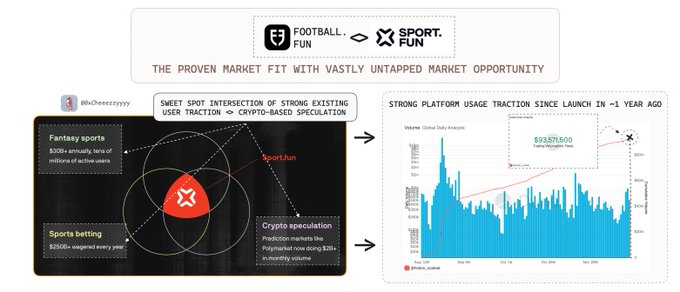

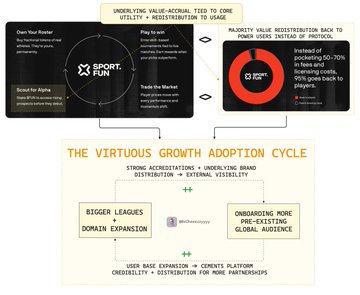

Not many projects demonstrate true market fit before running a community sale. Even fewer do it through actual fundamental performance, not incentives or hype. But when a product sits at the intersection of large existing user behaviour <> crypto-native speculation, real traction potentially turns into a durable one. Football.Fun and LEGIONSports gambling is one of those rare categories: 🔸$250B+ wagered annually 🔸Prediction markets hitting ~$2B in monthly volume These are massive cultural & seasonal cycles that naturally drive repeat participation. And this is why @footballdotfun stands out so clearly. Its historical performance since Q3 2024 demonstrates this: 🔹$90M+ total trading volume 🔹$10M+ actual underlying revenue 🔹$30M+ in user deposits from 20,000+ unique paying users Notably, strong user retentivity was reflected in 1st week (71%) → 2nd week (51%) → 1st month (35%) All these reflects strong consumer confidence + usage where not surprisingly, it topped @base’s consumer app leaderboard by revenue in Q3. Out of all the metrics, the strongest signal here is retention where it reinforces one thing: distribution is real, not subsidised. ========== On The Horizontal Expansion Flywheel: The most compelling part of FootballDotfun isn’t just its performance to date, it’s the linearity of its expansion roadmap. Through a horizontal scaling approach, recent + upcoming expansions includes: 1. NFL already launched → $1.8M pre-sale, $2M day-1 volume 2. NBA coming Q1 2026 3. Cricket, F1, tennis, and others pending demand signals The expansion into globally recognised leagues with built-in fandom + new sports domains → Unlocks a massive, pre-existing global audience where benefit from external visibility, larger liquidity pools + stronger network effects. Football.Fun and LEGIONAs more leagues go live, you probably can expect each new market gets easier to bootstrap because distribution is already in place. And this is how valuation compounds with actual fundamentals. Finally, on monetising value accrual via $FUN. $FUN structured to route value back into the ecosystem, reinforcing usage, activity & long-term engagement. Going through the announced token utility, this is how I see: A strong product + strong retention + strong horizontal expansion + clear token value flows = a rare alignment in consumer crypto. In a market where most apps chase “adoption” through incentives, this is one of the few building on real demand w/ real money at stake. ========== On $FUN Sale Deeds on @legiondotcc: 🔸 Sale Window: Dec 16, 1PM UTC → Dec 18, 1PM UTC 🔸 FDV: $60M 🔸 Soft Cap Target: $3M 🔸 Terms: 50% unlocked at TGE w/ remaining 50% vested linearly over 6 months *Allocations will be finalised by Dec 20, 1PM UTC upon sale conclusion. Considering the value proposition + given terms, it looks fairly reasonable imo but as always, DYOR NFA

Football.Fun

@footballdotfun

12-15

At SDF, we’re about to hit one of our most important milestones yet: the upcoming sale of our native ecosystem token, $FUN.

After carefully reviewing how to launch the token in a way that reflects our principles of product-first execution and aligned incentives, we chose to

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content