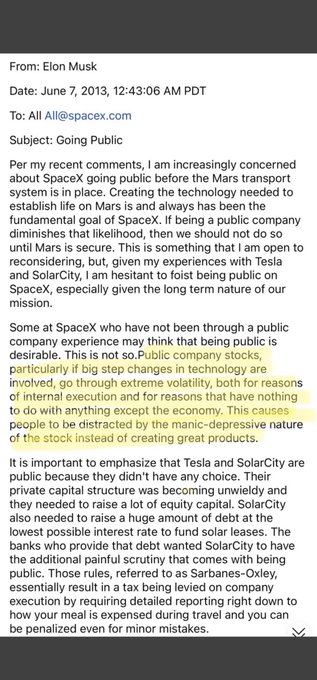

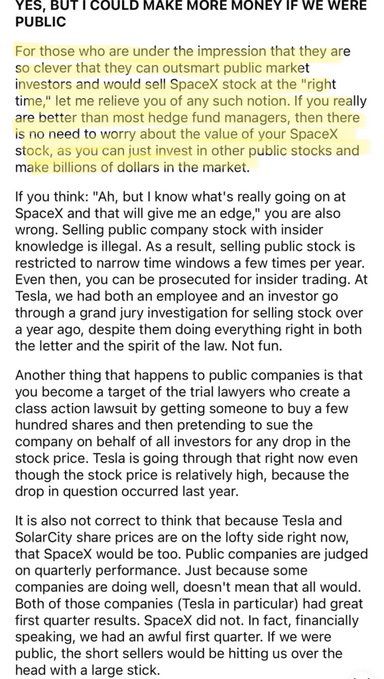

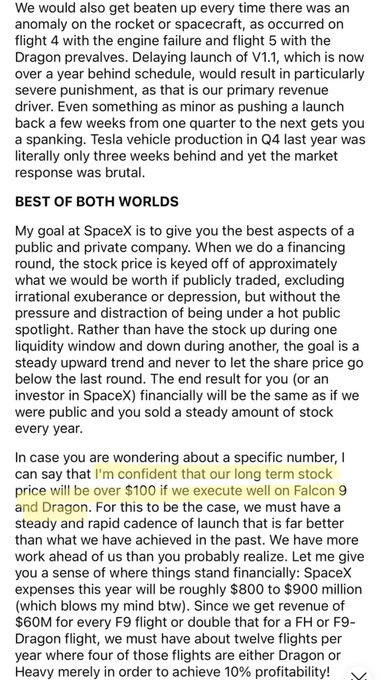

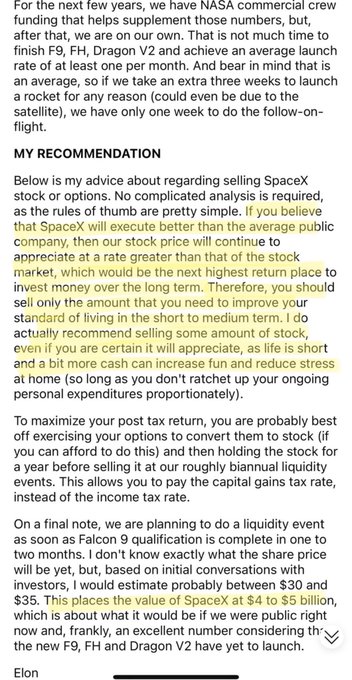

Elon e-mail from 2013 on why SpaceX should stay private until it’s reached certain technological milestones: ▫️ “Public company stocks, particularly if big step changes in technology are involved, go through extreme volatility, both for reasons of internal execution and for reasons that have nothing to do with anything except the economy. This causes people to be distracted by the manic-depressive nature of the stock instead of creating great products.” ▫️ SpaceX was valued at $5B in 2013 and he thought if Dragon and Falcon 9 were well executed the business could be worth $15B. Meanwhile, the company would keep offering secondary sales for employee liquidity and this was his recommendation on whether or not to sell: ▫️ “Below is my advice about selling SpaceX stock or options. No complicated analysis is required, as the rules of thumb are pretty simple. If you believe that SpaceX will execute better than the average public company, then our stock price will continue to appreciate at a rate greater than that of the stock market, which would be the next highest return place to invest money over the long term. Therefore, you should sell only the amount that you need to improve your standard of living in the short to medium term. I do actually recommend selling some amount of stock, even if you are certain it will appreciate, as life is short and a bit more cash can increase fun and reduce stress at home (so long as you don't ratchet up your ongoing personal expenditures proportionately).” ▫️ The concept of Starlink was unveiled in 2015. The first constellation was launched in 2019. Starlink is projected to do $20B+ sales next year, steady revenue (on top of world-beating launch business) that will definitely limit volatility as a public co to pursue next big tech changes (eg. AI data centre opportunity).

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content