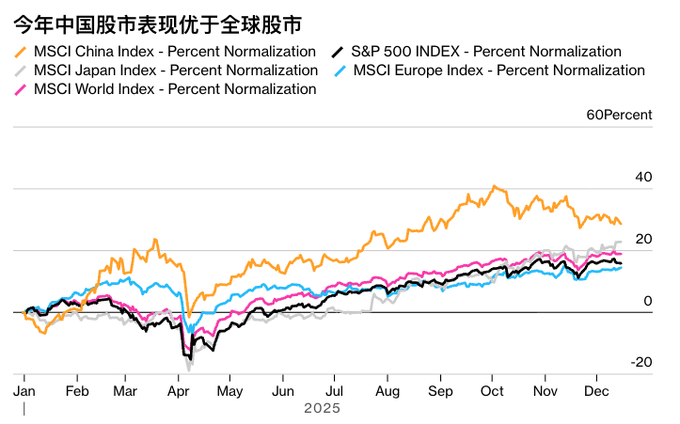

A stock market bull market is often a barometer of a great power's rise. The United States: A Long-Term Bull Market King, a Perpetual Motion Machine of Innovation (Classic): 1942-1966 Post-War Bull Market: Dow Jones Industrial Average rose over 500%, lasting 20 years; 1990s Tech Bull Market: S&P 500 rose over 400%. Secret: Innovation Wave (Automobiles → Internet) + Global Hegemony + Mature Institutions. Result: A century-long bull market, S&P 500 rose ten thousandfold. Long bull markets, short bear markets, guaranteed wins! Japan: A Bubble Frenzy, 30 Years of Aftereffects (Classic): 1986-1989: Nikkei surged from 10,000 to 39,000, a rise of over 300%. Secret: Low Interest Rates + Real Estate Speculation + Currency Frenzy. Result: The bubble burst in 1990, the Nikkei fell 80%, and it took 30 years to recover to its peak. A rapid bull market inevitably crashes! China 🇨🇳: Evolving from a rapid bull market to a long-term bull market – Classic examples: 2005-2007 Stock Reform Bull Market (up 500%+); 2014-2015 Leveraged Bull Market; 2025 Current Bull Market (Number One Globally, Up 40%+). Secret: Policy dividends + economic transformation + technological self-reliance (new energy, AI, chips). Result: Still on the way! Past booms and busts have been followed by more stable fundamentals, increasingly resembling a healthy American-style bull market. The US relied on innovation for long-term growth, Japan collapsed due to its bubble economy, and China is evolving from a "rapid bull market" to a "long-term bull market"—this rise of a great power has only just begun!

This article is machine translated

Show original

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content