Pyth Network has launched PYTH Reserve, implementing a periodic buyback mechanism that uses 33% of the DAO treasury each month to purchase PYTH.

Pyth implements a buyback mechanism, using 33% of the DAO treasury to purchase PYTH periodically each month.

Pyth implements a buyback mechanism, using 33% of the DAO treasury to purchase PYTH periodically each month.

On December 12, 2025, the Pyth Network oracle project officially announced the PYTH Reserve along with a periodic buyback mechanism, in which 33% of the DAO's treasury balance will be used each month to purchase PYTH on the market, starting in December 2025.

Introducing the PYTH Reserve: turning real revenue growth into sustainable network value.

— Pyth Network 🔮 (@PythNetwork) December 12, 2025

Pyth Pro surpasses $1M annualized revenue in its first month, and that revenue now fuels systematic PYTH purchases on the open market.

More adoption. More revenue. More value. Let's dive… pic.twitter.com/NqodrKfGoK

This is XEM one of Pyth's most significant steps since the project's launch, marking a shift from a user growth phase to a revenue-generating data infrastructure model that accumulates value for the Token.

How PYTH Reserve works

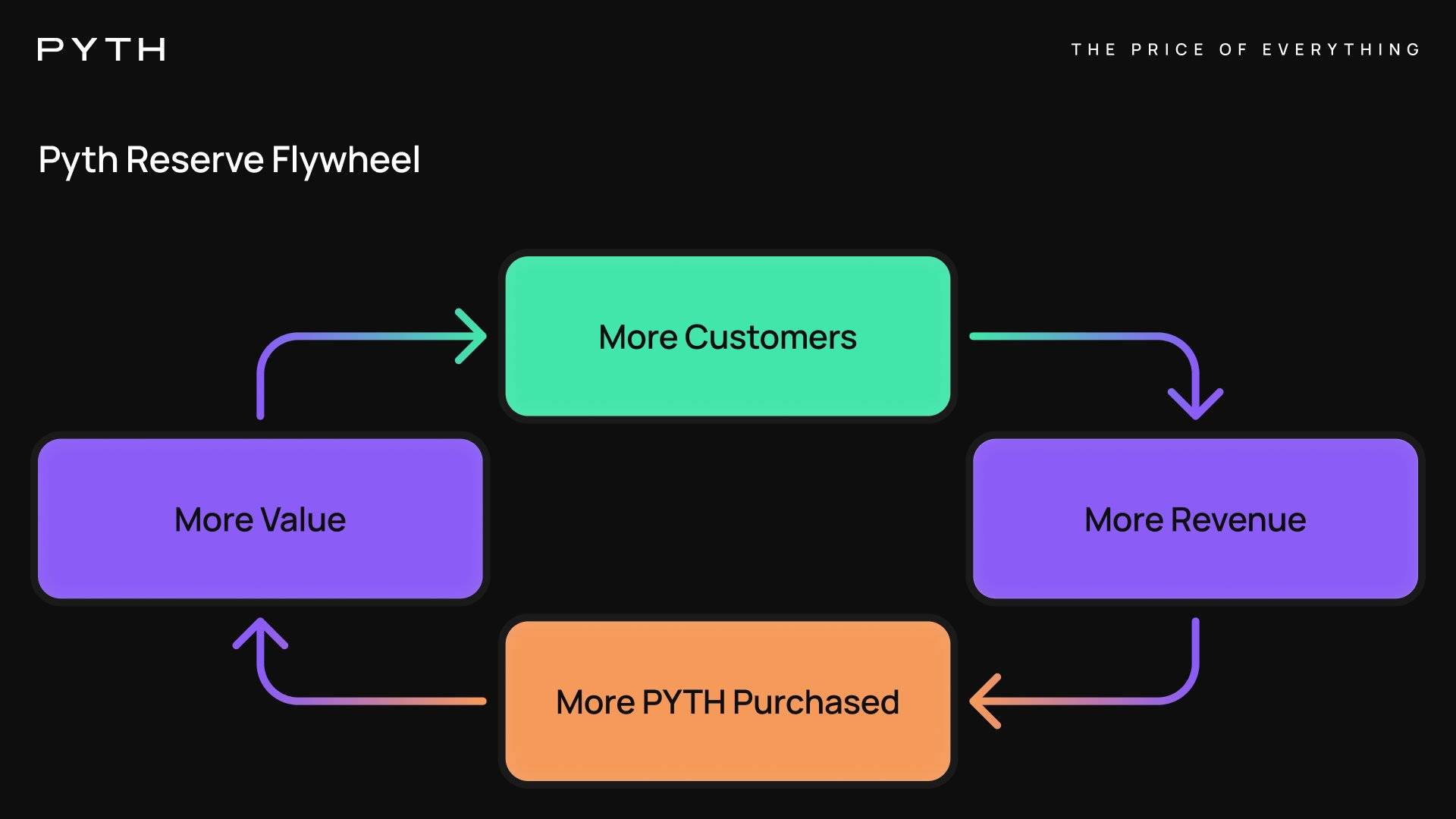

- PYTH Reserve is designed as a systemic economic mechanism to directly convert the network's actual revenue into long-term accumulated value for the PYTH Token .

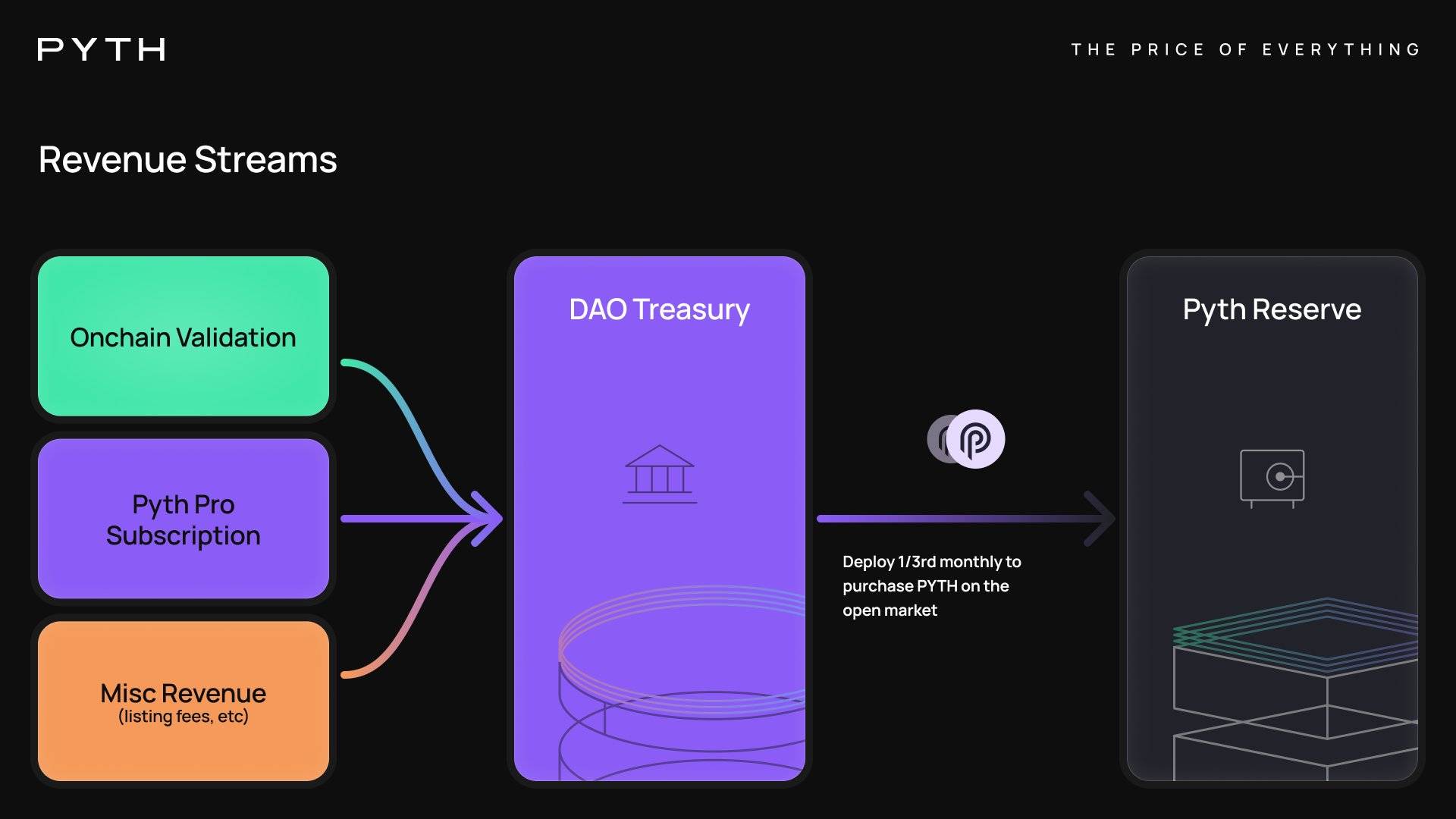

- Accordingly, all revenue from Pyth Network products will be channeled to the DAO treasury, and each month the DAO will use 33% of its total Treasury balance at that time to purchase PYTH directly on the market.

- This approach helps to distribute the impact evenly across the market, avoiding sharp price fluctuations, while creating stable buying pressure that gradually increases in line with revenue growth.

- All buyback transactions are conducted on-chain and transparently, with the purchased Token being deposited into the PYTH Reserve instead of being immediately redistributed to the market, thereby strengthening the value accumulation mechanism for the entire network.

Simultaneously, Pyth is also implementing, for the first time, a quarterly price review and optimization process for products such as Pyth Core, Pyth Entropy, and Pyth Express Relay, in order to adjust pricing to match market demand and maximize revenue.

- Initially, the buyback size is projected to be around $100,000–$200,000, with the Treasury currently holding approximately $500,000. However, this figure is expected to increase significantly from 2026 onwards as Pyth's revenue expands.

Pyth reports that revenue is growing.

- Michael James, head of institutional business development at Douro Labs (the company that develops Pyth), said that Pyth Pro, the network's newest data product, which provides real-time market data across a wide range of asset classes and geographic regions, is experiencing very positive initial traction.

- Since its launch in late September 2025, Pyth Pro has achieved $1 million in annual recurring revenue (ARR) in its first month alone, attracting over 80 paying customers. James added:

"Based on pipeline forecasts for the next 12–18 months, we are aiming for a $50 million ARR,"

- He also predicted that the global data industry, currently worth around $50 billion and growing at 5–6% annually, could reach $80–90 billion by 2035. However, with the boom in RWAs, the growing demand from financial institutions, and AI driving data consumption, James believes this market size could be even larger, approaching $100–125 billion by 2035. He said;

"Our first mission is to capture 1% of the current $50 billion data market, equivalent to approximately $500 million in ARR,"

- In addition to Pyth Pro, Pyth's product ecosystem also includes Pyth Core (crypto market data), Pyth Entropy ( on-chain random number generator), and Pyth Express Relay (plug-and-play liquidation aggregator for trading applications).

Pyth states that it has supported over $2.3 trillion in volume, with transactions utilizing data from Pyth, integrating with over 100 blockchains, and serving over 600 applications.

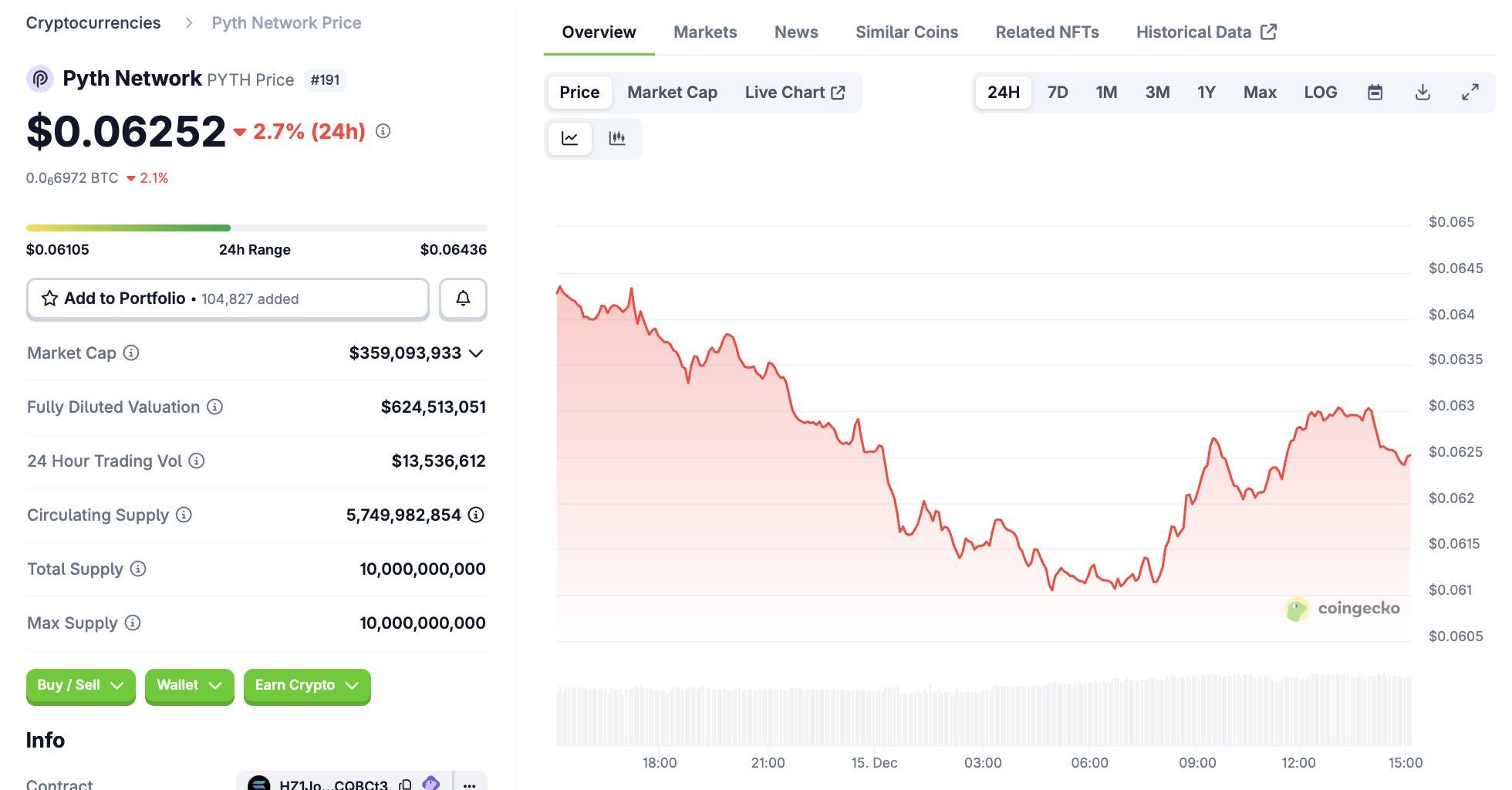

- At the time of writing, the price of PYTH is currently fluctuating around $0.062, down slightly by 2.7% in the last 24 hours.

PYTH price fluctuations over the past 24 hours, screenshot from CoinGecko at 3:00 PM on December 15, 2025.

PYTH price fluctuations over the past 24 hours, screenshot from CoinGecko at 3:00 PM on December 15, 2025.

Coin68 compilation