Market Update aims to provide readers with the latest market reports and key digital asset data.

Article author: 0x9999in1

Article source: ME

The crypto market generally declined, with 24-hour drops typically ranging from 2% to 5%. The DePIN sector led the decline, falling 5.8%, with Filecoin (FIL) down 6.29% and Render (RENDER) down 7.07%. Additionally, Bitcoin (BTC) fell 3.19%, dropping below $86,000, while Ethereum (ETH) fell 4.11%, falling below $3,000.

In other sectors, the CeFi sector fell 3.02% in the last 24 hours, with Aster (ASTER) down 15.82%; the Layer 1 sector fell 3.34%, with Sui (SUI) down 8.35%; the Layer 2 sector fell 4.03% in the last 24 hours, with SOON (SOON) down 11.09%; the Meme sector fell 4.31%, with PIPPIN (PIPPIN) bucking the trend and rising 25.96%; the PayFi sector fell 4.81%, with Telcoin (TEL) down 8.85%; and the DeFi sector fell 4.93%, but MYX Finance (MYX) surged 9.96% intraday.

The crypto sector indices, which reflect the historical performance of the sector, show that the ssiAI, ssiDePIN, and ssiRWA indices fell by 7.05%, 6.80%, and 6.41%, respectively.

ETF Directional Data

According to SoSoValue data, the XRP spot ETF saw a total net inflow of $10.89 million yesterday (December 15, Eastern Time).

Yesterday (December 15th, Eastern Time), the XRP spot ETF with the largest single-day net inflow was the Franklin XRP ETF (XRPZ), with a single-day net inflow of $8.19 million and a historical cumulative net inflow of $193 million.

The second largest inflow was the Canary XRP ETF (XRPC), with a net inflow of $1.61 million in a single day. The total historical net inflow of XRP has reached $377 million.

As of press time, the XRP spot ETF has a total net asset value of $1.12 billion, an XRP net asset ratio of 0.98%, and a cumulative net inflow of $1 billion.

BTC Directional Data

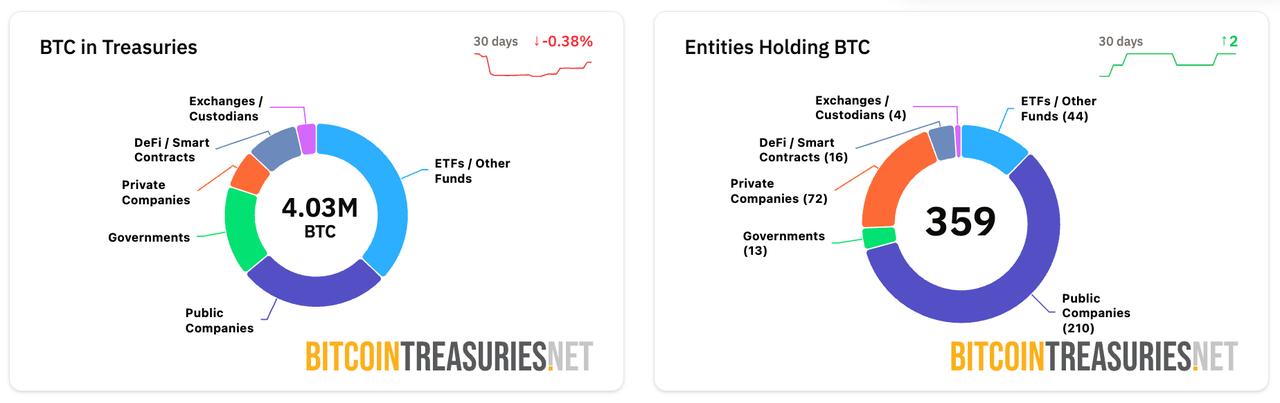

According to data from BitcoinTreasuries, 210 listed companies currently hold a total of 1,087,066 Bitcoins, accounting for 5.17% of the total Bitcoin supply. Among them, Strategy holds the largest amount, with 671,268 Bitcoins, accounting for 61.75% of the holdings of listed companies.

Stablecoin data

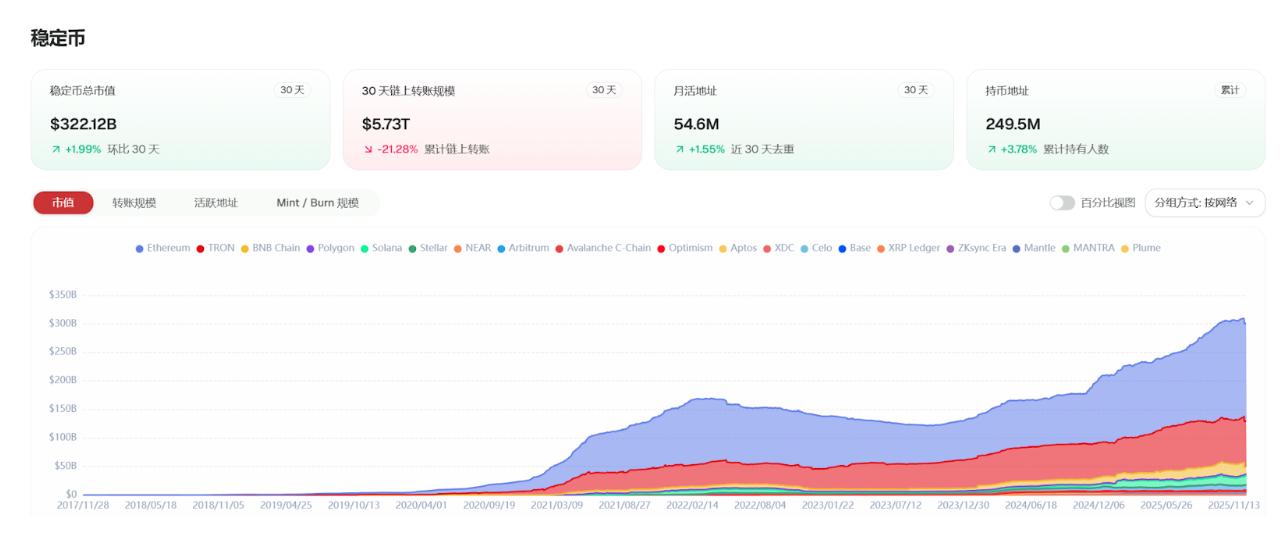

According to CoinFound data:

USDT market capitalization: US$198.99 billion

USDC market capitalization: $78.37 billion

USDS market capitalization: $11.15 billion

USDe market capitalization: $6.58 billion

PYUSD Market Cap: $3.92 billion

USD1 Market Cap: $2.77 billion

Market Dynamics

Visa launches stablecoin consulting practice to help institutions build stablecoin strategies.

PayPal PYUSD completes OCC trust conversion, becoming the largest federally regulated USD stablecoin.

The Italian Agnelli family unanimously rejected Tether's $1.3 billion offer to acquire Juventus football club.

Summarize:

The global stablecoin market is stable, with a slight increase in total market capitalization. Trading activity and user participation have declined in the short term, while the long-term holding group continues to expand. Currently, it serves as a safe-haven asset during the crypto market downturn.

RWA Directional Data

According to CoinFound data:

Commodity market capitalization: $3.71 billion (+2.24%)

Government bond market value: $1.2 billion (+1.21%)

Institutional fund market capitalization: $2.78 billion (-0.31%)

Private lending market capitalization: $34.48 billion (+0.88%)

Market value of US Treasury bonds: $8.97 billion (-1.58%)

Market value of corporate bonds: $260 million (-0.34%)

X-Stock Market Cap: $620 million (-3.08%)

Market Dynamics:

Orderly has launched trading in Gold (XAU) and Silver (XAG) with 20x leverage. Its RWA market uses institutional-grade oracles to provide fast and reliable pricing, operating on the same engine as crypto perpetual contracts.

JPMorgan Chase pushes for tokenized funds on Ethereum; UK FCA to fully regulate crypto.

Summarize:

Corporate bonds and commodities have been included in the S-level narrative, X-Stocks have received implicit SEC approval, and overall liquidity injections and regulatory benefits support the market's transformation towards institutional-level assets. The market narrative favors RWA's dominance in 2026, with liquidity and compliance infrastructure becoming key factors.