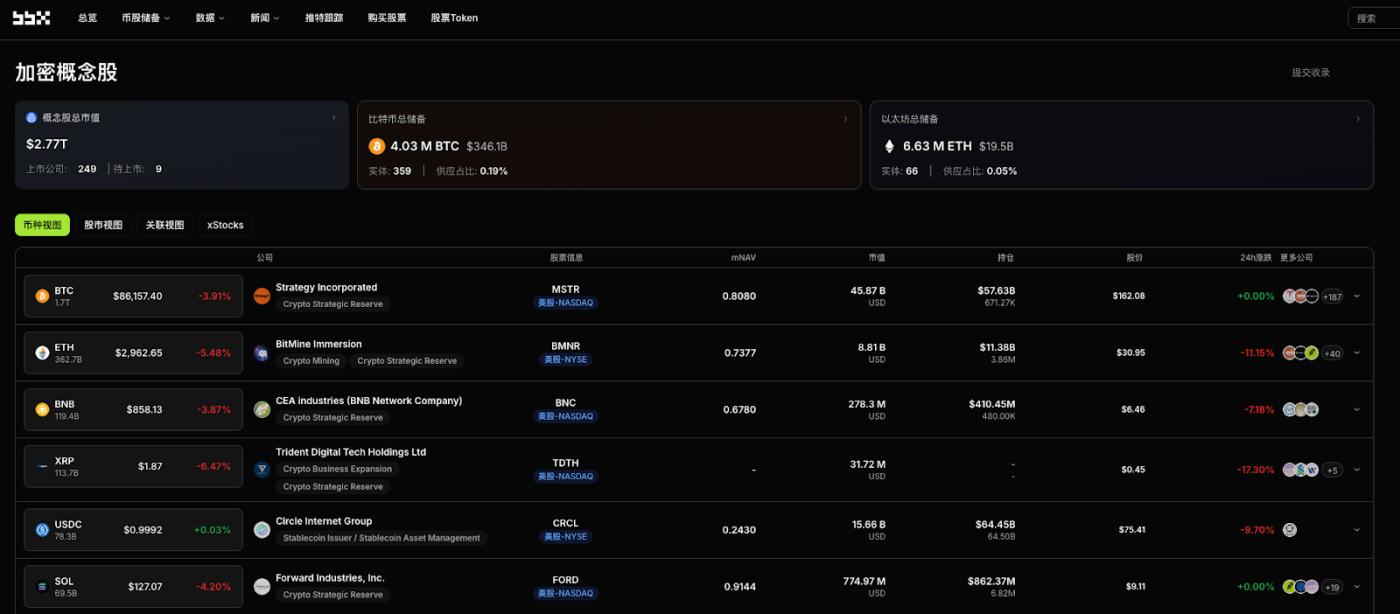

According to ME News, on December 16, 2025 (UTC+8), BBX Crypto Concept Stock Information reported that several listed and quasi-institutional entities continued to advance their crypto asset allocation strategies yesterday, further consolidating the position of Bitcoin and Ethereum in the balance sheets of enterprises and financial institutions.

Bitcoin holdings dynamics

American Bitcoin Corp. (NASDAQ: ABTC) announced the addition of 261 bitcoins (BTC), bringing its total bitcoin holdings to 5,044 BTC. The company stated that this continued accumulation of bitcoins is an important part of its long-term mining operations and treasury strategy, aimed at expanding its computing power while strengthening its asset reserves.

Ethereum and Institutional Holdings Dynamics

DBS Bank Ltd. (SGX: D05) disclosed that it received 2,000 Ethereum (ETH) from Galaxy Digital yesterday, with a transaction value of approximately US$6.27 million. As of now, DBS holds approximately 158,770 ETH (worth approximately US$499 million) and 7,861 BTC (worth approximately US$706.5 million), demonstrating a significant institutional-grade exposure to mainstream crypto assets.

BitMine (NYSE: BMNR), an Ethereum treasury company, recently disclosed that its ETH holdings have reached nearly 3.97 million, continuing to rank among the world's major enterprise-level Ethereum holders, highlighting its long-term treasury strategy centered on ETH.

Market perspective

Based on yesterday's disclosures, the institutional adoption of crypto assets is becoming increasingly diversified:

On the one hand, mining companies like American Bitcoin continue to strengthen their "mining + treasury" dual-track model by increasing their BTC holdings; on the other hand, traditional financial institutions such as DBS have established substantial direct exposure to both ETH and BTC, indicating that crypto assets are being incorporated into a broader institutional asset allocation framework. Meanwhile, BitMine's large ETH holdings also demonstrate that Ethereum is evolving from a technological infrastructure asset into one of the core assets of enterprise-level treasuries. (Source: ME)