The non-farm payroll data released tonight was more bark than bite, having little impact, so I won't elaborate. After yesterday's sharp drop and bottoming out, we're currently in a low-level consolidation and minor rebound phase. I think the time to buy the dips is getting closer; bulls can now begin their gradual accumulation.

In the past 24 hours, a total of 102,332 people across the internet have had their positions liquidated, with a total liquidation amount of $258 million. Long positions were liquidated for $152 million and short positions for $106 million.

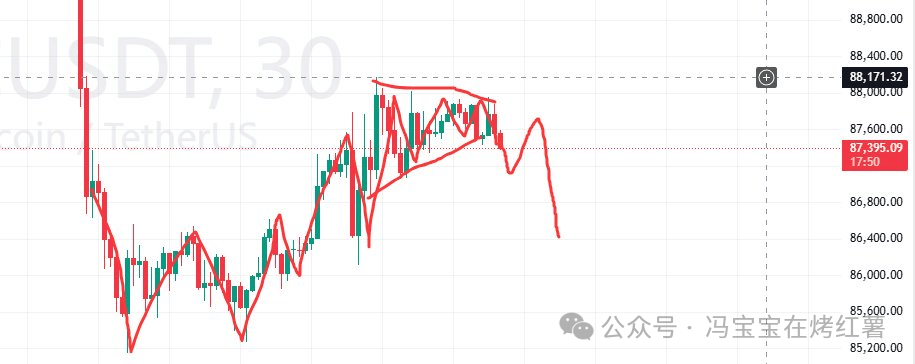

BTC

The Bitcoin short position has been successfully entered, with a cost basis around 88,000. The price is currently in a minor triangle consolidation pattern, but has broken below the lower trendline, so a short-term pullback is highly probable. The minor support level is at 86,000; if this level is broken, the short position can be held.

ETH

Ethereum's rebound has been weak. While its rebounds in the previous days were stronger than Bitcoin's, last night's rebound was too feeble, failing to even reach 3000 before falling back. Our short positions haven't been filled yet, and we expect it to fluctuate for a while. As long as it doesn't break the short-term low on smaller timeframes, there's still a chance for a rebound to around 3050. Therefore, the short positions planned yesterday can continue to be placed and awaited.

Copycat

There are two core gameplay styles for on-chain meme Memecoin; choose the one that suits you best for stability.

1. Gatling gun style: This is a short-term, high-frequency, wide-net approach, focusing on hot topics, placing multiple orders, taking profits when they are made and cutting losses when they are lost. It consumes a lot of capital and time spent monitoring the market (commonly used by the "car head" style).

2. Single-point sniping style: This is suitable for retail investors. They wait for the leading stock to pull back before entering the market and then hold the position for a long time. The risk is low and they don't need to keep an eye on the market, but the potential returns are limited and they may miss out on the large MC memecoin.

Both approaches have their advantages and disadvantages. The key is to consider your own funds and time. If you don't have enough resources, observe more and don't blindly rush in to become someone else's fuel.

$PTB

PTB surged 60%, reaching a high of 0.0068, very close to the target of 0.007. I'm preparing to take profits and exit, having made approximately $3300 this time. As the price rose, my margin increased from 380 yesterday to 440 today. Margin increases during price surges and decreases during price drops, so going long usually yields more profit than short. Next, I'll select the next potential coin.

$NIGHT

NIGHT is also one of the newly listed coins, and its price movement is more erratic than any other coin! When BTC fell, it didn't move, and it can be said that it completely does not follow the market trend. Such erratic coins usually experience a big surge.

$ASTER

Since CZ admitted to being trapped in ASTER, the project team seems to have completely given up on supporting its price, and it continues to fall while other Altcoin rebound. I am currently holding short positions to hedge against spot losses. So what makes ASTER have a market capitalization of billions? It's unreasonable to say that CZ bought in; that's just short-term news and doesn't change the long-term trend. A bear market will bring everything back to its true value, and the time to buy is when the price has bottomed out.

Every sharp drop is followed by a period of great potential. Those who are unsure about future market strategies can follow Potato (or similar product/service): TDTB07

$HYPE

HYPE is still falling. If anyone tells me now that a certain coin has good fundamentals and is a good time to buy the dips, I'll think they're crazy. How many coins in the crypto have better fundamentals than HYPE? Even HYPE can't hold up in a bear market. The old rule is to buy the buy the dips when it falls below 20.