The price of ASTER is under immense pressure. The Token has dropped nearly 20% in the last seven days and almost 10% in just the last 24 hours. The difference this time is who is selling.

After weeks of steadfast holding, Aster's most loyal "whales" have finally begun to gradually reduce their holdings. With both spot and Derivative data signaling caution, the chart shows a risk of a further 10% decline if key support levels are broken.

Loyal whales have shifted to a bearish trend in both spot and Derivative markets.

The clearest warning comes from the actions of whales in the spot market. In the last 24 hours, ASTER whales have reduced their holdings by 4.05%. After this sale, the whales' remaining balance is 70.39 million ASTER. This means that approximately 2.97 million Token have been sold. At the current price, this Token is equivalent to over $2 million in direct sales on the spot market.

ASTER whale: Nansen

ASTER whale: NansenWant to Also Read Token analyses like this? Sign up for the daily Crypto newsletter from editor Harsh Notariya here .

This is significant becausethese whale wallets had been consistently buying during previous dips. But the decision to sell when the market weakened suggests that confidence in a rapid price recovery had begun to wane.

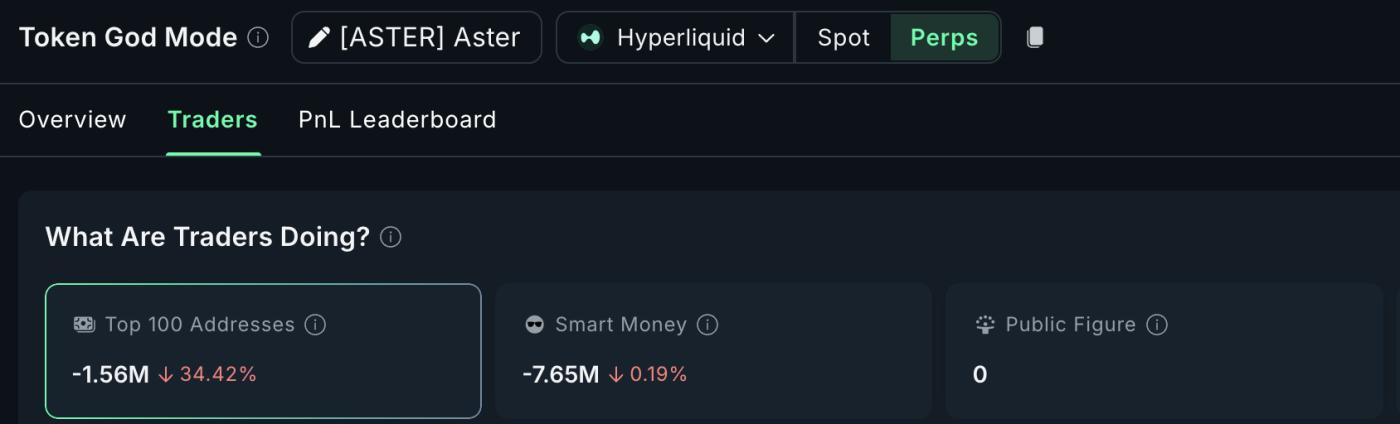

Derivative data also confirms the same message. The top 100 largest addresses (mega whales – typically high-leverage traders) reduced their positions by 34.42%. More notably, the remaining positions were mostly short positions.

Derivative are biased toward short selling: Nansen

Derivative are biased toward short selling: NansenWhen both spot whales and leveraged whales reduce risk at the same time, it usually indicates they expect prices to continue falling, rather than simply experiencing temporary volatility.

Smart money continues to withdraw.

The Smart Money Index is causing even more concern among investors. This index tracks the behavior of smart traders, who are typically quick to react to major market movements.

For ASTER , the Smart Money Index crossed below the signal line around November 22, 2023, and has been continuously declining since then. This crossover marks a transition from accumulation to distribution. Since then, the price of ASTER has continued to fall, and smart money has shown no signs of returning to the market.

Smart Money is still being sold: TradingView

Smart Money is still being sold: TradingViewThis is clearly demonstrated: even though the ASTER price is approaching the lower price levels within the Falling Wedge pattern (which is a bullish reversal pattern), smart traders are still not entering buy orders to anticipate it. Until the Smart Money Index rises and crosses back above the signal line, price rallies are more likely to be sold off rather than continue to rise sharply.

Combined with the whale activity, this suggests that the selling pressure is very proactive, not due to temporary emotional factors.

The ASTER price structure indicates an additional 10% downside risk.

On the chart, ASTER is still within a Falling Wedge pattern and is testing the very strong lower support zone. This pattern theoretically usually triggers a rebound, but only if clear buying pressure emerges – which is not currently happening.

If the lower trendline is broken, the next downside target would be around $0.66, meaning the price could fall by another 10% from the current level. If it falls below $0.66, the risk of it dropping to the $0.55 region would increase rapidly.

For an upward reversal to occur, the ASTER price needs to close the day above $0.96 – this is the upper resistance zone of the wedge pattern and also coincides with the old support zone. Otherwise, any upward bounce will only be a short-term technical rebound.

ASTER price analysis: TradingView

ASTER price analysis: TradingViewLarge whales are selling, Smart Money is staying on the sidelines, and the price of ASTER is continuously weakening due to a lack of support. Without a return of buying pressure soon, ASTER is likely to fall further in the near future.