This article is machine translated

Show original

🐓 "Dual Currency Investment": Should You Accept the Losses?

Logically, I should have written my 60-day summary of "dual currency investment" last week, but I haven't, and the reason is simple:

😭 I lost money.

That's right, so-called "dual currency investment" (dual currency wealth management, dual currency wins) is certainly not "principal-protected wealth management," and it certainly won't let you "win whether it goes up or down."

Once the "sell high" condition is triggered, and the price rises to a certain level and then stops falling, it basically means a "loss in currency terms" (the same applies if buying low is triggered).

For example, the yellow arrow in my screenshot, which represents the 10% surge on December 2nd, was the day my "dual currency sell high" option was exercised.

Even though I had conservatively set a strike price of +5.17% the day before, I was still shaken out by this surge.

You'll encounter this sooner or later.

You can't always set a maximum safety margin of around +10% (that would mean an almost negligible return).

So, the more practical question is:

🤔 What should you do if your dual-currency investment is exercised?

As I understand it, you have three options:

1️⃣ Accept the loss and immediately buy back the spot assets (e.g., ETH, BTC).

2️⃣ Hold the stablecoin and start a reverse operation to "buy low" (sell put options).

3️⃣ Place a limit order on the spot trading platform (at your average strike price) to try and buy back the same amount of spot assets.

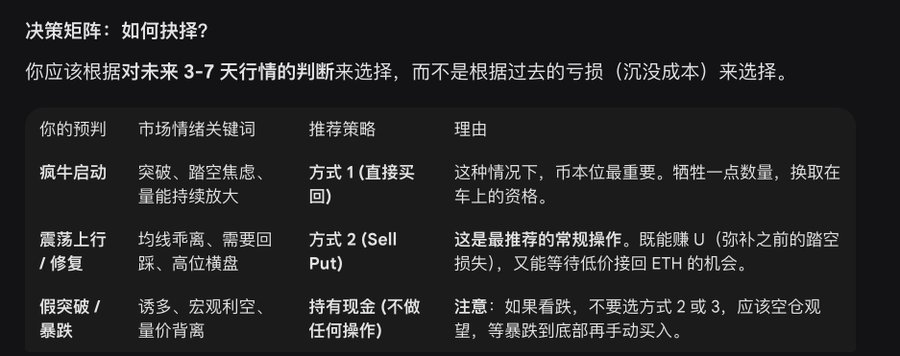

The question then becomes, how should you choose among these three options?

First, it's important to note that although Gemini initially recommended option one, I was reluctant to do so.

I tried the latter two options, repeatedly switching back and forth, without success (I never managed to buy back the same amount of ETH). After a serious discussion with Gemini, I've chosen option two and plan to implement it long-term.

Incidentally, based on previous information, it seems Deribit defaults to option one; if you, as the option seller, have your option exercised, a portion of your spot assets will be directly deducted.

This essentially forces you to accept the consequences of your actions.

It clearly tells you that "being exercised" equals a real loss.

However, as humans, our psychological characteristic is an unwillingness to accept losses. Therefore, we fantasize about buying back the same quantity of physical goods at a certain price and time, or even buying back more when the price drops significantly, perfectly executing a swing trade.

This "fantasy-driven" mentality, ignoring reality, leads quickly into a loss abyss.

This fantasy requires favorable market conditions, and the actual market trend will not change because of your thoughts.

Theoretically, option sellers need to be aware of the following:

1. Try to avoid being exercised.

2. Once exercised (a low-probability event), continuously sell to make up for previous losses.

In short, use long-term positive returns to smooth out occasional losses.

Of course, if you have your own (accurate) judgment on the short-term market trend, you can choose different strategies, rather than being forced to choose a particular path.

See Screenshot 2 for details: Decision Matrix.

In summary: This is a long-term game. You need to maintain a calm mindset, avoid fighting the market, and be willing to accept losses when necessary, rather than expecting the market to move according to your wishes.

Occasional losses from "forced exercise" can be offset by positive daily returns over a longer period.

Ensuring you have a strategy with positive EV is the foundation for staying at the table long-term.

gm365

@gm365

11-05

🗓 双币投资 30 天总结

从 10 月 5 号第一笔“双币理财”开始到今天,刚好一个月过去了。

今晚算了下收益,5%。

当然,这是币本位收益率。如果要算 U 本位,别怪我现在就哭给你看。

币安平台统计的收益数据没法看,我不懂为何差异如此巨大。实际上并没有显示的那么高。 x.com/gm365/status/1…

☘️ Illusory Profit Data

If you're willing to "live in a dream," then the data on Binance's "Investment Analysis" page will absolutely fulfill your fantasies.

1. Positive daily returns

2. Always trending upwards

3. Profit data significantly "corrected upwards"

When you feel unhappy about losing money, open "Investment Analysis," and you'll instantly feel like you're invincible again, and absolutely a one-in-a-million "investment genius."

Yeah, I'm invincible again.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content