Author: BlockWeeks

In the cryptocurrency market, if you only look at market capitalization, you'll see a thriving, burgeoning digital utopia. Valuations of tens of billions of dollars, grand technical white papers, the halo of Turing Award winners... everything looks like the dawn of the next generation of the internet.

But if you change your perspective—to one that focuses solely on "on-chain real revenue (Fees)"—you'll see a completely different, even chilling, picture: in this so-called trillion-dollar market, the vast majority of "unicorns" are actually zombies that have long since stopped breathing.

Recently, BlockWeeks conducted a detailed analysis of the "Fees" data of the DeFiLlama public chain and discovered an unavoidable structural problem: crypto public chains have entered an era of "extremely concentrated profits and the collective stagnation of the long tail".

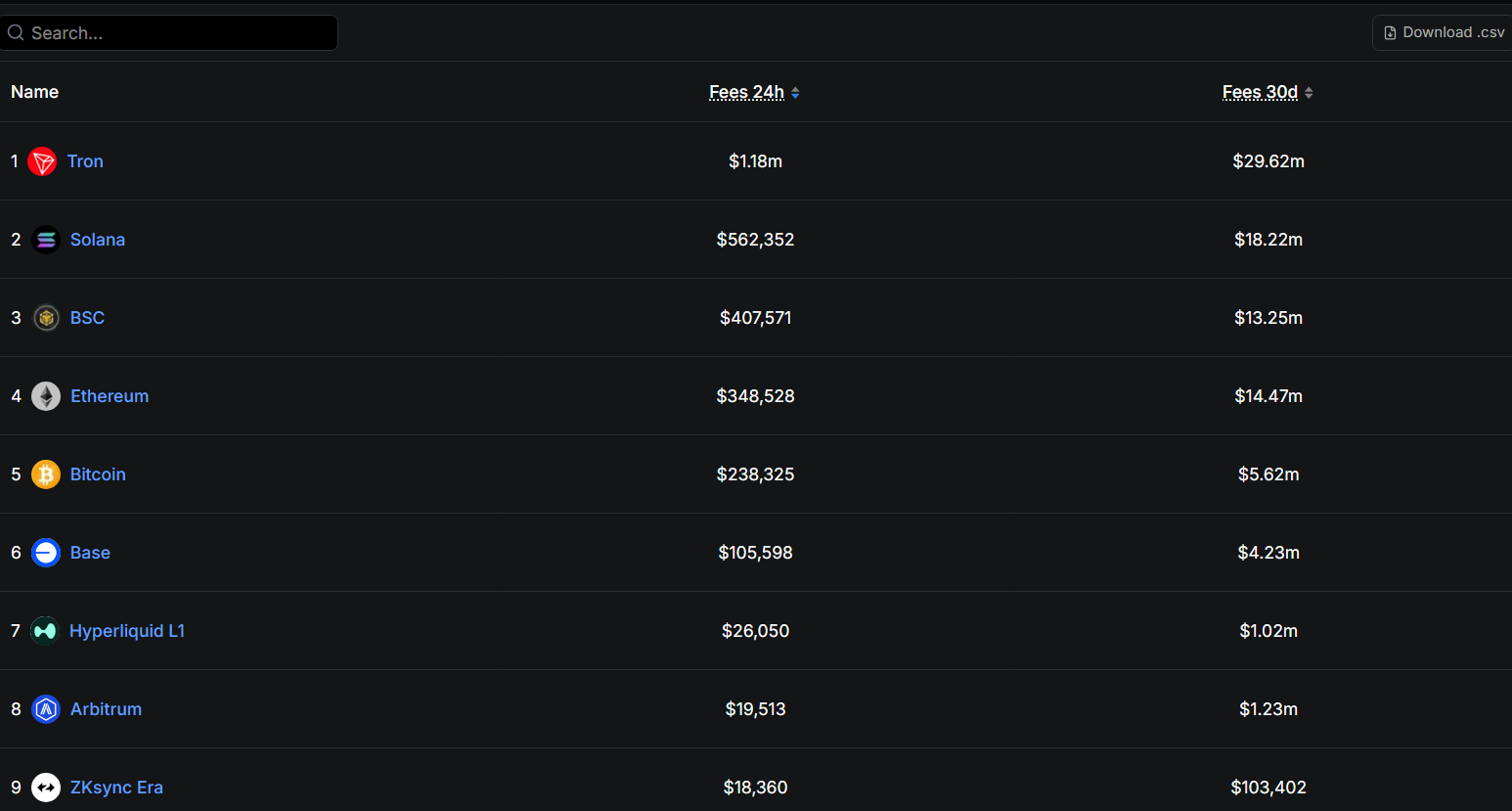

The core data in this article is sourced from DeFiLlama's "Fees / Revenue by Chain" dashboard (data retrieved on December 16, 2025). The "Fees" defined therein refers to the total fees paid by users on-chain (top-line), an approximate metric for measuring the scale of on-chain economic activity, rather than protocol net revenue. This article aims to use this open and unified standard to examine the on-chain value capture capabilities of various public chains.

I. The $17 Humiliation: The Demise of a Technological Utopia

According to publicly available data we scraped from DeFiLlama, the most alarming figure doesn't come from the top-ranked million-dollar giants, but from the bottom at $17.

This is Algorand—a public blockchain once touted as the "solution to the Blockchain Trilemma," founded by Turing Award winner Silvio Micali, and backed by top-tier technology—showing its total network protocol revenue on a particular day.

You read that right, it's not $170,000, it's $17.

At this moment, Algorand's market capitalization is still in the $1 billion range. The direct tax revenue generated by a $1 billion "digital nation" in a single day wouldn't even buy four lattes at Starbucks. This demonstrates that despite possessing state-of-the-art decentralized technology, its ability to capture economic value will approach zero if there is a lack of genuine, sustained demand for real-world applications.

This is not just an embarrassment for Algorand; it is the death knell for the entire "classical public blockchain" camp.

Take Cardano (ADA) as an example. A behemoth consistently ranked in the top ten by market capitalization, it boasts millions of holding addresses. However, data shows that its recent daily on-chain transaction fees have hovered around $6,000. This implies that, aside from asset transfers between holders and network maintenance staking, the chain lacks sufficient commercial activity to generate significant fees—no large-scale lending, no high-frequency trading, and no genuine, paid value exchange.

These public blockchains are like luxurious ghost towns built at great expense in the middle of the desert. The infrastructure is complete, the roads are wide, and the city hall (foundation) is well-funded, but there are no residents (active paying users) on the streets. The way they maintain operation is often that the city hall constantly sells its reserves (dumping tokens) to pay for operating costs.

II. Ugly Victory: Who is Really Capturing Value?

When you look at the top of the list, a fact that makes "technological fundamentalists" even more uncomfortable emerges: the most profitable technologies are often not the most "elegant" or "decentralized" technologies.

Tron tops the list, with daily transaction fees reaching a staggering $1.24 million. To many elitists, Tron might not be considered "technologically advanced." But the market has voted with its feet, providing the ultimate answer: payments are a necessity. Tron handles the vast majority of on-chain USDT transfers globally. In this industry rife with speculation and bubbles, Tron has inadvertently become the only payment layer application to achieve mass adoption—even though it's merely a shadow banking channel for fiat currency.

It can be said that payment, the oldest and most fundamental internet need, is currently the only cryptocurrency to achieve mass adoption. Tron's success serves as a powerful satire of all projects that pursue "perfect technology" while ignoring "real needs."

Following closely behind is Solana, with daily transaction fees approaching $600,000. Its success logic is more straightforward: it's the world's most active on-chain casino. Meme tokens, high-frequency DEX trading, and early access—these activities contribute the vast majority of its fees. Solana's moat is no longer TPS, but rather "attention flow." Base's rise, however, is even more disruptive (approximately $105,000 daily): it proves that distribution channels are far more important than the technology itself. Backed by Coinbase's massive user base, Base delivers a devastating blow to other L2 cryptocurrencies.

This provides a stark and clear revelation: in the current Crypto market, there are only two and a half proven business models capable of generating large-scale on-chain fees—low-cost payments (Tron), high-frequency speculation (Solana/Base), and the asset settlement layer (Ethereum), which is being increasingly eroded by L2.

In addition, those once highly anticipated "enterprise applications", "supply chain traceability" and "Web3 social networking" have not yet shown large-scale paid demand, at least at this stage, in the face of cold on-chain transaction fee data.

III. The Dilemma of VC Groups: Why is it that "they reach their peak as soon as they debut"?

This data also reveals another deep crisis: the new L1/L2 narrative model driven by huge venture capital (VC) funding is facing a brutal test of monetization.

We have seen that new public chains like Sui (approximately $12,000 per day), Sei (approximately $320 per day), and Starknet (approximately $10,000 per day), which launched with great fanfare and raised hundreds of millions of dollars, have on-chain transaction fee revenues that are severely inverted with their total circulating value (FDV) of billions or even tens of billions of dollars.

The standard script over the past few years has been: VC investment -> team builds up technical highlights -> attracting airdrop farmers to generate data -> token listing on exchanges to create wealth -> retail investors take over the narrative -> airdrop farmers leave -> on-chain activity data plummets.

This is why many new blockchains boast astonishing TPS and hundreds of thousands of daily active users when they launch, only to quickly become "ghost towns" within a few months. Because those users are mercenaries, not residents. When the airdrop expectations are met and the incentive subsidies cease, the true, organic demand is laid bare—daily transaction fee revenue of thousands or tens of thousands of dollars is simply insufficient to support a valuation dream of tens of billions.

We are facing a severe “block space inflation.” The industry has built too many chains, too many L2 layers, and too many data availability (DA) layers, but there is a severe lack of innovation at the application layer. This is like the frenzy of laying thousands of fiber optic cables at the beginning of broadband network rollout, but no Netflix, YouTube, or any killer application that needs to consume that bandwidth has yet to emerge.

IV. Investors' Awakening: From "Listening to Stories" to "Checking the Books"

For a long time, the valuation logic of the crypto market has been based on the "market dream ratio." The grander the narrative and the richer the imagination, the higher the market capitalization can soar.

However, 2024-2025 is becoming a watershed moment. With tightening macro liquidity and institutional investors demanding more substantial returns, the market is being forced back to rationality.

For investors, the logic must change:

Beware of "zombie coins": If a project has a market capitalization of billions, but its daily on-chain transaction fees are only a few hundred or a few thousand dollars, this extreme "mismatch" is often the starting point for a long-term decline. Its only support—community faith—will eventually run out.

Focus on "positive cash flow" capabilities: Look for ecosystems where users are willing to continue paying for services even without token incentives. Tron's stablecoin transfer fees, and Base and Solana's transaction fees, are direct reflections of real demand.

Acknowledging the importance of "channels and ecosystem": Base's success proves that pure technological advantage is no longer a strong competitive moat. Giants with massive user bases (like Coinbase) or native communities capable of fostering a fervent culture are the more valuable assets at this stage. Purely technology-driven public chains, if unable to address the questions of "who will use it and why," will ultimately become nothing more than academic showcases like Algorand.

Seeing through the VC game: Stop paying for the false prosperity driven by subsidies and airdrops.

Faced with the harsh reality of earning an average of $17 per day, instead of paying for grand narratives and empty "digital ghost towns," it's better to hold onto your wallet and turn to a few ecosystems that can generate real cash flow and have active paying users.

This is not to deny the long-term value of all technological exploration, but rather a necessary reckoning with the current distorted valuation system. Only when the market learns to pay for "real value" rather than overdrawing on "promises of the future" can the industry usher in a truly healthy dawn.

Important Notes and Evaluation Framework

The core of this article is to measure the "instant value capture capability" of various public blockchains using "on-chain transaction fees" as a unified and transparent benchmark. When reading and citing the conclusions of this article, please be sure to understand the following key background and limitations:

1. General Background Description

Differences in development stage: Some public blockchains may be technologically advanced but are in their early stages, and their user base has not yet reached a scale effect. The data in this article reflects the "current state," not the "final potential."

Impact of Fee Model: Some public blockchains are designed with ultra-low gas fees, and their native token prices are relatively low. This makes the "total fee revenue" in USD terms appear small even if the number of on-chain transactions is considerable. This suggests that the evaluation of such chains should be based on a comprehensive assessment of indicators such as the number of transactions and active addresses, but their upper limit in USD-denominated economic throughput remains an objective fact.

2. Evaluation instructions for specific chain types

To facilitate a more impartial discussion, we offer the following evaluation approach for several specific types of projects:

| Chain type | Assessment and Recommendations in this Article |

|---|---|

| Storage/Service Network (such as Filecoin, Arweave) | There is indeed a difference in the metrics used. The core value of these networks lies in storage/retrieval services, and their revenue model differs from that of simple transaction fees. DeFiLlama's "Fees" metric may significantly underestimate its actual business activity. If you are an investor, you should focus on its storage market size, active trading orders, and actual storage revenue streams. |

| Off-chain/consortium business-driven public chains (such as some enterprise supply chains) | The data has limitations. DeFiLlama only tracks public on-chain activity, a view BlockWeeks fully agrees with. However, we also wonder: if the primary value of a public blockchain isn't reflected on-chain, then what supports the market capitalization of its publicly issued tokens used for on-chain governance and security? |

| Technically low-fee/high-TPS public blockchain | The initial design intent was good. However, extremely low fees per transaction mean that the chain itself and validators capture very little value. The success of this model depends on extremely high transaction volume to compensate for the low unit price. If the low fee rate fails to attract massive amounts of transactions, its economic model may face challenges. |

| Ecosystem traffic is concentrated in CEX public chains | It's difficult to evaluate. If a public blockchain's on-chain economic activity is weak and unable to generate sufficient transaction fees, then its practical value and value capture capability as a "decentralized settlement layer" or "smart contract platform" are low. Its value may be closer to that of a simple "digital collectible." |

We firmly believe that in a world where profits are highly concentrated, projects in the long tail are almost doomed unless they find unique use cases (such as games or specific app chains). Only platforms that can generate cash flow through genuine and continuous user demand have the potential to survive in the long term and outperform the market.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush