HashKey has officially listed on the Hong Kong Stock Exchange (HKEX) following its initial public offering (IPO) worth US$206 million, with significant price fluctuations on its first day of trading.

HashKey has officially listed on the Hong Kong Stock Exchange (HKEX) following its initial public offering (IPO) worth US$206 million, with significant price fluctuations on its first day of trading.

HashKey, Hong Kong's largest cryptocurrency exchange, has made its stock market debut after completing a $206 million IPO.

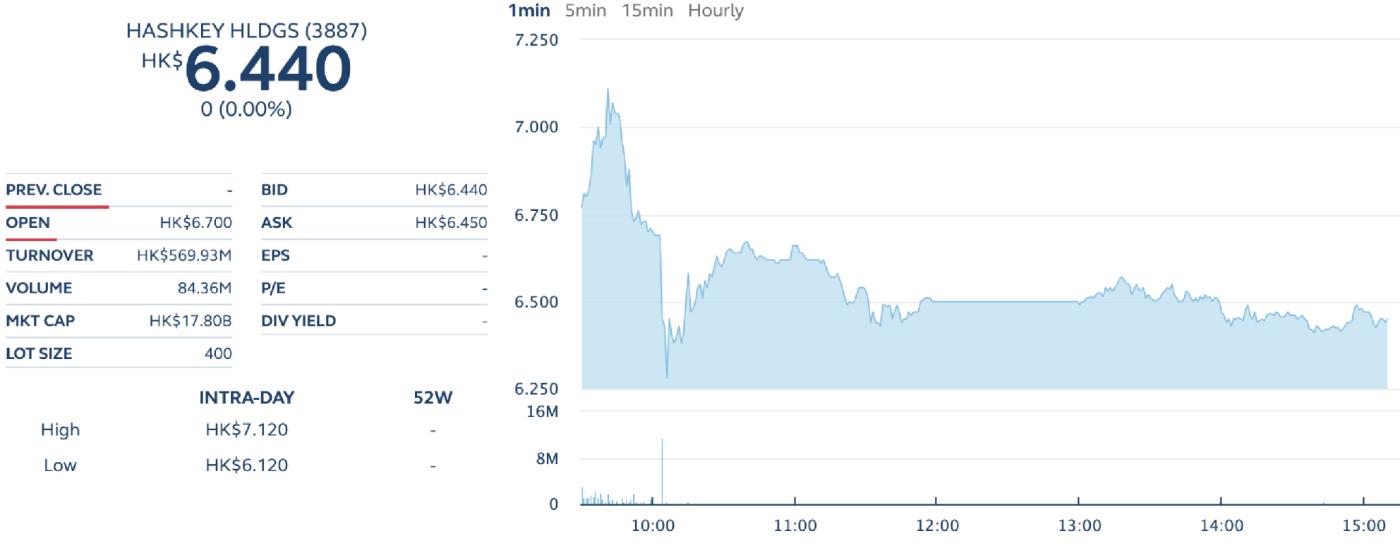

HashKey Holdings' shares were officially listed on the HKEX main board on Wednesday, opening at HK$6.70 (approximately US$0.86), according to data from the exchange.

In a blog post, HashKey Group announced that it has become the first digital asset company in Asia to go public through an IPO in Hong Kong.

“This milestone marks the company entering a new phase of growth, while also laying a stronger foundation for global expansion and long-term strategies,” HashKey announced.

HashKey shares fall after IPO exceeds subscription limit.

Launched on December 9th, HashKey's IPO attracted strong demand from both institutional and individual investors. A total of 240 million shares were sold, raising HK$1.6 billion (approximately US$206 million), according to filings with the HKEX.

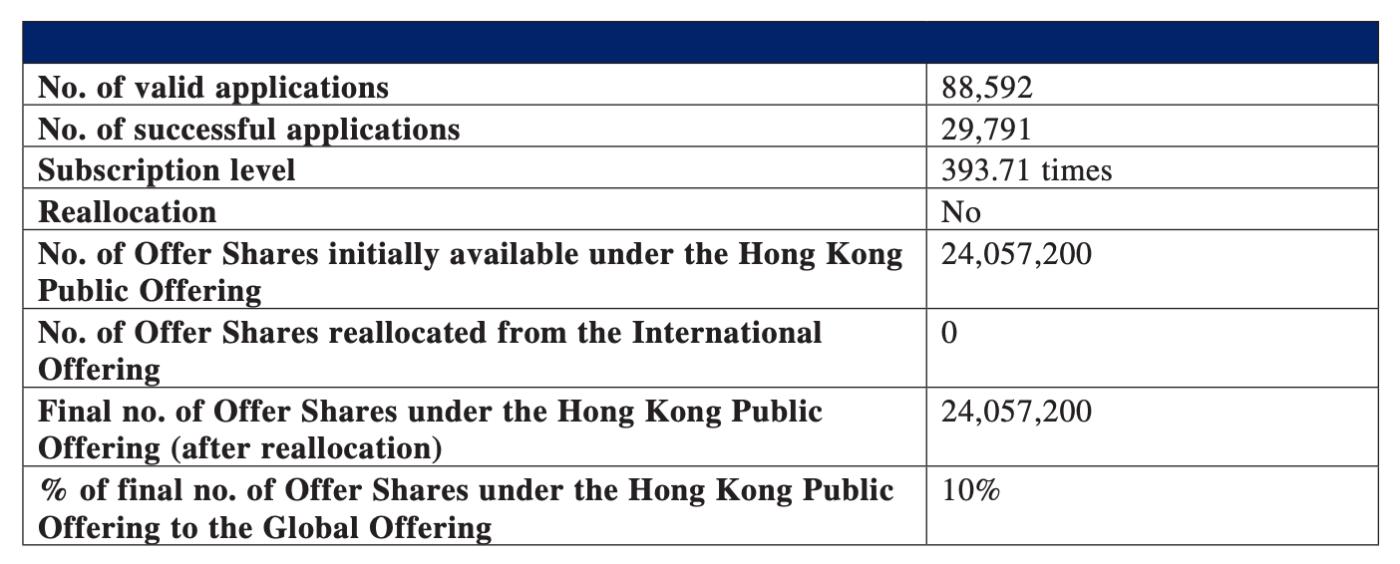

The Hong Kong offering was subscribed to nearly 394 times its offered amount, with 24 million shares distributed. Meanwhile, the international IPO reached 5.5 times the offered amount in terms of subscriptions, with 216.5 million shares sold.

This Capital round attracted nine cornerstone investors, including Cithara Global Multi-Strategy SPC, UBS Asset Management Singapore, Fidelity , and CDH. Cithara and UBS were the two largest investors, allocating approximately 17.5 million and 11.7 million shares respectively.

In its first trading session, HashKey shares fluctuated sharply in the morning, at one point rising about 5% from the opening price to 7.1 HKD (0.91 USD), before falling to a low of 6.1 HKD (0.78 USD).

In the afternoon, the stock continued to trade below its IPO price, around HK$6.5 (US$0.84).

“Listing on the HKEX is a starting point that comes with greater responsibility,” said Xiao Feng, Chairman and CEO of HashKey, at the listing ceremony.

"As a company deeply committed to Hong Kong, we have always believed that legal compliance is a core element for achieving long-term success and sustainable growth," he emphasized, adding that the company will continue to invest in upgrading infrastructure, security, and compliance.

HashKey's IPO adds to the growing list of crypto companies planning to go public in 2025, which includes USDC stablecoin issuer Circle , along with exchanges Bullish and Gemini .

Additionally, the US cryptocurrency exchange Kraken also announced that it filed for a confidential IPO registration last November.