Compiled by: Block unicorn

Foreword

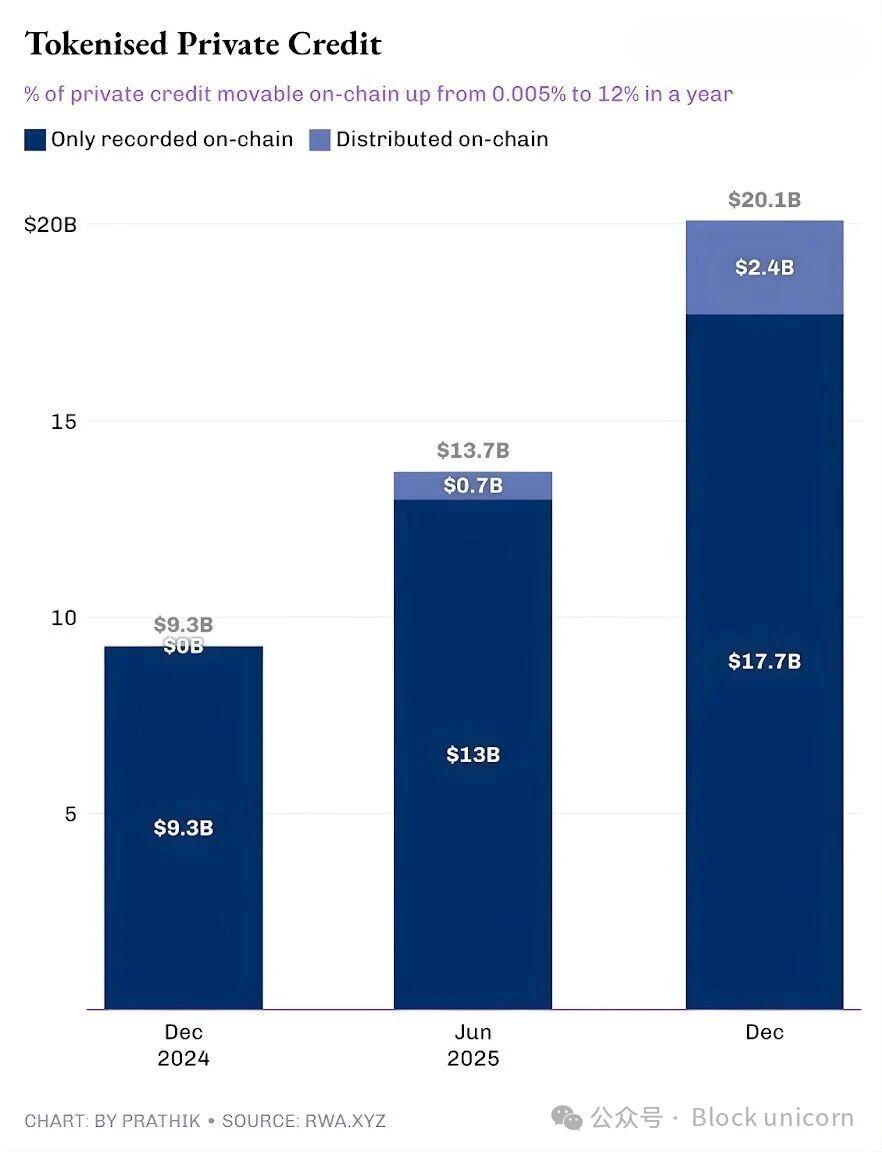

Private lending is gaining momentum on tokenized real-world assets ( RWA ) platforms. Over the past year, tokenized private lending has been the fastest-growing category, jumping from less than $50,000 to approximately $2.4 billion.

If stablecoins are excluded (whose payment channels cover all on-chain activities), tokenized private lending ranks second only to on-chain commodities. Top tokenized commodities include gold-standard currencies from Tether and Paxos, and cotton, soybean oil, and corn -standard tokens from Justoken. This appears to be a serious category, with real borrowers, cash flows, underwriting mechanisms, and yields, and is less dependent on market cycles compared to commodities.

But the story only becomes complicated when you delve deeper.

This $2.4 billion in outstanding tokenized private credit represents only a small fraction of the total outstanding loans. This indicates that only a portion of assets can actually be held and transferred on-chain via tokens.

In today's article, I will examine the realities behind tokenized private credit figures and what these figures mean for the future of this category.

Let's get straight to the point.

The dual nature of tokenized private lending

The total active lending volume on the RWA.xyz platform is slightly over $19.3 billion. However, only about 12% of these assets can be held and transferred in tokenized form. This illustrates the duality of tokenized private lending.

On one hand, there is "representative" tokenized private lending, where the blockchain only provides an operational upgrade by recording loans originating from the traditional private lending market through the establishment of an on-chain register of outstanding loans . On the other hand , there is a distributed upgrade, where the blockchain-driven market coexists with the traditional (or off-chain) private lending market.

The former is only used for recording and reconciliation, and is recorded in a public ledger. Distributed assets, on the other hand, can be transferred to wallets for transactions.

Once we understand this classification system, you'll no longer ask whether private lending is on-chain. Instead , you'll ask a more pointed question: how much private lending asset originates from the blockchain? The answer to this question might offer some insights.

The trajectory of tokenized private lending is encouraging .

Until last year, almost all tokenized private lending was merely an operational upgrade. Loans already existed, borrowers were repaying on time, and the platform was functioning properly; the blockchain simply recorded these activities. All tokenized private lending was simply recorded on-chain and could not be transferred as tokens. Within a year, this transferable on-chain share had climbed to 12% of the total traceable private lending.

It demonstrates the growth of tokenized private lending as a distributable on-chain product. This enables investors to hold fund units, pooled tokens, notes, or structured investment exposure in token form.

If this distributed model continues to expand, private lending will no longer resemble a loan ledger but rather an investable on-chain asset class. This shift will change the returns lenders derive from transactions. Beyond returns, lenders will gain access to a tool with greater operational transparency, faster settlement, and more flexible custody options. Borrowers will gain access to funds that are not reliant on a single distribution channel, which could be highly beneficial in a risk-averse environment.

But who will drive the growth of the distributable private credit market?

Figure effect

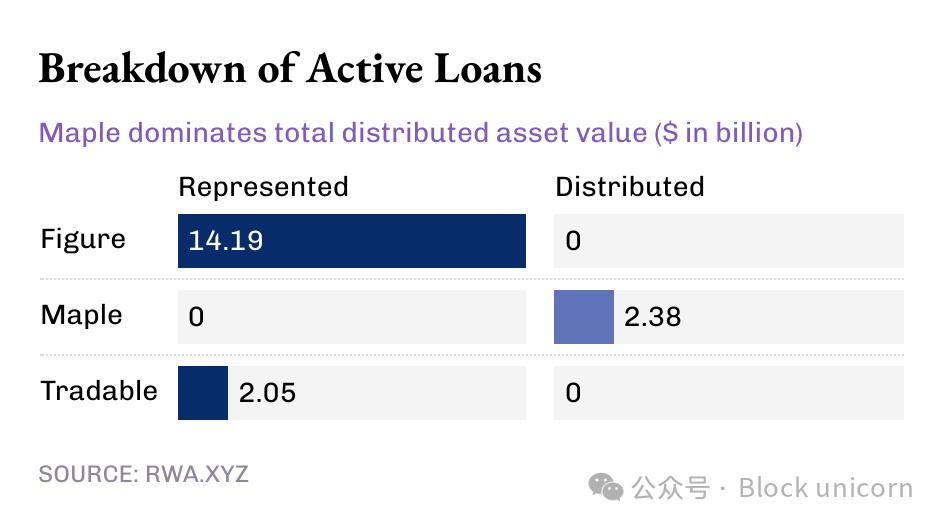

Currently, the majority of outstanding loans originate from a single platform, while other parts of the ecosystem constitute the long tail effect.

Figure has dominated the tokenized private lending market since October 2022, but its market share has fallen from over 90% in February to 73% currently.

But what's even more interesting is Figure's private credit model.

While tokenized private lending now exceeds $14 billion, all the value of this industry leader is reflected in the value of its " representative " assets, while distributed value is zero. This suggests that Figure's model is an operational pipeline that records loan disbursement and ownership traceability on the Provenance blockchain.

At the same time, some smaller players are driving the distribution of tokenized private credit.

Figure and Tradable hold all their tokenized private credits as representative value, while Maple 's value is distributed entirely through the blockchain.

From a macro perspective, the vast majority of the $19 billion in active on-chain lending is recorded on the blockchain. However, the trend of the past few months is undeniable: an increasing amount of private credit is being distributed via blockchain. Given the enormous growth potential of tokenized private credit, this trend is only likely to intensify.

Even with a size of $19 billion, RWA currently represents less than 2% of the total $1.6 trillion private lending market.

But why is it important to have “mobile, not just recorded ” private credit?

Portable private credit offers more than just liquidity. Gaining private credit exposure outside the platform through tokens provides portability, standardization, and faster distribution.

Assets acquired through traditional private lending channels trap holders within the ecosystem of a specific platform. Such ecosystems offer limited transfer windows, and secondary market transactions are cumbersome. Furthermore, negotiations in the secondary market are slow and primarily driven by professionals. This results in the existing market infrastructure wielding far more power than the asset holders.

Distributable tokens can reduce these frictions by enabling faster settlement, clearer ownership transfers, and simpler custody.

More importantly, "mobility" is a prerequisite for the large-scale standardized distribution of private credit, which is precisely what has been lacking in the history of private credit. In the traditional model, private credit takes the form of funds, business development companies ( BDCs ), and secured loan certificates (CLOs), each of which adds multiple layers of intermediaries and opaque fees.

On-chain distribution offers a different path: programmable wrappers enforce compliance (whitelisting), cash flow rules, and information disclosure at the tool level, rather than through manual processes.

That's all for today. See you in the next article.