As Bitcoin's price declines, Bitcoin mining companies are pivoting their operations. With mining becoming more competitive than ever, how are they surviving?

Key Takeaways

The unpredictable profits and ever-increasing cost structure of mining companies make the mining business itself unstable.

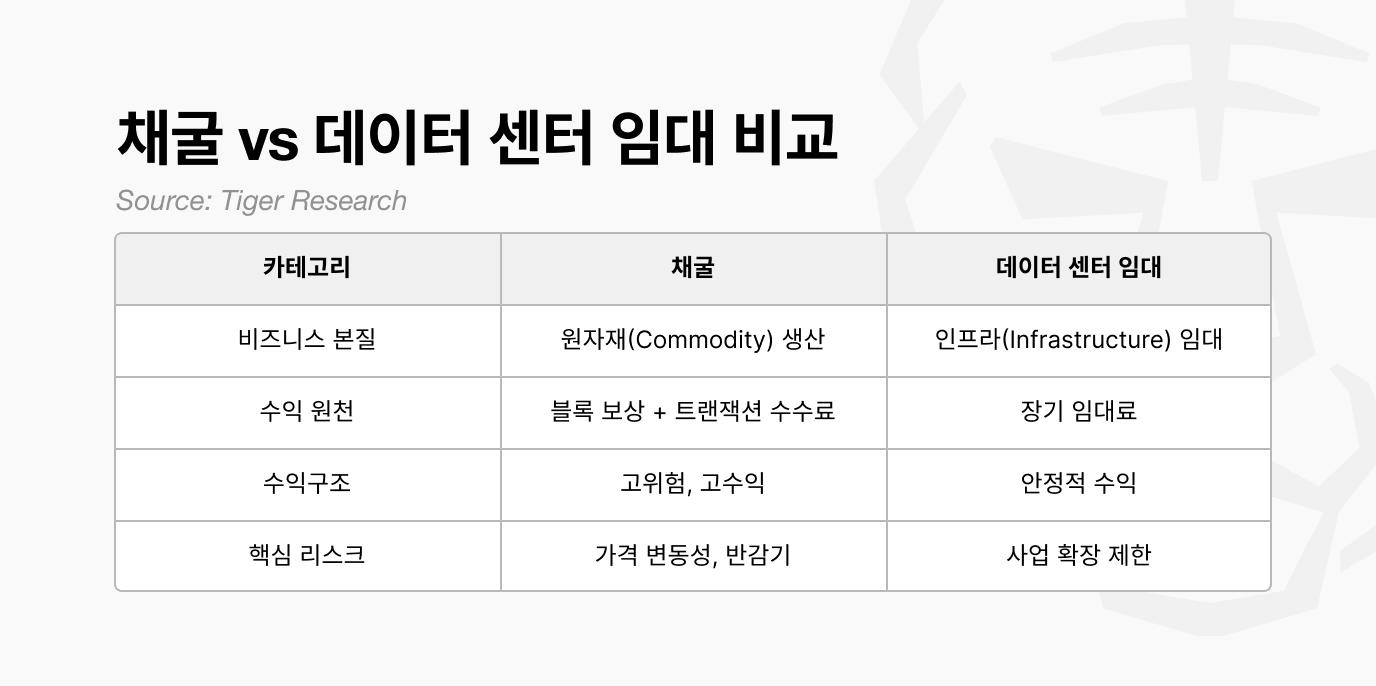

Accordingly, mining companies are shifting their business to leasing data centers to big tech companies by utilizing existing infrastructure.

However, this structure rather relieves overheated competition and makes the mining business healthier.

1. Business Risks of Cryptocurrency Mining Companies

In a previous report , we analyzed Strategy's financial risks amidst the Bitcoin price decline. However, it's not just DAT companies like Strategy that are at risk. Mining companies that actually mine Bitcoin are also exposed to significant risks.

The vulnerability of these mining companies stems from a simple revenue structure: their profits are entirely dependent on the unpredictable price of Bitcoin, while their costs are structurally bound to continue to rise.

Unpredictable earnings : A company's revenue is determined solely by the price of Bitcoin.

Continuously increasing costs : structurally increasing due to rising mining difficulty, rising electricity costs, and equipment replacement.

This structure presents a problem when the Bitcoin price falls, as it does now. This creates a double whammy: revenues immediately decrease, while costs actually increase.

Moreover, a bill recently proposed in New York State would increase excise taxes on mining companies. Most major mining companies are located in lax regulatory states like Texas, so the direct impact is limited, but regulatory risks could arise at any time.

In this unfavorable environment, mining companies are facing a fundamental question: “Can we really sustain this business?”

Be the first to discover insights from the Asian Web3 market, read by over 22,000 Web3 market leaders.

2. Structural vulnerabilities of mining companies

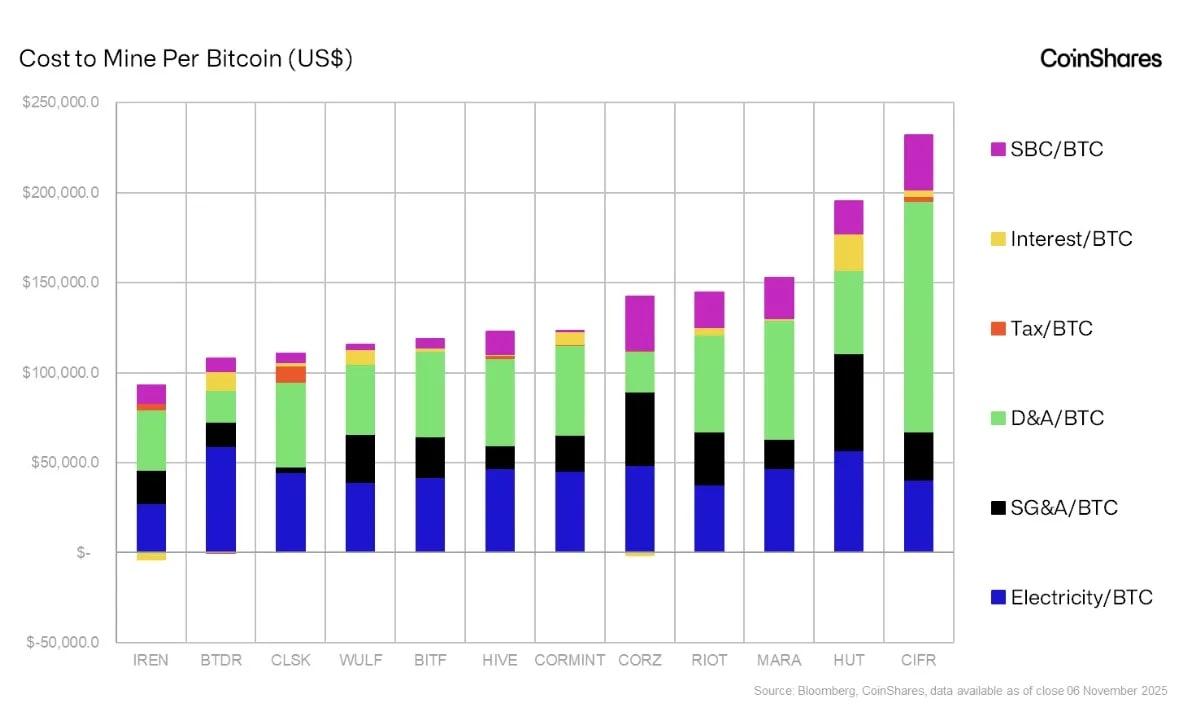

Currently, the average cost for mining companies to mine a single Bitcoin is $74,600, a roughly 30% increase from a year ago. However, the total production cost, including depreciation and stock-based compensation, amounts to approximately $130,000 . Considering that the Bitcoin price is currently hovering around $91,000, mining companies are reporting an accounting loss of approximately $46,000 for each Bitcoin mined.

As of 2025, mining difficulty has increased compared to 2022, and energy regulations have been strengthened, making mining operations unstable.

3. Pivoting to Leasing AI Data Centers from Mining Companies

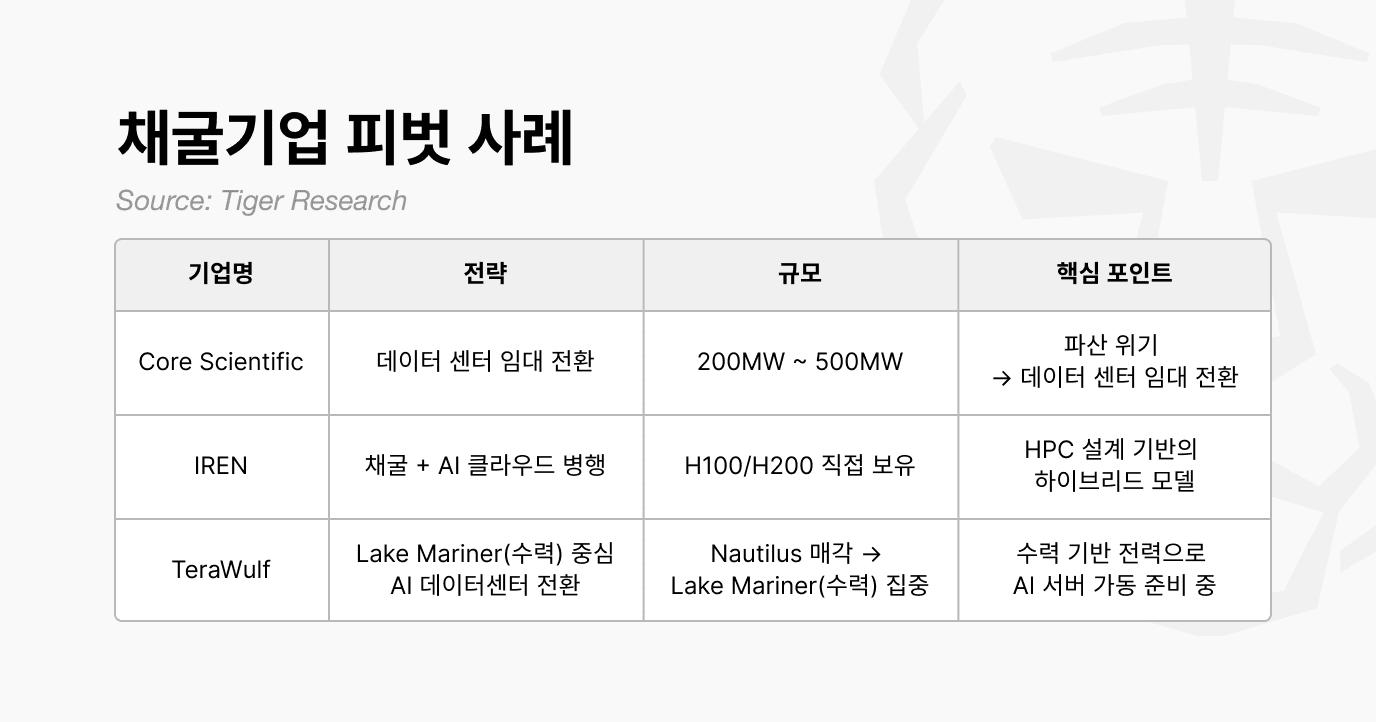

A prime example is Core Scientific . Facing bankruptcy in 2022, the company pivoted to AI data centers. It currently operates 200MW of capacity and plans to expand to 500MW. This is a prime example of a company on the brink of bankruptcy pivoting to data center leasing.

IREN and TeraWulf are also expanding into businesses other than mining. While not entirely data center leasing, they are expanding into additional business models beyond mining. As mining companies struggle to find profitability in Bitcoin mining, they are shifting to businesses suited to the AI era.

4. Diversifying Mining Companies' Strategies

Mining companies' shift from unprofitable mining operations to AI data centers is not a mere fad. It's a perfectly natural and rational survival strategy for companies seeking to relocate to more capital-efficient locations.

This is by no means a negative trend. Rather, it should be seen as a sign that mining companies have developed the fundamentals to generate a stable cash flow and continue to hold Bitcoin.

Rather than the worst-case scenario of suffering losses, going bankrupt, and selling off all their Bitcoin holdings at a low price on the market, it would be far more positive for the market overall if mining companies had the power to strategically hold Bitcoin or choose when to sell it through data center revenue.

Moreover, not all companies are solely focused on data center leasing. Companies like Bitmine and Cathedra Bitcoin are expanding beyond simple mining to become DAT companies.

In conclusion, the current changes represent a maturing process for the cryptocurrency mining industry. Companies that have lost their competitive edge are transitioning to AI data centers, naturally alleviating the excessive mining competition in the market. At the same time, leading companies are expanding their businesses beyond simple mining to include DAT companies.

In other words, weak links are being broken and the entire market is becoming stronger.

Be the first to discover insights from the Asian Web3 market, read by over 22,000 Web3 market leaders.

🐯 More from Tiger Research

이번 리서치와 관련된 더 많은 자료를 읽어보세요.Disclaimer

This report has been prepared based on reliable sources. However, we make no express or implied warranties as to the accuracy, completeness, or suitability of the information. We are not responsible for any losses resulting from the use of this report or its contents. The conclusions, recommendations, projections, estimates, forecasts, objectives, opinions, and views contained in this report are based on information current at the time of preparation and are subject to change without notice. They may also differ from or be inconsistent with the opinions of other individuals or organizations. This report has been prepared for informational purposes only and should not be construed as legal, business, investment, or tax advice. Furthermore, any reference to securities or digital assets is for illustrative purposes only and does not constitute investment advice or an offer to provide investment advisory services. This material is not intended for investors or potential investors.

Tiger Search Report Usage Guide

Tigersearch supports fair use in its reports. This principle allows for the broad use of content for public interest purposes, provided it does not affect commercial value. Under fair use rules, reports may be used without prior permission. However, when citing Tigersearch reports, 1) "Tigersearch" must be clearly cited as the source, and 2) the Tigersearch logo must be included. Reproducing and publishing materials requires separate agreement. Unauthorized use may result in legal action.