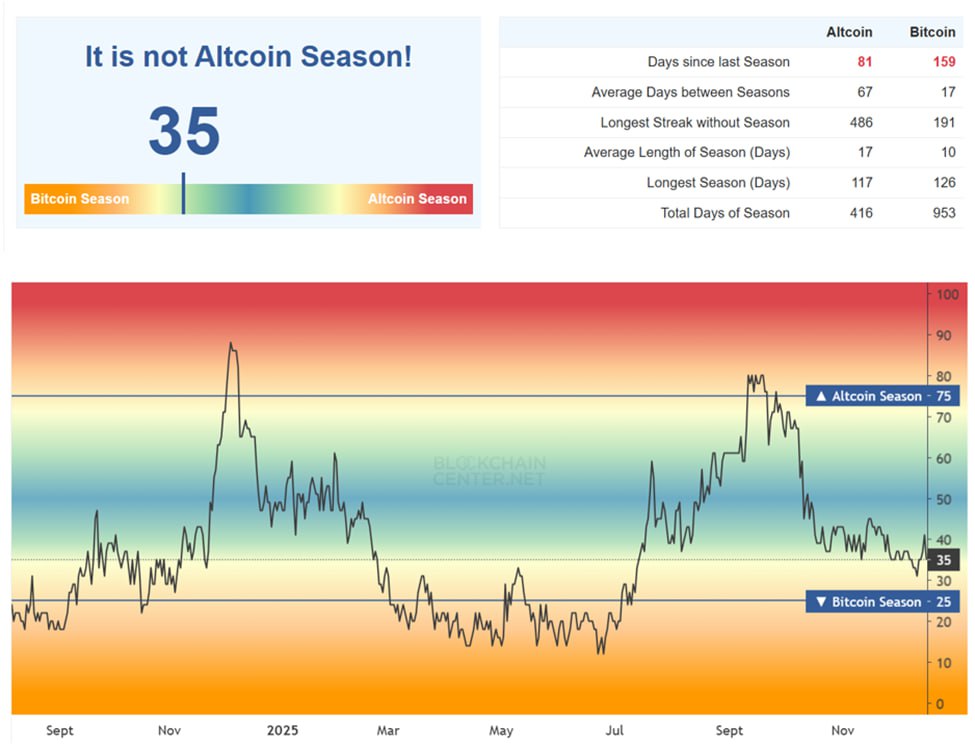

Donald Trump's return has brought everything to crypto except a massive price surge. When Donald Trump returned to the White House, many in the crypto market believed history was about to repeat itself. Friendly rhetoric, expectations of deregulation, institutional money flows, and renewed risk appetite—everything sounded so familiar that many assumed a new Bull run was inevitable. But the reality at the end of 2025 is quite different. The total crypto market Capital is now only about 20% of its peak under Biden. A chilling figure, enough to shake the faith of even the most steadfast holder . Ran Neuner bluntly called this a "serious problem." Liquidation is there, ETFs are available, the US government supports it, whales are still accumulating, and macro assets are peaking. Yet prices aren't going up. The general market sentiment is one of disappointment and confusion, as if the old rules are no longer in effect. Conversely, Gordon Gekko argues that nothing is "broken." This is simply a mature market where leverage has been filtered and emotions have been exhausted. Crypto is no longer a playground for the masses, but a game of patience. Perhaps the truth lies in the middle ground. Trump offered hope, but the post-Biden market structure has changed. Money is gravitating toward Bitcoin, ETFs, and safe havens. Altcoins are being left behind. Crypto isn't dead, but it's forcing investors to grow with it.

This article is machine translated

Show original

Sector:

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content