From collapse to leap: The restart and next growth cycle of the South Korean crypto market.

Article author: JE labs

Article source: TechFlow

1. Introduction: The Market Paradigm is Shifting

Key signals

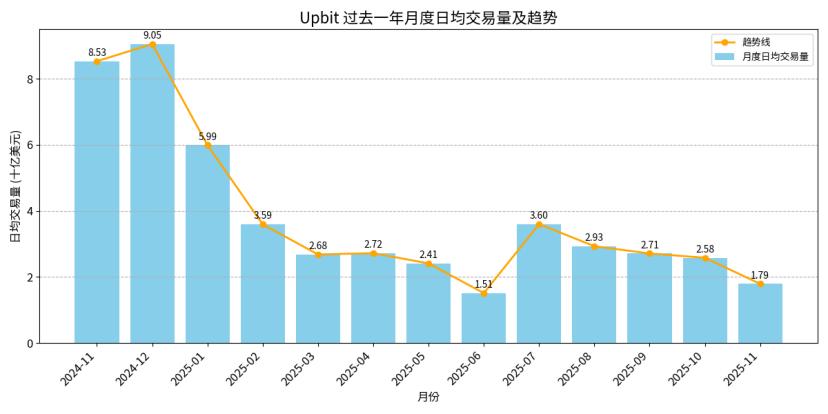

- The South Korean digital asset market is undergoing one of the most significant structural reshuffles in its history. Upbit's daily trading volume plummeted from $9 billion in December 2024 to $1.78 billion in November 2025, a drop of approximately 80%. This occurred against the backdrop of a 141% year-on-year increase in the overall number of new token listings on South Korean exchanges in 2025. Simultaneously, retail investor funds are rotating aggressively, flowing into the soaring stock market. Driven by the AI chip sector, spearheaded by Samsung Electronics and SK Hynix, the KOSPI index has risen by approximately 70%.

- The "kimchi premium," once considered a hallmark of the South Korean market, has historically hovered around 10%, but has now shrunk to about 1.75%. This is not a massive capital flight, but rather a normalization process as speculative bubbles are squeezed out.

- Kimchi premium refers to the higher price difference between crypto assets such as Bitcoin on local South Korean exchanges (such as Upbit and Bithumb) and on global exchanges (such as Binance and Coinbase).

- The core question is: Has South Korea's era of encryption come to an end, or is it undergoing a systemic reset before the next structural wave?

2. Behind the Freeze: Deconstructing the Slowdown in South Korea's Crypto Market

This is not a short-term correction, but a structural readjustment driven by regulation, capital controls, and investor fatigue.

2.1 Regulatory delays and uncertainties

- The stablecoin bill, a core pillar of South Korea's future digital asset development, has been stalled for seven months due to controversy surrounding whether banks or non-bank institutions should be the issuers. Currently, six different proposals are under review, and the Financial Services Commission (FSC) plans to consolidate them into a single unified bill by the end of 2025.

- This regulatory vacuum has slowed down the pace of innovation on the institutional side and made Web2 companies that are exploring tokenization and settlement layer innovations more cautious, with the overall environment clearly trending towards risk aversion.

2.2 Capital outflows and liquidity traps

- South Korea's strict foreign exchange controls have prevented overseas market makers and institutions from injecting liquidity, resulting in a long-term one-way capital outflow from the market.

- The Foreign Exchange Transactions Act (FETA) prohibits non-residents from freely holding or flexibly using Korean won. Most large foreign exchange and capital flows require mandatory reporting or prior approval, which significantly restricts the ability of overseas institutions to operate smoothly in the Korean market.

- The Financial Supervisory Service (FSS)’s “Foreign Exchange Business Processing Guidelines” state that local banks face strict intraday position limits and are essentially prohibited from providing Korean won liquidity to non-resident institutions, making it difficult for overseas market makers to establish Korean won positions and provide truly bilateral liquidity services.

- Although some forecasts suggest that South Korea's digital asset market revenue will reach $635 million by 2030, the problem of tight liquidity remains prominent in the short term.

- Interestingly, the South Korean market is highly dependent on leveraged trading, so if a new catalyst emerges, such as regulatory clarification or a new surge in global Bitcoin prices, the market could experience a very rapid rebound.

2.3 Constructive correction, rather than a real collapse

- Rather than viewing the market cooling as a recession, it's better to understand it as a return to normalcy. South Korea's cycle is aligning with global trends: a shift from speculative, extensive growth to a greater focus on use value. Market participants are gradually shifting their focus from short-term trading to infrastructure, hosting, compliance, and real-world applications. While this phase may be painful, it is a necessary process to support future sustainable expansion.

3. Crypto giants collectively land in Seoul

- Even with a significant decline in participation from domestic retail investors, global crypto giants are still actively increasing their investment in the South Korean market. This counter-cyclical expansion precisely demonstrates that external players remain highly optimistic about the technological literacy of South Korea's population and the long-term potential of its institutional market.

3.1 Key Actions

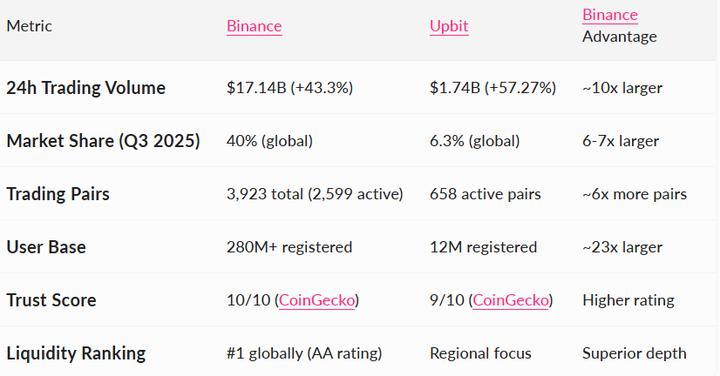

- In October 2025, Binance made a major foray into the South Korean market by acquiring Gopax, ending a four-year absence. This was partly due to South Korea's relaxation of restrictions on foreign ownership, and also signaled South Korea's willingness to further open up to global crypto companies.

- This acquisition lays the foundation for more intense market competition, smoother liquidity channels, and a more sophisticated and mature product offering, significantly upgrading the products and services available to local users.

- Core performance indicator matrix

Source: Surf AI, 2025

3.2 Why now?

This point in time can be understood from three strategic factors:

- High cryptography literacy and extremely fast technology adoption speed

- South Korea remains one of the fastest markets in the world to adopt and implement emerging technologies, including AI and digital assets.

- Stablecoin integration prospects

- Local banks, fintech companies, and internet giants such as Kakao and Naver are exploring stablecoin pilot programs, which are expected to bridge the gap between the local financial system and the on-chain world.

- Institutional demand continues to rise

- South Korean institutional investors are showing increasing interest in custody, asset tokenization, and legal and compliant digital asset allocation, laying the foundation for continued long-term capital inflows in the future.

4. Outlook

- The current downturn is not the end, but rather a structural reset that is pushing the South Korean market away from purely speculative activities and towards a more use-value-oriented approach, better aligned with institutional needs. Stablecoin legislation, institutional custody infrastructure, and a potential Bitcoin ETF are likely to be key pillars for the next phase of growth. South Korea is entering a new phase driven by real product value, user education, and compliant innovation.

4.1 Market Forecast

- The South Korean crypto market is projected to grow slowly at a CAGR of 2.94%, but the real turning point is likely to come with the potential approval of a Bitcoin ETF in 2026. This topic has already been frequently discussed and circulated among South Korean policymakers.

- Once approved, the possible changes include:

- Korean pension and asset management institutions officially participate

- Large-scale entry of overseas market makers

- Higher quality price discovery and tighter bid-ask spreads

This is also expected to re-establish South Korea's position as a regional "net capital inflow hub".

4.2 Web2 and Web3 Convergence in South Korea

- Large South Korean conglomerates are further exploring the practical applications of blockchain:

- Banks, fintech companies, and large tech enterprises are testing stablecoin pilots and exploring payment and settlement pathways related to the digital won.

- Upbit and Bithumb have launched or expanded institutional custody services, enabling local institutions and overseas capital to re-enter the market in a compliant manner.

- This signifies that the market is shifting from speculative use to an application model centered on infrastructure and practical use.

4.3 Global Benchmarking

- South Korea's regulatory trajectory is increasingly resembling Japan's: strict yet relatively predictable. If South Korea can achieve similar regulatory clarity on key issues such as stablecoins, asset tokenization, and digital asset ETFs, it has the potential to become one of Asia's most balanced crypto hubs, attracting both institutional builders and global liquidity.

4.4 From a Web3 Marketing Perspective: Why South Korea Places Special Importance on Product Usability

- In South Korea's next economic cycle, a key but often underestimated structural driver will be the increasing market demand for genuine product usability.

- South Korea is one of the few markets where exchanges and users actively test, verify, and thoroughly understand a project before truly accepting it. This trend is becoming increasingly apparent as the market transitions to a use-value-driven phase.

- For example:

- Upbit's quiz campaign: Treating education as a market infrastructure

- Upbit frequently conducts educational quizzes when new cryptocurrencies are listed, requiring users to answer questions about:

- Project Technical Architecture

- Token economic model

- Use cases and real-world functions

- Roadmap and Risk Profile

- This is fundamentally different from the airdrop-based profit-seeking model common in other regions. It sends a signal that South Korean exchanges place greater emphasis on verification, understanding, and user education, requiring project teams to clearly and thoroughly explain their value.

- Upbit X Surf product real-world usage activities

- In 2025, Upbit partnered with Surf to host a hands-on product experience event, encouraging users to directly use the project's products, experience its features, and generate meaningful results.

- This clearly demonstrates a shift:

- South Korean exchanges are increasingly emphasizing validation based on actual user experience, rather than superficial exposure and marketing.

- In South Korea, the fact that a product is usable and easy to use is itself the most powerful form of marketing.

- A narrative without execution cannot survive long-term here.

4.5 Investor's Operation Manual

To effectively position oneself during this reset phase, investors need to:

- Continue to monitor key catalysts, such as: progress on the integration of the FSC bill, discussions related to Bitcoin ETFs, and the upcoming legislation on stablecoins.

- Prioritize projects with long-term use value, rather than tokens that rely purely on sentiment and hype.

- Pay close attention to macroeconomic indicators in the fourth quarter, as historically, South Korean retail investors tend to re-enter the market on a large scale during periods of improved risk appetite.

- By diversifying allocations, we reduce our holdings in single thematic narratives that are entirely dependent on political and regulatory timing.

Furthermore, investors should focus on international ecosystems that have established a presence in South Korea and built local implementation capabilities. A key trend shaping South Korea's next economic cycle is the rapid establishment of partnerships between global public blockchain ecosystems and major South Korean corporations. This indicates that South Korea is transforming from a market primarily focused on transactions and consumption into a hub role of "joint development and deep infrastructure integration."

Case 1: Sui x t'order

- Local partner: t'order (Korea's dominant tableside ordering and POS network)

- Integration method: Supports stablecoin payments pegged to the Korean Won, combined with QR code and facial recognition payments, with zero transaction fees for merchants and real-time settlement.

Case 2: Solana x Shinhan Securities

- Local partner: Shinhan Securities (one of South Korea's top securities firms)

- Cooperation Method: Sign a strategic Memorandum of Understanding (MOU) to jointly support the development of Web3 entrepreneurs, developers, and the Solana ecosystem in South Korea, with Superteam Korea taking the lead.

Case 3: Arbitrum x Lotte Group

- Local partner: Lotte Group (one of the largest conglomerates in South Korea)

- Integration method: Arbitrum provides significant developer funding to Calisthey (Rakuten's metaverse platform) for integrating the Arbitrum blockchain.

5. South Korea's Crypto Winter is a reset, not a retreat—and also a strategic entry window for builders.

Despite the current market contraction, South Korea remains one of the world's most dynamic crypto markets. Stablecoins are helping large Web2 companies explore on-chain settlement and infrastructure tokenization; leading exchanges continue to expand custody and institutional services; and the potential approval of a Bitcoin ETF significantly increases the likelihood of overseas liquidity flowing back to South Korea.

South Korea's crypto ecosystem is not coming to an end, but is maturing rapidly.

This reset signifies that South Korea is transitioning from a speculative, retail-driven playground to a structured, institutionally supported digital asset economy centered on institutional participation.