Aave has released its 2026 strategic roadmap, with the V4 protocol, the institutional marketplace Horizon, and the mass-market app App as its three pillars, aiming to become a trillion-dollar on-chain global credit infrastructure.

Written by: Stani.eth, Founder of Aave

Compiled by: AididiaoJP, Foresight News

I've been involved in building Aave for nearly a decade, long before the concept of DeFi even took shape. I've witnessed countless hype cycles rise and fall, but our mission has remained constant.

When Aave was founded, the entire DeFi sector had less than $1 billion in funding. Today, Aave alone is more than 50 times larger than it was then.

Over the years, the team has undergone significant turnover. Aave Labs has been building its capabilities for over seven years, and few teams can match our track record. We continue to deepen our expertise:

- Aave protocol V1, V2, V3, and now V4

- Aave's native stablecoin GHO

- For four years, they continuously responded to scrutiny from the U.S. Securities and Exchange Commission.

- Aave.com and its maintenance, as well as the upcoming Aave Pro.

- Cross-chain extension of GHO

- First successful deployment in a non-EVM environment

- Aave App

- Aave technical documentation and developer toolkit

- ...

Today, the Aave Protocol has become the largest, most trusted, and most liquid lending protocol in history, firmly establishing its unique position in the industry.

Despite Aave's many achievements, I firmly believe we are still in the early stages compared to the future. This article will outline our vision for the coming decades: bringing the next trillion dollars of assets to Aave and attracting millions of new users to the blockchain.

Looking back at 2025

This year is Aave's most successful year to date.

Our net deposits peaked at $75 billion. Even more impressively, since its launch five years ago, Aave has processed a total of $3.33 trillion in deposits and issued nearly $1 trillion in loans.

Over the past year or two, we have actively embraced the cross-chain ecosystem within the Aave ecosystem. Leveraging our consistent strength, Aave has become the only protocol with a total value locked across four chains exceeding $1 billion.

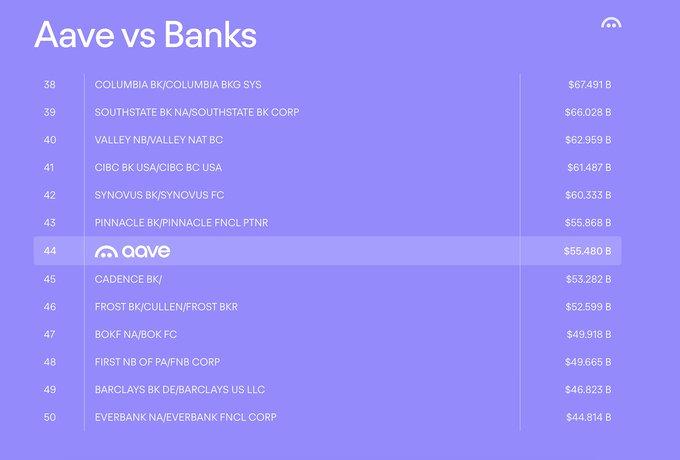

What's even more remarkable is that the Aave protocol is now comparable in size to the top 50 banks in the world's financial center, the United States.

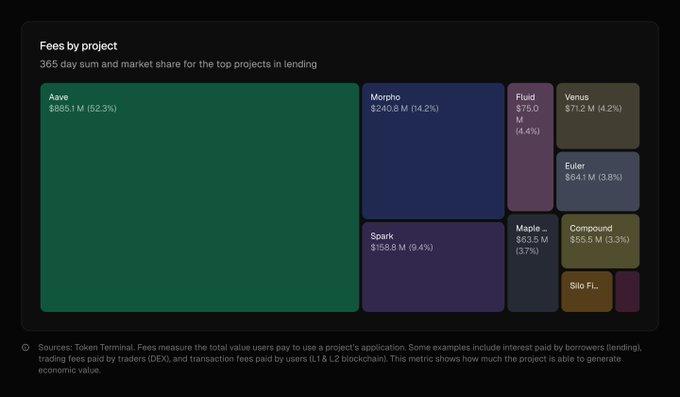

All this growth has given Aave a 59% share of the DeFi lending market and 61% of all active DeFi loans.

This year, the protocol generated $885 million in fees, accounting for 52% of the total fees of all lending protocols, exceeding the combined total of its next five largest competitors. Based on this fee revenue, we launched a substantial AAVE token buyback program.

The fact that a DeFi protocol can continue to operate at this scale is unprecedented in the history of our industry.

The market has demonstrated through its actions that Aave will exist for a long time.

Next, I will elaborate on Aave Labs' plans and outlook for next year.

Looking ahead to 2026

Currently, our strategy for next year revolves around three pillars: Aave V4, Horizon, and the Aave App.

Aave V4

Aave V4 will make Aave a pillar of the entire financial system. This is a complete overhaul of the Aave protocol.

Its core innovation lies in unifying liquidity through a "center-radius" model. The V4 architecture will replace the previous decentralized liquidity pools, instead establishing a funding "center" on each chain. Based on these centers, dedicated "radius" modules can be built to provide customized lending markets for various assets.

This will enable Aave to hold trillions of dollars in assets, making it the preferred platform for any institution, fintech company, or enterprise to access deep, reliable liquidity.

Next year, we will combine V4 with a brand-new developer experience. For the past few months, Aave Labs has been building a toolset designed to make developing products based on Aave easier than ever before.

In 2026, Aave will become an unprecedented incubator for new markets, new assets, and new integration models. We will continue to work closely with fintech companies and collaborate with DAOs and partners to gradually increase the total value locked throughout the year.

Horizon

Horizon is the bridge to the next trillion-dollar asset. Launched earlier this year, it is Aave's dedicated marketplace for institutional real-world assets. Horizon allows eligible institutions to borrow stablecoins using tokenized assets such as U.S. Treasury securities and other credit instruments as collateral.

This is a customized solution built by Aave Labs to meet the compliance and operational needs of top global financial participants. By providing a secure and efficient on-chain entry point for institutional funds, Horizon becomes a key vehicle for bringing traditional finance onto the blockchain on a large scale.

Horizon will attract numerous top financial institutions to Aave in ways that were previously impossible, expanding Aave's asset base to over $500 trillion.

In a very short time, Horizon has become the largest and fastest-growing platform for real-world asset-backed lending. We expect this momentum to continue.

Horizon currently has net deposits of $550 million. In 2026, we will rapidly expand our size to over $1 billion by deepening our partnerships with leading institutions such as Circle, Ripple, Franklin Templeton, and VanEck, and introducing mainstream global asset classes.

Aave cannot play a core role in the financial system if it cannot bring assets such as stocks, ETFs, funds, real estate and mortgages, commodities, accounts receivable, bonds, and fixed income into on-chain lending. Horizon was created precisely for this purpose.

Aave App

The Aave App is a "Trojan horse" that has attracted millions of users. As the protocol's flagship mobile application, it is dedicated to bringing DeFi into the lives of ordinary people.

Although the protocol itself is complex financial software, this application embodies our commitment to simplifying complexity, providing an intuitive user experience, and effectively addressing real needs in the current economy.

The Aave App integrates with Push, providing access to stablecoins globally with zero fees, covering over 70% of the world's capital markets. The Aave App will offer the best fiat-to-DeFi experience on the market.

Many people are unaware that mobile financial technology is an industry worth over $2 trillion. While apps like CashApp and Venmo boast tens of millions of users, they lack comprehensive savings services. Aave App, however, promises to permanently change the way people save.

Early next year, we will fully roll out the Aave App, embarking on our journey to acquire our first million users. This will directly drive the growth of the Aave protocol through a completely new and untapped market. Without widespread product adoption, Aave cannot achieve its trillion-dollar scale.

Maintaining independent insights, persisting in innovation, and freely designing products have always been the greatest driving forces behind Aave's development.

AAVE's aligned interests

At Aave Labs, we focus on three main goals:

- Bringing the next trillion-dollar asset onto the blockchain

- Attracting millions of new users to DeFi

- Driving AAVE to success

This vision requires us to build products and financial infrastructure that go beyond traditional financial alternatives, achieving a fundamental upgrade.

The key is that Aave Labs remains aligned with the long-term success of the Aave protocol. Actions speak louder than words, and consistency is proven through concrete actions:

- Aave Labs and its employees are the largest holders of AAVE.

- Everything we've built is designed to capture the core fees of a value-driven protocol, with all revenue ultimately going to the DAO.

- Aave Labs delivers far more products to Aave than any other contributor.

- Over the past eight years, I have dedicated countless hours to driving the growth of the Aave Protocol, from product innovation and global business development to the numerous events held to build the community.

By the way, I added $10 million worth of AAVE on-chain yesterday.

I also closely follow the discussions on the DAO forum. Let me state this clearly: no one cares more about Aave's development than I do.

Public debate is a characteristic of DeFi governance, not a sign of disharmony.

Aave as a global credit layer

Our vision for the next few decades is to build the foundational credit layer of the on-chain economy. Aave Labs firmly believes that in the future, any value can be tokenized, used as productive collateral, or lent out without intermediaries.

In that future, Aave will become the cornerstone of all financial activities and the underlying liquidity layer upon which the next generation of financial products and services rely.

The efforts of the past few years have laid a solid foundation for our ambitious goals, which we have yet to achieve.

Publicly building a DeFi ecosystem is no easy feat. Governance and DeFi are fraught with challenges. Aave is one of the few DeFi protocols that has stood the test of time, which is precisely what makes it exceptional. Innovation has always been the primary driving force behind the Aave ecosystem's development and is the reason for our community's immense success.

But now is not the time to celebrate...it's just the beginning.