington, D.C., Moreno outlined the progress of discussions regarding the scope of this broader bill. Moreno stated, “I don’t want to rush into a bad bill just to show we’ve passed some. It’s better to do nothing than to make a bad deal.” The versions of the market structure bill from the House and Senate are still being reconciled. The House passed its version of the Clarity Act in July. While the Senate proposal is not significantly different, passing bills in the Senate is generally more difficult than in the House.

Previously, Senator Tim Scott, a Republican and chairman of the Senate Banking Committee, stated that holding a hearing on the bill amendments on December 17th or 18th was "feasible." However, on Monday, Senator Mark Warner, a Democrat, revealed that completing the hearings before the holidays would be difficult, as they are still awaiting the White House's stance on quorum and ethical issues.

The UAE has enacted a new central bank law that brings digital assets and DeFi under its supervision.

On December 11, it was reported that the UAE enacted a new central bank law that incorporates digital assets and decentralized finance (DeFi) into the traditional banking regulatory framework.

According to Federal Decree No. 6, all cryptocurrency and blockchain organizations operating in or from the UAE must obtain a license from the Central Bank of the UAE (CBUAE), regardless of the technology used. Fines for operating without a license can reach up to 1 billion dirhams (approximately US$272 million).

The law brings virtual assets, DeFi protocols, stablecoins, tokenized real-world assets, decentralized exchanges, wallets, cross-chain bridges, and all supporting blockchain infrastructure under the central bank's jurisdiction. The new law provides a 60-day licensing decision, risk-based capital rules, and a one-year grace period (until September 2026) for existing participants to achieve compliance.

The US House of Representatives passed the National Defense Authorization Act, but it did not include a ban on CBDCs, drawing dissatisfaction from Republican hardliners.

On December 11, according to Cointelegraph, the U.S. House of Representatives passed the National Defense Authorization Act (NDAA) on Wednesday by a vote of 312-112, but the bill did not include the previously promised ban on central bank digital currencies (CBDCs), which has angered hardliners among Republicans.

Republican Representative Keith Self posted on the X platform, stating, "Conservatives were explicitly promised strong anti-central bank digital currency language in the NDAA, but that promise has been broken." Self had submitted an amendment on Tuesday to include a ban on CBDCs, but the amendment failed to advance and was not voted on in the House.

In July, House Republican leadership reached an agreement with hardliners within their party, promising to include a ban on CBDCs in the defense spending bill in exchange for the latter's support for three cryptocurrency bills. Representative Marjorie Taylor Greene also criticized House Speaker Mike Johnson for failing to keep his promise. The bill has now been sent to the Senate, with the aim of passing it before the end of the year. Self stated that he will continue to advocate for a CBDC ban in the next bill that must be passed.

3. Mining Dynamics

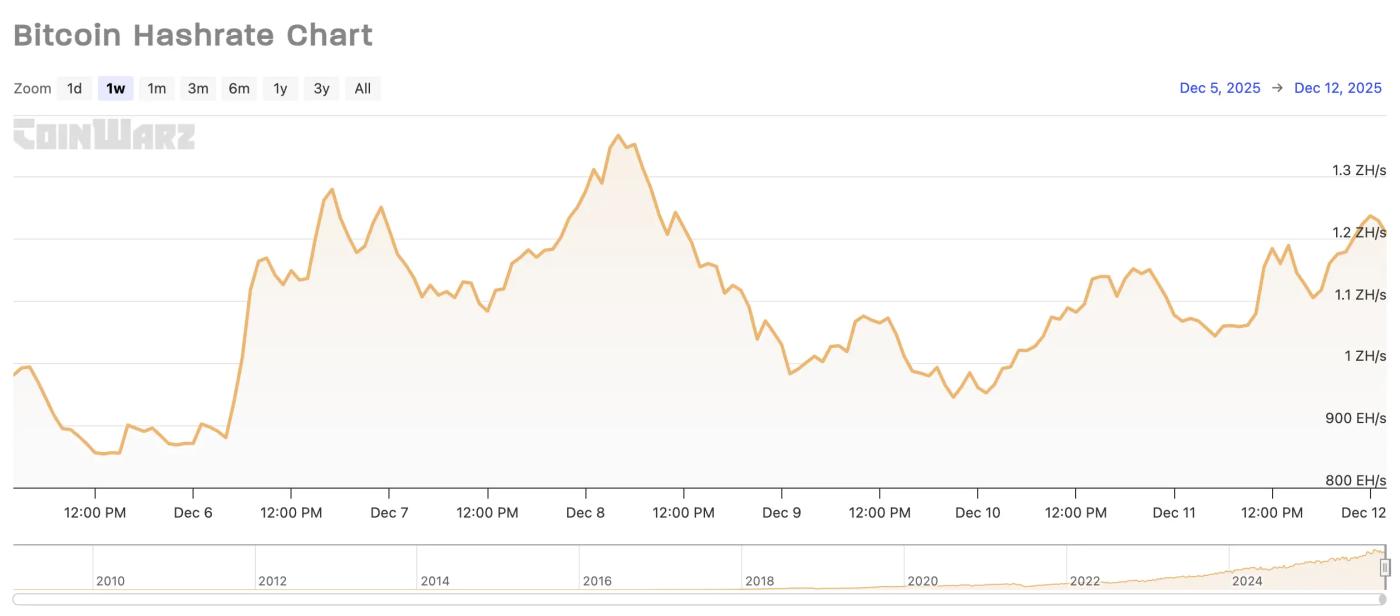

Hash rate change

Over the past seven days, the Bitcoin network hashrate has steadily increased, remaining at a relatively high level this week, ranging from 854.24 EH/s to 1285.30 EH/s.

From a trend perspective, the Bitcoin network hashrate has consistently remained at a high level around 1 ZH/s, maintaining a strong overall structure. Although short-term fluctuations have been frequent, they have all been high-level oscillations without a clear downward trend, indicating that the hashrate base remains solid. This week's main changes were still clearly correlated with Bitcoin prices. When BTC experienced a phase of correction around December 5th, the hashrate simultaneously saw a sharp drop, reaching a low of approximately 854 EH/s. Subsequently, as prices quickly recovered, the hashrate also rebounded rapidly, approaching a phase high of 1.36 ZH/s on December 8th, demonstrating the mining industry's rapid hashrate recovery and resilience in a high-cost environment.

Weekly Bitcoin network hashrate data

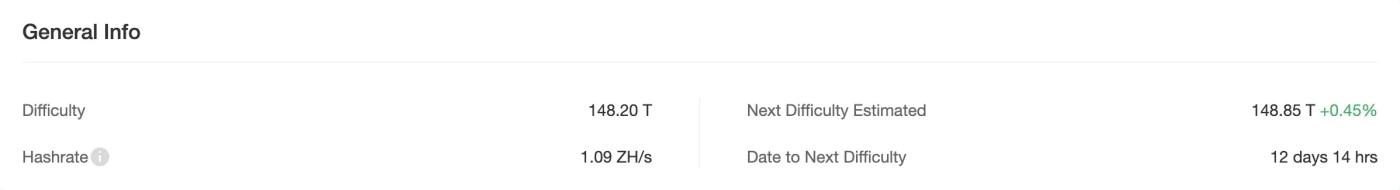

As of December 12, the total network hashrate reached 1.09 ZH/s, and the mining difficulty was 148.20T. The next difficulty adjustment is expected to take place on December 24, with an estimated increase of 0.45%, bringing the adjusted difficulty to approximately 148.85T.

Bitcoin mining difficulty data

Bitcoin Hash Price Index

From the perspective of daily revenue per unit of computing power (Hashprice), Hashrate Index data shows that as of December 12, 2025, Hashprice was $39.24/PH/s/day. This week, Hashprice largely mirrored the price movement of Bitcoin, exhibiting a pattern of pullback followed by a sharp rise to higher levels.

December 10: This week's high was $39.85/PH/s/day

December 7: This week's low was $37.41/PH/s/day

Hashprice's core drivers remain Bitcoin price and on-chain transaction demand. Looking at the 7-day price movement, Hashprice's core fluctuations are still driven by Bitcoin price and on-chain transaction demand. Affected by the recent BTC price correction and decreased on-chain activity, miner profits have repeatedly shown weak rebounds. Meanwhile, the network hashrate continues to rise at a high level, further compressing the profit margin per unit of hashrate. Despite this, the chart shows a significant surge on Wednesday, stronger than the weekly average, indicating a certain degree of resilience in a highly volatile environment.

Industry data indicates that the mining economy has entered a more challenging phase: longer payback periods for mining rigs and rising financing costs are prompting large mining companies to accelerate their deployments in AI and high-performance computing (HPC). However, the revenue contribution from these businesses is still insufficient to offset the decline in traditional mining profits.

Overall, miners' profits remain under pressure in the short term, and the mining ecosystem is entering a phase that places greater emphasis on efficiency optimization, cost control, and business diversification. However, with computing power continuing to reach new highs and institutional attention on the mining industry rebounding, the industry still possesses a certain degree of resilience and presents structural growth opportunities.

Hashprice data

5. Bitcoin-related news

Collection and compilation of information related to "Global Corporate and National Bitcoin Holdings (This Week's Statistics)"

1. Strategy announced that it added 130 Bitcoins to its holdings last week.

On December 8, Strategy announced that it added 130 bitcoins to its holdings last week, for a total of approximately $11.7 million, with an average purchase price of approximately $89,960.

2. BTC treasury company B HODL increased its holdings by 2.17 BTC, bringing its total holdings to 157,211 BTC.

On December 8th, according to a disclosure by BTC treasury company B HODL, the company has added 2.17 BTC to its treasury. Following this increase, B HODL's total Bitcoin holdings have reached 157.211 BTC.

3. OranjeBTC increased its holdings by 7.3 BTC, bringing its total holdings to 3720.3 BTC.

On December 8th, Brazilian listed company OranjeBTC announced that it had increased its holdings by 7.3 BTC at an average price of approximately $95,000, bringing its total holdings to 3,720.3 BTC. Its year-to-date Bitcoin return is 2.2%.

4. Japanese listed company Metaplanet plans to issue preferred shares similar to those of Strategy Inc. to increase its holdings of Bitcoin.

On December 9th, according to Bitcoin Magazine, Japanese listed company Metaplanet will issue a new type of stock similar to Strategy Inc., which it plans to use for further Bitcoin purchases.

5. MicroStrategy increased its holdings by 10,624 BTC, bringing its total holdings to 660,624 BTC.

On December 10th, MicroStrategy, a BTC treasury company, disclosed that it has added 10,624 BTC to its treasury. This purchase cost approximately $962.7 million, with an average transaction price of $90,615 per BTC.

Following this increase, MicroStrategy's total Bitcoin holdings have reached 660,624 BTC.

6. ProCap Financial increases its Bitcoin holdings to 5,000.

On December 10, ProCap Financial announced that it will hold 5,000 Bitcoins in 2025, making it one of the major Bitcoin holders in the public market.

The announcement shows that the company currently has more than $175 million in cash reserves to support its Bitcoin accumulation strategy and business operations.

7. Canaan Creative increased its holdings by 100 BTC in November, bringing its total Bitcoin holdings to 1730 BTC.

On December 11, according to PR Newswire, Nasdaq-listed Bitcoin mining company Canaan Creative released its unaudited operating report for November, disclosing that it mined 89 BTC in November and strategically increased its holdings of 100 BTC from the open market by taking advantage of price fluctuations. At the end of the month, the company's cryptocurrency inventory on its balance sheet reached 1,730 BTC and 3,951 ETH.

8. Mining company American Bitcoin Corp. increased its holdings by 416 bitcoins, bringing its total holdings to 4,783 bitcoins.

On December 11, publicly traded mining company American Bitcoin Corp. (NASDAQ: ABTC) announced that it has acquired an additional 416 bitcoins since its latest disclosure. As of December 8, 2025, the company holds approximately 4,783 bitcoins through self-mining and strategic purchases, some of which are held by custodians as part of mining equipment procurement agreements or as collateral.

9. Hyperscale Data increased its holdings by 25 Bitcoins, bringing its total holdings to 451.85 Bitcoins.

On December 11, it was reported that Hyperscale Data, a publicly traded company, increased its holdings by 25 bitcoins, bringing its total holdings to 451.85 bitcoins.

10. BNB Plus invested $3 million to increase its holdings by 3,349 BNB, bringing its total holdings to 18,840 BNB.

On December 11, according to Business Wire, BNB Plus (NASDAQ: BNBX) announced the purchase of 3,349 new BNB for approximately $3 million, at an average price of approximately $895 per BNB, bringing its total holdings to approximately 18,840 BNB (including OBNB Trust Units). The company stated that it will continue to implement a yield-oriented BNB treasury strategy and leverage DeFi and Binance's native yield opportunities.

11.21 Capital has increased its holdings by approximately 441 BTC in the past seven days.

On December 11, Jack Mallers, CEO of Twenty One Capital, reiterated in a recent CNBC interview that the company is not a Bitcoin treasury, but a Bitcoin-native company backed by Tether and SoftBank, aiming to achieve cash flow, growth, and Bitcoin accumulation.

According to on-chain holdings data released by Jack Mallers for Twenty One Capital, the company has increased its holdings by 441.25 Bitcoins in the past seven days, bringing its total Bitcoin holdings to 43,514.12.

12. Spanish listed company Vanadi Coffee increased its holdings by 10 Bitcoins, bringing its total holdings to 129 BTC.

On December 11, it was reported that Spanish listed company Vanadi Coffee (VANA.MC) increased its holdings by 10 Bitcoins, bringing its total holdings to 129 BTC.

DWF Labs Partner: The market is underestimating the future growth potential of BTC and the crypto industry.

On December 8th, Andrei Grachev, a partner at DWF Labs, posted on social media, "I think we underestimated the future growth potential of Bitcoin and its industry, which will continue to grow given all the positive signs, including regulation, institutional adoption, reserves, and tokenization. Speculation has become more complicated, but medium- to long-term investing is much easier."

Related pictures

Bank of America announced it will recommend crypto assets to its wealth management clients.

On December 9th, Bank of America announced that starting in January 2026, its wealth management advisors will be able to recommend cryptocurrency ETFs and products to clients, rather than simply executing trades. This move expands the accessibility of crypto assets to mainstream high-net-worth and institutional investors.

This indicates that Bitcoin is being incorporated into the ranks of legitimate investment tools by traditional financial institutions and wealth management services, which is conducive to driving broader capital into the crypto space.

JPMorgan Chase predicts that Bitcoin's price could surge to $170,000 in the coming months.

On December 9th, JPMorgan Chase strategists stated that if Bitcoin trades in a similar manner to gold, its price could reach $170,000 next year. The bank has consistently maintained that Bitcoin's price movements mirror those of precious metals over the past few years.

Cryptocurrency stocks generally rose, with AI stocks leading the gains at over 4%, and Bitcoin (BTC) up 2.49%.

On December 10th, according to SoSoValue data, after repeated fluctuations, the crypto market saw a general rise across all sectors, with the AI sector leading the gains at 4.46% in the past 24 hours. Among them, Fetch.ai (FET) rose 9.6%, Worldcoin (WLD) rose 6.5%, and Virtuals Protocol (VIRTUAL) rose 5.5%.

In addition, Bitcoin (BTC) rose 2.49%, returning above $92,000; Ethereum (ETH) rose 6.21%, briefly breaking through $3,300.

Related pictures

Bitcoin is poised to end its traditional four-year cycle, with predicted annual trading volume exceeding $100 billion.

On December 11, 21Shares released its 2026 State of Cryptocurrencies report, outlining several key predictions. The report's core predictions include: Bitcoin will end its traditional four-year cycle and shift towards becoming a mature macro asset driven by structural capital inflows, macroeconomic adjustments, and regulatory clarity.

The global cryptocurrency ETP assets under management will grow from over $250 billion currently to $400 billion, outperforming the Nasdaq 100 ETF; the stablecoin supply will increase 3.3 times from $300 billion in 2025 to $1 trillion; the market's annual trading volume is projected to exceed $100 billion; and the total value locked in tokenized real-world assets (RWA) will increase from $35 billion to over $500 billion.

Bitcoin is expected to rise to $103,500 to $112,500 in the next month.

On December 11th, Chinese crypto analyst Banmu Xia posted an article stating, "Bitcoin saw a surge in the early hours of today, but the magnitude was insufficient. Currently, the rise from $80,500 appears to be a leading wedge pattern. Meanwhile, $89,000-$90,000 is a relatively strong support level. The market's target for the next month is $103,500-$112,500. The process is likely to be very volatile."